U.S. Stock Funds See Inflows in May Despite Market Turmoil

Investors continue their retreat from bond funds.

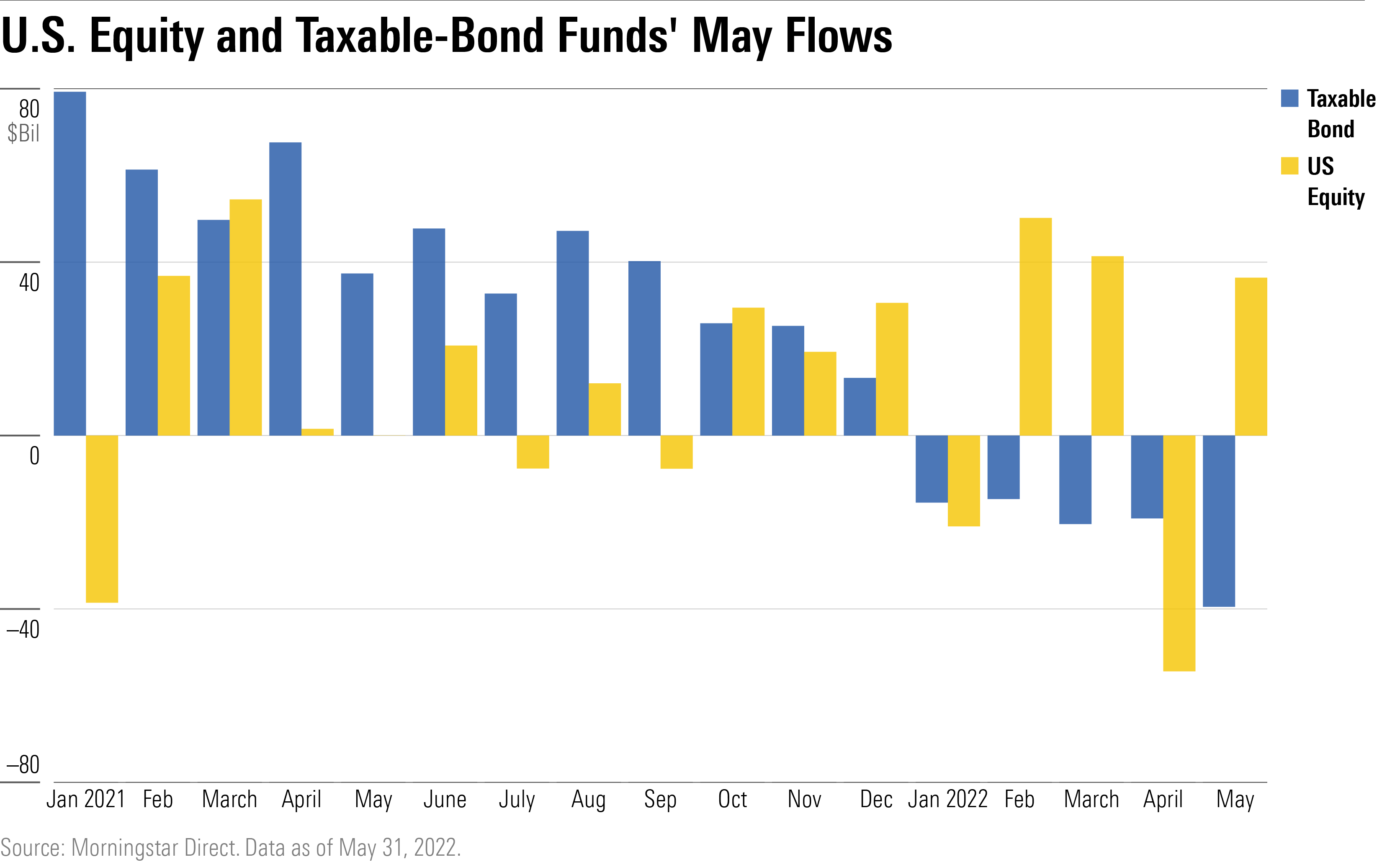

Even as the stock market continued to be battered by concerns about inflation and slowing economic growth, fund investors returned to U.S. equity funds in May 2022 after a one-month retreat.

For bond funds, however, it was a different story. With taxable-bond funds posting some of their worst losses in decades, mutual fund investors continued to pull money out of fixed-income strategies. Still, with five-straight months of outflows, the withdrawals only equal 2% of the money in taxable-bond funds at the end of 2021. Municipal-bond funds, however, have seen outflows equaling nearly 6% of the assets from the end of last year.

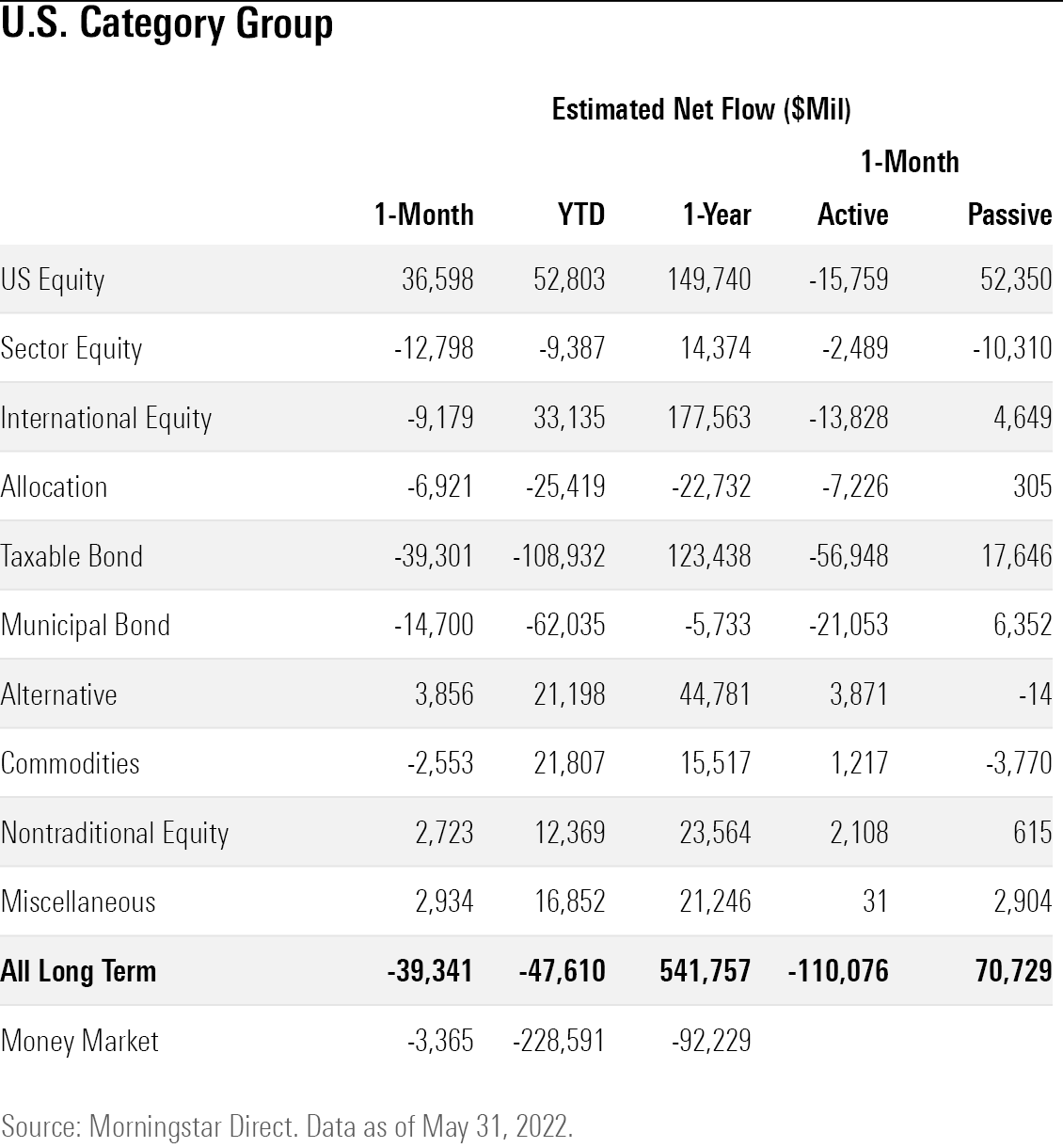

Investors moved a net $36.6 billion into U.S. equity funds in May after $51.9 billion was pulled from U.S. equity open-end and exchange-traded funds in April. Most of investors' money went to broad U.S. market funds. Vanguard Total Stock Market Index VTSAX gathered $10.3 billion, and iShares Core S&P 500 ETF IVV collected $7.4 billion.

Most growth funds, which have been battered in this year's stock market selloff, recorded outflows, while value categories recorded inflows. Large-value funds as a whole collected $10.5 billion, and for the year to date they have garnered $43.8 billion. Dividend-focused funds have been popular, with iShares Core High Dividend ETF HDV leading large-value flows in May by taking in $2.9 billion.

Investors intensified their withdrawals from taxable-bond funds in May, pulling $39.3 billion from the group. This marks the fifth consecutive month of outflows, the longest monthly streak since the group recorded six months of outflows near the end of 2000.

Intermediate-core bond funds saw the largest outflows among taxable-bond funds. At $15.4 billion, it was the worst month of outflows for the Morningstar Category since March 2020. This follows positive flows for the category in March and April. Vanguard Total Bond Market II Index VTBIX registered the largest outflows of any single fund at $4.9 billion.

Multisector bond funds also recorded outflows for the month, bringing year-to-date outflows to $25.9 billion.

Inflation-protected bond funds and bank-loan funds have been popular in 2022 as investors seek protection from stubbornly high inflation and rising interest rates. However, flows turned negative for both categories in May.

Despite the losses inflicted by rising interest rates this year, the short, intermediate, and long government-bond fund categories all posted inflows in May, along with ultrashort bond funds.

Investors continue to sell out of municipal-bond funds, however; the group has recorded outflows every month this year for a total of $62 billion.

International-equity funds have been a stalwart as investors stuck with them even as they sold out of U.S. equity funds in January and April. May, however, snapped an 18-month streak of inflows that started in November 2020. Investors sold out growth-oriented foreign funds but stuck with foreign value funds.

Investors sold out of financial and technology funds in May, pulling $5.9 billion from financial stock funds and $3.8 billion from technology funds.

Investors still piled into infrastructure funds, putting $1.2 billion into the group. Utilities and health funds were also popular. Health Care Select Sector SPDR ETF XLV saw a $2.2 billion inflow in May.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)