ETFs Close a Turbulent Quarter With Strong Inflows

U.S. stocks found their footing, bonds backpedaled, and commodities ETFs continued to cruise in March.

Markets rebounded last month after a turbulent start to the year. The Morningstar Global Markets Index (a broad gauge of global equities) advanced 2.03% in March but finished the quarter 5.45% lower than where it started, marking its worst quarter since the start of 2020. Bonds continued to tumble. The Morningstar US Core Bond Index slid 2.74% in March, its fourth consecutive month in the red. The index’s 6% first-quarter decline was its worst three-month stretch since its back-tested performance started in January 2000.

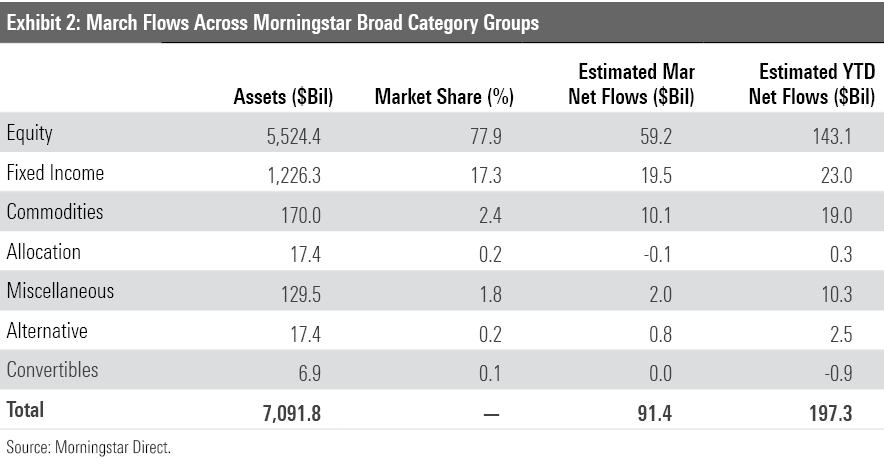

While uncertainty continued to swirl in the markets, investors piled $91.4 billion into U.S. exchange-traded funds. Stock ETFs raked in $59.1 billion, and fixed-income ETFs collected $19.5 billion. Commodities ETFs notched an excellent month, as their $10.4 billion collective haul was the heftiest monthly inflow into the group since April 2020.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end--all through the lens of ETFs.

U.S. Stocks Settle In

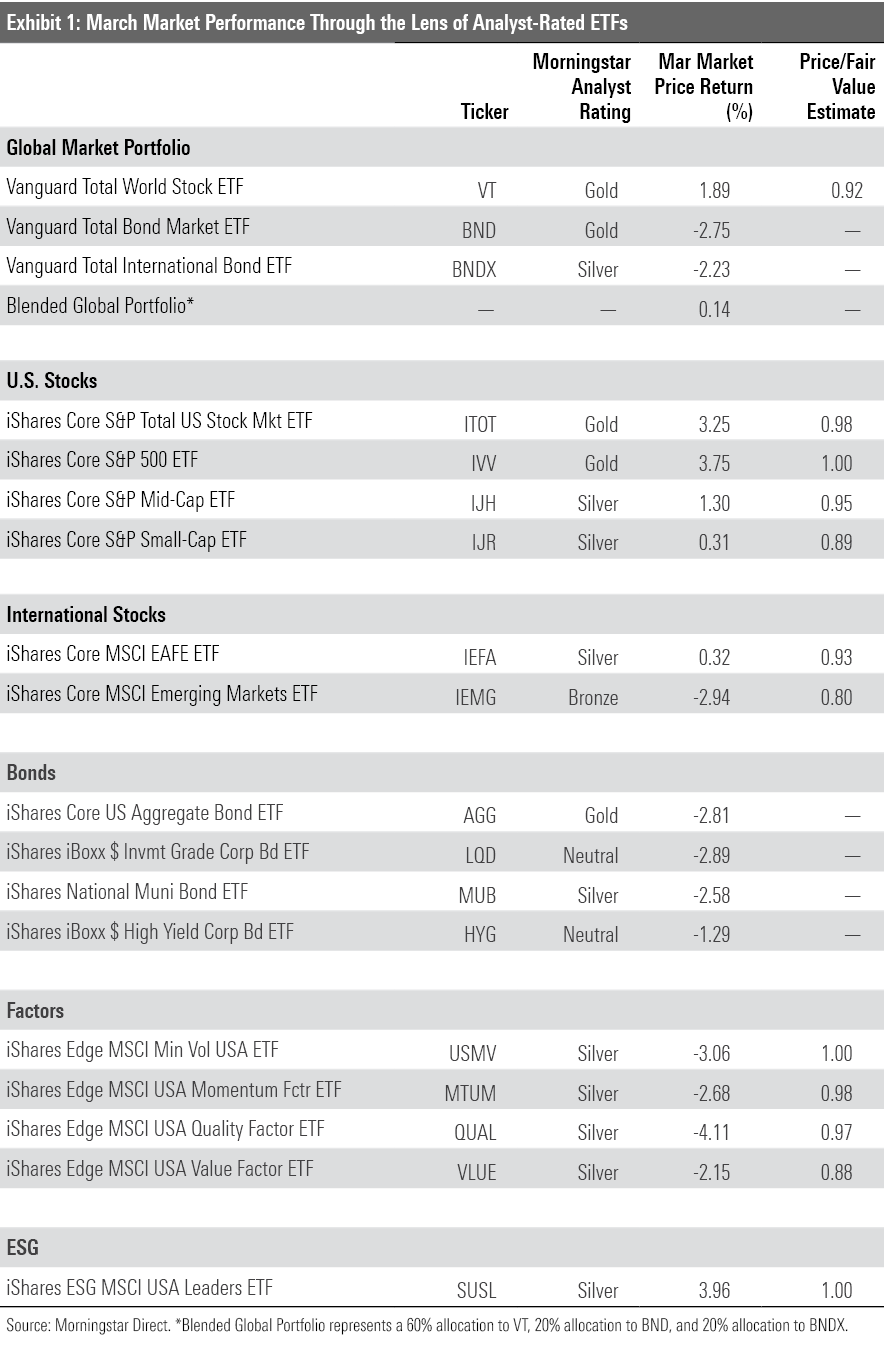

Exhibit 1 shows March returns for a sample of Morningstar Analyst-rated ETFs that serve as proxies for major asset classes. A blended global portfolio scratched out a 0.14% gain in March, its first positive month for the year. Another difficult month for bonds weighed on returns. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX, which shape the portfolio’s bond sleeve, sank 2.75% and 2.23%, respectively. Bond prices sank as inflation ran hot and the Federal Reserve kicked off a series of interest-rate hikes in response.

Vanguard Total World Stock ETF VT carried the blended portfolio into positive territory, bouncing back from consecutive down months with a 1.89% gain. International stocks, which constituted 41% of the portfolio at end-March, did not contribute much. Vanguard Total International Stock VXUS sank 0.28% last month, as it was burned by its 8% stake in Chinese stocks. China’s worst bout with the novel coronavirus since the onset of the pandemic sent the Morningstar China Index into a 7.71% decline in March. Eurozone stocks did not fare well, either; iShares MSCI Eurozone ETF EZU slid 1.39%.

U.S. stocks shook off their winter woes, as iShares Core S&P Total U.S. Stock Market ETF ITOT posted a 3.25% March gain. Investors have seemed to accept a still-uncertain economic outlook colored by inflation, the Russia-Ukraine conflict, and lockdowns in China. The Russia-Ukraine conflict’s ultimate impact on global supply chains and the financial system remains to be seen, but it seems U.S. stock investors priced in their initial concerns toward the end of February.

Large-cap stocks paced the market in March after small-caps led the way in February. IShares Core S&P 500 ETF IVV climbed 3.75%, while iShares Core S&P Small-Cap ETF IJR rose a more-modest 0.31%. Tesla TSLA was the most valuable contributor, swelling 23.8% after it requested shareholder approval for a stock split. That warm market reception made Tesla the only top-five holding in IVV to crack a positive first-quarter return; solid March efforts weren’t enough to push Apple AAPL, Microsoft MSFT, Amazon.com AMZN, or Alphabet GOOG into positive territory for the year to date.

Utilities stocks led all sectors in March. Utilities Select Sector SPDR ETF XLU climbed 10.34% in its best month since March 2021, boosted by stellar returns from power firms Constellation Energy CEG and AES AES. Energy stocks continued their tear, as Energy Select Sector SPDR ETF XLE advanced 9.3%. That sealed a 39% first-quarter return for the fund, which trounced the next-closest SPDR sector ETF (XLU) by more than 34 percentage points. Restrictions on oil exports from Russia--the world’s third-largest producer--have led to sky-high oil prices and propelled gains for firms like Chevron CVX and Marathon Oil MRO. That said, these stocks closed March on a lower note after the White House announced it would tap into strategic oil reserves to stabilize prices.

While utilities and energy stocks tend to be more popular among value funds, growth stocks outperformed their cheaper counterparts in March. Vanguard Growth ETF VUG climbed 3.8%, while Vanguard Value ETF VTV finished the month 3.29% higher. Financials stocks weighed on value funds; Financial Select Sector SPDR ETF XLF was the lone SPDR sector fund to close last month in the red. Bank stocks like Bank of America BAC, Wells Fargo WFC, and JPMorgan Chase JPM all slumped in March after effectively weathering market volatility in the two months prior. The automobile industry also proved a decisive arena in March. Tesla put a charge into VUG’s returns, while traditional auto manufacturers Ford F and General Motors GM went in reverse for VTV. After a narrow defeat last month, VTV outpaced VUG by 11.28 percentage points in the first quarter.

Within iShares’ suite of single-factor strategic-beta funds, iShares MSCI USA Value Factor ETF VLUE looked to be the most attractively valued at March’s end. It traded 11% below its fair value, according to Morningstar’s price/fair value ratio. Weak recent performance explains some of that discount. VLUE trailed 90% of its large-value Morningstar Category peers in the first quarter with a 3.82% decline. This fund tethers its sector allocation to the broad market, so it has not benefited from energy and utilities’ stellar start to the same extent as funds like VUG. This indicates that value funds’ relatively strong first quarter may stem from favorable sector positioning.

Cramming Into Commodities

As markets came to life in March, flows into ETFs did too. Investors poured $91.4 billion into ETFs last month, the largest monthly total so far this year and second-largest over the past 12 months. Stock ETFs led the way. They collected $59.2 billion in March, eclipsing the $50 billion inflow mark for the second consecutive month.

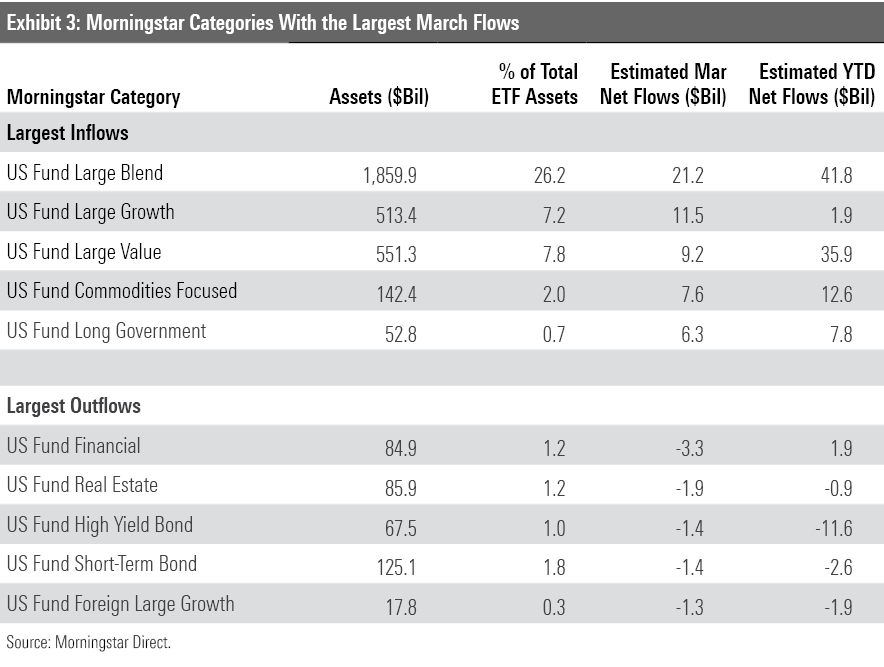

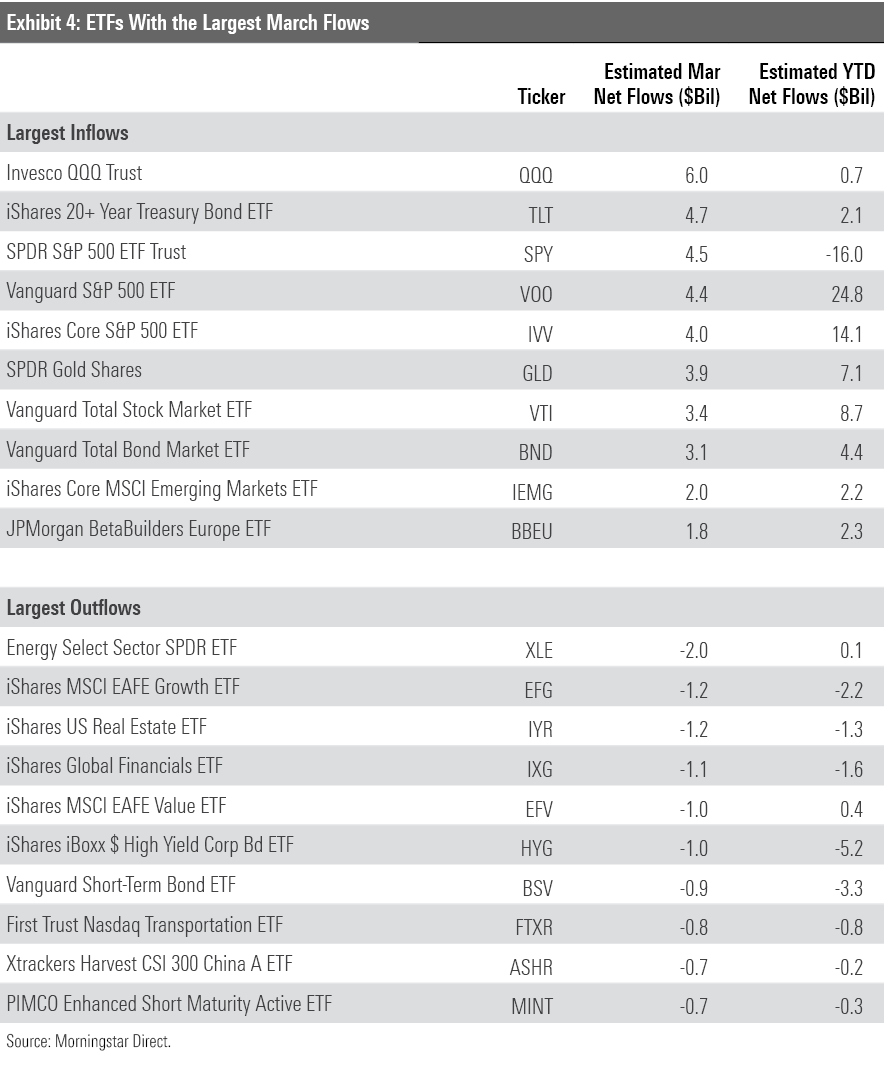

Stock investors played it straight with large-blend funds in March. Large-blend funds led all categories for the second consecutive month, pulling in $21.2 billion. A trio of S&P 500 trackers--SPDR S&P 500 ETF Trust SPY, Vanguard S&P 500 ETF VOO, and IVV-- notched top-five flows into individual ETFs in March.

Large-rowth and large-value funds’ inflows clocked in at second and third place, respectively, in March. Growth funds saw a narrow advantage, reeling in $11.5 billion to value funds’ $9.2 billion haul. Invesco QQQ Trust QQQ inhaled $6 billion alone, tops among all ETFs in March. Sector ETF investors seemed to follow the same script. Faster-growing technology ETFs took in $2.2 billion last month, while the cheaper financials and real estate categories’ $3.3 billion and $1.9 billion respective outflows landed them in the bottom two spots. Flows often mirror performance, and value funds’ stronger first-quarter returns translated into much larger inflows over the year’s first three months. They have absorbed $39.2 billion for the year to date, compared with growth funds’ $1.9 billion haul.

Fixed-income funds posted their most lucrative flows month of the year with a $19.5 billion intake. Investors have drifted toward quality in the fixed-income realm. Government bond funds pulled in $9.9 billion in the first quarter, headlined by long-term government bond funds’ $6.3 billion March inflow, a one-month record for the category. Funds that court more credit risk have not seen the same success. Corporate-bond funds welcomed a tepid $1.5 billion in the first quarter, and taxable high-yield bond funds’ $11.6 billion outflow ranked last among all categories by a wide margin. As stock markets started the year on a volatile note, it seems investors have opted to err on the safe side with their bond allocations. That said, iShares iBoxx $ High Yield Corporate Bond ETF’s HYG 4.73% first-quarter decline was not as pronounced as iShares U.S. Treasury Bond’s GOVT 6.47% drop.

Commodities ETFs continued their tear, raking in $10.1 billion in March. They added $23 billion of new money in the first quarter after bleeding $5.2 billion in 2021. No fund has seen a more dramatic turnaround than SPDR Gold Shares GLD. After welcoming $3.9 billion in March, its year-to-date inflow stands at $7.1 billion, fifth-largest across all ETFs. In 2021, its $10.7 billion outflow was the second-largest across all ETFs. The commodities broad basket category had a lucrative first quarter as well, adding $6.3 billion in new money. That’s a substantial sum, considering it closed 2021 with just $16.2 billion in total assets. These funds soared with commodity prices in the first quarter. Invesco Optimum Yield Diversified Commodity Strategy No K1 ETF PDBC--the largest fund in the category--has jumped 25.46% since the start of the year.

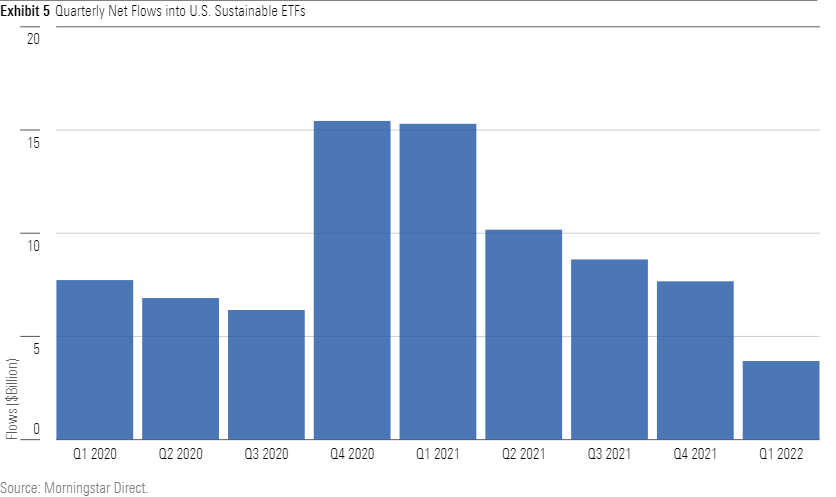

Flows into environmental, social, and governance-themed ETFs cooled off in the first quarter. ETFs on Morningstar’s sustainable funds list--a directory curated by Morningstar manager research’s sustainability specialists-–collectively absorbed $3.81 billion in the first quarter. That's down dramatically from $15.3 billion over 2021’s first three months. IShares Global Clean Energy ETF ICLN best exemplifies the drop-off; it collected a paltry $11 million in the first quarter after reeling in $2 billion in the first quarter of 2021. Performance may help explain investors’ diminished appetite. IShares ESG Aware MSCI USA ETF ESGU--the largest sustainable ETF by a wide margin--trailed the Morningstar US Market Index by 44 basis points last quarter after beating it by 1.2% annually over the trailing three years through 2021.

IShares and Invesco Get on Track

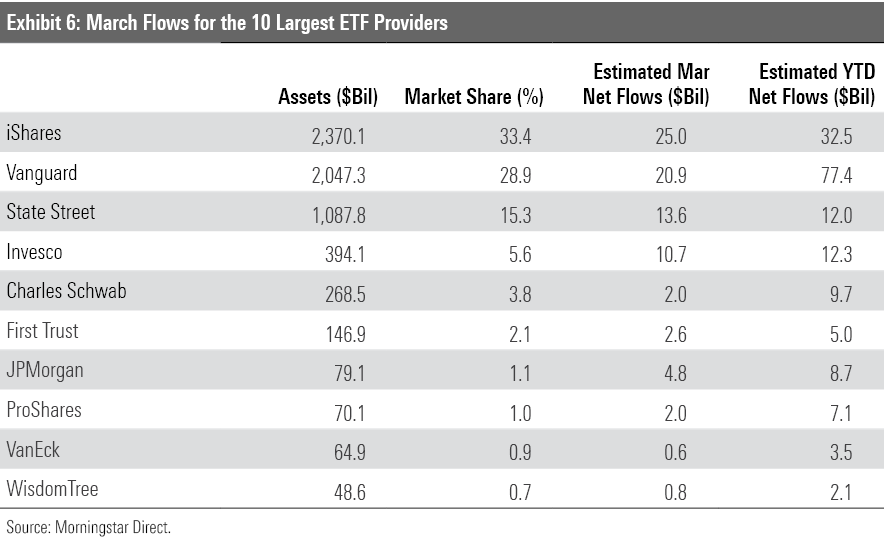

IShares broke out of a flows slump with a lucrative March. It pulled in $25 billion last month, which accounts for 77% of the firm’s total net flows for the year to date. IShares 20+ Year Treasury Bond ETF TLT led the firm’s ETF lineup in March with a $4.7 billion haul. In terms of flows, TLT was a microcosm of iShares as a whole in the first quarter. Like iShares, its March course-correction came on the heels of January outflows and modest February inflows. Whether TLT--and the firm as a whole--can sustain its momentum remains to be seen.

Invesco also shook off winter rust in March with a $10.7 billion inflow, a one-month record for the firm. As tech stocks came back to life, QQQ did, too. The tech-heavy behemoth raked in over $6 billion last month to recoup about the same amount it bled in January. As the fifth-largest ETF in the United States--and the only one in the top five whose portfolio does not span the broader market--QQQ is prone to material flows undulations from one month to the next.

Even after solid months from iShares and Invesco, Vanguard dominated the flows race in the first quarter. After collecting $20.9 billion in March, its first-quarter haul totaled $77.4 billion, which more than doubled second-place iShares. VOO has captained the ship. It collected $24.8 billion over the first three months of the year and is well on its way to breaking its own annual flow record of $47.2 billion set in 2021. VOO’s rise has helped power a stellar run for Vanguard; after cinching the flows crown for this quarter, it has led all firms in flows in all but one quarter since the start of 2020.

Not All Plants Are Pricey

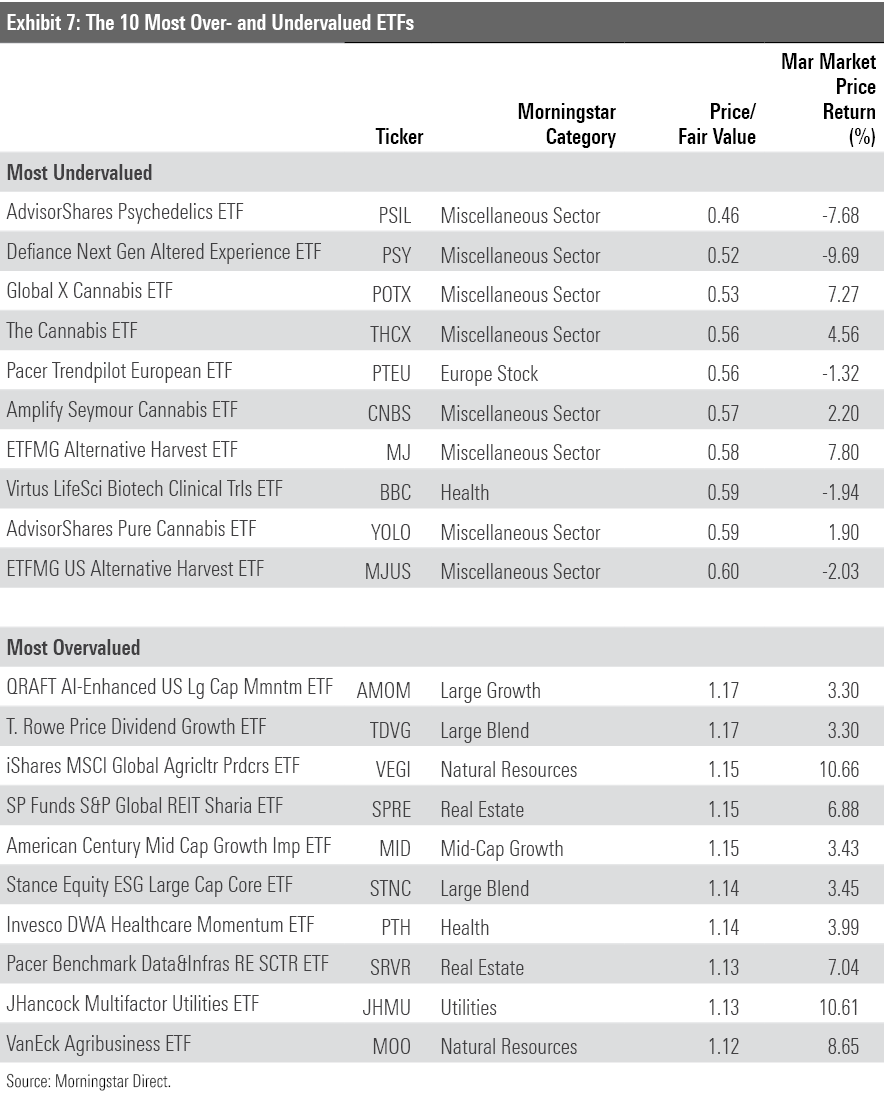

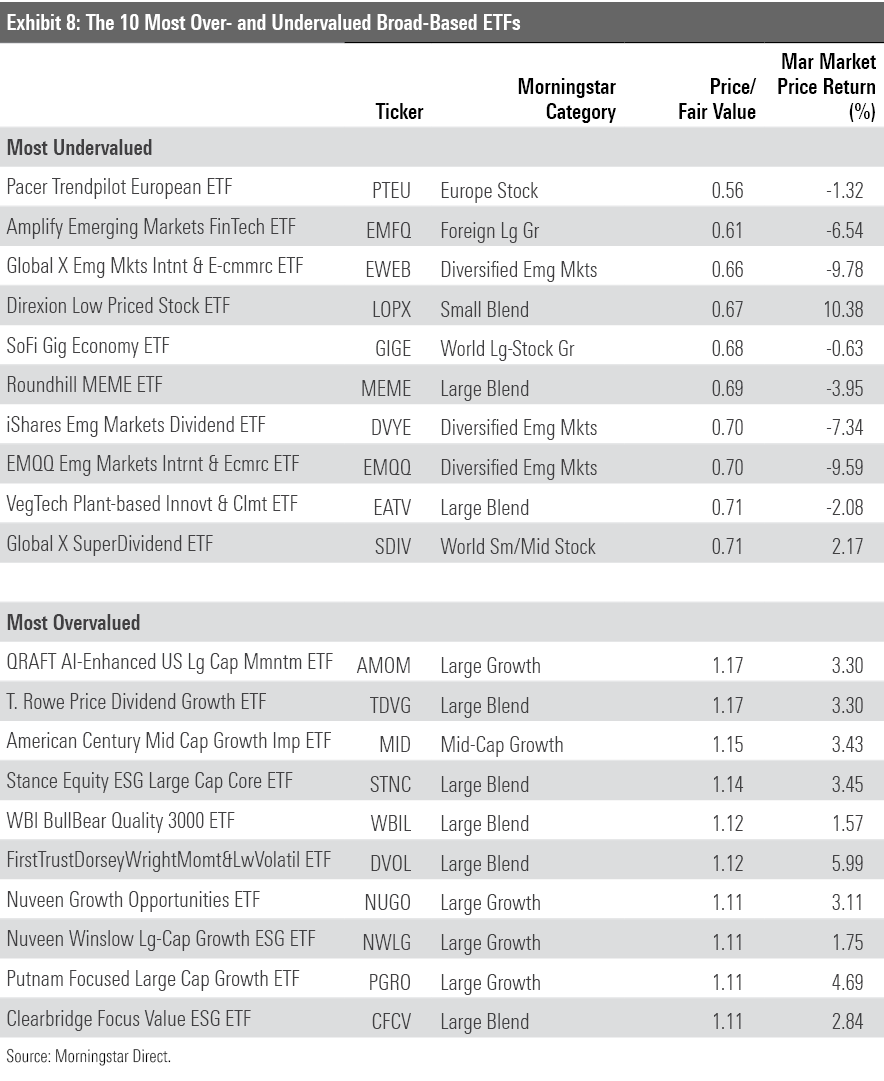

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

ETFs that aim to leverage the legalization of cannabis or other drugs resumed their post on the cheaper half of Exhibit 7, which features funds that traded at the lowest prices relative to their fair value at March-end. Dreadful performance has compressed these funds’ price/fair value ratios. March may have marked the start of a rebound, however, as funds like Global X Cannabis ETF POTX and AdvisorShares Pure Cannabis ETF YOLO notched their best monthly returns since February 2021. Both funds got a boost from Tilray Brands TLRY, a Canadian cannabis provider that leapt 27.38% last month.

A different kind of plant-themed fund found itself on the pricier half of Exhibit 7 in March: iShares MSCI Global Agriculture Producers ETF VEGI. This fund, which includes stocks whose operations center around the production of various crops, rode soaring commodity prices to a 10.67% March return. As a “producer ETF,” VEGI can offer backdoor exposure to the broad commodities market. But investors should still expect such funds to behave more like stock funds than commodity portfolios more often than not.

Several value-oriented emerging-markets funds populate the cheaper half of Exhibit 8. Emerging-markets stocks looked cheap over entering 2022, and the Russian stock market’s collapse exacerbated that trend. IShares Emerging Markets Dividend ETF DVYE has felt the pain of a relatively hefty stake in Russian stocks; they represented 18% of its portfolio entering February. Over February and March, it tumbled 15.07%, about 10 percentage points further than the MSCI Emerging Markets Index, its category benchmark. Russian stocks’ recent cascade exemplifies why investing in emerging markets can be a perilous endeavor.

Active ETFs occupied nine of the 10 spots on the pricier side of Exhibit 8 in March. T. Rowe Price Dividend Growth ETF TDVG is a tried-and-true fund that could be worth its rich valuation. Manager Tom Huber has led TDVG’s open-end parent to stellar results over his 20-plus-year tenure on the fund, which helps earn this ETF a Morningstar Analyst Rating of Silver.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)