Inflation Pressures Broadened Prior to Russia Attack

Despite the bad news on inflation in February, price pressures still look to ease in late 2022.

Editor's note: Read the latest on how Russia's invasion of Ukraine is affecting the global economy and what it means for investors.

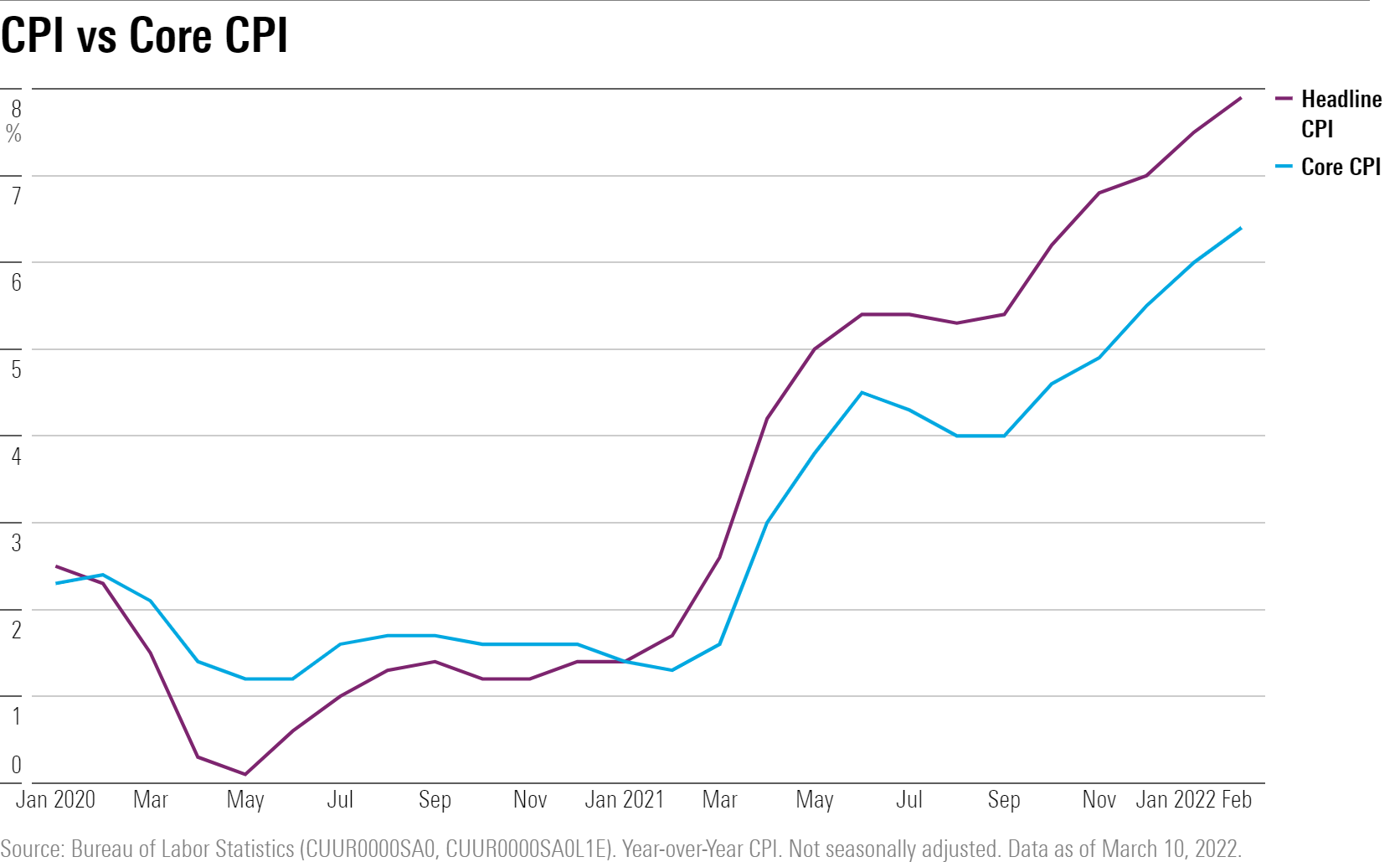

Stubbornly high inflation pressures were extending across the U.S. economy in February, even before Russia’s attack on Ukraine led to a surge in oil, food and other commodity prices.

Despite the fluid situation around higher prices caused by the war, other factors – like the supply chain constraints caused by the pandemic – could still mean that inflation will soon be its peak. That could be the case even as the war in Ukraine adds new complications to the outlook for the global economy.

“Inflation remained high in February, and March will likely bring the worst CPI readings, owing to impact from the war in Ukraine,” says Preston Caldwell, Morningstar’s chief economist. “However, we continue to believe that high inflation will eventually subside as supply chains heal and energy production recovers.”

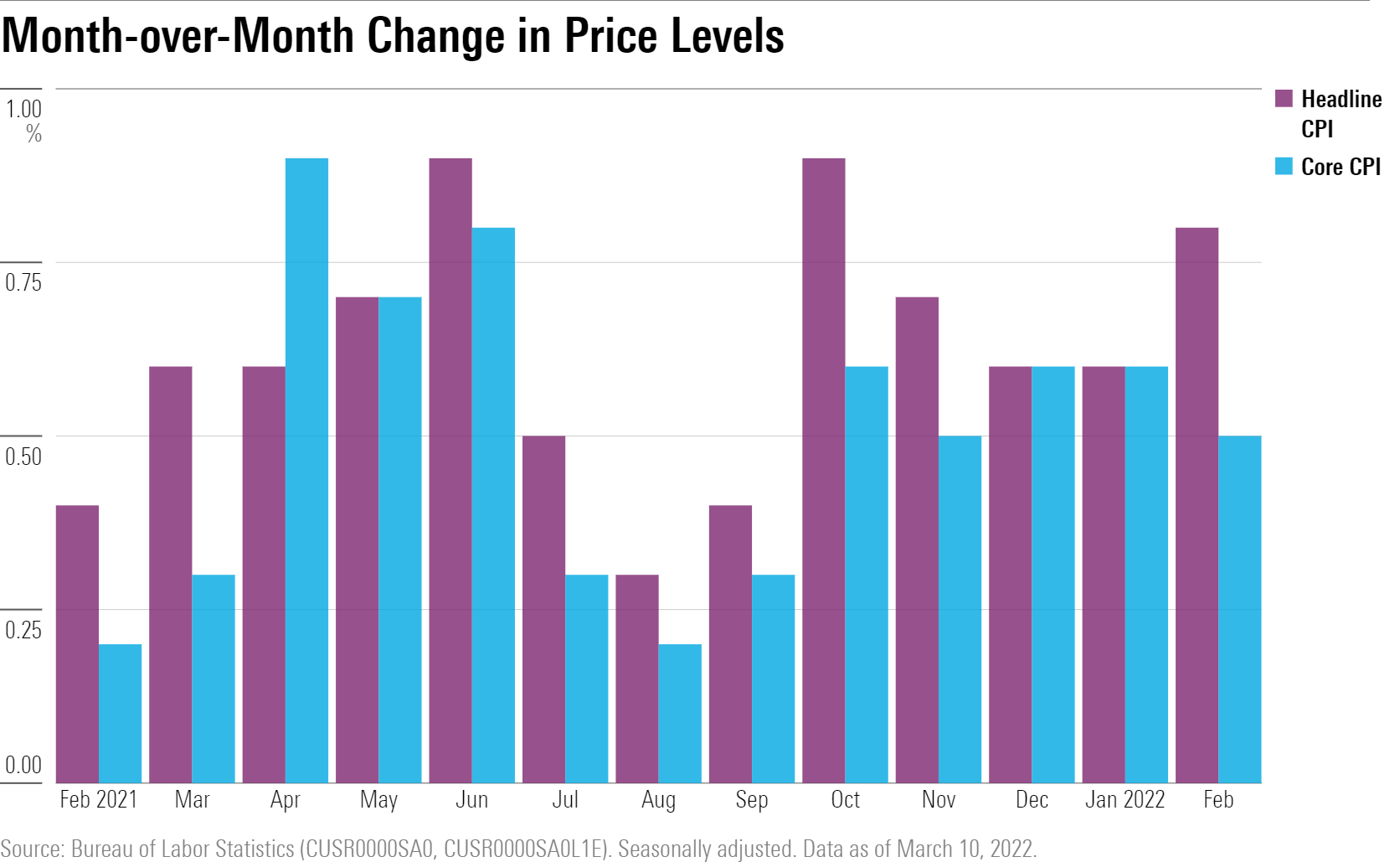

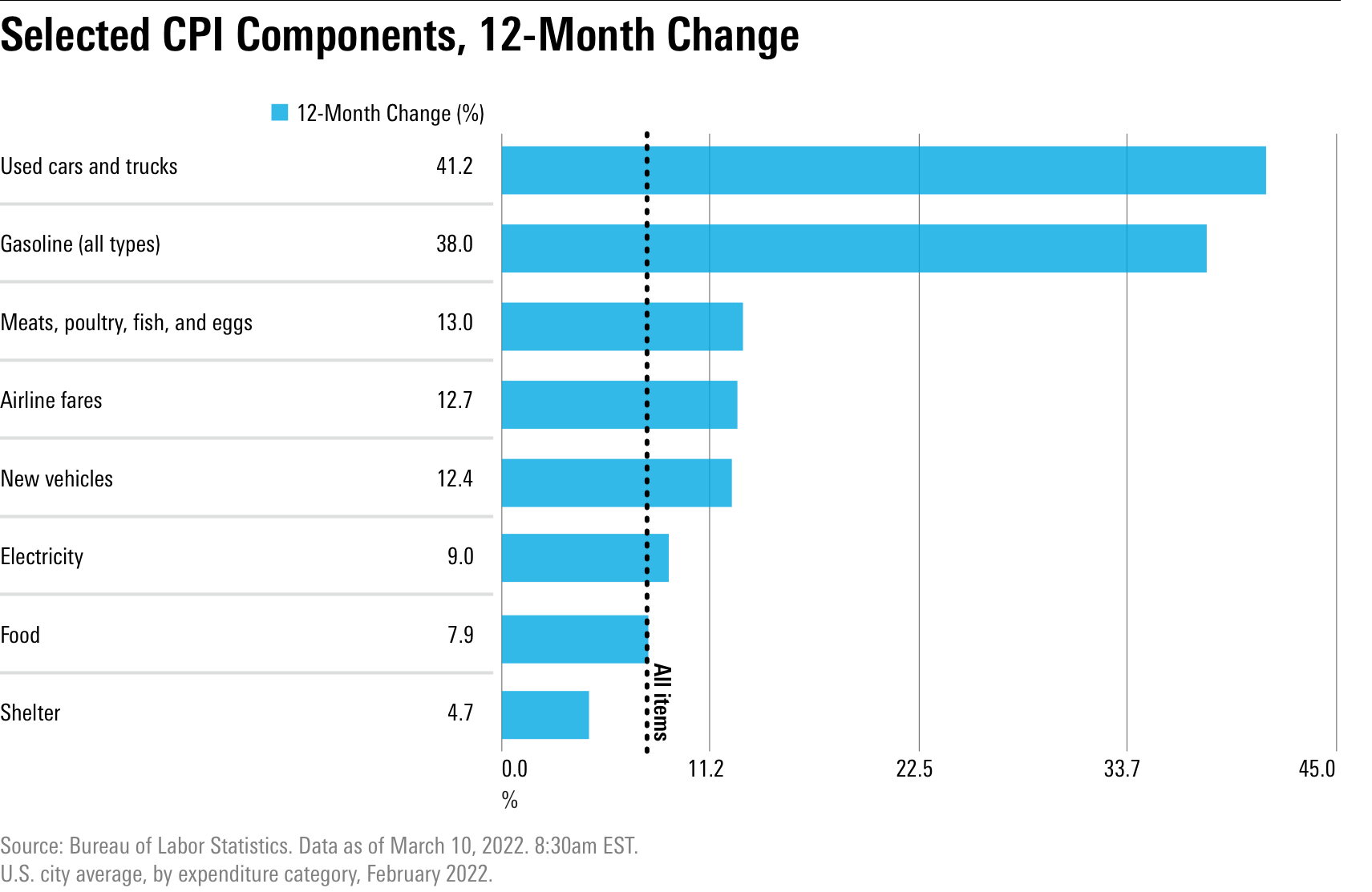

The Consumer Price Index rose 0.8% in February, and for the last 12 months posted an increase of 7.9%. Excluding food and energy, the index rose 0.5% in February following a 0.6% increase in January.

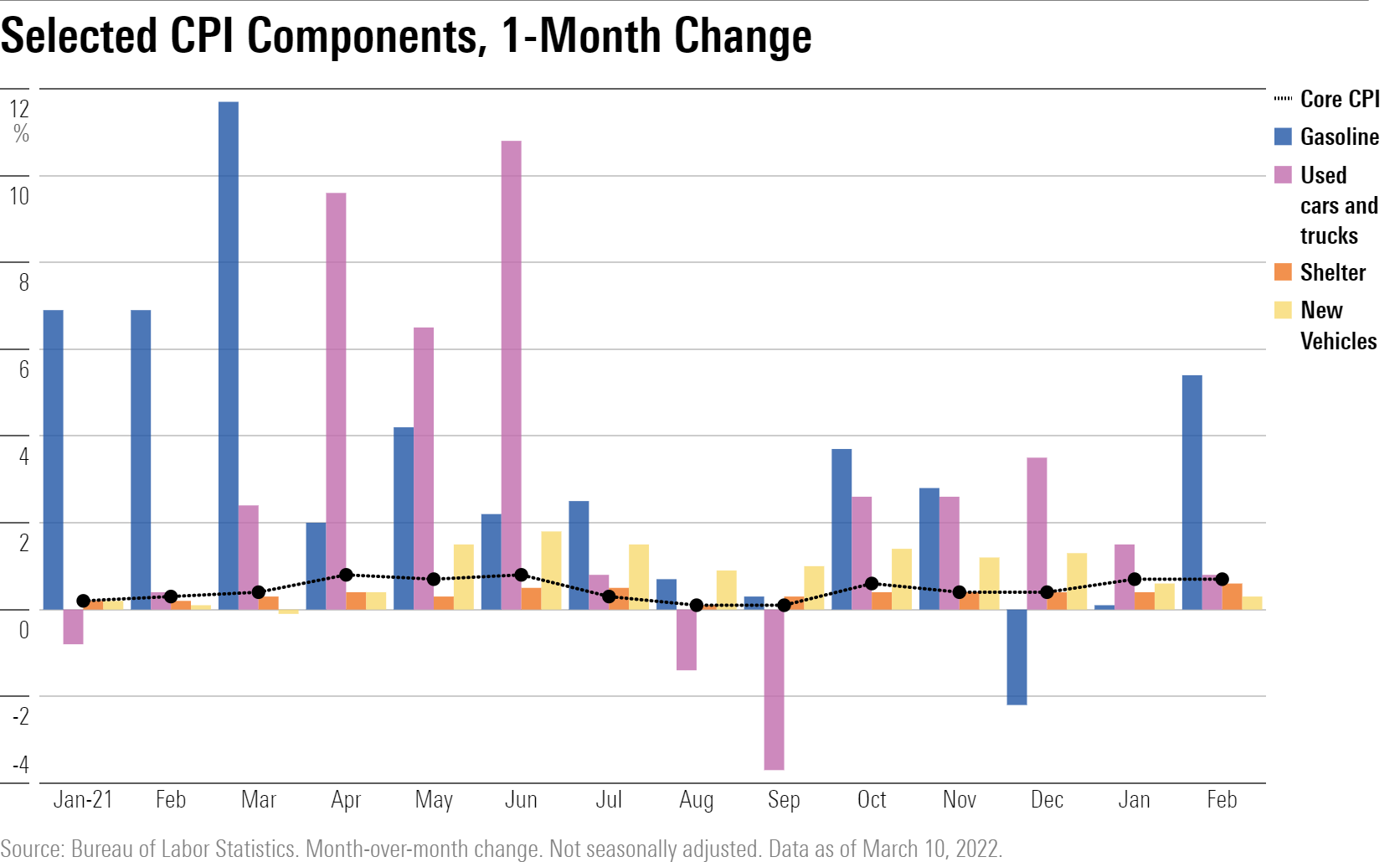

Gasoline, food, and shelter were major factors driving inflation pressures in February compared to the prior month, according to the Bureau of Labor Statistics. But vehicle prices, which have been a significant inflation driver over the past year, told a different story. New-vehicle prices rose 0.3% and used-vehicle prices fell 0.2% for the month.

On a year-over-year basis, virtually all of its major component indexes showed increases, including the largest 12-month rise in shelter since 1991.

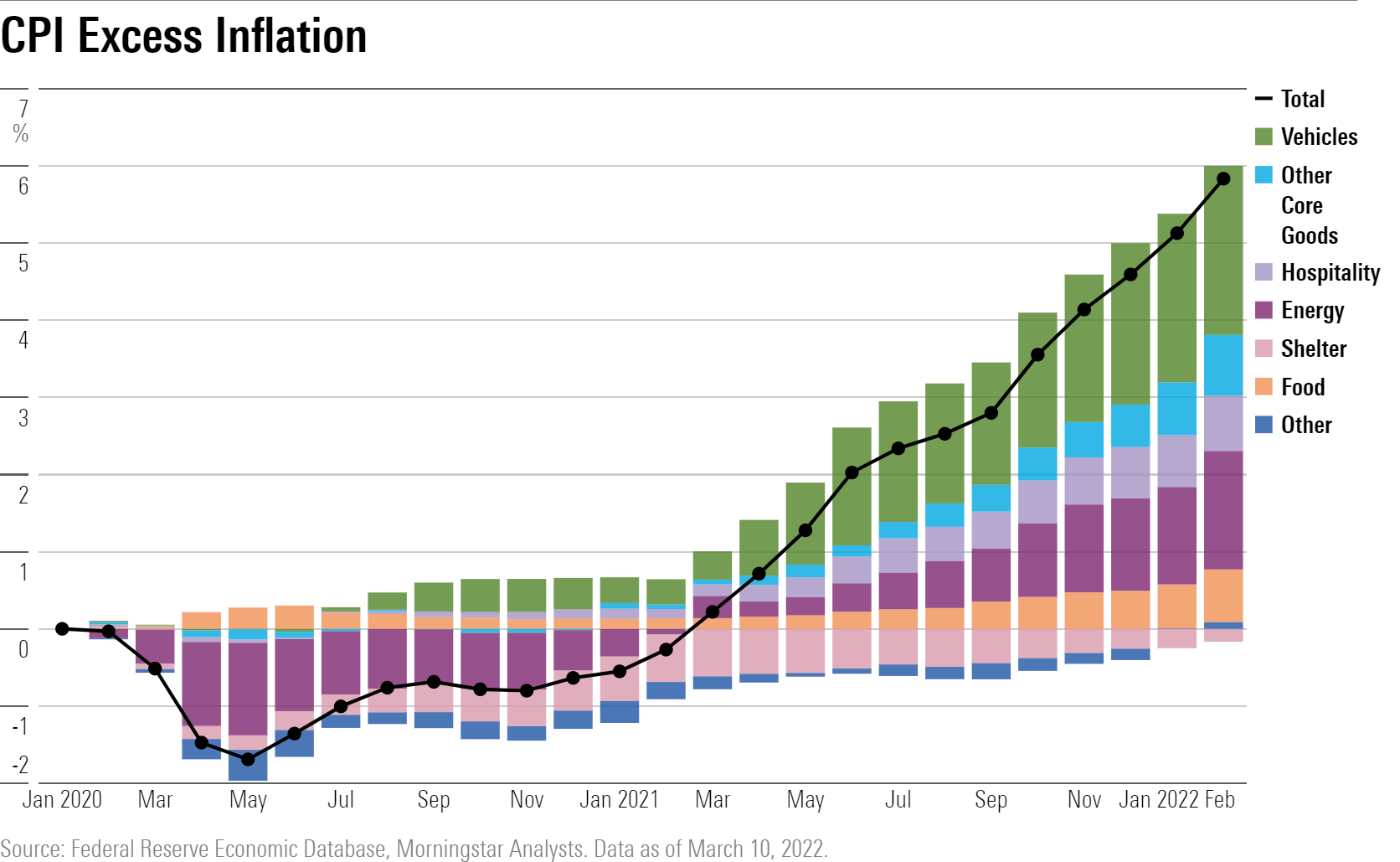

“Inflation continued to rocket above trend in February,” Caldwell says. Excess inflation--which measures cumulative inflation since the start of the pandemic compared with the prepandemic trend--rose by 0.7% in February.

“Energy and food--both related to events in Ukraine--accounted for about one half of the excess inflation,” he says. “But the rest of the excess of inflation was scattered across a variety of other categories, suggesting a continued broadening out of inflation pressure.”

Caldwell expects that the worst readings for inflation will come in the March report. He notes that oil prices in March have averaged 25% higher than February, which suggests the CPI energy component will increase roughly 10% month over month in March. That, he says, will add 0.6% to the headline CPI monthly reading. “However, we expect oil prices to drop steadily through the end of 2022, in line with futures prices,” Caldwell says.

“We still expect an eventual resolution of the supply chain issues which have caused prices for several goods--especially vehicles--to surge,” Caldwell says. “The unwinding of this price increase will dampen inflation greatly. However, the exact timing remains uncertain, and the war in Ukraine could disrupt supply chains further in the near term. In particular, Russia and Ukraine account for much of the global supply of neon and palladium, two important inputs to semiconductor production.”

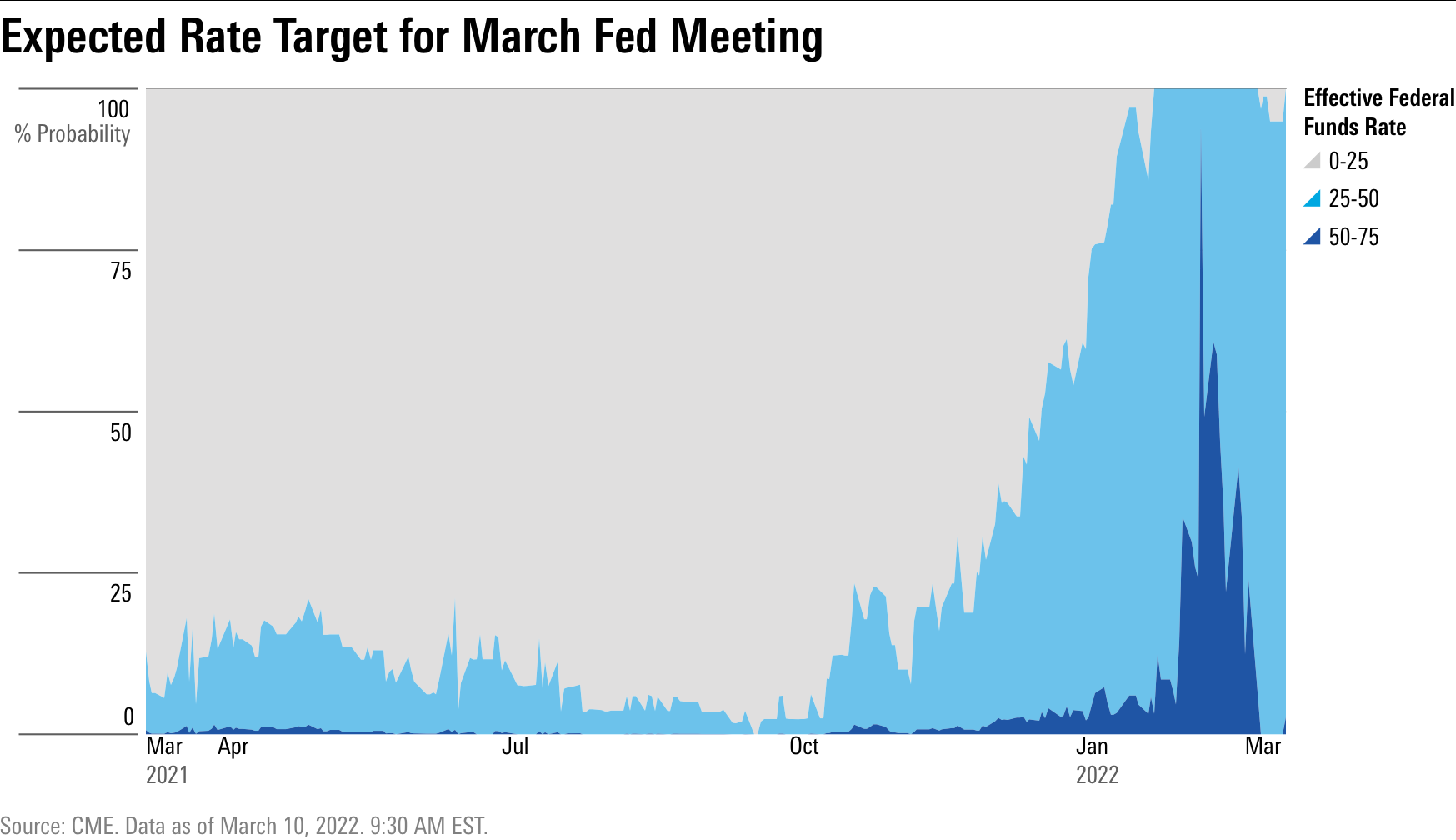

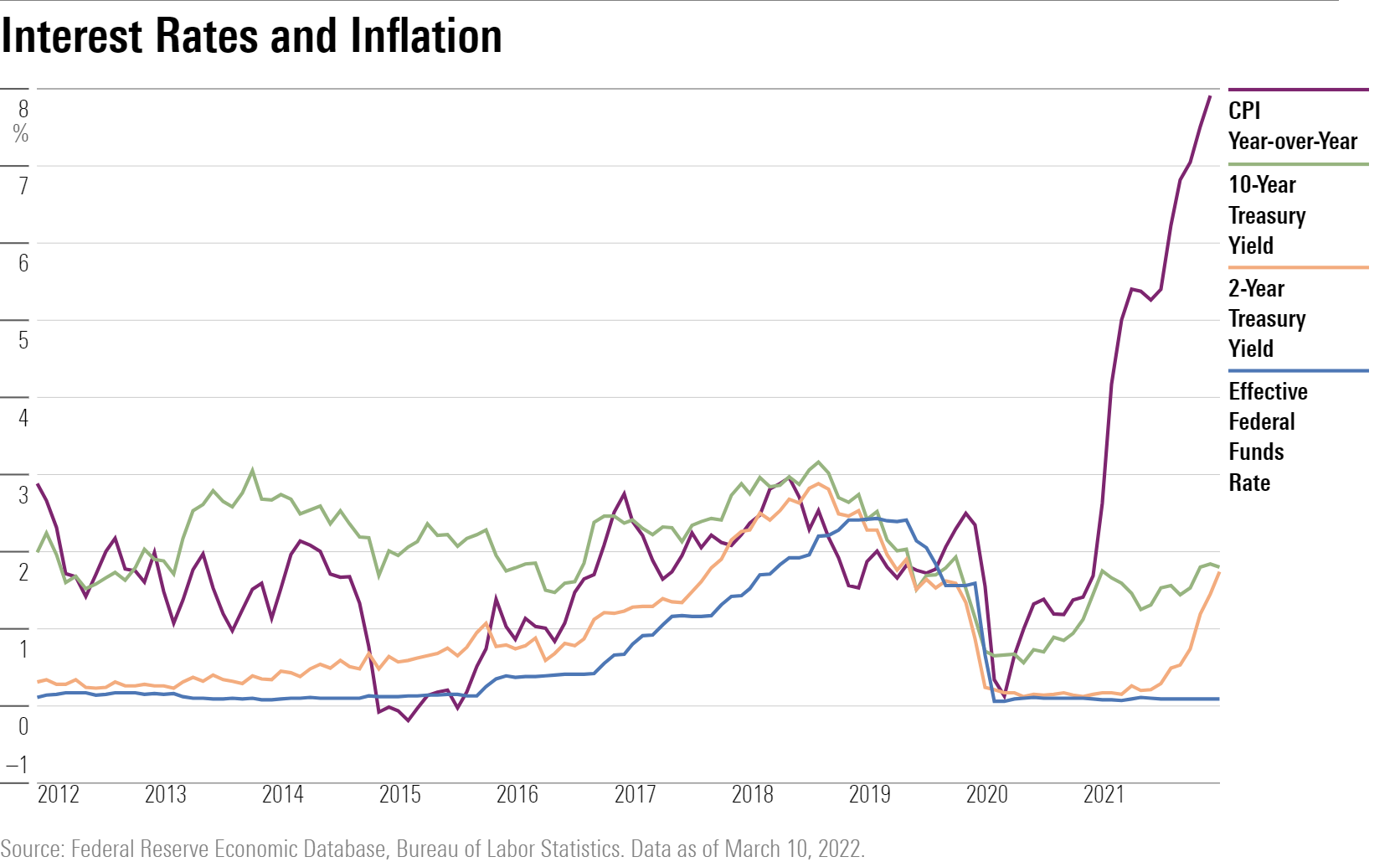

The CPI report comes one week ahead of the Fed’s decision on interest rates. Expectations for the Fed’s direction on rates has changed dramatically over the past two weeks, as the ripples from Russia's attack on Ukraine have filtered through the markets. Investors, concerned about impact of price and supply shocks on the economy, have significantly scaled back expectations for rate hikes. Before the invasion, the bond market was priced for a 0.5-percentage-point increase in the federal-funds rate. Now investors believe odds are in favor of just a quarter-point increase.

“We expect the Fed to largely look past the burst in near-term inflation caused by the war in Ukraine (over which it has little influence anyways),” says Caldwell. “The underlying fundamentals in the economy call for a moderate pace of interest-rate normalization. The bond market is expecting six to seven fed-fund rate hikes through the end of 2022, about in line with our expectation of six.”

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)