Bitcoin ETF Investors Stick Tight Despite Crypto Rout

A 20% drop in bitcoin hasn't fazed the ETF's owners.

Investors in bitcoin-tracking exchange-traded funds are staying true to the crypto mantra of HODL, or "hold on for dear life."

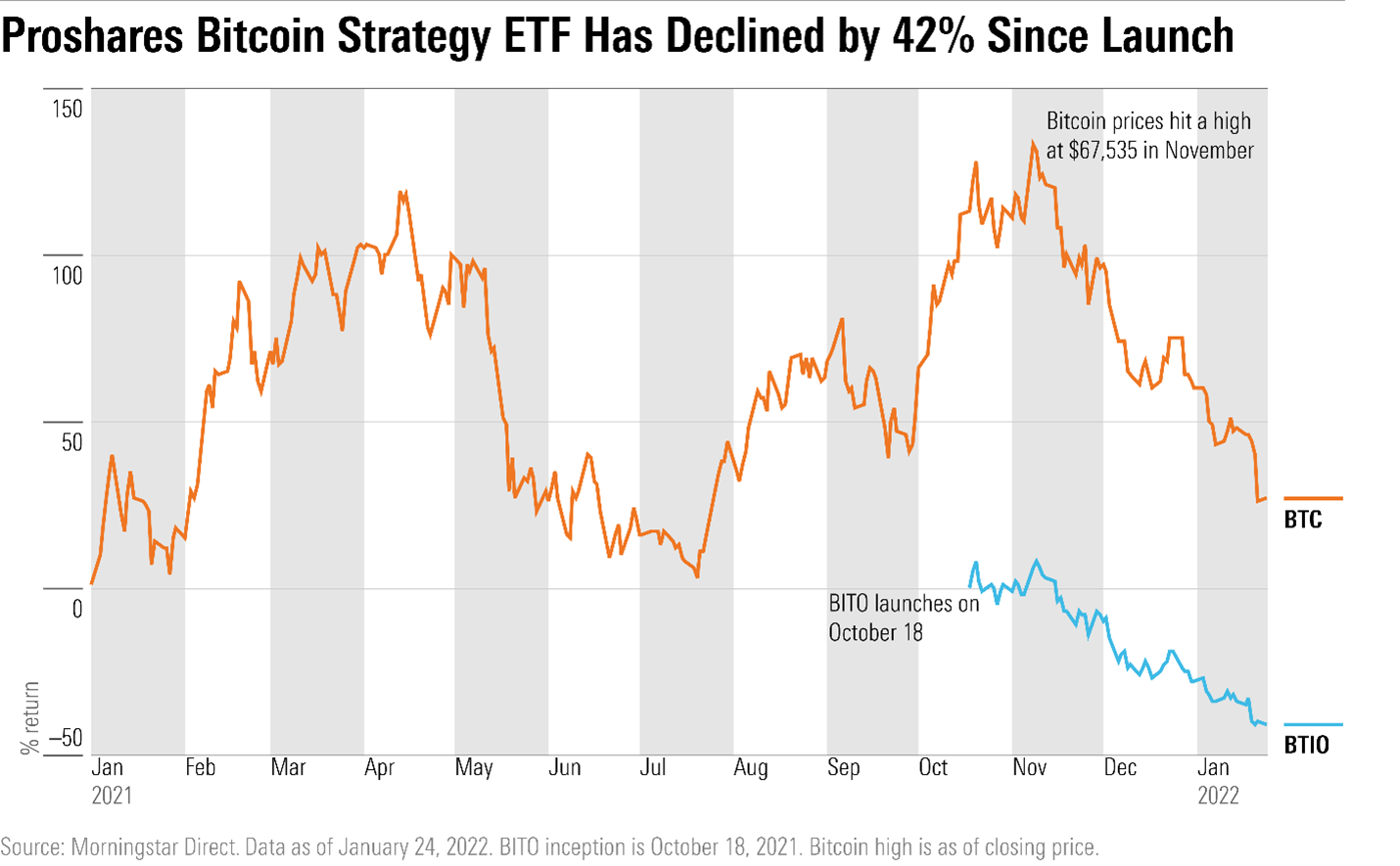

The first U.S. bitcoin-tracking ETFs launched last October, just as bitcoin was nearing its most recent peak. Since then, bitcoin has collapsed 46%, but investors in bitcoin ETFs aren't running for the exits.

ProShares Bitcoin Strategy ETF BITO had one of the largest fund launches in 2021, collecting some $550 million within in its first days. The fund took in $372 million more during November and December and finished the year with $1.2 billion in assets.

Cryptocurrencies have been notoriously volatile, and while these ETFs don’t hold actual bitcoins, by tracking the currencies, investors were likely headed for a wild ride.

So far this year, that’s been the case. BITO is down 19% this year and 41.4% since launch.

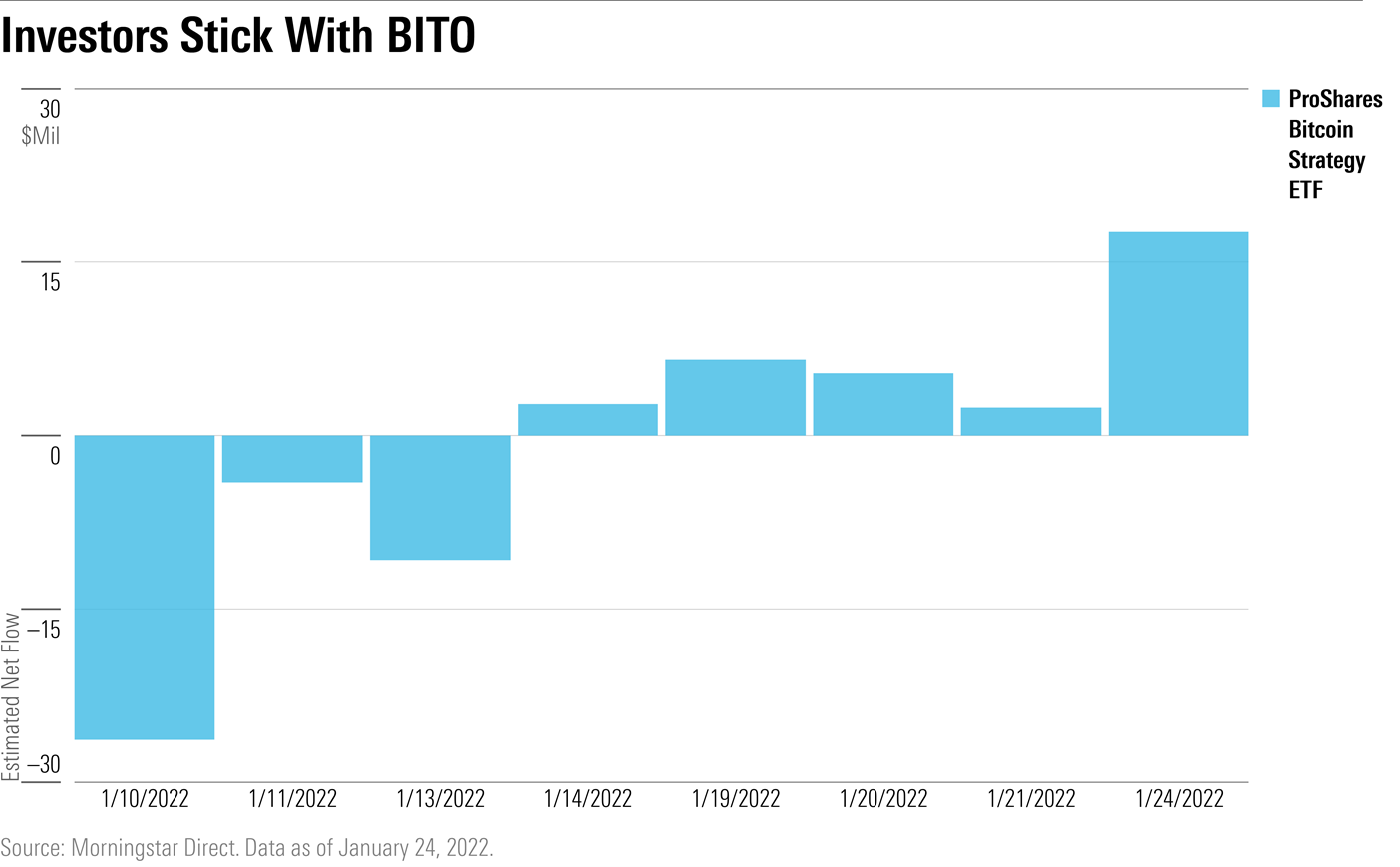

Despite the speed and scope of the decline, investors in the fund are staying put. Only $6.5 million net has been pulled from BITO this year. (During the same period, investors have pulled $10 billion from SPDR S&P 500 ETF Trust SPY, the largest S&P 500-tracking index fund.)

Investors’ largest redemptions of the fund occurred on Jan. 10, but on Jan. 24--one of the most volatile trading days of the year--investors poured $18 million into the fund. Conversely, they pulled $1.9 billion from SPY on Jan. 24.

Morningstar analysts see multiple forces at work in the stickiness of bitcoin ETF investors.

Ben Johnson, director of global ETF research, points out that BITO has a very large daily trading volume at nearly 21% of assets. "There is ample demand from parties that are feverishly trading the fund’s shares back and forth with one another," Johnson says. "As long as supply and demand among this cohort is evenly matched, there will be no inflows or outflows."

In addition, senior manager research analyst Bobby Blue says investors may be using bitcoin ETFs as a part of a longer-term allocation strategy as they can’t outright own bitcoin in some retirement portfolios. "BITO may be being used to fill a strategic allocation to crypto in investors’ portfolios rather than as a speculative trading tool. Advisors have started to come around to the idea of adding crypto exposure to some client portfolios, and if they use ETFs/funds as their building blocks, BITO is one of the only options that can approximate that exposure."

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)