8 Key Takeaways on the Outlook for Fed Policy

While Powell is tapped for a second term, the outlook for Fed policy has plenty of unknowns.

With President Joe Biden nominating Jerome Powell to a second term as chair of the Federal Reserve, investors can expect a continuation of the path that the central bank has charted for ensuring the U.S. economy is on track as it recovers from the pandemic-driven recession.

However, with rising inflation proving more durable than many observers expected, the outlook for Fed policy has a higher level of uncertainty than usual. In addition, the nomination of Lael Brainard to Fed vice chair could point the Fed's regulation of banks in a stricter direction, even if she didn't get the nod for Fed chair, as some Democrats had been pushing.

"Biden could have tried to push in a more left-leaning direction from a regulatory perspective, and in a slightly more dovish direction from a rate perspective, but he decided to go with more of the middle ground and renominate Powell," says Eric Compton, senior equity analyst at Morningstar. "What will be interesting is what he does with the (Fed governor Randal) Quarles vacancy coming up at the end of December. If you see someone like Brainard take over for Quarles as the vice chair of supervision, then Biden could get his more aggressive regulatory agenda in the end anyway. So, the drama isn't completely over yet."

In the meantime, there is a lot for investors to wrestle with when it comes to the near- and medium-term outlook for Fed policy. Compton outlines eight key takeaways in a new report on the Fed, "The Federal Reserve and U.S. Monetary Policy 101," available here for Morningstar Direct and Office clients.

Here are Compton's takeaways:

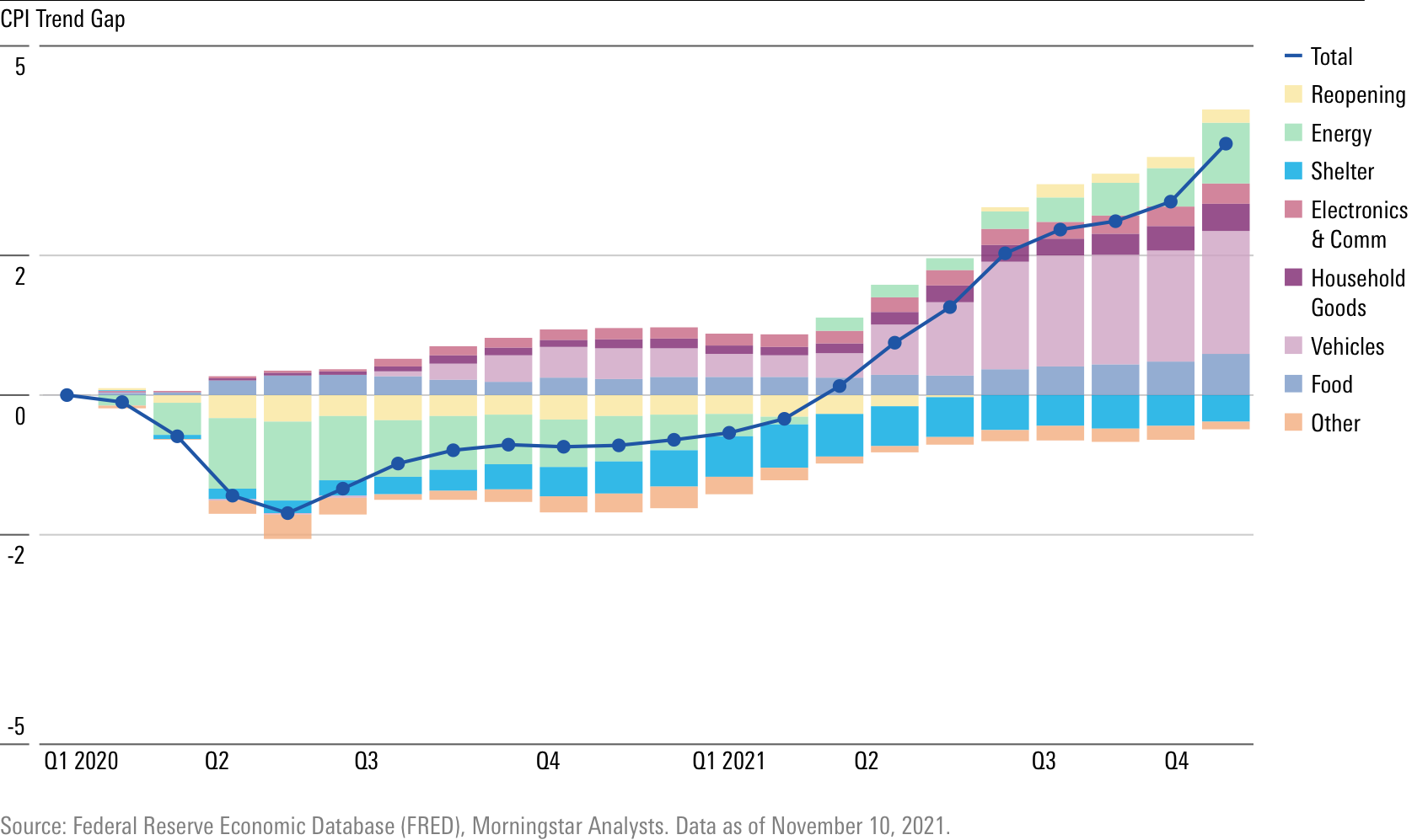

1) Understanding the dynamics of supply shocks is key to understanding monetary policy today. During a supply shock, the Fed is put in the difficult position of choosing between its two mandates. Does it fight higher inflation and reduce gross domestic product growth further, or does it support GDP growth but let already-high inflation continue to run? We are in a type of supply shock now, and this is one of the fundamental issues the Fed currently faces.

2) Higher inflation levels that last longer than expected, and a Fed that does not react to already-high inflation, can reset inflation expectations higher. This can reinforce already-high inflation and cause it to persist. While we don't currently think there are expectations of inflation resetting higher, this is one of the key risks facing the Fed today.

3) It is difficult to know when the current supply issues will resolve. They are complex and multivariate and span global supply chains across industries and geographies. Current data suggests these issues are not yet letting up. This is one of the key uncertainties the Fed faces. When will supply issues resolve, helping to relieve some of the inflationary pressure?

4) Inflation is not just being driven by supply issues, but also by an imbalance in demand. Overall consumer demand has heavily shifted toward goods, exacerbating supply/demand imbalances. We currently see much of the inflationary pressure easing in 2022 and into 2023 as price increases--particularly related to autos--slow, but this is a key area of risk: Will pricing pressure continue to spread throughout the economy, or will demand rebalance and supply catch up?

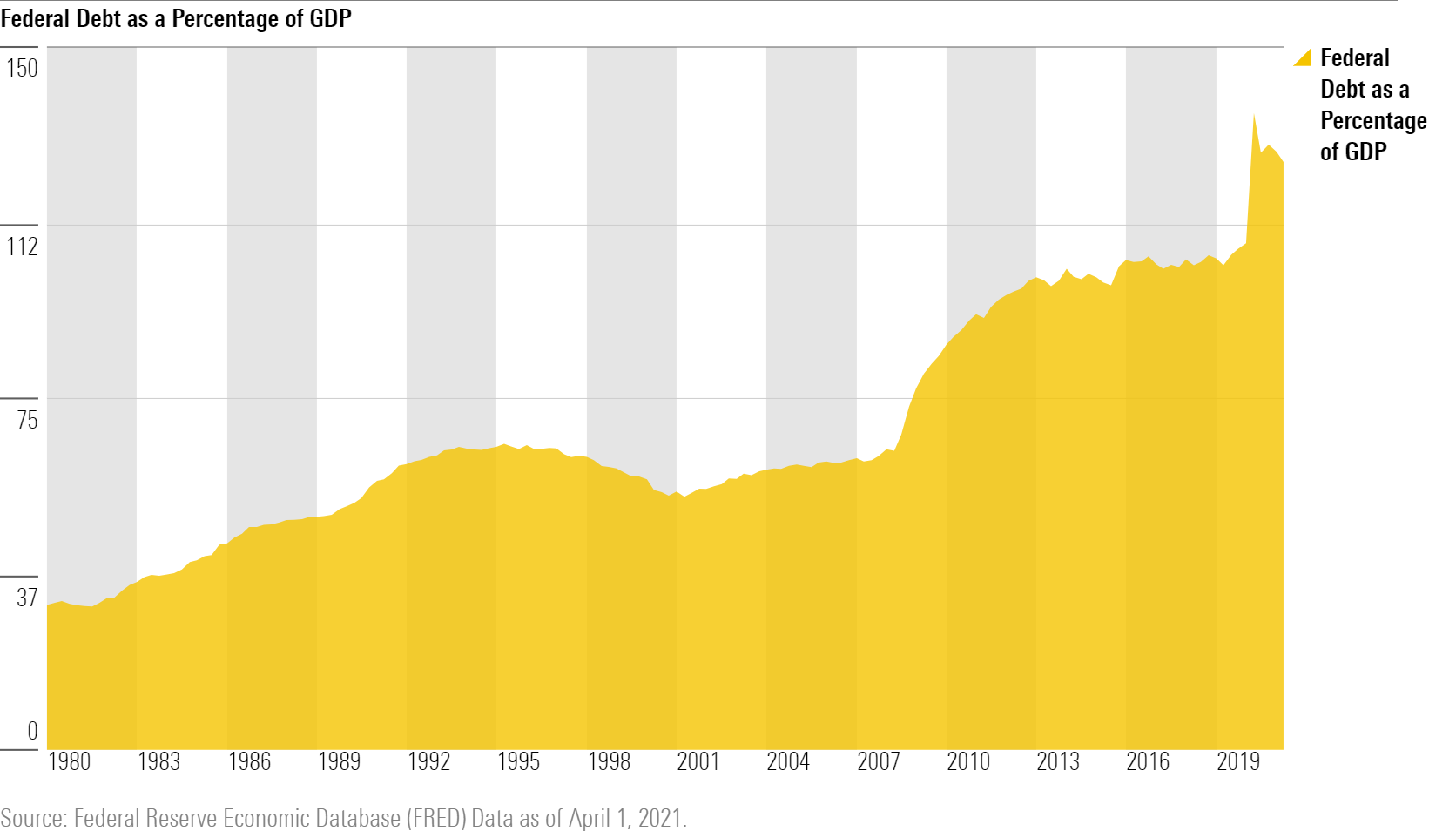

5) We often hear analysis suggesting that quantitative easing is leading to inflation, with analysis of monetary aggregates used to drive home the point. We find that this analysis rests on a faulty understanding of the relationship between monetary aggregates and inflation. Quantitative easing does not mechanically lead to broad inflation in the economy, as most of the "extra money" is not spent but simply sits on bank balance sheets. However, higher fiscal spending can be a more direct cause of increased demand and therefore inflationary pressure as it does lead to an increase in wealth and spending. Therefore, we would focus more on the overall health of the supply side, government spending, and a rebalancing of demand rather than quantitative easing and monetary aggregates.

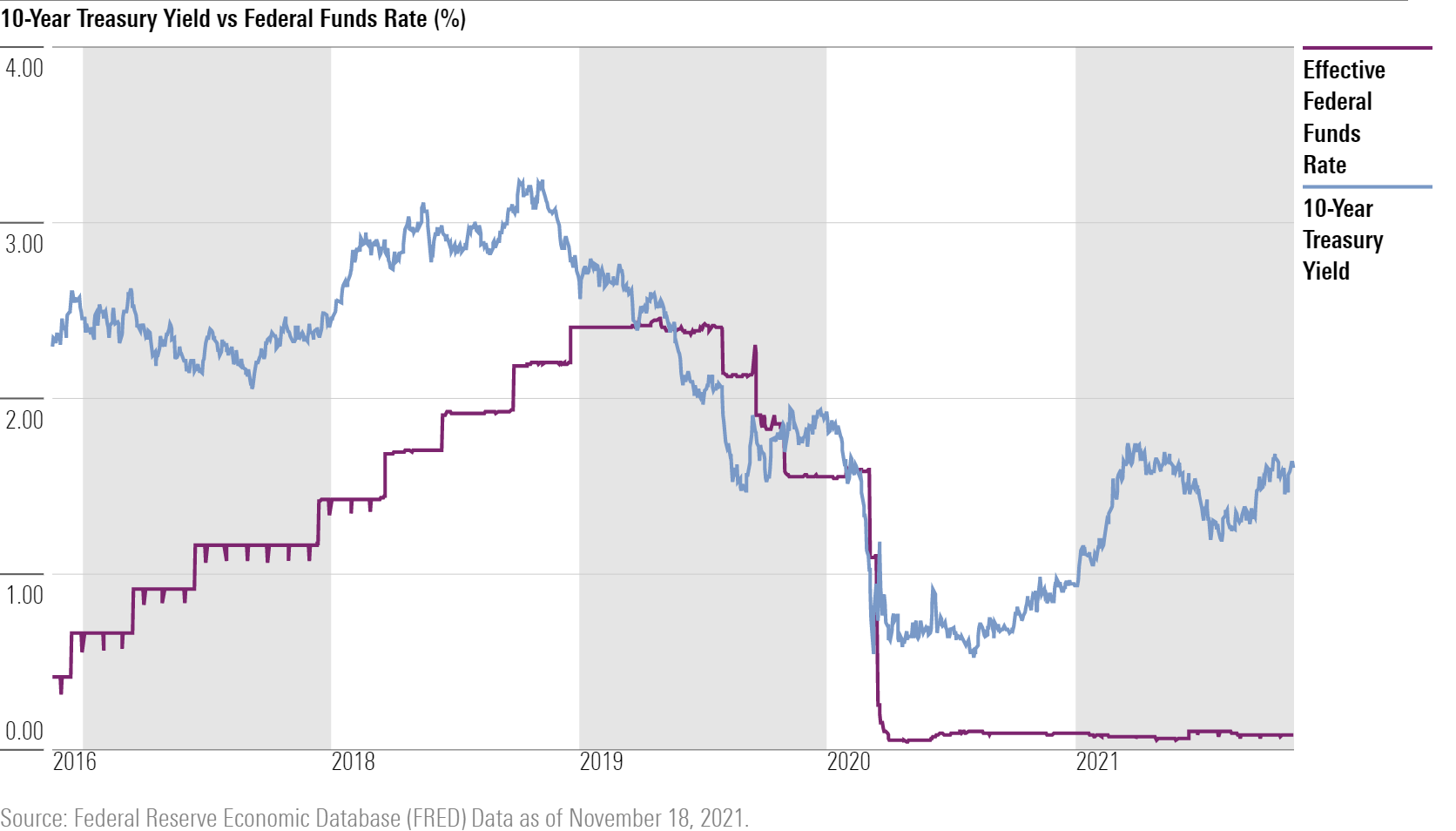

6) How strongly will the Fed react if inflation remains stubbornly high? This is sometimes referred to as the Fed's reaction function. Currently, we view the Fed as rather dovish, implying a less strong reaction to higher inflation, but this could change. This is another key uncertainty facing investors: Will the Fed's reaction function change over time?

7) If inflation does remain stubbornly high and the Fed decides it is time to break the current inflationary cycle, the Fed will have to raise rates; this will likely induce a recession. While we forecast that the economy will gradually recover from its supply-side woes and demand will rebalance, leading to inflation that isn't high enough to force the Fed's hand, this is another key uncertainty facing investors: Will the Fed have to induce a recession if inflation remains too high while growth remains below potential?

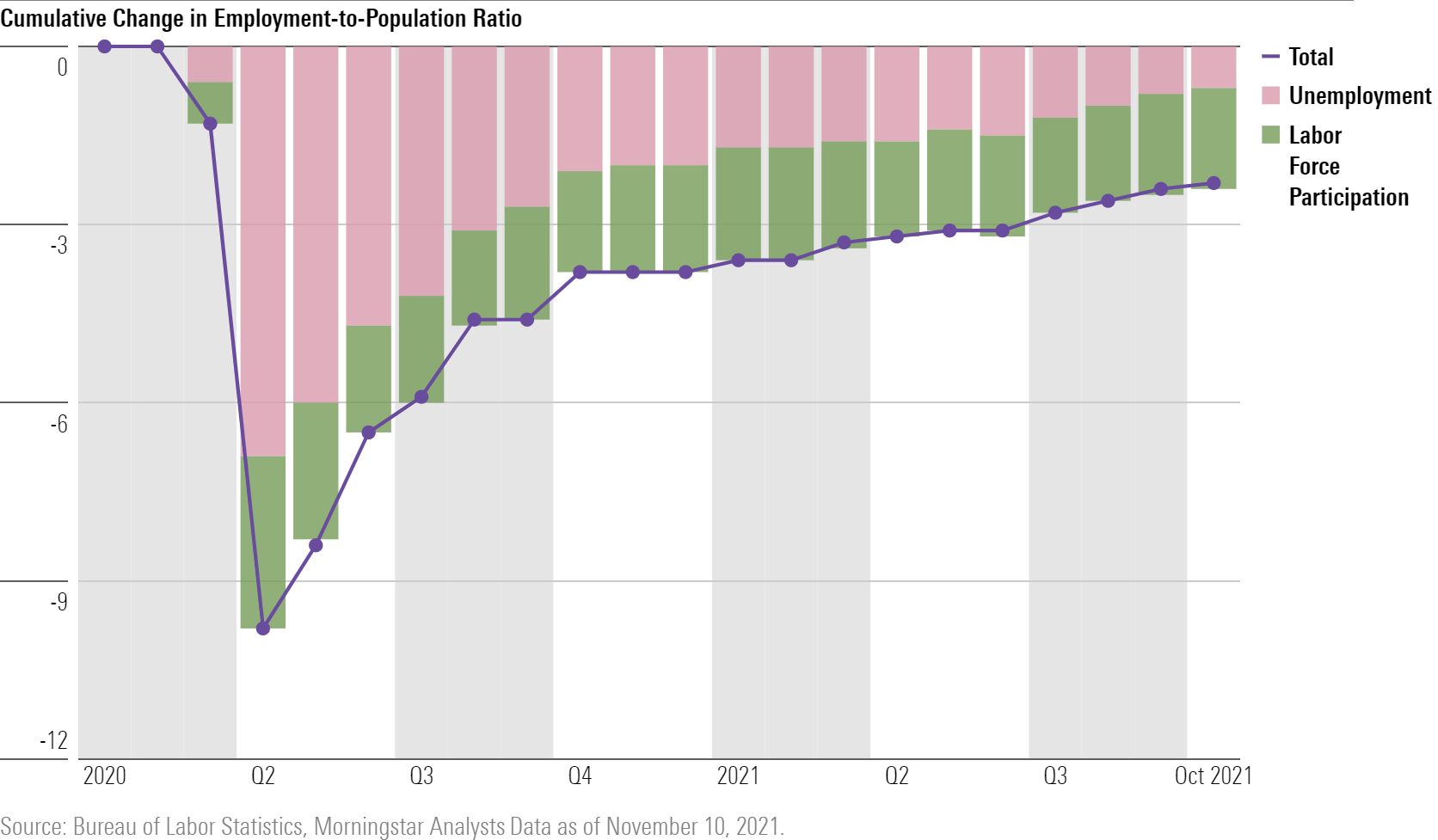

8) Finally, given the current labor participation issues, one of the ultimate questions facing investors is how labor-related issues will be resolved. Will the economy continue to broadly recover to its potential over the next year as participation returns, or will the labor market take many years to heal, as it did after 2008? This is another key uncertainty facing the Fed and investors: How will maximum potential employment and potential GDP develop over the next several years? We currently see a gradual recovery in the labor market that takes participation rates back to their prepandemic trend, but we also think this will take several years to fully play out.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)