7 Charts on the Fed's Tapering News

Higher inflation may be transitory, but watch the job market for Fed rate hike cues.

The latest Federal Reserve meeting made news, but it was the largely as-expected kind.

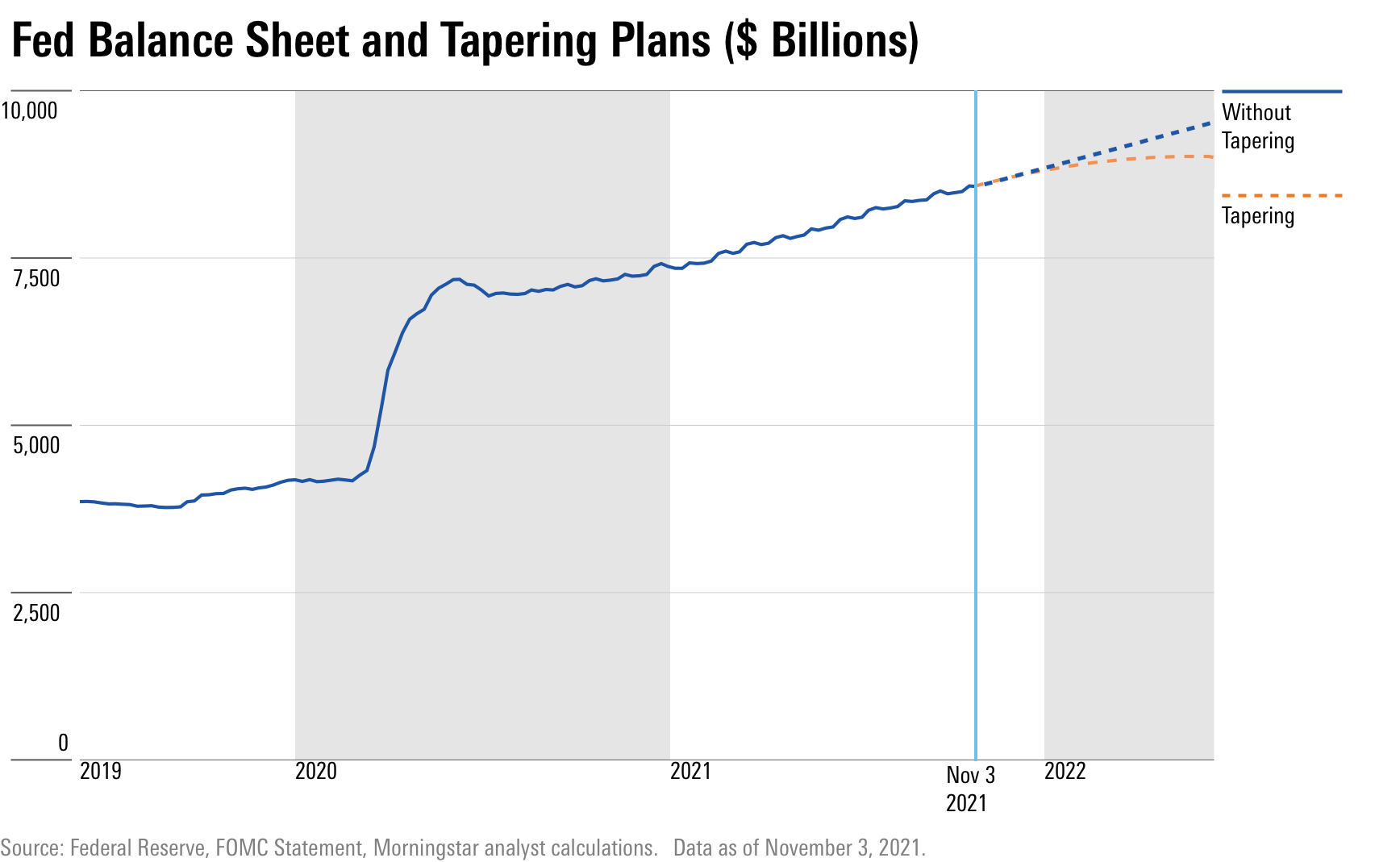

In its latest statement, released on Nov. 3, the Federal Open Market Committee unsurprisingly held the key federal-funds rate steady at 0.0%-0.25%. Nobody expected a change in rates at this meeting. Instead, the big issue on everyone’s mind related to the timing and amount of tapering in the bond market purchases that the central bank has been using since early 2020 to inject money into the banking system and support the economy amid the damaging impact of the coronavirus pandemic.

The Fed’s tapering announcement was essentially in line with market expectations, reducing the monthly pace of bond market purchases of $120 billion by $15 billion per month, with room to adjust along the way. This baseline tapering should lead to the end of asset purchases by sometime in June.

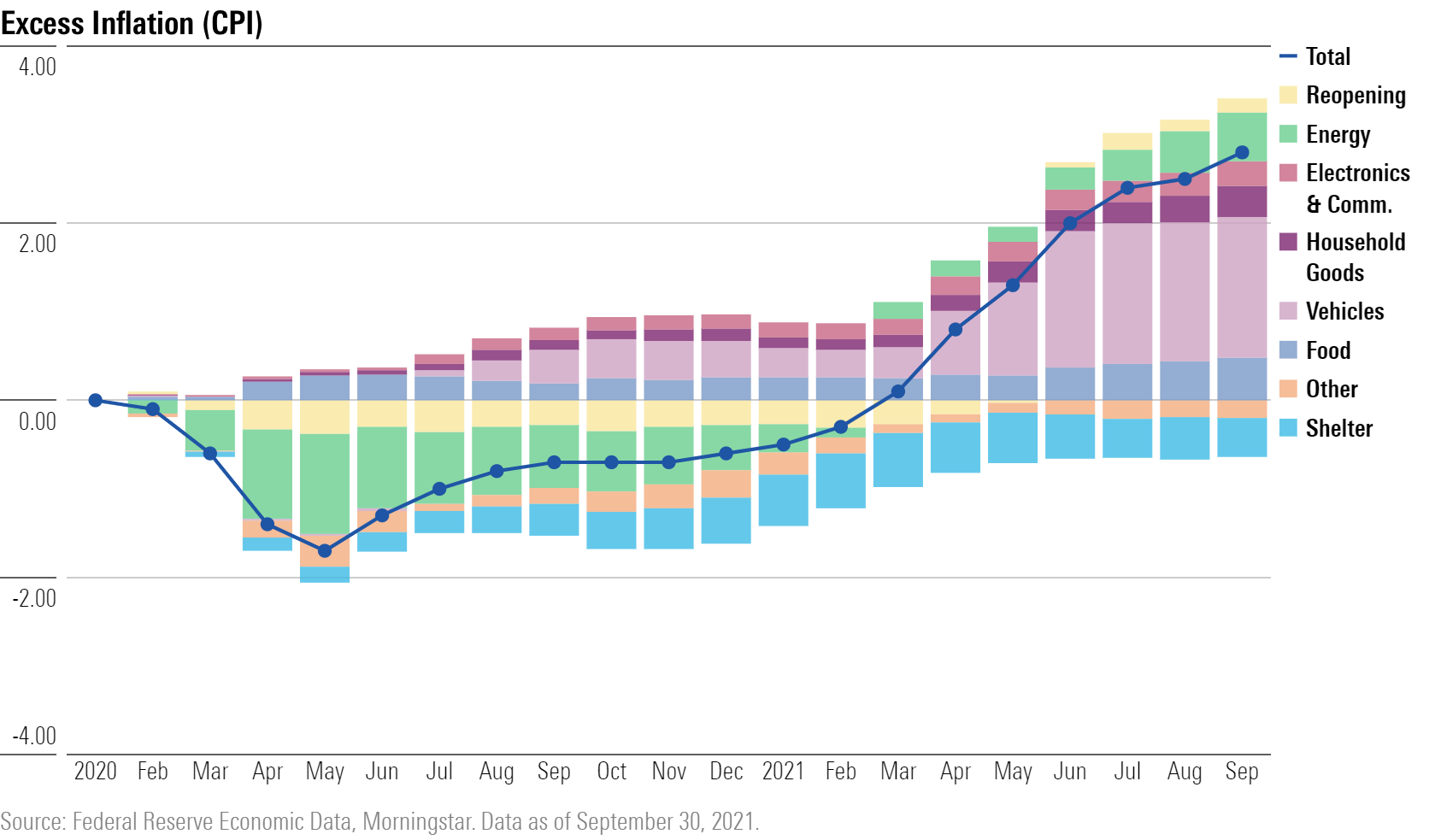

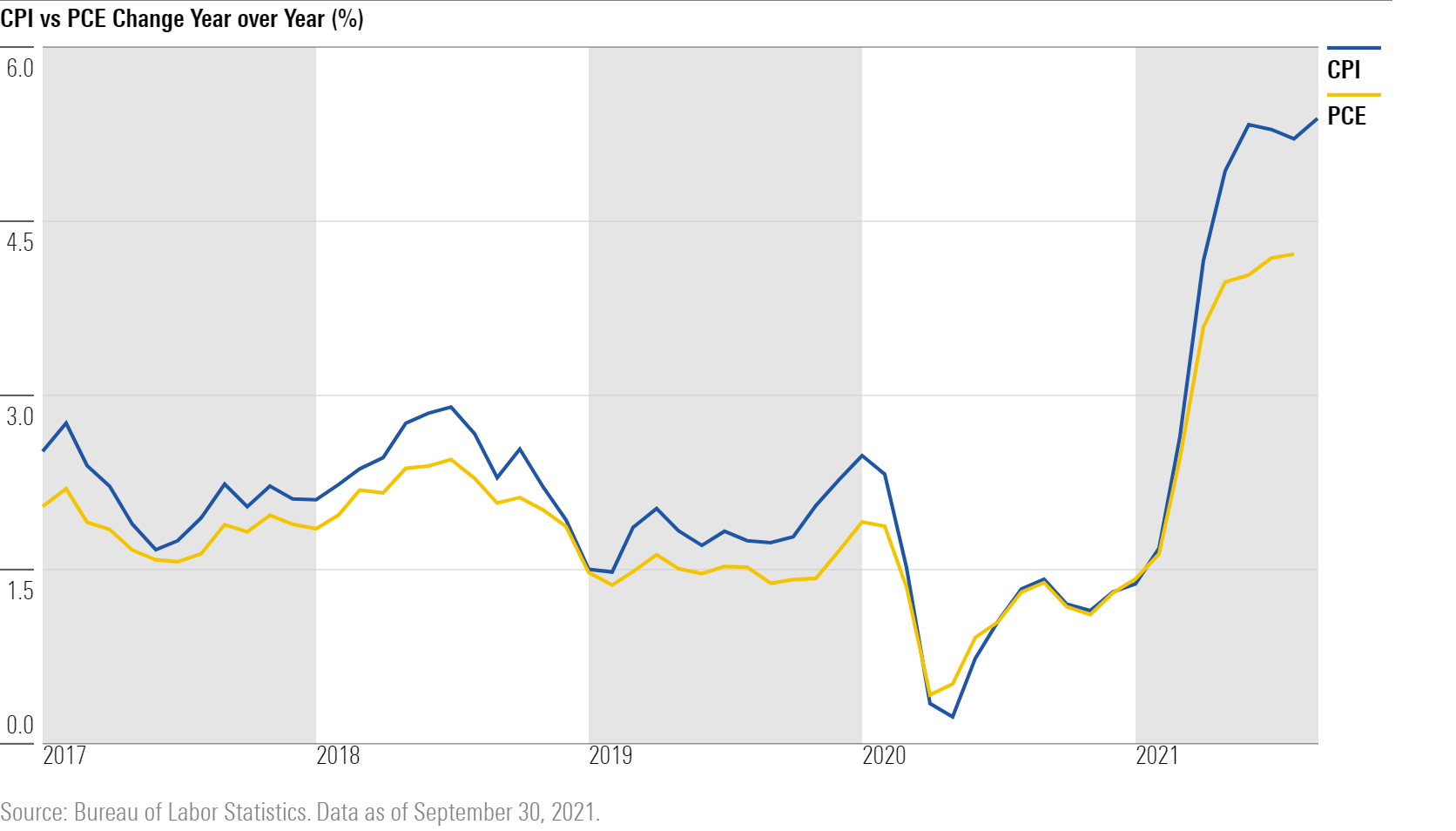

The overall commentary in the release changed slightly. The Fed now referred to factors driving higher inflation as “expected to be transitory” rather than simply “transitory,” which we view as an acknowledgement that inflation has trended higher for longer than the Fed expected and that it will be difficult to predict precisely when exactly the current supply issues will fully resolve. The new statement also linked an “easing of supply constraints” to employment gains and a reduction in inflation, rather than just focusing on vaccination progress. Again, a new acknowledgement that the supply side is the key determining factor at this point.

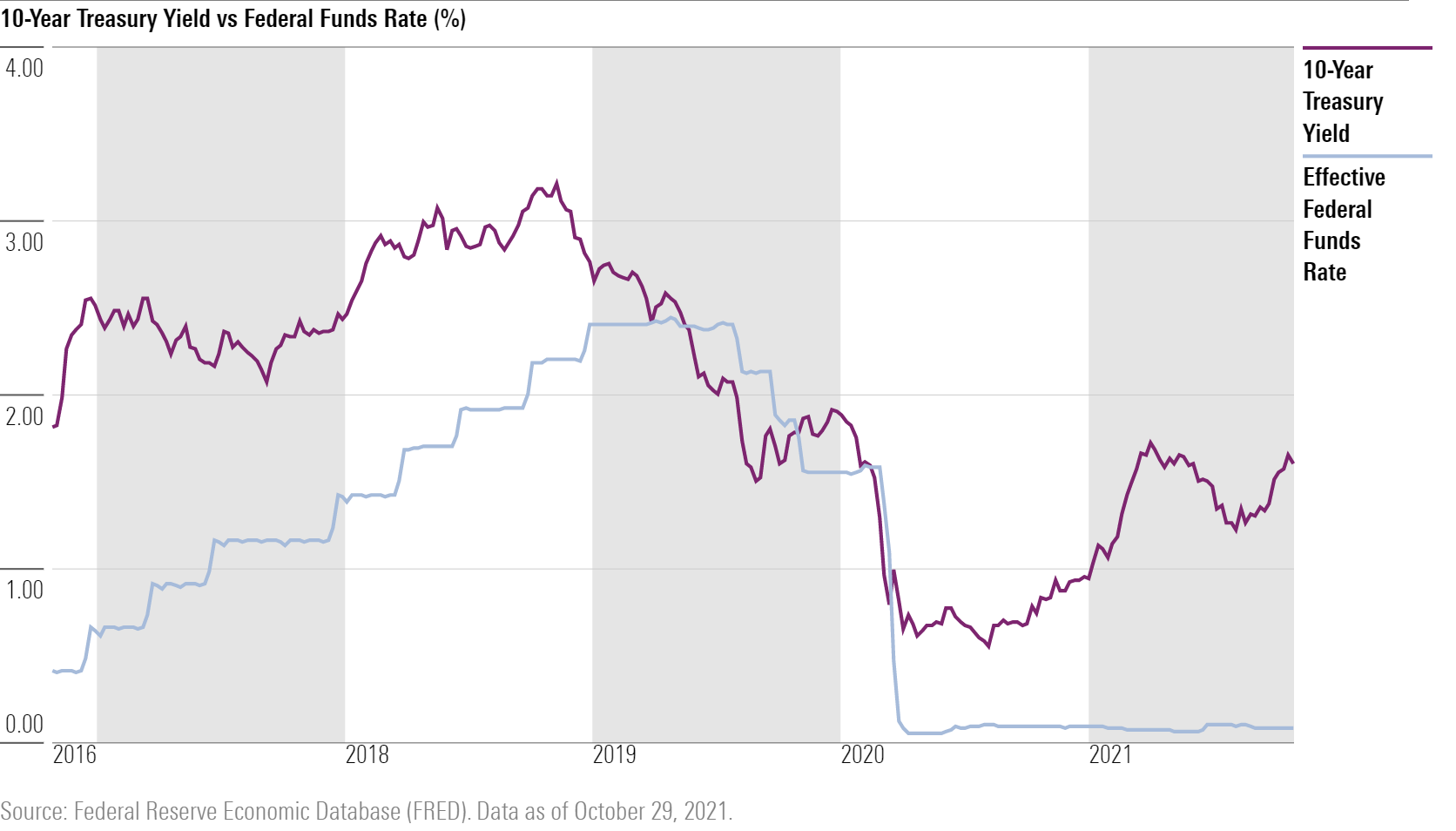

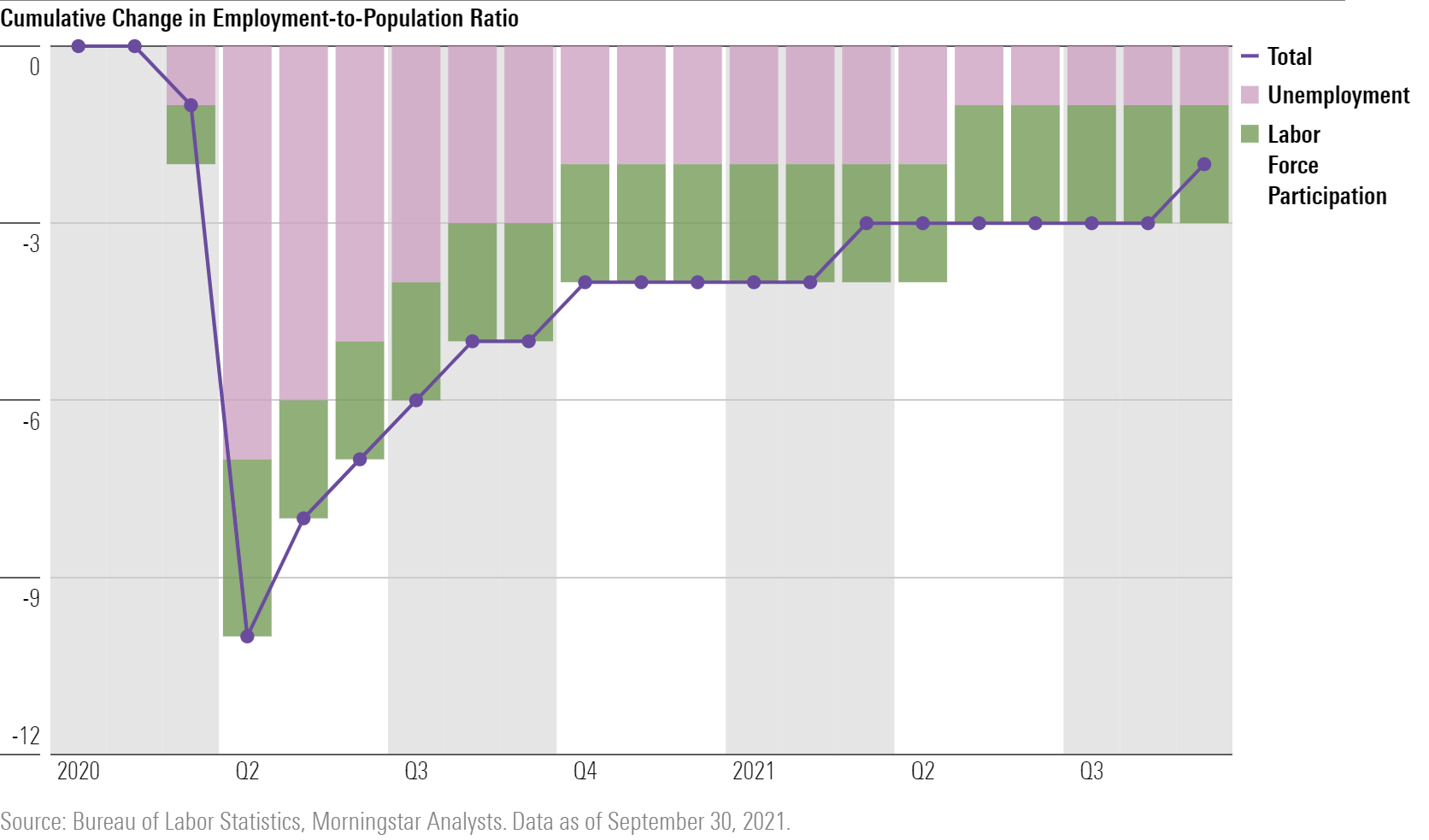

We think continued issues within labor supply will be the driving issue determining the timing of rate hikes. It is likely that it will take years for the labor market to fully recover, as higher wages gradually pull more people into the labor force over time. However, the Fed will likely start raising rates before we reach what we view as full employment, so the timing is still a bit ambiguous.

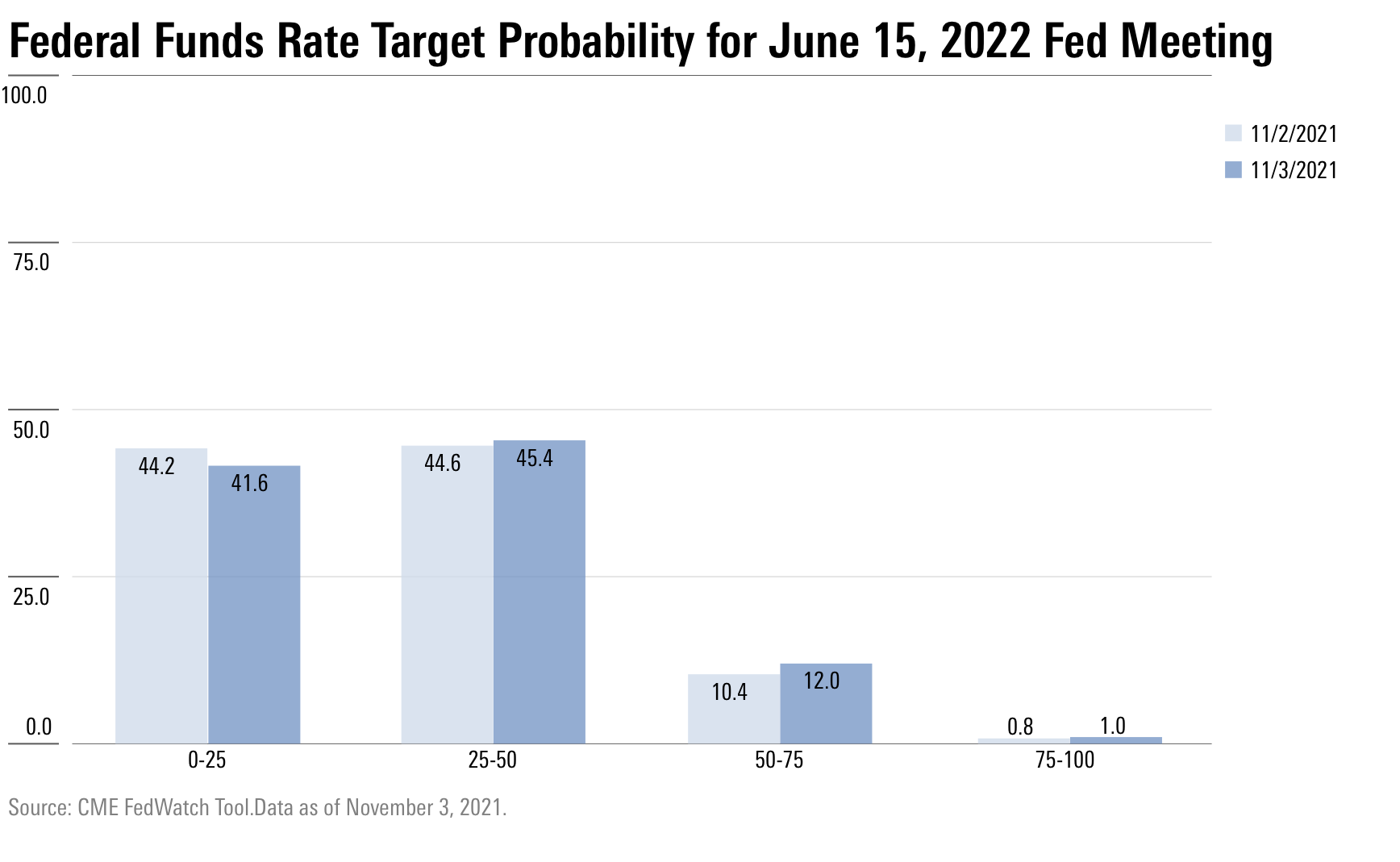

We think the market may be slightly overestimating the Fed’s reaction function with regards to inflation. Morningstar's forecasts call for inflation to likely remain slightly above 2% for the next several years, but that this would not force the Fed’s hand on rate hikes. We are leaving our expectations for a single rate hike in late 2022, and a single rate hike in early to mid-2023 unchanged, which is close to, but slightly below, market expectations for roughly 3 hikes by early to mid-2023. The risks to this rate outlook admittedly are to the upside, with higher inflation and a more aggressive Fed reaction seeming to be more likely risks than the opposite.

There remains a key debate about how the Fed will react to the current higher inflation and slowing growth environment. Will the Fed favor the job market and be more dovish, or try to stamp out inflation and be more hawkish? This is what many of the questions in the post-release press conference focused on, trying to tease out which mandate the Fed was favoring, stable prices or maximum employment.

Market expectations have moved increasingly hawkish, with rate hike expectations moving toward earlier and more often. CME futures now show expectations for at least one hike by mid-2022, two by the end of 2022, and a good chance of three hikes by early 2023. We think the economic data increasingly supports upside risk to inflation, but we still think the Fed will be reluctant to react too harshly to inflation that remains only modestly above 2% in 2022 and 2023.

Preston Caldwell, head of economics at Morningstar, notes that the Fed is still resisting calls to tighten monetary policy more aggressively, based on its expectation that inflation will be transitory. Morningstar agrees with the Fed’s view. Since the beginning of the pandemic, the Consumer Price Index has increased a cumulative 6%, which is 2.8% higher than Morningstar would have expected based on the pre-pandemic rate of inflation. As shown in the following chart, the bulk of that 2.8% of excess inflation has been driven by vehicles and other categories where supply has been limited by the semiconductor shortage. This issue--and other bottlenecks--should resolve in due time, helping to cool off inflation without any action from the Fed.

We think inflation may remain above the Fed’s September projections, which called for PCE inflation of 2.2% in 2022 and 2023, but that this would not force the Fed’s hand for aggressive rate hikes.

The Fed’s switch to an average inflation target, the increasing focus on the recovery of specific segments of the labor market, and the benefits of financial repression given the increase in government debt all point to a more dovish reaction function. The Fed also had an opportunity in its latest release to come out ahead of expectations on its tapering plan, or to remove its transitory language in a more forceful way, but didn’t, further suggesting a more dovish tilt in our opinion.

Taken all together, a couple of rate hikes over the next two years will likely be enough for the Fed to claim it is reacting to some inflationary pressures, while still supporting the recovery of the labor market. The Fed may even use balance sheet reductions at some point after tapering is complete as an intermediary step prior to rate hikes.

Caldwell says that when it comes to rate increases, much will depend on how the labor market and supply bottlenecks play out, with some upside risks to inflation and to the Fed reacting more harshly to this inflation remaining in play. This is not only because of the Fed’s goal of maximum employment, but also because high wage inflation emanating from tight labor markets is the most plausible reason why inflation could remain higher for longer. It’s difficult to say when the labor market recovery will fully play out, which is why the Fed is giving itself maximum flexibility to adjust monetary policy accordingly over the next year. As of September 2021, total U.S. employment remains about 3% below pre-pandemic levels.

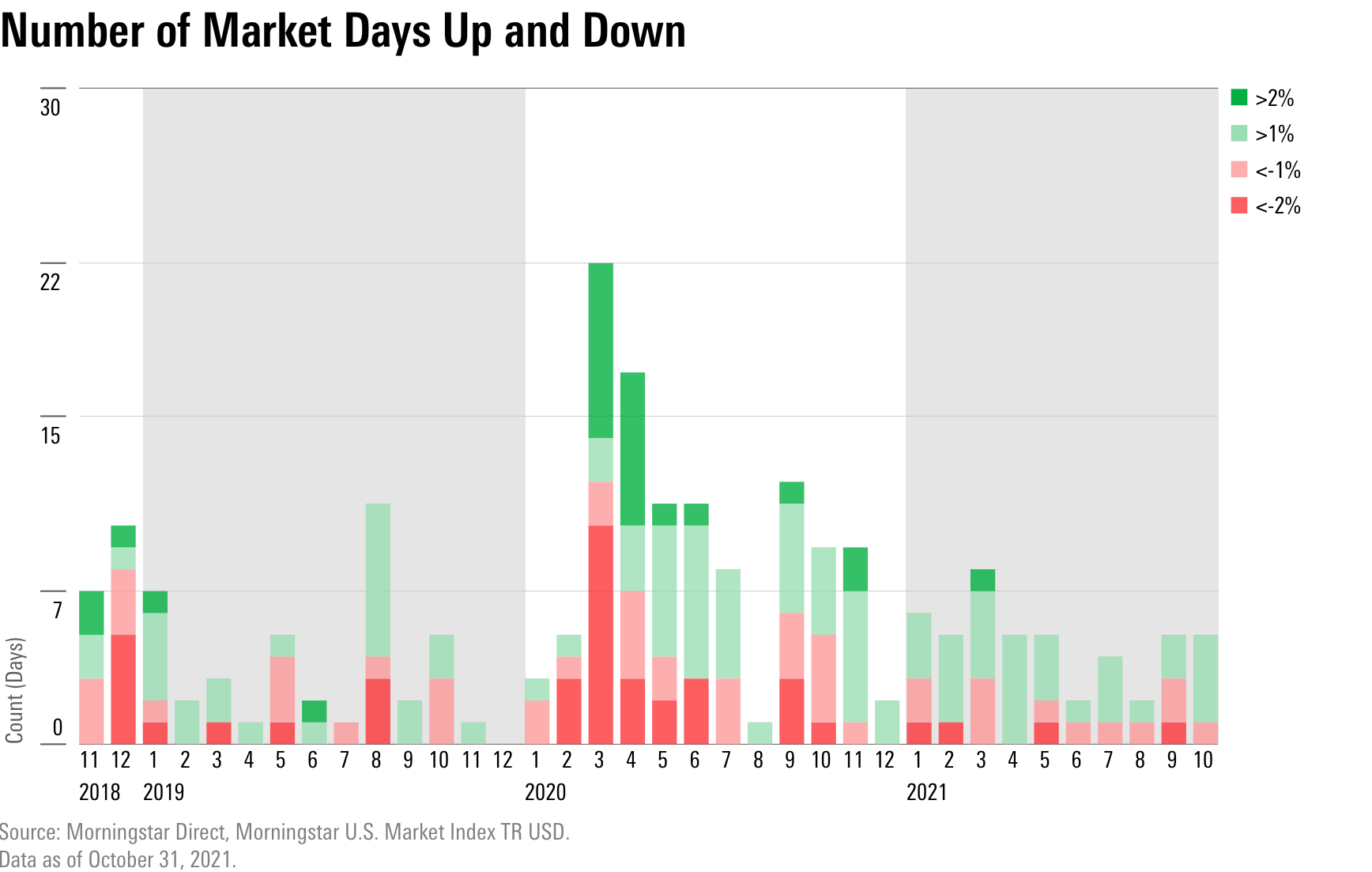

The news from the Fed was taken in stride, with the Morningstar U.S. Market Index hitting a record high for the second time in week.

This suggested that Fed officials had successfully telegraphed their intentions going into this week’s meeting and avoiding the kind of surprise that had roiled financial markets in 2013 when the central bank began its exit strategy from the easy-money policies that followed the 2008 global financial crisis. Instead, stocks have rallied to record highs with little volatility.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)