Medalist Managers Buy SPACs, Airlines, and Oil in 2021's First Quarter

Top managers looked ahead to a post-pandemic economy.

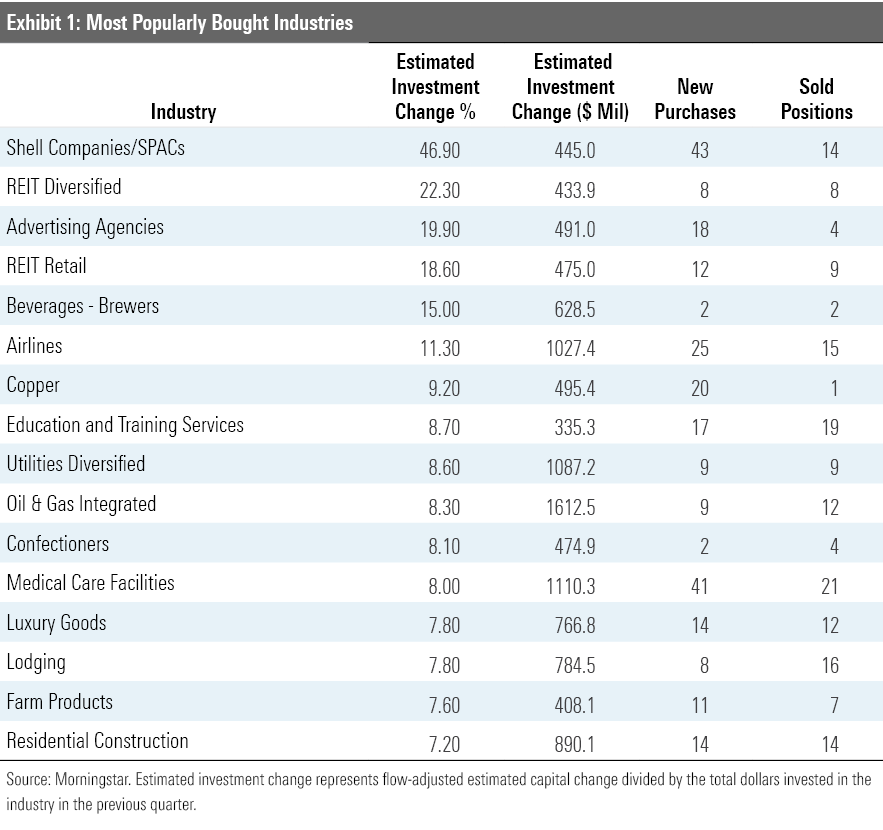

Top mutual fund managers positioned their portfolios for a post-pandemic economy in the United States in the first quarter. Reopening trades, including retail-focused REITs, airlines, breweries, luxury brands, hotels, and homebuilders were popular among U.S.-focused active equity funds with Morningstar Analyst Ratings of Gold, Silver, or Bronze. Top managers also showed an appetite for special-purpose acquisition companies--the "blank check" companies that have exploded in popularity since the beginning of 2020.

Here is a look at some of the medalists’ most popular stock purchases in the period, broken out by industry. The following data represents funds with at least one medalist-rated share class and a reported first-quarter portfolio as of May 11, 2021. It includes: 130 large-cap strategies, 51 mid-cap strategies, and 52 small-cap strategies covering more than $3 trillion in combined assets. The data is adjusted for fund-level cash inflows and outflows to distinguish changes managers’ chose to make from those they had to make to meet redemptions or put new money to work.

Shell Companies/SPACs

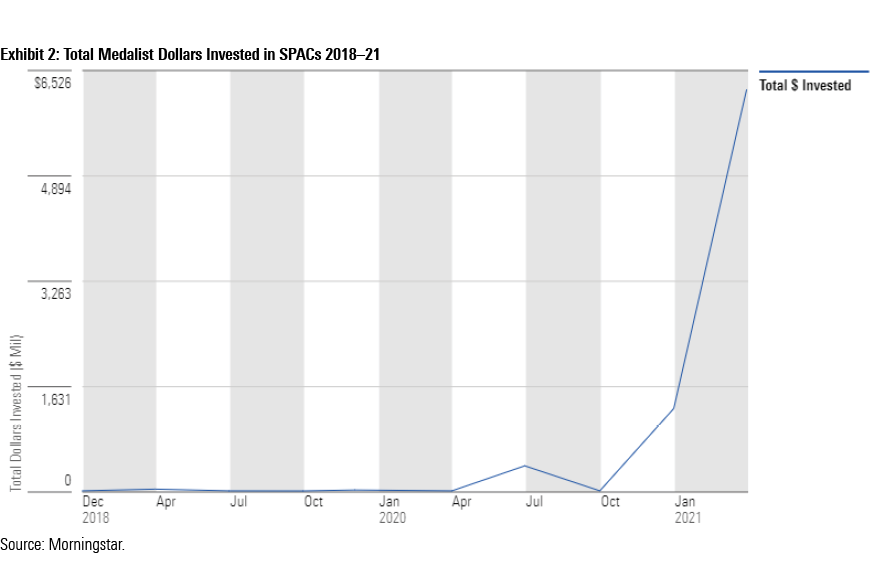

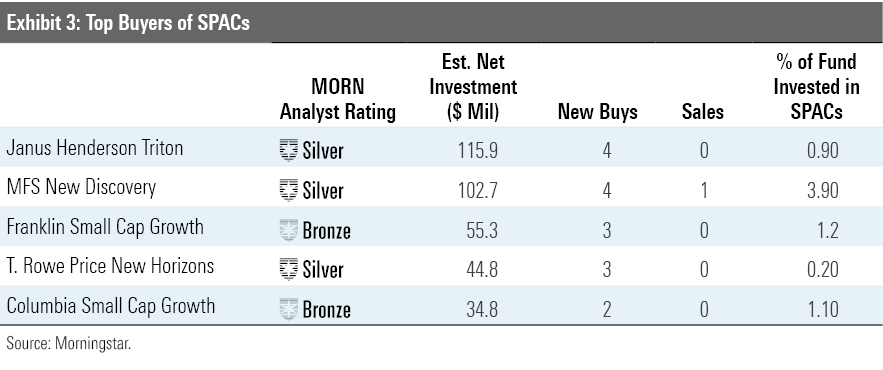

SPACs rose to prominence in 2020 as an alternative route to taking companies public. They raise capital through a shell company and then use it to purchase or merge with an existing operating company. SPACs have stumbled recently, but many medalist managers joined the party while it was still raging in 2021’s first three months. They increased their collective SPAC stake by nearly 50% as 30 separate medalists bought at least one SPAC. Wells Fargo Global Small Cap Fund EKGAX went on a SPAC shopping spree, buying six of them, including two (Poema Global Holdings PPGHU and Tailwind International Acquisition Corp TWNI) that have yet to announce a merger. A lot of managers won’t invest in a SPAC until it announces a definitive merger agreement with an operating company. MFS New Discovery MNDAX, for example, was another active buyer, but the four SPACs it added each had announced mergers before the fund purchased them.

Ad Agencies

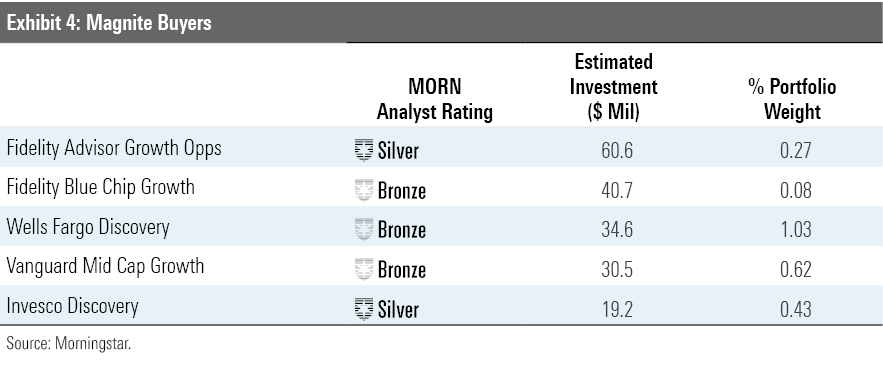

Active stock managers also snapped up advertising companies like Magnite MGNI, Omnicom OMC, and WPP PLC WPP. An open economy should bolster these businesses as they derive significant revenue from live event marketing. However, Magnite, the most popular buy, focuses on helping digital publishers sell ad space. Seven medalists bought the agency’s shares. Most of them were growth managers, although Goldman Sachs Small Cap Value GSSMX also bought it. The stock is volatile: It jumped from $30 per share in January to $62 in February and fell to $42 by quarter-end.

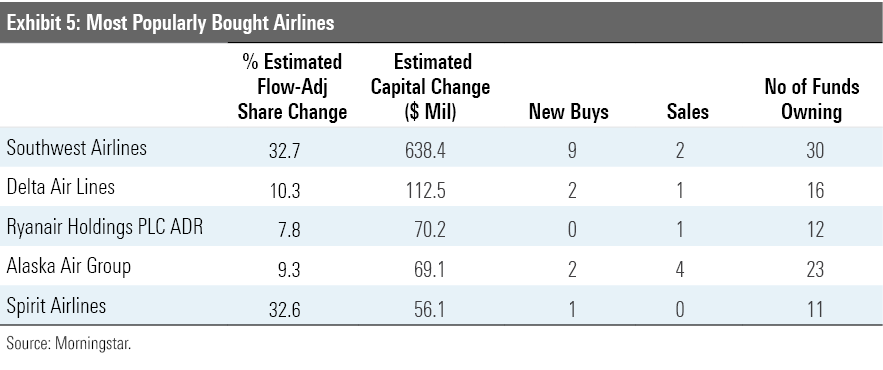

Airlines

Medalists increased their aggregate airlines holdings by more than an estimated $1 billion, as the likelihood that people would soon resume personal and business-related travel increased. Medalists increased their collective position in Southwest LUV by nearly a third, more than any of the other largest U.S. airlines by passenger volume, including American AAL, Delta DAL, and United UAL. Six T. Rowe Price funds initiated new positions in the company, with T. Rowe Price Value TRVLX buying the most--more than $250 million worth. American was the only major airline that medalists sold. Fidelity Blue Chip Growth FBGRX shed its stake in the airline while adding to its position in discount carrier Spirit Airlines SAVE.

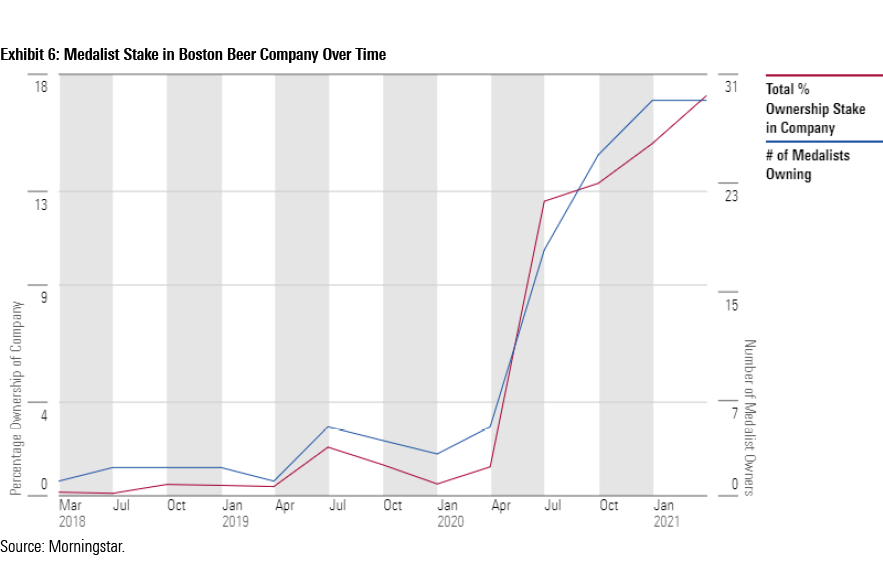

Brewers

Continuing a 2020 trend, top managers bellied up for breweries. Medalist managers increased their combined stake in them by 15% in the first quarter. A single fund accounted for the bulk of the increase. American Funds Growth Fund of America AGTHX, the largest actively managed mutual fund in the world, initiated a more than $350 million position in Heineken HEINY, and was the only medalist to own the Dutch brewer. Boston Beer Company SAM remained a medalist favorite: Eight funds increased their stakes by at least 10% on a flow-adjusted basis in the quarter. Twenty-nine medalist funds collectively own more than 15% of the company.

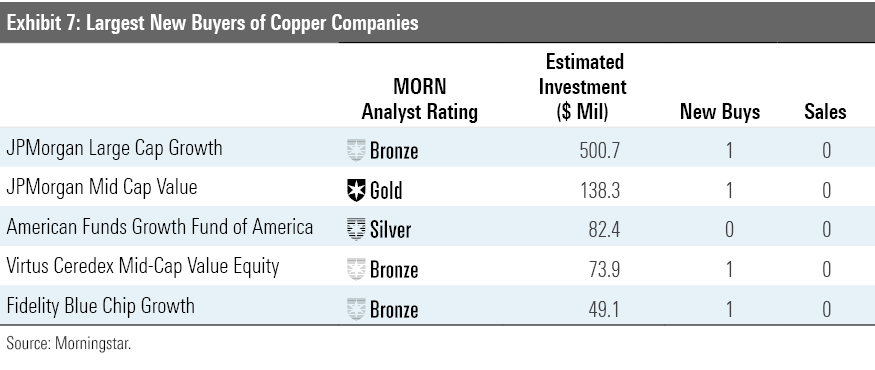

Copper

A couple of copper miners attracted a lot of new interest as the price of copper climbed nearly 85% from March 2020 through the end of 2021’s first quarter. Twenty medalist funds established new positions in two copper-related companies, including nine that bought FreePort McMoRan FCX, the largest copper miner in the world. A swath of Fidelity funds, including Fidelity Contrafund FCNTX and Fidelity Blue Chip Growth FBGRX, bought First Quantum Minerals FM, a Canadian mining company that derives the bulk of its revenue from copper. American Funds Fundamental Investors ANCFX, however, cut its stake in the company by more than 50%, resulting in a net decrease in the aggregate medalist stake in the company.

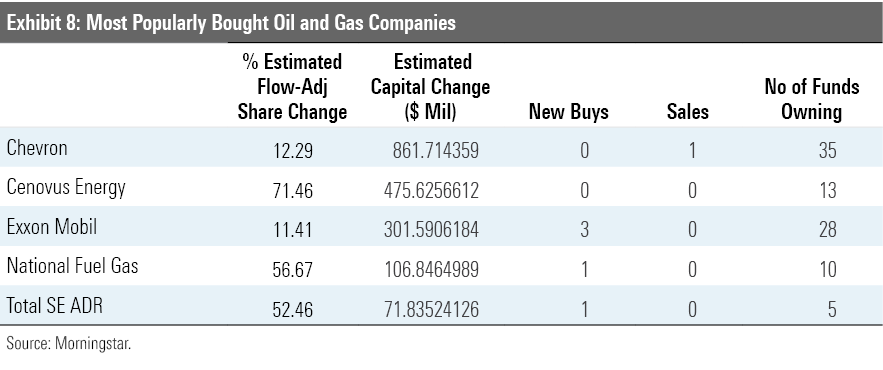

Oil and Gas

Medalist managers have jumped back into energy companies after the sector’s brutal start to 2020. The Morningstar U.S. Energy Index dropped more than 56% in February and March of last year. It has rebounded and then some; since the March 2020 market trough, the index has gained more than 120%, much more than the Morningstar U.S. Market Index’s 76%. The index is still far below its 2014 peak, though, and medalist managers continue to buy. Blend and value funds bought the most energy. BNY Mellon Dynamic Value DAGVX and T. Rowe Price Mid-Cap Value TRMCX, for example, bought Exxon Mobil XOM and National Fuel Gas NFG, respectively.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)