Green Technology Stocks That Look Cheap

Samsung SDI and First Solar are trading at a discount within the Morningstar Global Emerging Green Technologies Select 30 Index.

Green technology stocks have underperformed the markets, but a few stand out for value.

Despite over USD 1 trillion spent by the U.S. government on green energy, green stocks are having a difficult year. Stock prices for individual companies have fallen globally, as higher costs and interest rates, equipment failures, and uncooperative weather have combined to reduce revenue.

IShares Global Clean Energy ETF ICLN, the largest clean energy technology fund, is down 28.5% for the year to date.

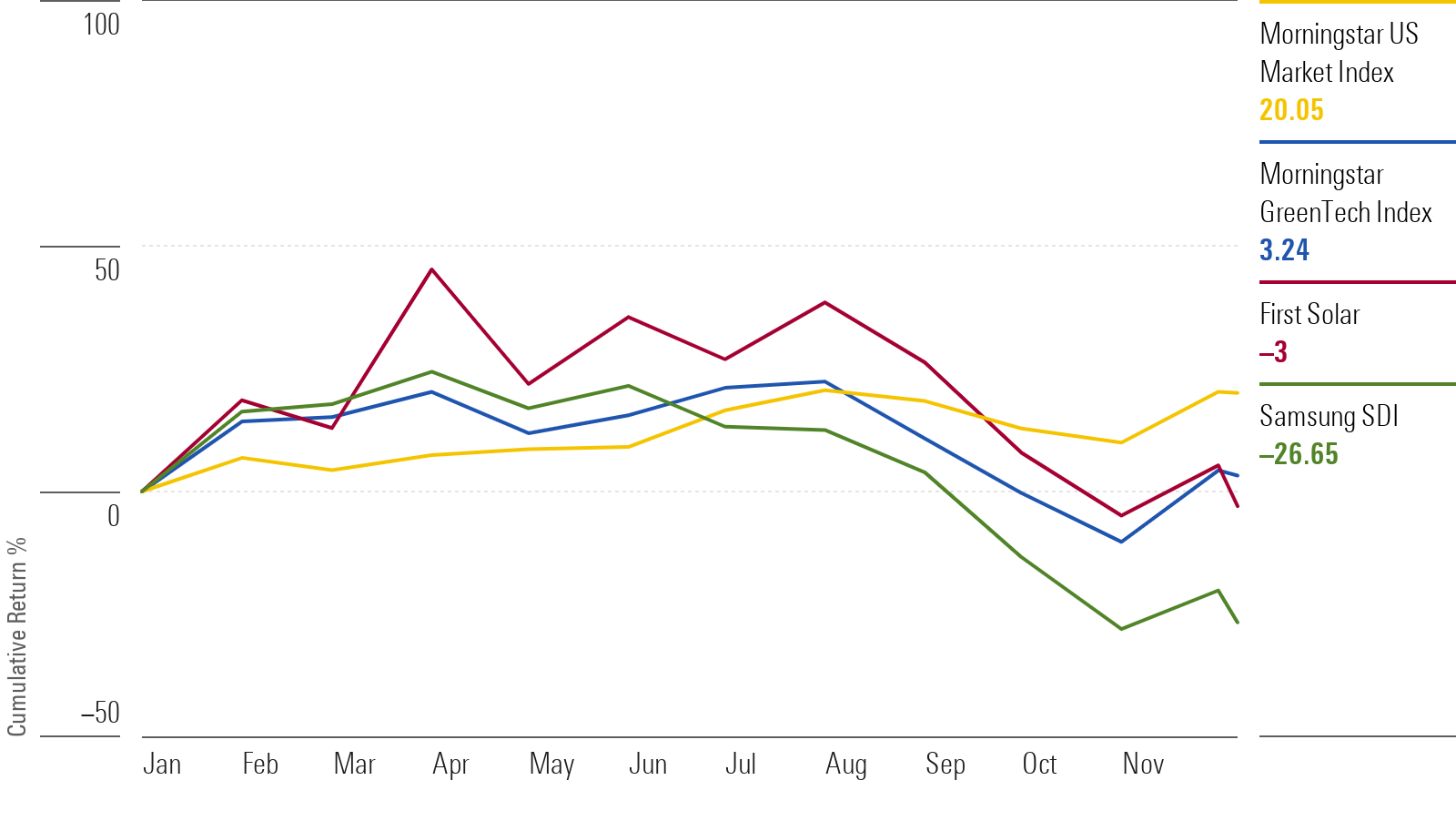

In its short life, the Morningstar Global Emerging Green Technologies Select 30 Index, which launched Sept. 29, 2023, is up just 5.0%, lagging the Morningstar US Market Index’s 7.2% return over the same period and the Morningstar Global Markets Index’s gain of 6.1%. Based on Morningstar’s calculations, the underlying holdings of the Green Technologies index would have returned about 3.3% since Jan. 1, versus 21.0% for the US Market Index and 8.7% for the Global Markets Index.

The Morningstar Global Emerging Green Technologies Select 30 Index owns the top 30 companies that generate at least a fourth of their revenue from innovative green technologies, as determined by Morningstar’s equity research team and data from Morningstar Sustainalytics.

Green Tech Stocks

Green tech is a type of technology that is considered environmentally friendly based on its production process or supply chain. The term can also apply to technologies that produce clean energy, utilize alternative fuels, and are less harmful to the environment than fossil fuels. The five largest names in the index are Vestas Wind Systems VWDRY, Tesla TSLA, ABB ABBNY, Xylem XYL, and Samsung SDI 006400.

2 Cheap Green Tech Stocks

As we combed the index, two stocks stood out for being cheap.

We looked at the stocks within the Morningstar Global Emerging Green Technologies Select 30 Index that had Morningstar Ratings of 4 or 5 stars, which indicates that the stocks are undervalued. We also looked at the difference between the current price of the stock compared with the stock’s fair value estimate to calculate the price/fair value estimate.

By our calculations, the cheapest stocks in the index were Korea’s Samsung SDI and First Solar FSLR. The two make up approximately 18% of the index. Samsung SDI makes LCD panels and batteries, and First Solar makes solar panels. Among other things, the solar sector was already struggling this year as rising interest rates hurt the financing environment for U.S. solar installation. One First Solar fan is Microsoft MSFT, which is using the company to meet its goal of 100% renewable energy supply for its data centers and buildings. Samsung SDI is trading at a 37% discount to Morningstar’s fair value estimate, and First Solar is trading at a 21% discount.

Year-to-Date Performance

Samsung SDI

Morningstar Rating: 4 stars

Morningstar Economic Moat Rating: None

Morningstar ESG Risk Rating Assessment: 4 globes

Fair Value Estimate: KRW 700,500

Current Price: KRW 443,486.55 as of Dec. 7, 2023

“Samsung SDI is one of the major companies in the Samsung Group and one of the top global suppliers of lithium-ion rechargeable batteries. By leveraging its expertise in electronic materials, Samsung SDI has been supplying various materials and films for semiconductors, LCD and OLED panels, and rechargeable batteries to Samsung Electronics, which is the world’s largest consumer electronics and memory manufacturer.

“Our fair value estimate is KRW 700,500, which implies 23 times price/earnings and 9 times EV/EBITDA on a fiscal 2024 basis. We forecast Samsung SDI’s revenue to increase at a 17% compound annual growth rate over 2022-25, driven by the growth of rechargeable batteries mainly used for automobiles. To meet strict environmental regulations, auto manufacturers are required to increase the proportion of electric and hybrid vehicles.

“While smartphone shipments may stagnate, we forecast steady revenue growth for small lithium-ion batteries and electronic materials, because of the 5G rollout. 5G phones require larger power consumption, faster processing speed, and larger data storage, which drives content growth per phone. Higher energy density and capacity will contribute to improving the product mix of rechargeable batteries and increasing memory per phone will drive the sales of electronic materials.”

—Vincent Sun, Morningstar equity analyst

The battery maker, which supplies General Motors GM, Stellantis STLA, and BMW, among others, said that it will supply batteries manufactured at its factory in Hungary for Hyundai Motor’s electric vehicles targeting the European market from 2026 through 2032.

Samsung SDI accounts for 1.6% of the Korea Composite Stock Price Index. So far this year, the Kospi is up 13.3%, while Samsung SDI is down approximately 24.0%.

First Solar

Morningstar Rating: 4 stars

Morningstar Economic Moat Rating: None

Morningstar ESG Risk Rating Assessment: 4 globes

Fair Value Estimate: USD 185

Current Price: USD 144.18 as of Dec. 7, 2023

“First Solar is the world leader in thin-film solar panel technology. Following the exit from its development business in recent years, the company is a pure-play manufacturer of solar panels. The key drivers of shareholder returns are shipment volume, average selling prices, gross margin, capital expenditures, and incentives. We expect capacity to more than triple by year-end 2025 from 2021 levels, thanks to U.S. and India factories.

“First Solar remains poised to deliver a windfall in profits in the coming years thanks to domestic manufacturing credits and its leading U.S. position. Looking longer term, we remain interested in how First Solar can potentially leverage this windfall to enhance its competitive position via its thin-film technology as solar panel technology shifts to tandem cells later this decade.”

—Brett Castelli, Morningstar equity analyst

If the rout in green tech stocks continues, it’s worth keeping an eye on fair values and potential bargains.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)