This Sustainable Fund Jumped 45% in 2023

Exposure to AI stocks like Adobe was a driver last year. Will it continue to pay off in 2024?

Parnassus Growth Equity PFPGX is off to a strong start.

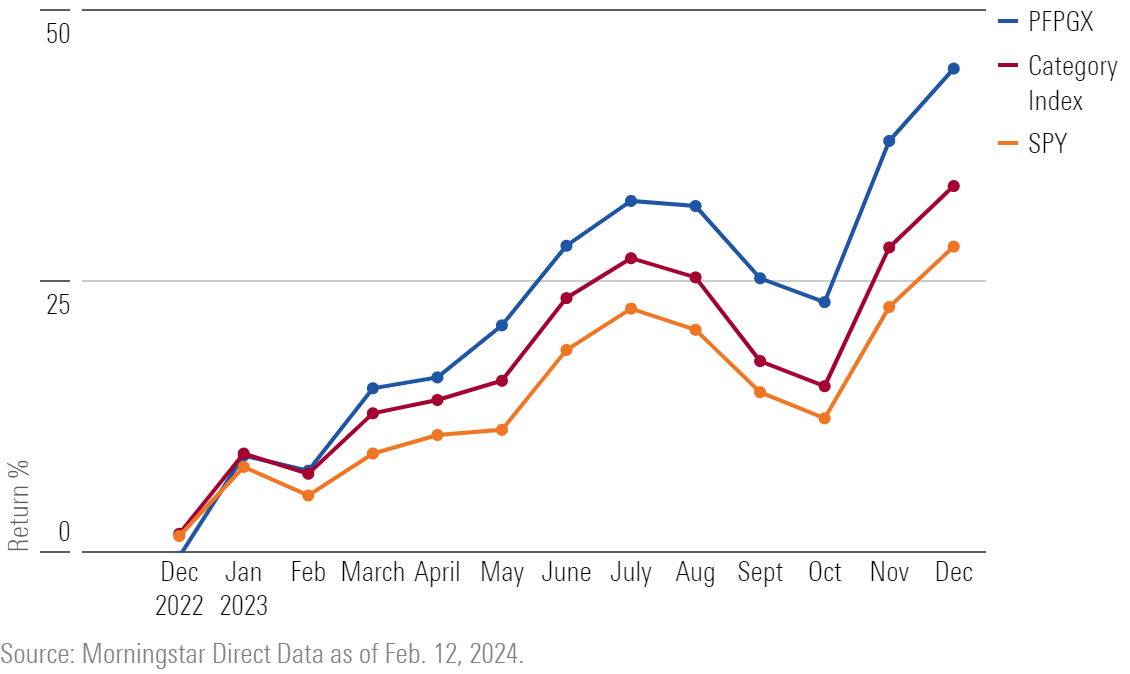

In 2023, the fund jumped 45%, thanks in part to the vogue for artificial intelligence stocks. So far this year, the fund is up 5.96%, pacing the 5.79% return of the average large-growth fund and the 5.99% return for the Morningstar US Large-Mid Cap Broad Growth Index.

PFPGX Growth Chart

“In 2024, we’re going to start learning the value proposition of AI, and who’s going to make money,” says Andrew Choi, the fund’s comanager.

Parnassus Growth Equity began life in late 2022. Parnassus, a sustainable investing specialist, was looking to offer a large-cap growth fund in addition to an existing large-cap blend fund. That year, the market savaged mega-cap technology stocks. But that correction allowed the fund to pick up cheap shares. The following year, good fortune followed, as mega-cap tech surged.

Moats, Good Management, and ESG

Parnassus, founded in 1984, has always sought companies with durable competitive advantages and ethical practices. They also use ESG, quality, and valuation screens, which Choi regards as a way to responsibly compound wealth. “We look at companies with a moat, good management, and relevancy,” says Choi. Including what Choi calls “sustainable considerations” as investment factors provides “a holistic consideration of all the things that might matter and prioritizing the things that do matter” to an investment. He emphasizes the absence of a one-size-fits-all model for ESG analysis, recognizing the uniqueness of each company’s ESG considerations.

Parnassus Growth Equity holds a Morningstar Medalist Rating of Bronze as of Dec. 31, 2023. It has a Low Morningstar Portfolio Carbon Risk Score of 3.4 and minimal fossil fuel exposure. Choi, who manages the fund with Shivani Vohra, joined Parnassus in 2018 and has been a core part of the equity team since 2022.

“Parnassus Growth Equity employs a firmwide approach looking for companies with wider moats, relevant offerings, management teams, and strong sustainable characteristics. This fund is helmed by two up-and-comers, Choi and Vohra, that have been very involved in promising technology and healthcare picks for the firm’s strategies,” says Morningstar analyst Stephen Welch.

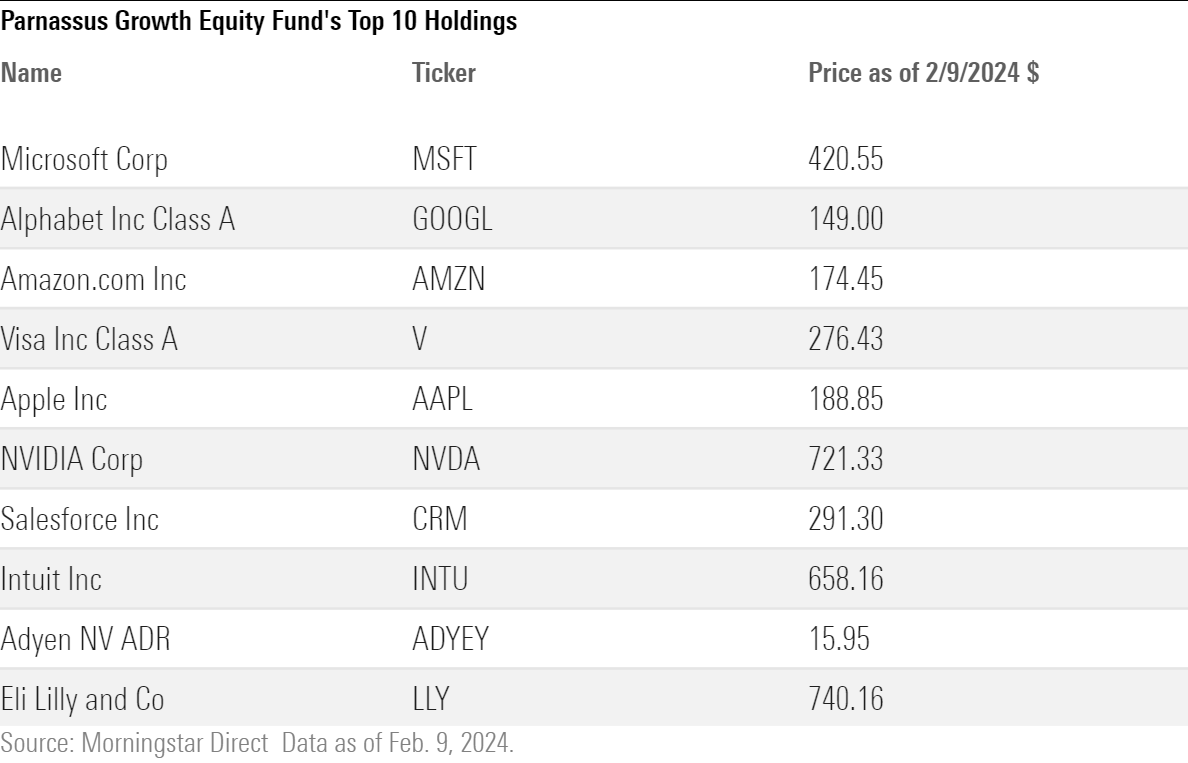

Choi and Vohra are committed stock-pickers. The fund owns just 40 holdings, and the largest 10 positions account for 48.5% of assets. Some 10% of the portfolio is invested in Microsoft and a notable emphasis on the technology sector, Choi anticipates that 2024 will unveil the potential and growth of AI. The top 10 holdings of the fund all boast a wide Morningstar Economic Moat Rating, emphasizing the importance placed on companies with a competitive advantage over their peers.

Parnassus Growth Equity Fund's Top 10 Holdings

Adobe, Adyen Boost Performance

In 2023, the top two contributors to the fund’s performance were Adobe ADBE and Adyen ADYYF. Acquiring the stocks fit “a common pattern of the bread and butter for Parnassus, where a high-quality business sells off due to some controversy or debate from which we have a different view,” says Choi.

The fund purchased Adobe in the second quarter of 2023. “This was a business that would benefit from AI rather than be disrupted,” says Choi. Yet Adobe was an incumbent and worries that it would be left behind weighed on the stock. At the same time, Adobe did an initial beta launch of Firefly, a generative machine learning model used in design. “Adobe has basically transferred from perceived to being an incumbent being disrupted by AI to now being an incumbent benefiting from AI,” says Choi. “Now the core business will continue to compound value and the optionality in generative AI is a net contributor.” In 2023, Adobe stock rose 51%.

The fund added European payments firm Adyen in 2023, when it was down more than 70% from its high amid concerns about competition from PayPal PYPL and other rivals. Adyen, known for its user-friendly and innovative approach to payments, serves diverse industries, simplifying global payments for businesses. “When you start to do work in a high-quality business with stock that has underperformed, there’s lots of scar tissue and investor bias,” says Choi. However, Adyen is “the gold standard of payment companies.” Adyen, as a low-cost provider, was saving money for customers. The company’s multiple began expanding. In 2023, Adyen stock rose 6.67%, although the stock has more than doubled from its bottom last fall.

Expect AI Champions to Win in 2024

Choi thinks the champions of AI will emerge in 2024. “We’re incrementally less positive than in 2023, when our biggest bets were far and away enterprise software. We still have enterprise software exposure but we’re sizing up areas that fall out of that.”

“In 2023, AI was the big investment thread that was the driver of performance. In 2024, we’re going to start learning the value proposition, who’s going to make money, and we’ll see the actual value creation,” Choi says.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)