Investors Turn to Bonds and International Stocks

In 2021, these fund categories pulled in investor dollars.

Fund investors weren’t fazed by anything in 2021. Almost every type of mutual fund and exchange-traded fund experienced a wave of cash. Even some long-struggling areas, including actively managed funds, saw an injection of new money.

Here’s what investors did with their money in 2021.

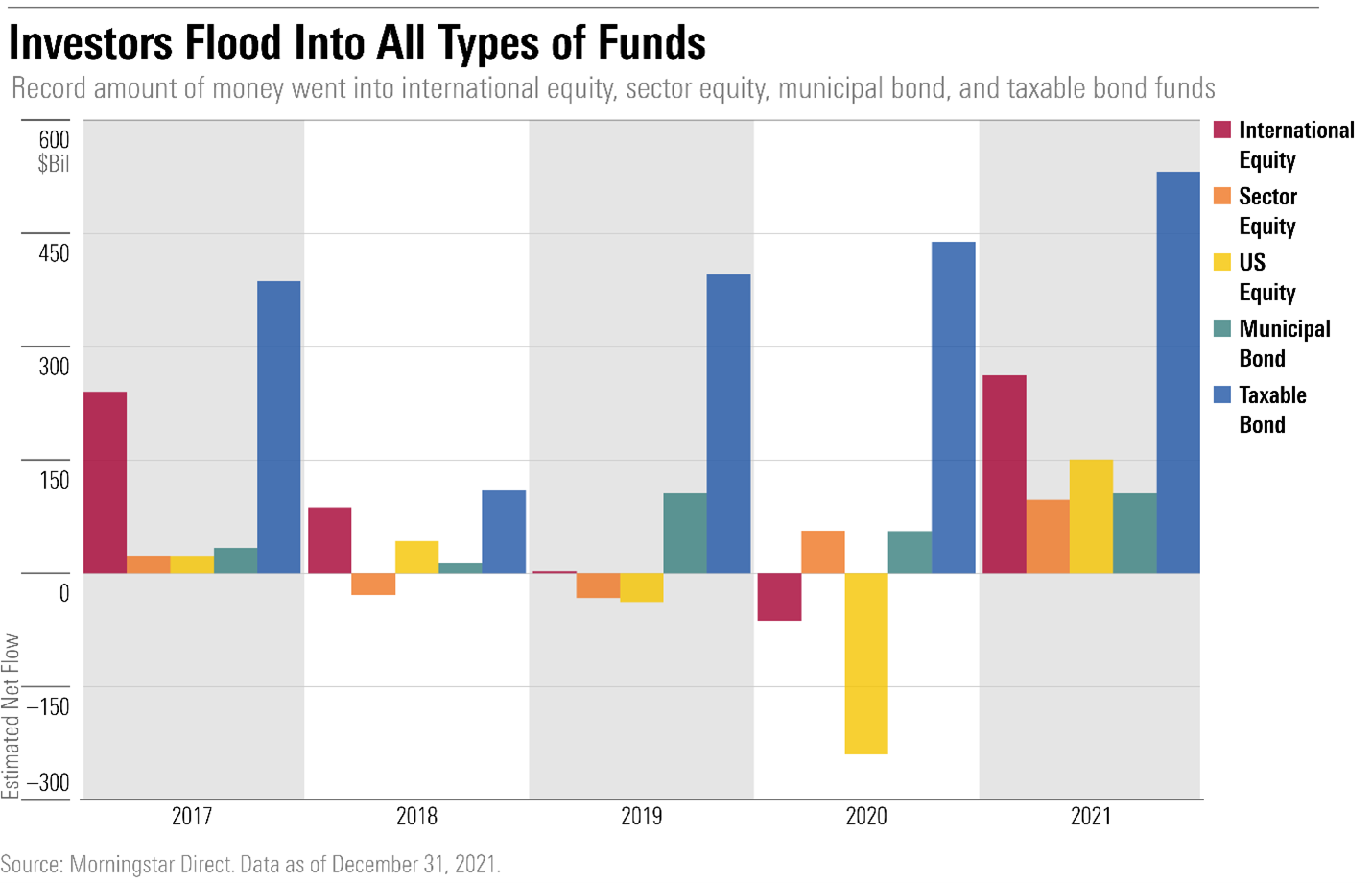

1. Investors Poured a Record Amount of Money Into All Types of Funds…

Even as inflation rose and bond returns turned negative, investors poured more money than ever into taxable-bond funds. Similarly, political risk and economic concerns didn’t deter investors from international equity funds. Both broad category groups recorded more inflows than in any year since Morningstar started tracking fund flow data in 1993.

Sector equity funds also hit a new annual record, driven by investors’ fervor for financial and real estate funds, and municipal bond funds saw their largest haul ever.

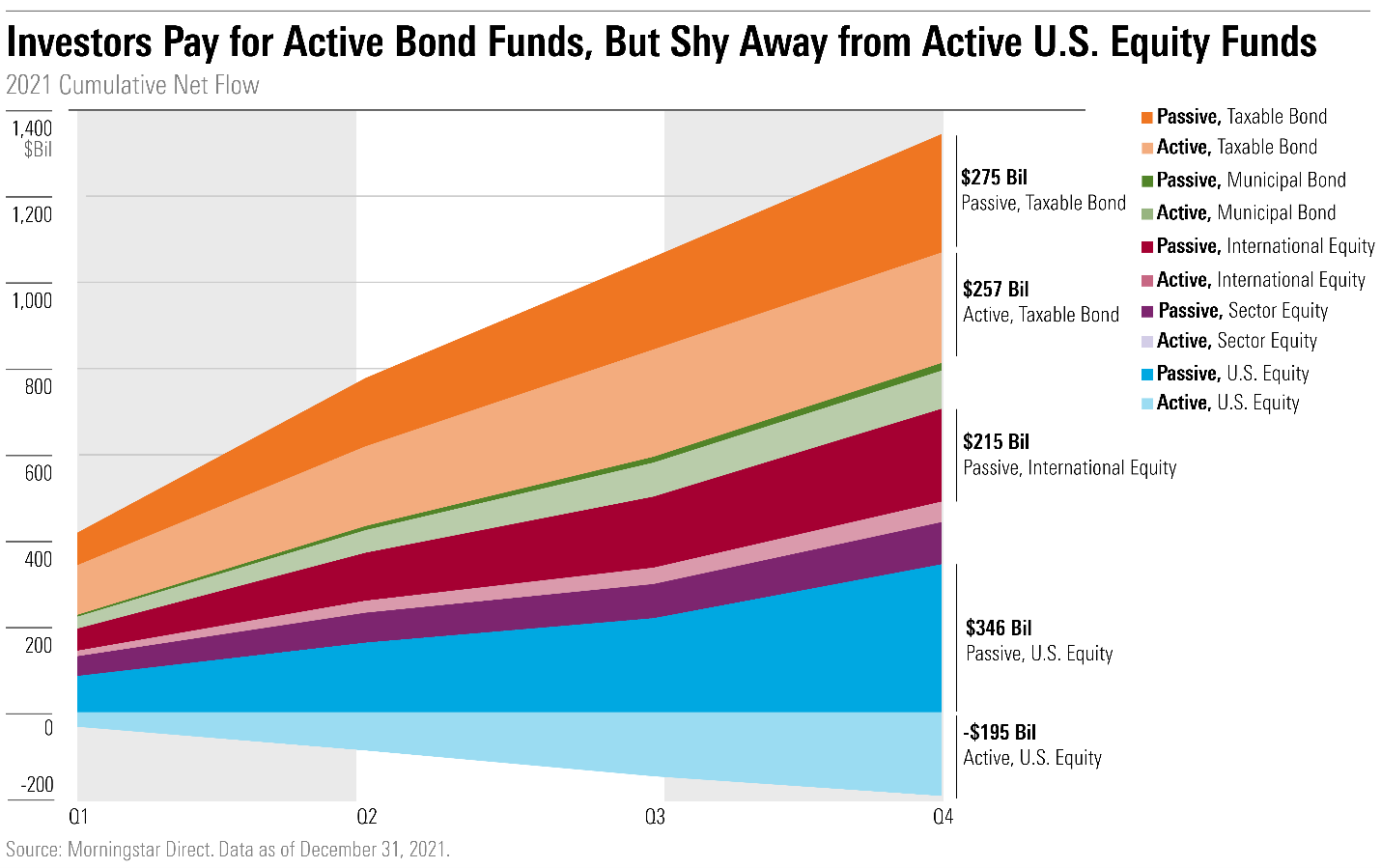

2. …Even Returning to Active Funds

The flood of money even hit long-struggling active funds.

Investors had pulled money from active U.S. funds every year from 2014 through 2020. In 2021, however, active funds raked in $250 billion, their largest haul since 2009. That was partly driven by the rise of active ETFs, which collected $87 billion.

Though investors were willing to pay for actively managed bond funds, they still shunned actively managed U.S. equity open-end funds: $195 billion exited active U.S. equity funds, the 16th year of outflows from the group.

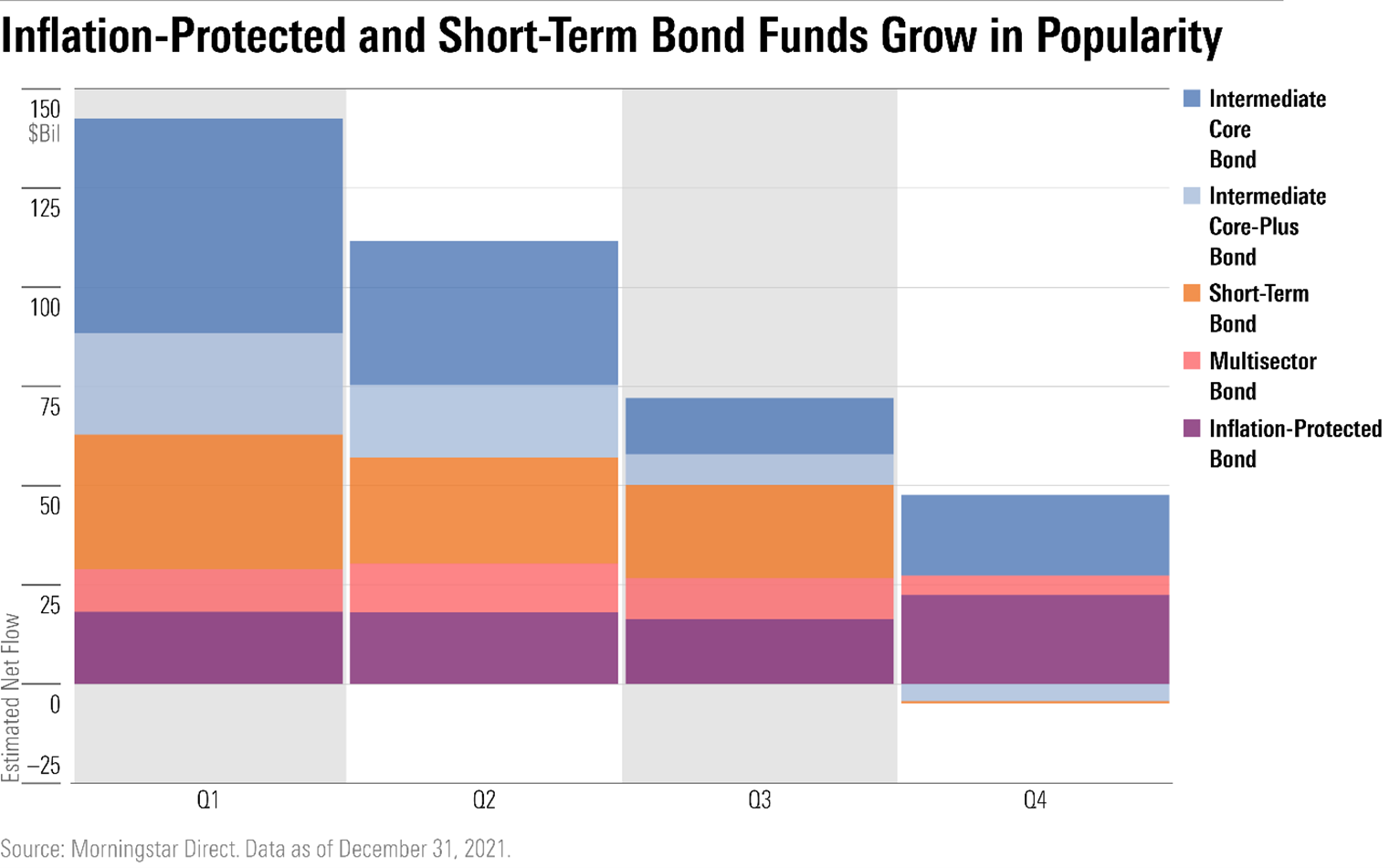

3. Inflation-Protected Bond Funds Stole the Show

Intermediate-core bonds still garnered the most money, but short-term and inflation-protected bond funds took a large share of investors’ dollars this year.

Short-term bond funds were extremely popular in the start of the year. As inflation jumped, investors put more and more into inflation-protected bond funds. The amount of money in these funds grew by 35%.

In a change from 2020, investors lost interest in corporate and high-yield bond funds--two of the best-performing corners of the bond market in 2021.

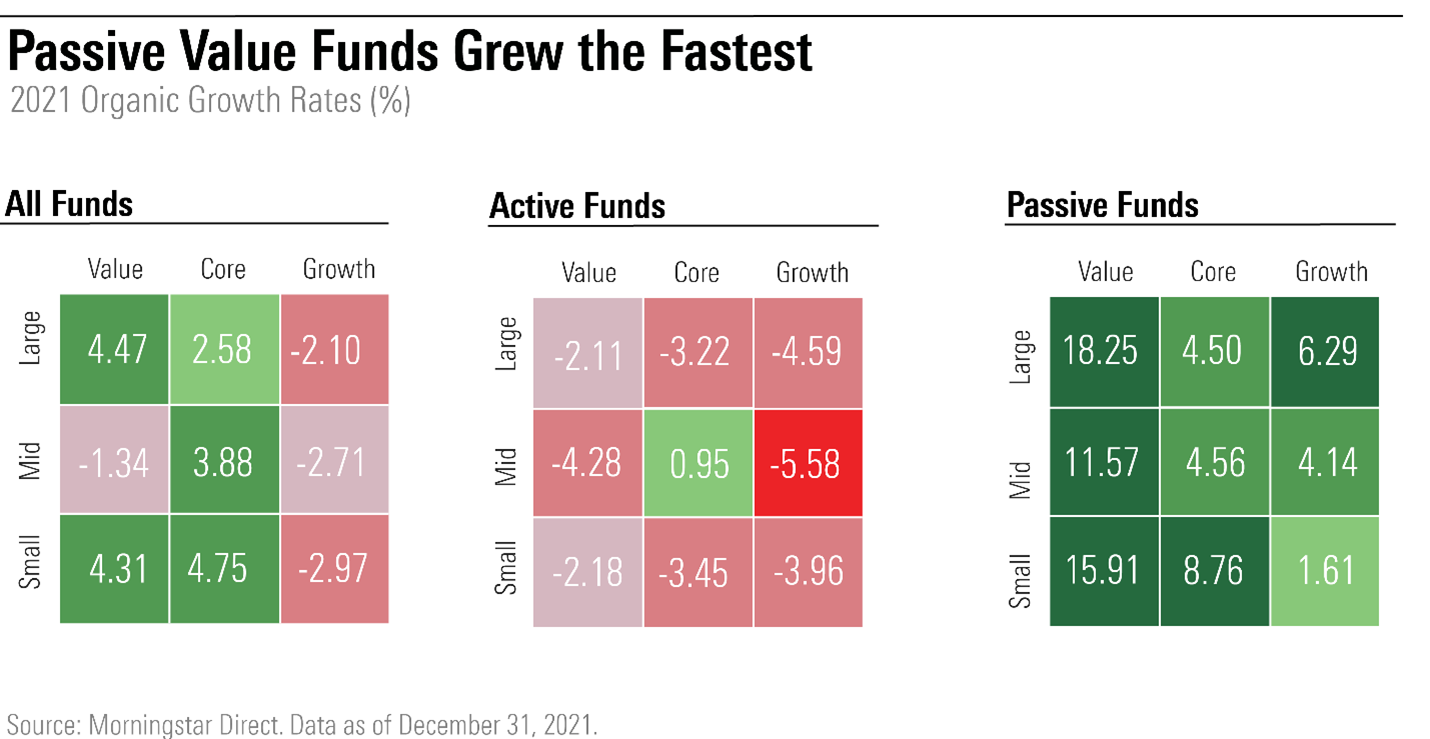

4. Investors Returned to (Passive) U.S. Equity Funds…

For the first time since 2018, investors put more money into U.S. equity funds than they pulled out. They demonstrated a clear preference for passive funds. Value funds led the charge, with passive funds in both the large- and small-value Morningstar Categories growing by more than 15%.

The surge of cash comes after a year where investors pulled $240 billion from U.S. equity funds.

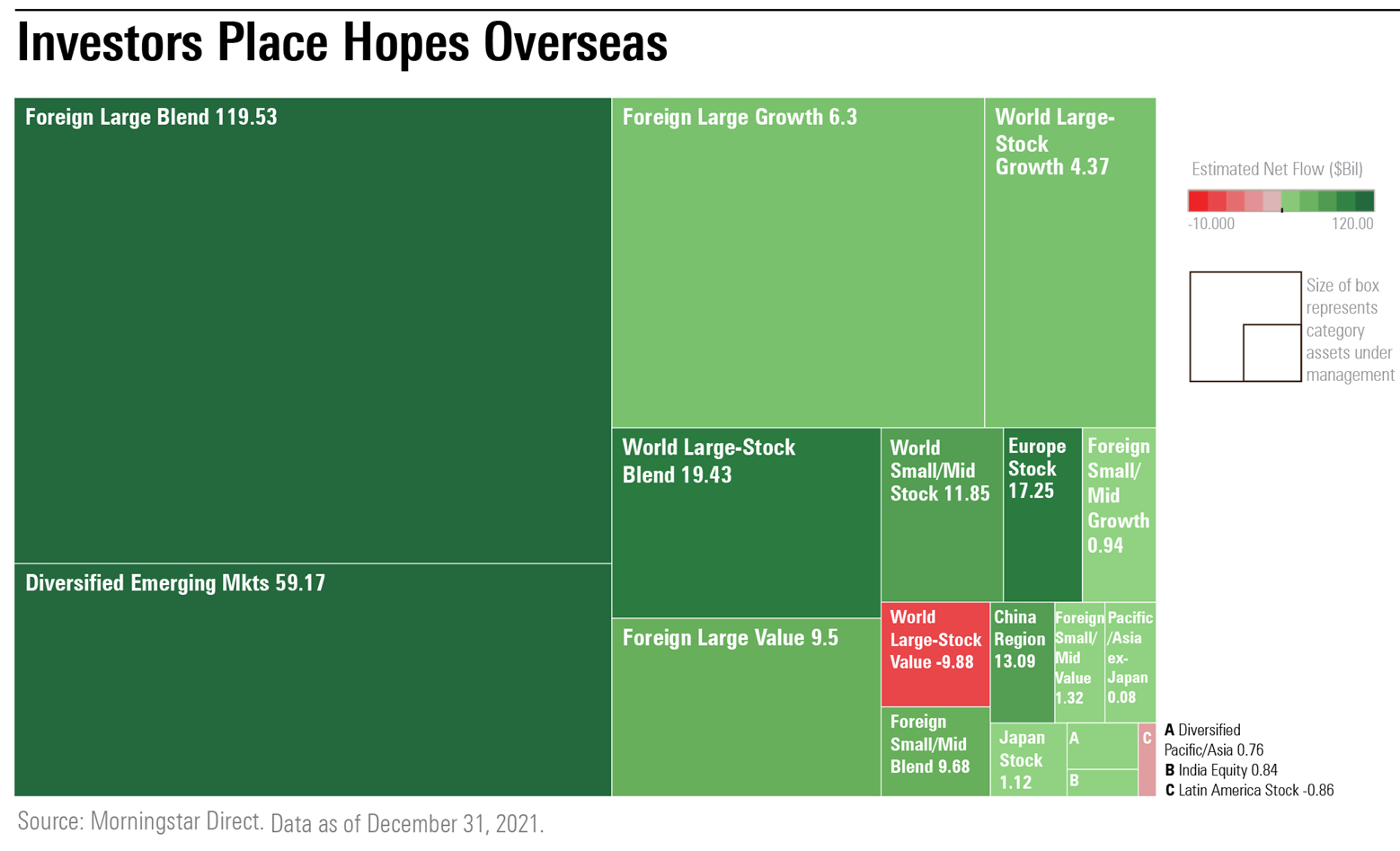

5. ….But Preferred International Equity Funds

Investors searched for value overseas in 2021, putting more money into international equity funds than into U.S. diversified and sector equity funds combined.

Political risk in China and economic concerns in Europe didn’t deter investors: Assets in both categories expanded by more than 30%. Emerging-markets funds recorded nearly $60 billion in inflows.

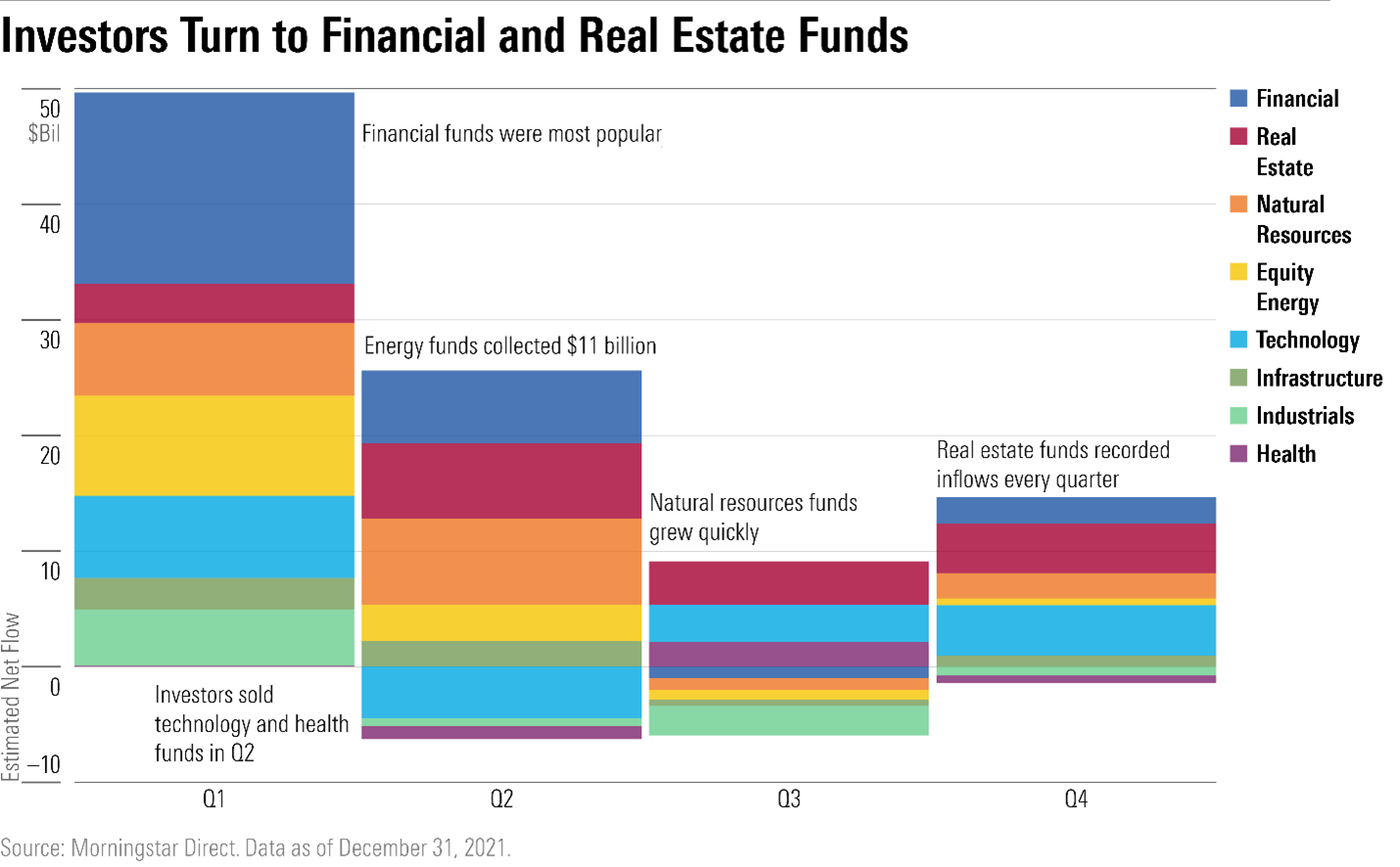

6. Investors Rotated Into New Sectors

Less enamored with technology and health sector funds than they were in 2020, investors placed large bets on cyclical sector funds early in the year, which would prove apt as the energy and real estate sectors outperformed throughout the year. Perhaps seeking an inflation hedge, investors also piled into natural resources funds at a record pace.

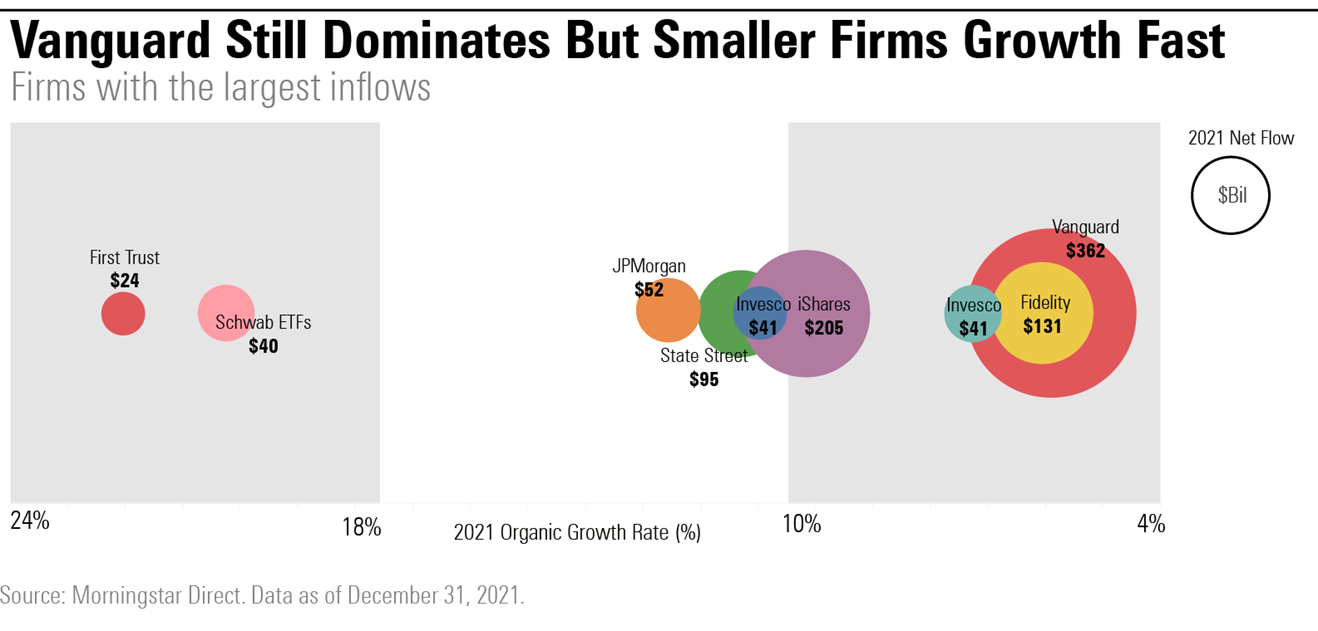

7. Vanguard Still Reigns by Size, but Not Growth Rate

Vanguard, iShares, and Fidelity are still the destinations of choice for most investor dollars, but some smaller firms grew significantly. First Trust expanded by nearly 24% in part because of its popular sector funds, including First Trust Rising Dividend Achievers RDVY and First Trust Nasdaq Oil & Gas ETF FTXN, which both doubled in size.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)