Worst-Performing Stocks of Q1 2023

Regional banks and REITs got pummeled; Bed Bath & Beyond and Groupon also took a hit.

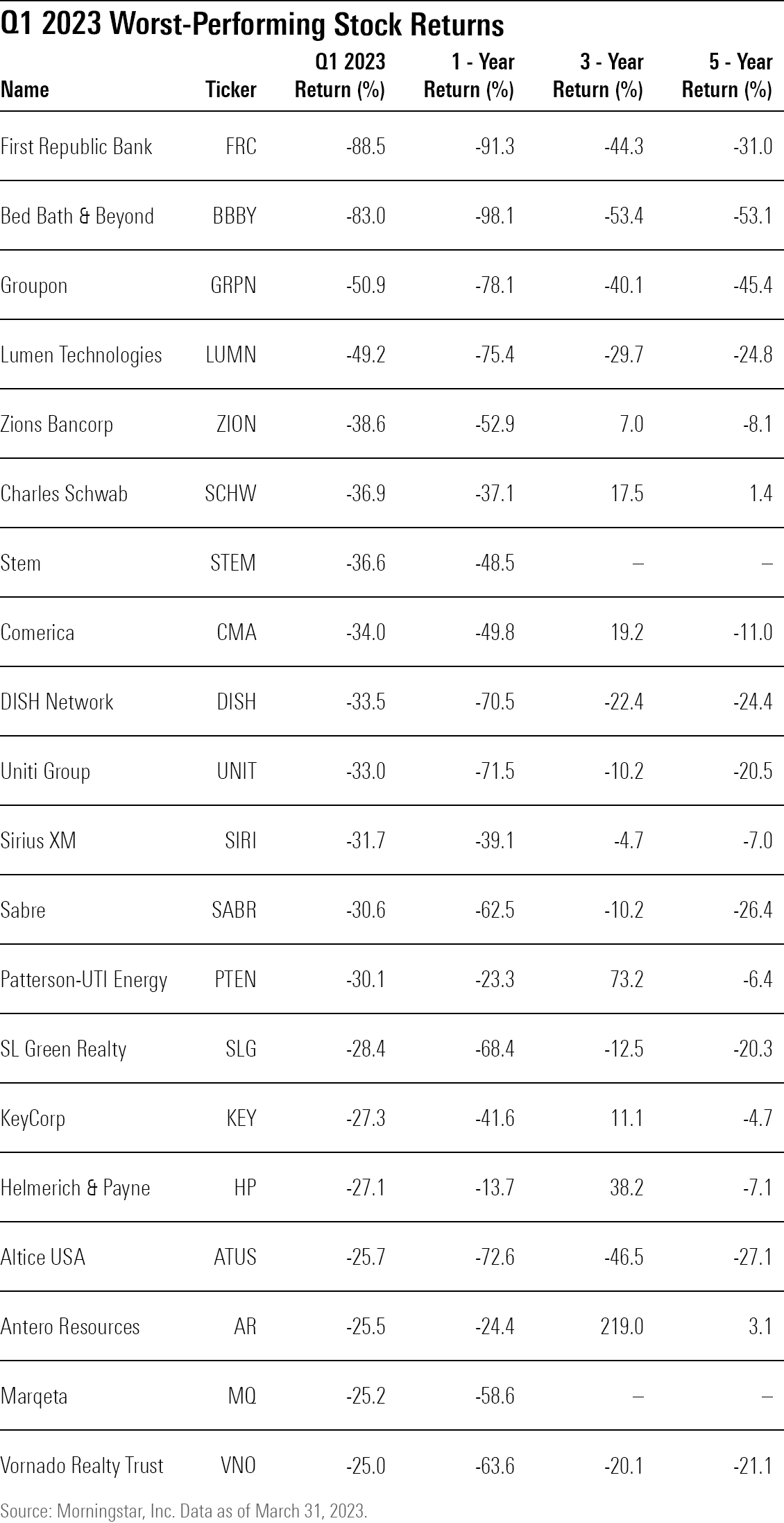

While the stocks posted broad gains in the first quarter of 2023, some corners of the market still took a drubbing.

The industry ending up as the poster child for poor performance in the first quarter: regional bank stocks.

Taking center stage was the collapse of Silicon Valley Bank and Signature Bank, which kicked off an industrywide selloff in regional bank stocks, including First Republic Bank FRC and Zions Bancorp ZION.

Fears of further bank runs also led to concerns of a potential credit crunch and negative macroeconomic implications, which contributed to outsize declines in real estate investment trusts, also known as REITs.

Of the 844 U.S.-listed stocks covered by Morningstar analysts, 319 stocks declined during the first quarter of 2023 compared with the 608 that fell throughout 2022. Of those, only 29 fell by more than 20%.

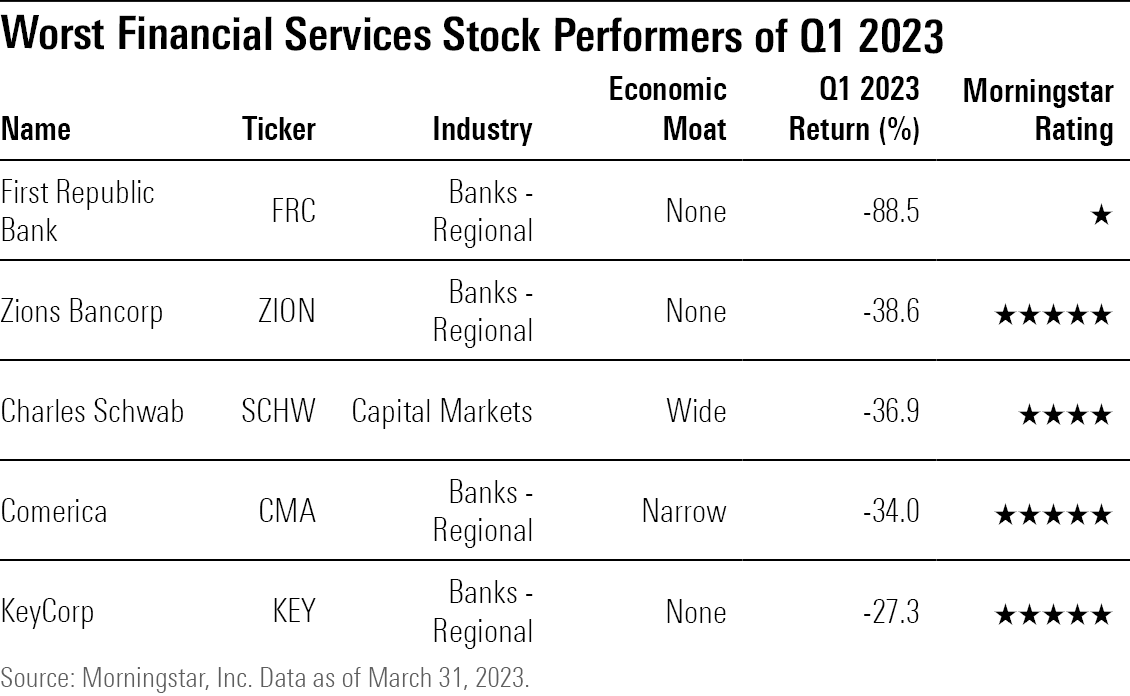

Regional Bank Stocks Plunge

Bank stocks suffered heavily during the first quarter, as the closures of Silicon Valley Bank and Signature Bank sent shock waves across the market and resurfaced memories of the global financial crisis.

Investors quickly sold off on the banking industry as a whole, with regional banks facing the brunt of their fears.

“Regional banks face higher risks in today’s environment due to deposit outflow risks,” says Morningstar strategist Eric Compton. “In the aftermath of the Silicon Valley Bank collapse, deposit psychology likely shifted in a negative direction, making it more likely they [customers] would withdraw deposits from smaller banks and send them to larger banks where they didn’t have to worry about the bank going under and not having the backing of the government.”

Worst off was First Republic Bank, which fell 88.5% during the quarter, finishing down 93.6% from its November 2021 high-water mark. First Republic Bank ranked as the worst-performing stock on Morningstar’s coverage list during the first quarter of 2023.

Among other bank stocks taking a beating, Zions Bancorp, was down 38.6% for the quarter, Comerica CMA, was down 34.0%, and KeyCorp KEY, was down 27.3%. Liquidity fears also spread to financial brokerage giant Charles Schwab SCHW, which fell 36.9%.

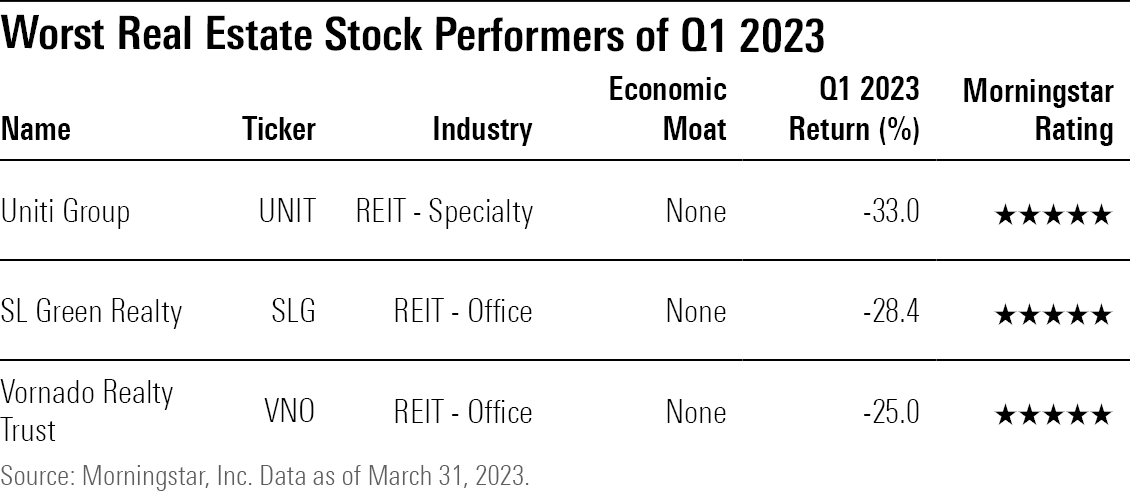

Banking Fears Swamp REITs

The regional bank crisis also spread fears that capital markets would become more stringent when issuing loans, which could lead to a credit crunch. While that could be bad for many companies, especially those that depend on bank loans to meet payroll or other financial obligations, it’s especially worrisome for REITs.

REITs are required to distribute a minimum of 90% of their rental income back to shareholders, which means they have a limited ability to store up cash to withstand financial turmoil. As such, they are a lot more dependent on lenders to roll their debt and keep their operations afloat, which a credit crunch would make much more difficult.

That contributed to major declines in REIT stocks such as such as SL Green Realty SLG, which fell 28.4% during the quarter, and Vornado Realty Trust VNO, which was down 25.0%. Both SL Green and Vornado rent out office spaces, an industry already facing pressure because of toughening macroeconomic conditions and remote work, which have pushed corporate clients to reevaluate their real estate needs, says Morningstar equity analyst Suryansh Sharma.

Uniti Group UNIT, a specialty REIT that leases cell towers and fiber networks to wireless service providers, was hit by concerns over its “high financial leverage and poor credit rating,” says Morningstar equity analyst Matthew Dolgin. Uniti Group stock fell 33.0% during the first quarter.

Worst-Performing Stocks of Q1 2023

Other stocks that suffered major losses included Bed Bath & Beyond BBBY, which tumbled 83.0% over the course of the first quarter, making it the second-worst-performing U.S.-listed stock among those covered by Morningstar analysts.

Bed Bath & Beyond had been facing a significant decline in sales and was struggling to pay back a $300 million debt balance due in 2024. That’s led to doubts about the company being able to continue as a going concern. The company spent nearly all the first quarter trying to raise capital and most recently kicked off a $300 million equity offering, which Morningstar senior equity analyst Jaime Katz believes “was likely the only option of liquidity available” to the firm.

“Even if Bed Bath can miraculously remain a going concern, we don’t think there’s an opportunity for shareholders to find return in the stock,” Katz says.

Shares of Groupon GRPN plunged 50.9%, making it the third-worst-performing stock on Morningstar’s coverage list during the first quarter of 2023. Both the firm’s “demand and supply sides continue to weaken, demonstrated by the firm’s fourth-quarter results,” says Morningstar senior equity analyst Ali Mogharabi. The firm reported 19% fewer customers during the fourth quarter and had $32.8 million in operating losses, versus an operating income of $2.3 million in the year-ago period.

Groupon also recently brought on a new chief executive, which Mogharabi says could “indicate that the firm is seeking a buyer.”

Lumen Technologies’ LUMN stock collapsed 49.2% during the first quarter as investors grew concerned over the telecommunication company’s near-term performance. The company intends to spend heavily in building out its fiber networks for its legacy consumer broadband business, which Morningstar’s Dolgin sees as declining.

“We’re concerned that no amount of investment can make up for a sizable, declining legacy revenue base, which we think will roll off over time under any scenario,” he says. As a result of the investment, “Lumen expects to see little to no free cash flow in 2023.”

Dolgin adds, “We believe Lumen has value, and our fair value estimate implies the stock is a bargain. [However], barring additional assets sales or financial maneuvers, we see little that would turn the stock around until the business shows it can grow. Such an outcome is unlikely in the next two years, and we’re skeptical it will ever occur.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)