REITs Are Getting Caught Up in the Wave of Banking Fear

Investors are worried that dividend-paying REITs could get squeezed by tenants, lenders, or both.

Ripples from worries about the banking system have claimed real estate investment trusts—known as REITs—as their most recent victim.

The sector, favored by investors for its high dividend yields, has fallen nearly 10% in March.

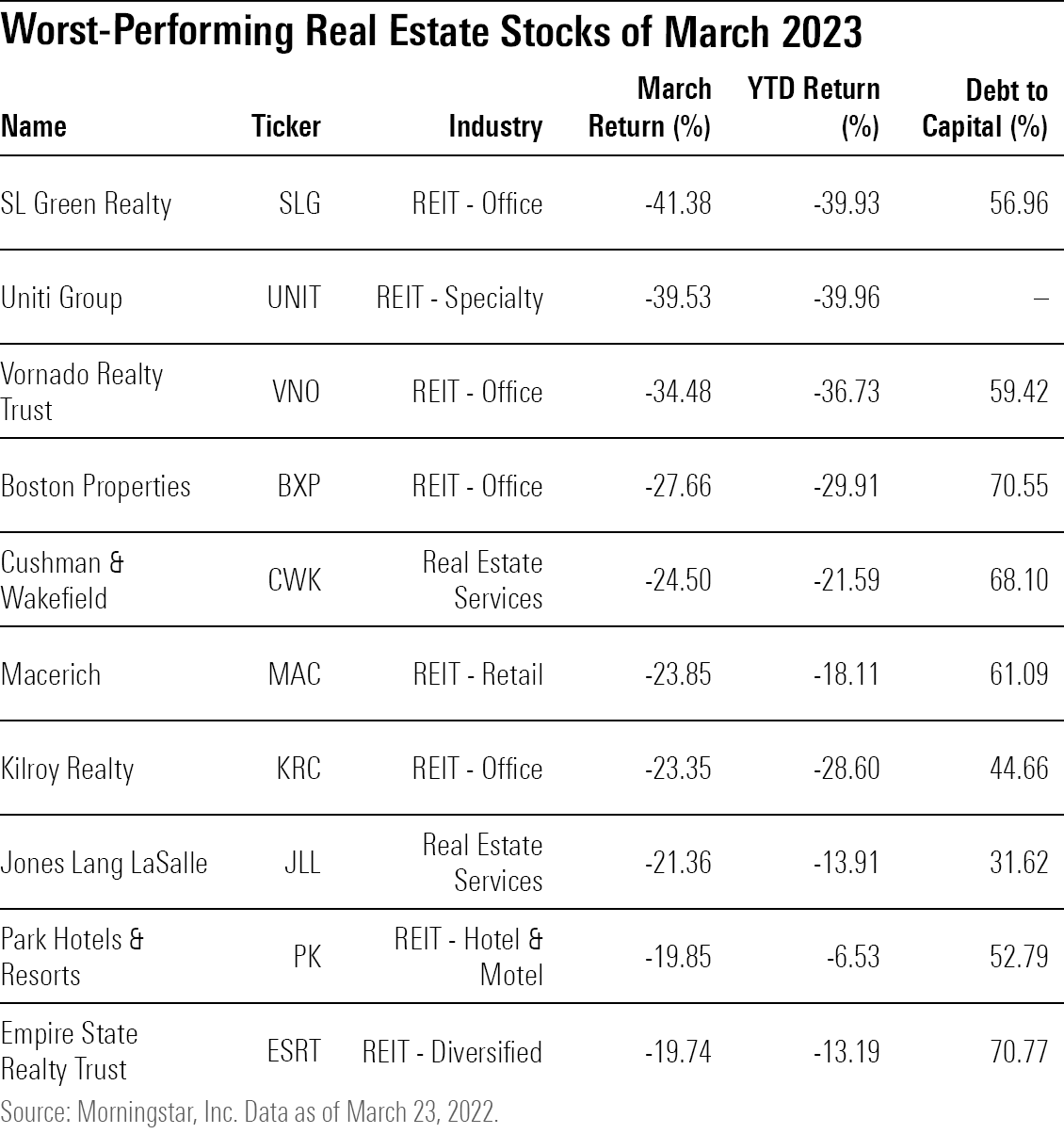

Among the stocks hit hardest in the sector have been office REITs, which rent out office spaces and amenities to businesses. On average, office REITs saw their stock valuations drop about 24% during the month, making it the worst-performing industry in the sector during the month. The broad stock market, as measured by the Morningstar US Market Index, is down 1.4% during this time frame.

Among the REITs covered by Morningstar’s equity analysts, SL Green Realty SLG, Vornado Realty Trust VNO, and Boston Properties BXP were some of the worst-performing REITs so far this month, falling at least 25%.

REITs are companies that own portfolios of properties: office buildings, shopping centers, hotels, apartments, and more. The properties generate income from rent and capital appreciation. They differ from traditional stocks in that they are then required to pay out at least 90% of that income to investors in the form of dividends, making them an attractive play for income-focused investors.

Real estate stocks more broadly have suffered over the past year. The sector has fallen by nearly 26% from one year ago as higher interest rates increased companies’ funding costs, cut into earnings, and tempered expectations for shareholder returns. Meanwhile, the overall stock market is down 12.4% from a year ago.

The recent banking crisis has raised fresh concerns. Bianca Rose, senior portfolio manager at Morningstar Investment Management, argues that the recent bank run emphasized two risks to the real estate sector: tenant risk and financial system stability. These risks place further pressure on REITs’ funds from operations, and their ability to roll over looming debt maturities.

Why Are REIT Stocks Falling?

Turmoil in the banking industry put a spotlight on how deteriorating conditions in one area of the economy can have knock-on effects on another, Rose says. She notes that financial struggles among technology firms, especially tech startups, partially contributed to the failure at SVB Financial Group SIVB. “People thought it was contained,” she said. However, tech companies’ issues led them to pull deposits from banks like Silicon Valley Bank in order to fulfill their debt obligations, leading to the bank’s collapse.

Investors now view REITs as one of the next areas where pressures could mount, she says. That’s especially the case as bank failures lead lenders to become more conservative in providing loans, which in turn could mean that struggling businesses will find it even more difficult to meet their financial obligations.

Across the economy, many companies were riding the coattails of lower interest rates and easy capital markets, but “what happens if all these businesses that were doing well from easy money now go bust? They’re tenants to someone,” Rose says.

Why Tenant Risk Matters

Tenant risk—when tenants stop paying rent—harms some REITs in more ways than one. For starters, REITs are required to distribute at least 90% of their income, also known as funds from operations, from their properties back to shareholders.

That restricts their ability to stash large amounts of cash for rainy days in the way other companies with large cash flows can. Furthermore, the remaining 10% would also need to be divided toward repaying debts, limiting the amount of money REITs can save.

Lower rental income subsequently lowers their ability to continue to provide attractive distributions to shareholders and affects their ability to stay on top of their debt obligations.

Making matters even worse is that lower rental income and riskier tenant profiles tend to decrease property values. Since the size of the loans that REITs took out to purchase the property doesn’t change, it causes an increase in REITs’ loan/value ratios for those properties, Rose says. In other words, falling property values increases REITs’ financial leverage: They hold less equity from their properties relative to the amount of debt they incurred to acquire them.

Given that financial leverage is critical for lenders to consider when approving loans and refinancing, that could spell trouble for REITs that have debt maturities looming, Rose says.

Since REITs can’t save up money to help reduce their debt loads, they’re dependent on being able to “roll” their debt and refinance it to be due at a later date. Refinancing in a rate-hiking environment is already worrisome for REITs, as the new loans would have greater costs that could diminish returns to shareholders, observers say.

Credit Crunch Worries Rise for REITs

Another area of concern, says Rose, is the willingness of lenders to work with highly leveraged businesses like REITs in the first place. “There’s a difference between ‘interest rates are rising, my costs will go up, but I can access funding’ versus ‘you just can’t have the funding,’” says Rose. If REITs can’t get access to any funding, things get dire.

During times when fears over financial instability arise, capital markets—those in the business of lending money—tend to become significantly less risk-tolerant. That often leads to a credit crunch, where it becomes difficult for companies and businesses to find lenders to help them remain liquid.

The potential impact of capital market access drying up is particularly significant for REITs. Unlike other businesses, it’s harder for them to stash away large sums of cash because of their distribution requirements. As a result, REITs are significantly more reliant on loans and the whims of capital markets.

If a credit crunch occurs and is persistent, players in the debt-reliant REIT sectors could find themselves having to consider extreme options ranging from releasing their properties back to lenders to reduce their leverage, to considering an equity injection by issuing and selling more stock, in order to remain afloat.

Not all REIT properties are equally exposed to tenant risk and the declines in REIT prices across the sector have varied significantly according to their business models. For example, Equinix EQIX focuses on purchasing properties to host data centers, and with a 2.7% decline so far in March, has been the best-performing U.S.-listed REIT among those covered by Morningstar analysts. Other more buoyant REITs include American Tower AMT and Crown Castle CCI, which both service land for communications infrastructure purposes.

Risks for REIT Stock Owners

Those at most risk are the REITs that already had above-average financial leverage levels, as REITs that were already highly leveraged tend to become even more so in times of crises, says Rose. The higher the leverage, the closer REITs get to considering extreme options.

The good news is that the debt REITs take on to acquire property tends to be organized in such a way that the debt is tied to the property, says Morningstar equity analyst Suryansh Sharma. In the event a REIT is no longer able to repay that debt, they have the option of returning the property to the lender to wipe the debt from the balance sheet.

“REITs often structure buildings as separate financial entities. If they default on debt, creditors generally can foreclose on the building but have no recourse against the rest of the company … in this way, the loss incurred by the REIT is contained,” says Sharma. In contrast, “in other industries, if companies are unable to pay their debt, it could lead to bankruptcy.” However, REITs that must take this route would also lose the cash flows associated with the released property.

Equity injections require a REIT to issue new stock, which can dilute the shares of existing shareholders in the company. That’s bad news for current stock investors, as it means less income distributions per share, which is one of the primary allures of REIT investments.

These options should be a last resort for REITs. Ultimately, whether they need to resort to that will depend on whether REITs are able to tap into capital markets when they are in need.

REITs’ Debt Structures Offer an Advantage

Sharma says that in general, REITs’ unique debt structure allows them to avoid bankruptcy in ways companies from other sectors cannot. So, although a credit crunch would be concerning, in a way REITs are better equipped to survive in those tough conditions. “Even in the 2008 global financial crisis, no REIT went bankrupt,” says Sharma.

Still, Sharma expects conditions in the sector to remain challenging for the near term. If REITs start to lose tenants because of a shakier economy, coupled with a worsening capital market environment, their ability to return cash to shareholders could be significantly hindered.

“Things will probably get worse before they get better,” he says, with expectations that pressures would persist into 2025. “But even if we take very conservative forecasts for the next decade, or take a worst-case scenario, we can still find value in some of these names.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)