Despite Rally, Stock Market Remains Undervalued

Our monthly outlook includes sector valuations, a look at commercial real estate, and the latest on banks.

May Market Outlook Takeaways:

- U.S. stock market remains undervalued, but easy gains are behind us.

- Time to move growth category to market weight from overweight.

- Stressed, but not broken. Rising interest rates playing havoc with U.S. regional banks.

Between the low valuations we highlighted in our 2023 Market Outlook and the technical overhang of tax loss selling last December, the U.S. stock market was set up for a strong start to the year—and it has not disappointed. Through April 28, the stock market has risen 8.59% this year to date.

Even after this rally, the stock market remains undervalued, trading at an 8% discount to a composite of our stock coverage. However, while the market remains undervalued, we see a rough road ahead over the next few quarters. We expect that the combination of tight monetary policy and declining credit availability will take their toll on the economy over the course of the year.

We project economic growth will stagnate in the second quarter, constrict in the third, and only begin a sluggish recovery in the fourth. A weak economy will pressure earnings growth and likely lead to negative sentiment in the markets. We expect that the markets will be looking for an upswing in leading economic indicators in order to begin the next move higher toward our long-term, intrinsic valuations.

Latest U.S. Stock Market Trends

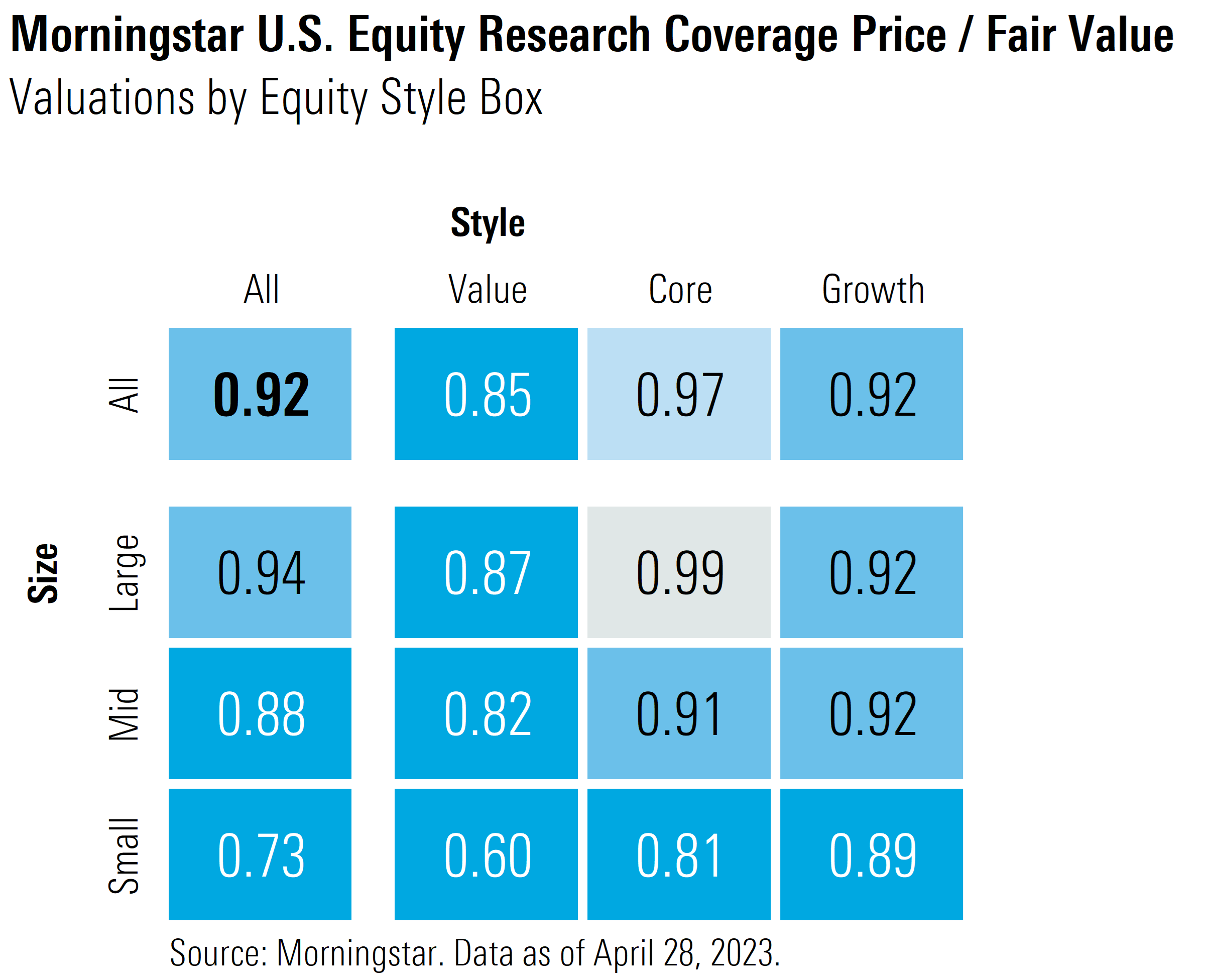

The broad U.S. market is 8% undervalued as of April 28, according to a composite of the 700-plus stocks we cover that trade on U.S. exchanges.

Based on our stock valuations, it appears to be time to revise asset allocations by Morningstar Categories. While we still see an overweight opportunity in the value category, which trades at a 15% discount, it is now time to move to a market weight position in growth from overweight as the category now trades in line with the broad market. Core/blend can be underweighted as it is trading close to fair value.

By market capitalization, small-cap stocks remain the most undervalued, trading at a 27% discount to fair value, whereas large- and mid-cap categories remain closer to the broad market valuation. The single most undervalued category is small-cap value, trading at a 40% discount to our fair value.

Sector Valuations

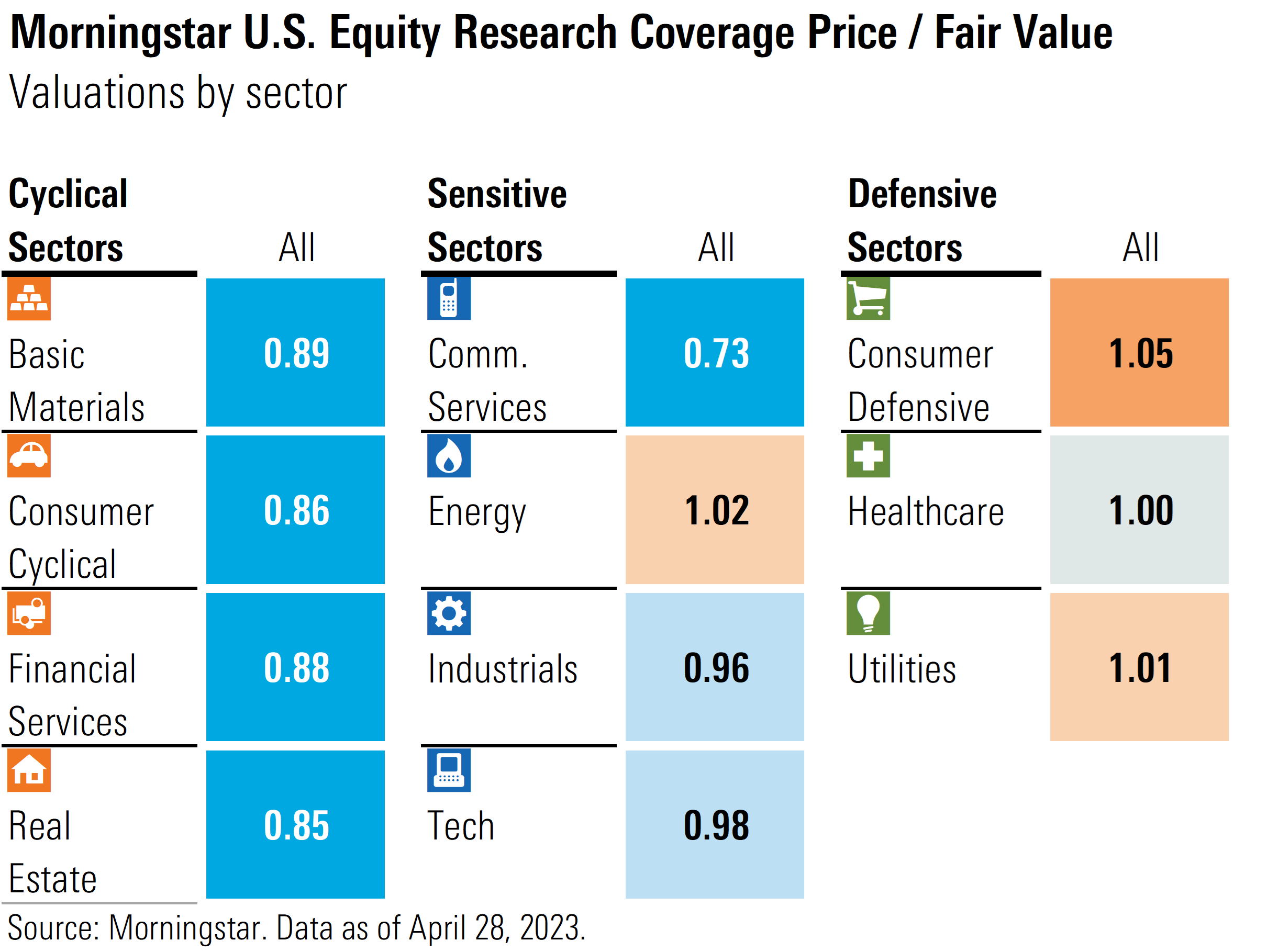

Although we expect the economy to be relatively stagnant over the remainder of this year, we see the best values across the cyclical sectors. These were the worst-performing sectors in 2022 and we think the market has pushed prices down too far as compared with our long-term intrinsic valuations.

Among the economically sensitive sectors, communications rallied in April following strong earnings reports from Alphabet GOOGL and Meta Platforms META, but the sector remains the most undervalued, trading at a 27% discount to our fair value. Technology also rallied and is now trading even closer to fair value. Energy and industrials both remain in within fair value territory.

After slipping below fair value at the end of February, defensive sectors bounced back and are right back to fully valued.

U.S. Regional Banks—Stressed, but Not Broken

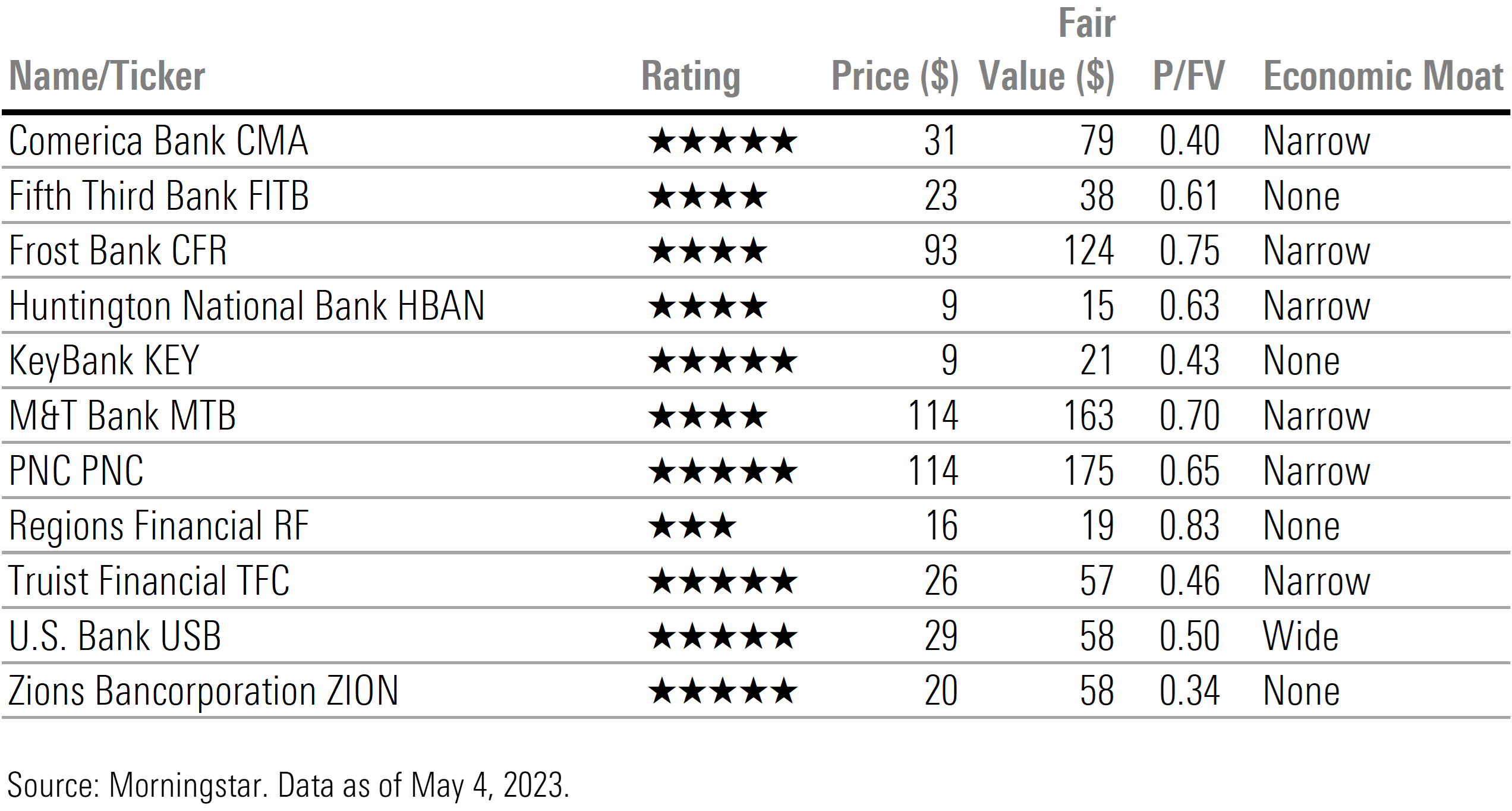

The U.S. regional bank sector remains under stress, but we think the pressures will be manageable. We forecast that earnings will drop sequentially over the course of this year before bottoming out and beginning to recover next year. In our view, the regional banking business model is not broken. Over the long term, these banks will continue to earn returns higher than their cost of capital.

Of the regional banks under our coverage, First Republic Bank FRC was the only one about which we had concerns regarding viability. We had originally lowered our fair value estimate to $3 in March and in April lowered it again to $0. Ultimately, the FDIC placed First Republic into receivership and J.P. Morgan JPM then bought the assets and assumed the deposits. As far as the other regional banks under our coverage, we think the market is overreacting to short-term pressures and have pushed valuations down too far.

Q1 Earnings Results and Takeaways

For most part, deposit outflows were quite modest at most regional banks, generally in the low single digits across our coverage. Comerica CMA was a significant exception, as their deposits dropped by -9%. US Bank USB and Cullen/Frost Bank CFR each saw deposits drop by -4%, the second greatest amount of outflows.

Earnings across the regional banking sector are on a declining trend. We believe earnings peaked in the fourth quarter of 2022, and project earnings will decline sequentially through the end of this year and then begin to recover throughout 2024.

The main factor leading to declining earnings is a contraction in net interest income margins. Regional banks are paying higher funding costs due to a combination of paying higher interest rates on deposits as well as higher rates on other funding vehicles. We forecast net interest income margins will continue to contract during the second quarter and then, depending on the individual bank, will stabilize in either the third or fourth quarter.

Commercial Real Estate Exposure

One of investors’ greater fears regarding the value of regional banks is their exposure to the commercial real estate market. Across some of the regional banks, we estimate that commercial real estate accounts for up to one third of their total loan book, but many banks are well below that level.

Within commercial real estate, the area of greatest concern is the office sector, especially in urban areas where workers have been slow to return to the office full time. In fact, according to the Kastle Return to Work Barometer, average occupancy remains only near 50%. We estimate that on average, loans made for offices account for 10% to 20% of commercial real estate exposure, thus only 3% to 5% of total loan exposures are in the office category.

To put this in context, most regional banks typically operate with a common equity Tier 1 ratio of 9% to 10%. The regulatory minimum is 7%. Even if the regional banks were to take a capital hit from losses on office loans greater than the offsetting interest income, there is enough cushion to absorb a large amount of losses before it would push that ratio down near its regulatory minimum.

What Should an Investor Do?

While we wouldn’t be surprised to see other banks fail over the coming weeks, we do not have concerns regarding the viability of those under our coverage. However, while these banks are now trading at significant margins of safety, investors should tread lightly. Market sentiment is already very negative, and these stocks are still searching for a bottom. Further bank failures would likely put even more pressure on these stocks.

At this point it may take some form of government intervention to provide the market with the reassurance it needs to become comfortable with investing in this sector. For investors with the risk tolerance to invest in these stocks, we see significant margins of safety; however, investors will need a great deal of fortitude to ride out near-term volatility and will have to have the wherewithal to invest for the long term. It may take a while before these stocks begin to trade up toward our estimates of their intrinsic value.

Earnings notes across our U.S. regional bank coverage:

Comerica Earnings: Facing More Deposit Pressure Than Most Peers, but We Think Market Is Too Harsh

Cullen/Frost Earnings: Minimal Effects From Banking Industry Turmoil

Fifth Third Earnings: Manageable Decline in Net Interest Income Outlook, Stock Still Undervalued

Huntington Bank Earnings: Not Much Affected by Sector Turmoil

KeyCorp Earnings: Deposit Base Increases Slightly Even as Funding Costs Rise

M&T Bank Earnings: Deposit Base Intact, Dispelling Fears of Funding Armageddon

PNC Earnings: Funding Pressure Is Increasing, but Should Be Manageable

Regions Financial Earnings: Barely Seeing Any Effects From Banking Industry Turmoil

Truist Earnings: Funding Costs Accelerate, but Hit to Profitability Should Be Manageable

U.S. Bancorp Earnings: Slight Drop in Revenue Outlook, but Capital Build Should Remain on Track

Zions Bank Earnings: Earnings Pressure Is Building, but It’s Manageable

Weekly Livestream to Provide You With What You Will Need to Know For the Week Ahead

Interested in staying up to date with our research and learn about new investment ideas? Join Susan Dziubinski and I on Monday Morning Markets with Morningstar at 8 a.m. CT/9 a.m. ET via our livestream as we discuss:

- what investors should be watching the week ahead,

- new financial research from Morningstar you shouldn’t miss, and

- weekly stock picks and pans.

Over the past two weeks, Susan and I have been keeping investors up to date with earnings and highlighting those stocks that we think are undervalued and worth your attention. Our most recent livestreams include:

- 5 Undervalued Stocks to Buy After Earnings where we highlighted: Citigroup C, US Bancorp, Charles Schwab SCHW, Delta Air Lines DAL, and ASML ASML.

- Then the next week, we followed up with 4 More Undervalued Stocks to Buy After Earnings and reviewed our valuations on ServiceNow NOW, Discover Financial DFS, Verizon VZ, and Illumina ILMN.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)