Markets Brief: The ‘Most Important’ Number to Watch in the November CPI Report

Fed Chair Powell highlighted this CPI stat as one to watch. Plus a recap of last week in the markets.

Coming just ahead of a critical Federal Reserve meeting, the November Consumer Price Index report due out Tuesday will provide important clues for the markets on just how much progress is being made in the fight against inflation.

Forecasts for the November CPI report center on a slight easing of inflation pressures for the month. But many in the markets will be looking beyond the November headline figures and to the details for hints as to where inflation may be headed in the months to come. This, in turn, coupled with the Fed meeting set to conclude Wednesday, will likely set the tone for the markets through the close of the year.

Roger Aliaga-Diaz, chief Americas economist at Vanguard Group, notes that the October CPI report had provided some comfort to investors, especially when it came to the CPI report’s reading on so-called core inflation, which excludes volatile food and energy costs. “It was nice to see the October data moving in the right way, and it would be nice to see another confirmation of core CPI stepping down to 6.1% or even 6% from 6.3% in October,” he says.

November CPI Report Forecast

Here’s the November CPI report forecast according to consensus estimates from FactSet:

- CPI to rise 0.35% for the month versus 0.4% in October.

- Core CPI to rise 0.3% for the month versus 0.3% in October.

- CPI, year over year, to rise 7.3% versus 7.7% in October.

- Core CPI, year over year, to rise 6.1% versus 6.3% in October.

Heading into the final weeks of the year, sentiment in both the stock and bond markets has improved thanks to clearer signs that inflation has peaked, and expectations that the Fed this week will slow down its unprecedented series of 0.75-percentage-point interest-rate increases to a smaller, but still aggressive, 0.50-percentage-point hike.

But speaking two weeks ago, Fed Chair Jerome Powell made clear he wasn’t yet satisfied with the limited declines in inflation, saying “it will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

Some of the market’s comfort with the inflation outlook has deteriorated in the wake of continued strong economic data, including the November employment report, which showed an increase in wages. That’s fueled concerns about the potential for a wage-price spiral keeping inflation high if the economy doesn’t start to cool off.

Those concerns are particularly focused on the services sector of the economy, where wage pressures have been strong, and there is a close connection between employees’ wages and the prices paid by consumers.

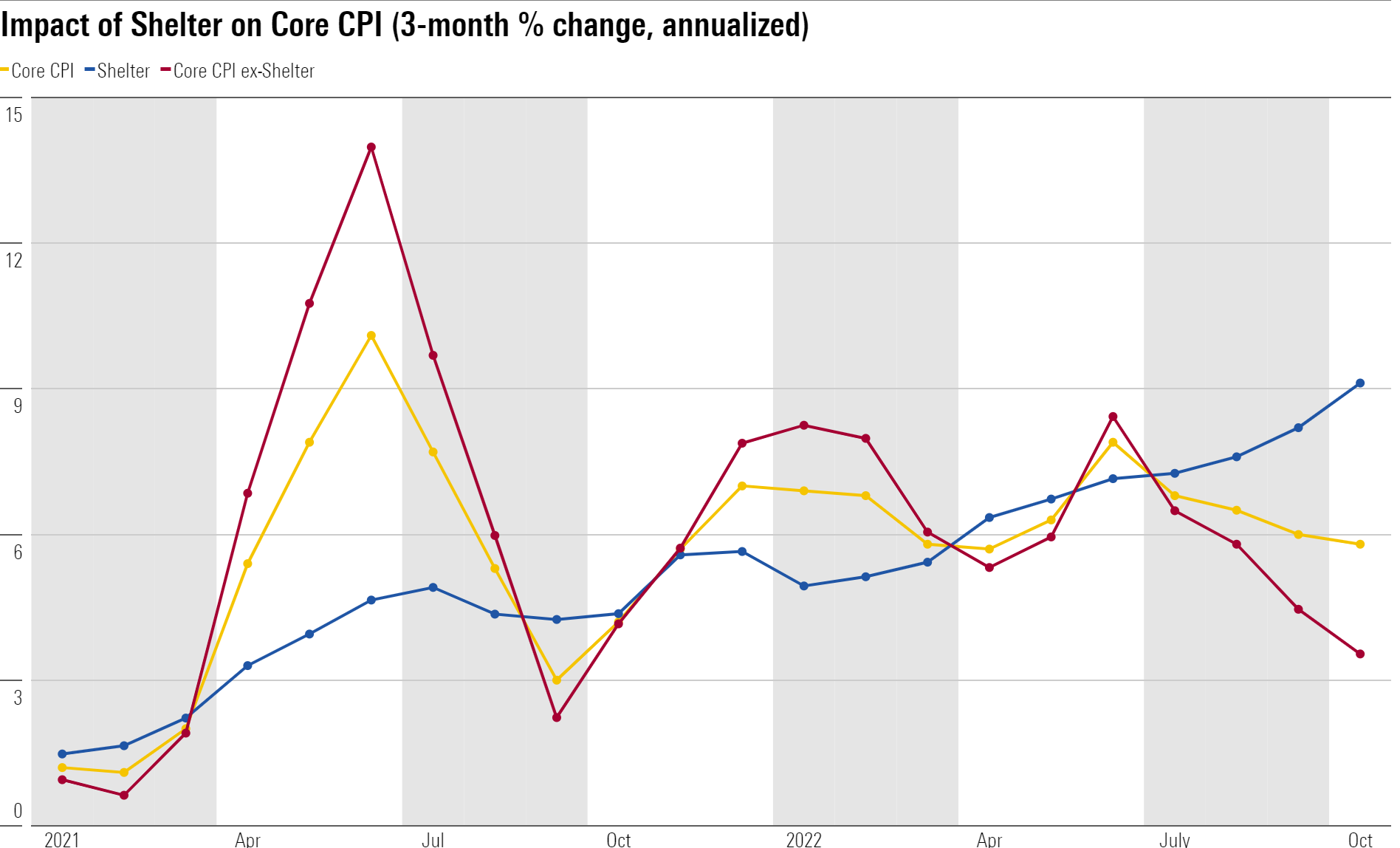

Preston Caldwell, Morningstar’s chief U.S. economist, says that given the usual volatility that comes with the monthly CPI report, he’s going to be focused on one key dataset: core inflation excluding shelter.

‘The Most Important Category’ in CPI

Powell pointed to the core services excluding shelter metric in his Nov. 30 speech, saying, “this may be the most important category for understanding the future evolution of core inflation.”

Among the different components that make up the CPI report, Vanguard’s Aliaga-Diaz says that core services ex-shelter “is the one that is more impacted by wages, and the only one where the Fed has true control with higher rates cooling down the labor market, wages coming down and easing inflation pressures.”

Caldwell notes that core inflation ex-shelter has been showing a broad-based deceleration in the last several months. “That will probably continue, as improving supply chains are cooling off core goods prices,” Caldwell says.

But “core services inflation ex-healthcare and shelter is one bucket that will be an interesting question mark, particularly in light of the uptick in wage inflation shown in the last jobs report,” Caldwell says.

Events scheduled for the coming week include:

- Monday: Coupa Software (COUP) and Oracle (ORCL) report earnings.

- Tuesday: Consumer Price Index report for November to be released.

- Wednesday: Federal Reserve Open Market Committee press conference. Trip.com (TCOM) reports earnings.

- Thursday: Lennar (LEN) and Adobe (ADBE) report earnings.

- Friday: Darden Restaurants (DRI) reports earnings.

For the trading week ended Dec. 9:

- The Morningstar US Market Index fell 3.6%.

- All sectors were down for the week, with the worst-performing being energy, which fell 8.8%, and communication services, down 5.6%.

- Yields on the U.S. 10-year Treasury rose to 3.56% from 3.51%.

- West Texas Intermediate crude oil prices fell 11.2% to $71.02 per barrel.

- Of the 841 U.S.-listed companies covered by Morningstar, 125, or 15%, were up, and 716, or 85%, declined.

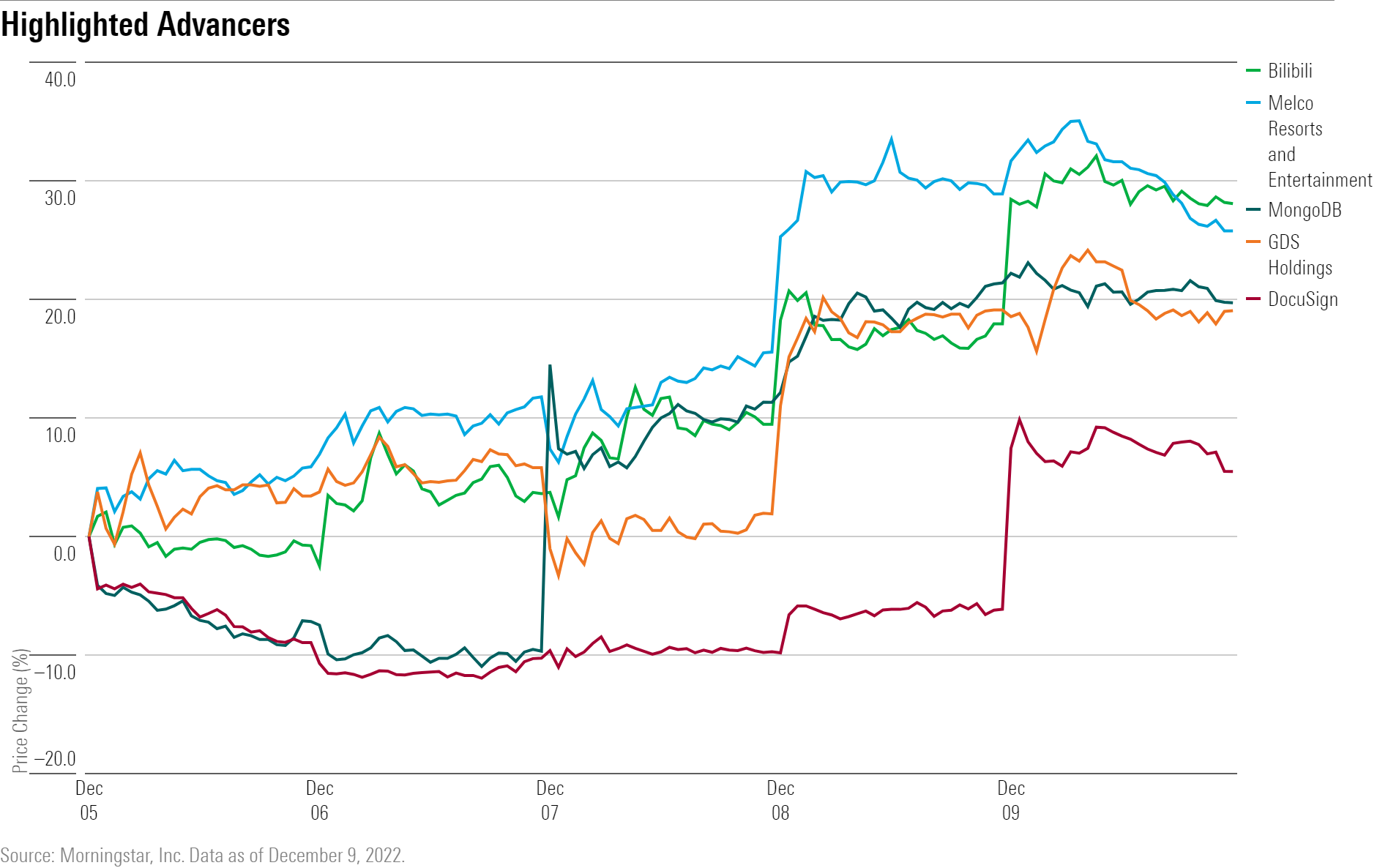

What Stocks Are Up?

Chinese stocks continued a rally that kicked off about a month ago, led by gains in Melco Resorts and Entertainment (MLCO), Bilibili (BILI), and GDS Holdings (GDS). Stocks jumped after the Chinese government started to lift key parts of their zero-COVID strategy following protests in the country, BBC reported.

Cloud database provider MongoDB (MDB) was up for the week after posting third-quarter results that Morningstar equity analyst Julie Bhusal Sharma described as “exceptional,” which contributed to a rally in its shares. Revenue came in at $334 million versus the high-end of company guidance of $303 million.

“MongoDB saw abundant improvement in the quarter compared with the second quarter as usage on their platform bounced back broadly, including in vulnerable Europe and the midmarket,” says Sharma. However, management noted that the strong performance was due to an “emerging seasonality effect.” Despite a surge in the stock’s price and Sharma maintaining her fair value estimate at $360, shares are still seen as undervalued.

Shares of cloud-based digital agreement software provider DocuSign (DOCU) jumped after also reporting strong results, with revenue for the third quarter of $645 million, topping the high end of guidance of $628 million. Despite solid results, Morningstar senior equity analyst Dan Romanoff cut his fair value estimate to $72 per share from $88.

“The most important item in our view was management’s preview of next year, which called for high-single-digit revenue growth,” he says. “We were looking for a bit more, hence we lowered our growth assumptions and therefore lowered our fair value estimate.”

What Stocks Are Down?

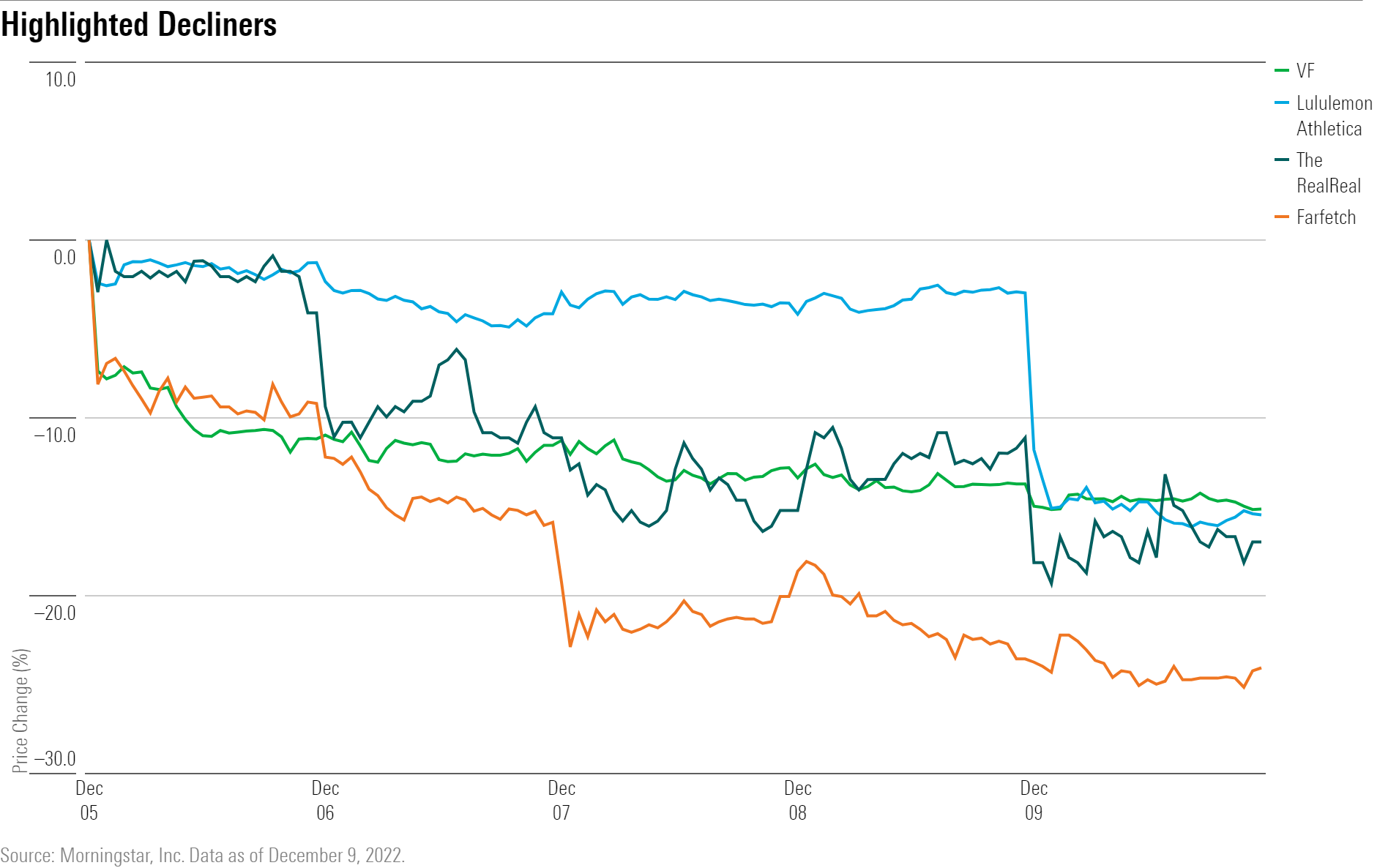

Apparel retailers struggled in the past week with shares of Lululemon Athletica (LULU) down after the firm reported 22% comparable sales growth that was in line with Morningstar equity analyst David Swartz’s expectations.

Despite the solid results shares dropped, “possibly because it did not raise guidance for the holiday season and because its inventories jumped 85% from last year,” says Swartz. While higher inventory may indicate slower sales, Lululemon’s management argues that higher inventories will be needed to meet demand.

“Even so, the firm expects that year-end inventories will be up 60% from last year. For now, given the firm’s momentum and history of full-price sell-through, we are inclined to support management’s argument that the inventory levels are manageable,” says Swartz.

Apparel maker VF (VFC) slumped after the unexpected and immediate resignation of chief executive Steve Rendle, chief executive of the last five years. Board member and former chief executive of Clorox (CLX) Benno Dorer is serving as head of the company on an interim basis.

“Rendle, who has been instrumental in VF’s success, oversaw an upbeat analyst event just two months ago,” says Swartz. “However, the firm has repeatedly lowered guidance this year, and did so again in conjunction with the CEO announcement due, primarily, to a heavily promotional environment and canceled wholesale orders in the U.S.”

Other decliners in the sector included Farfetch (FTCH) and The RealReal (REAL).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)