Markets Brief: Beyond the ‘Magnificent Seven,’ These Wide-Moat Stocks Soar

High-quality stocks are leading the charge.

Think the stock market’s big rally has been concentrated among a small group of names? You’d be right. But it’s not just because of the “Magnificent Seven.” There’s another relatively narrow set of stocks leading the bull market that happens to include the Magnificent Seven, along with dozens of others. What all these companies have in common is their strong competitive advantages, otherwise known as economic moats.

The companies with the widest moats have contributed roughly 72% of the 15.6% return on the Morningstar US Market Index’s gains since its low in late September. A similar share makes up the roughly 38% rally stocks have seen since they hit their bear-market low in 2022.

This group of stocks with the strongest economic moats includes six of the Magnificent Seven: Nvidia NVDA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL/GOOG. (Tesla TSLA only has a narrow moat.) But other important contributors to the rally have been left out of the narrative. Among the companies lifting the overall market with big gains are Broadcom AVGO, Eli Lilly LLY, JPMorgan Chase JPM, and Salesforce CRM. These companies all have wide moats, according to Morningstar’s analysts.

Performance of Selected Wide-Moat Stocks

What Is an Economic Moat?

Morningstar’s economic moat rating assesses a company’s ability to fend off competition based on its advantages and potential for high long-term returns. When determining whether a company has a moat, our analysts look at factors such as the strength of its network effect(s), the degree of switching costs involved, intangible assets such as patents and brand identity, cost advantage(s), and efficient scale.

Companies with narrow moats are expected to stave off their competition 10 for years. Those with wide moats are anticipated to have a market advantage for over 20 years. Firms without any such advantages are not given moats.

Only a small percentage of companies have wide moats. Out of the 704 U.S.-listed stocks covered by Morningstar analysts, 159 earn a wide-moat designation, while 331 have narrow moats. Wide-moat stocks comprise just 12% of the US Market Index.

The Outperformance of Wide-Moat Stocks

Since stocks hit their bear-market low in September 2022, wide-moat names have outperformed. The gains since then have been fueled primarily by Nvidia’s 468% return, as well as the 237% rally in Meta’s stock.

Moat Index and U.S. Stock Market Performance

Wide-moat stock performance has been a feature of the most recent leg of the rally that started in October. Since the Oct. 27 low, wide-moat stocks are up 25%, no-moat stocks are up roughly 21%, and narrow-moat stocks have gained just under 16%.

Since September 2022, the Morningstar US Market Index is up 37.94%. Of that gain, wide-moat stocks contributed 27.27 percentage points, or 72% of the return. Within that group, the six wide-moat stocks in the Magnificent Seven contributed 14.86 percentage points, or just shy of 40% of the entire market’s return. While that’s a heavily concentrated gain, that means more than 12 percentage points of investors’ returns came from other wide-moat stocks.

Of course, a hefty chunk of the wide-moat gains came from Nvidia and Meta. But since September 2022, Broadcom is up 185%, Eli Lilly is up 117%, Advanced Micro Devices AMD has rallied 172%, and Adobe ADBE is up 127%. Even stodgy Berkshire Hathaway BRK.B has outperformed the market with a 45% gain.

Meanwhile, narrow-moat stocks contributed 7.13 percentage points to the market’s overall gain, and no-moat stocks represented 2.48 percentage points. That equates to narrow moats providing 19% of the US Market Index’s return and no-moat stocks accounting for 6.5%.

Andrew Lane, director of equity research, index strategies at Morningstar, notes that beyond the “substantial” portion of the gains coming from the Magnificent Seven, wide-moat stocks could be seeing investor interest amid ongoing concerns about the potential for an economic slowdown that could turn into a recession. “Companies with wide moats are likely expected to hold up better than narrow- and no-moat stocks amid a recessionary environment,” he says. In addition, there tend to be more large companies among wide-moat stocks, and in general, large-cap companies have been outperforming small- and medium-sized stocks.

Stock Returns By Economic Moat

More recently, the stock market’s rally since its September low has been driven by a broader group of wide-moat names. Since Oct. 27, the US Market Index is up 20.16%, of which 13.44 percentage points, or two-thirds of total returns, came from wide-moat stocks. Within this time, the six wide-moat stocks of the Magnificent Seven were responsible for a smaller (though still significant) portion of the gains. Of the market’s return, around 6.58 percentage points, or 33%, was due to those six names. Broadcom, Lilly, JPMorgan, and Salesforce were also contributors, along with AMD, Berkshire, Costo COST, and Home Depot HD.

Meanwhile, narrow-moat stocks contributed 4.16 percentage points to the US Market Index return since the end of September, equal to 20% of the return. The contribution from no-moat stocks was 1.79 percentage points, or just shy of 9%.

For the Trading Week Ended Feb. 9

- The Morningstar US Market Index rose 1.48%.

- The best-performing sectors were technology, up 3.46%, and healthcare, up 1.52%.

- The worst-performing sector was utilities, down 1.99%.

- Yields on 10-year U.S. Treasury notes rose to 4.18% from 4.03%.

- West Texas Intermediate crude prices rose 5.27% to $76.55 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 466, or 55%, were up, six were unchanged, and 371, or 44%, were down.

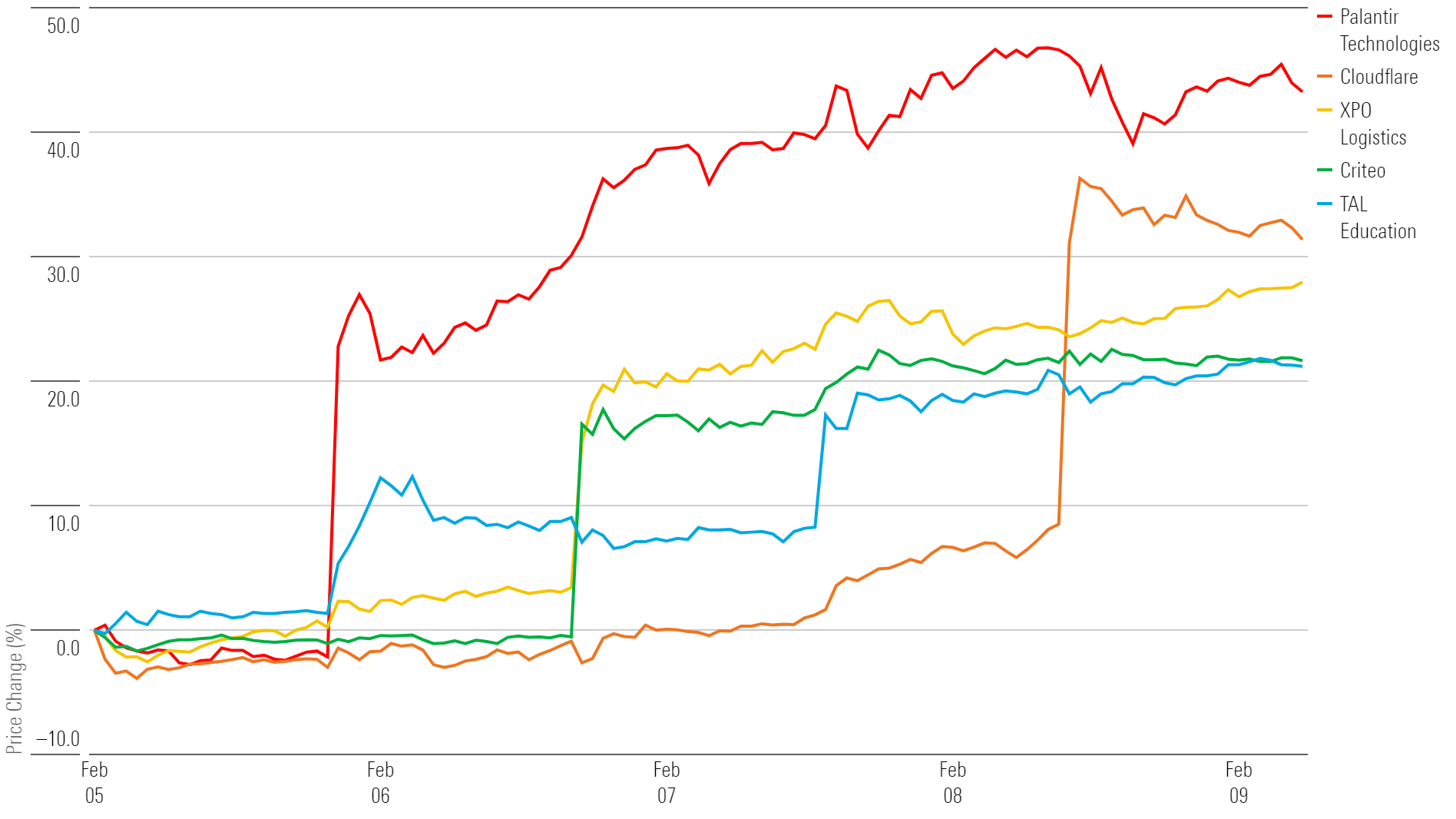

What Stocks Are Up?

Palantir Technologies PLTR, Cloudflare NET, XPO XPO, TAL Education Group TAL, and Criteo CRTO.

This Week's Top Performers

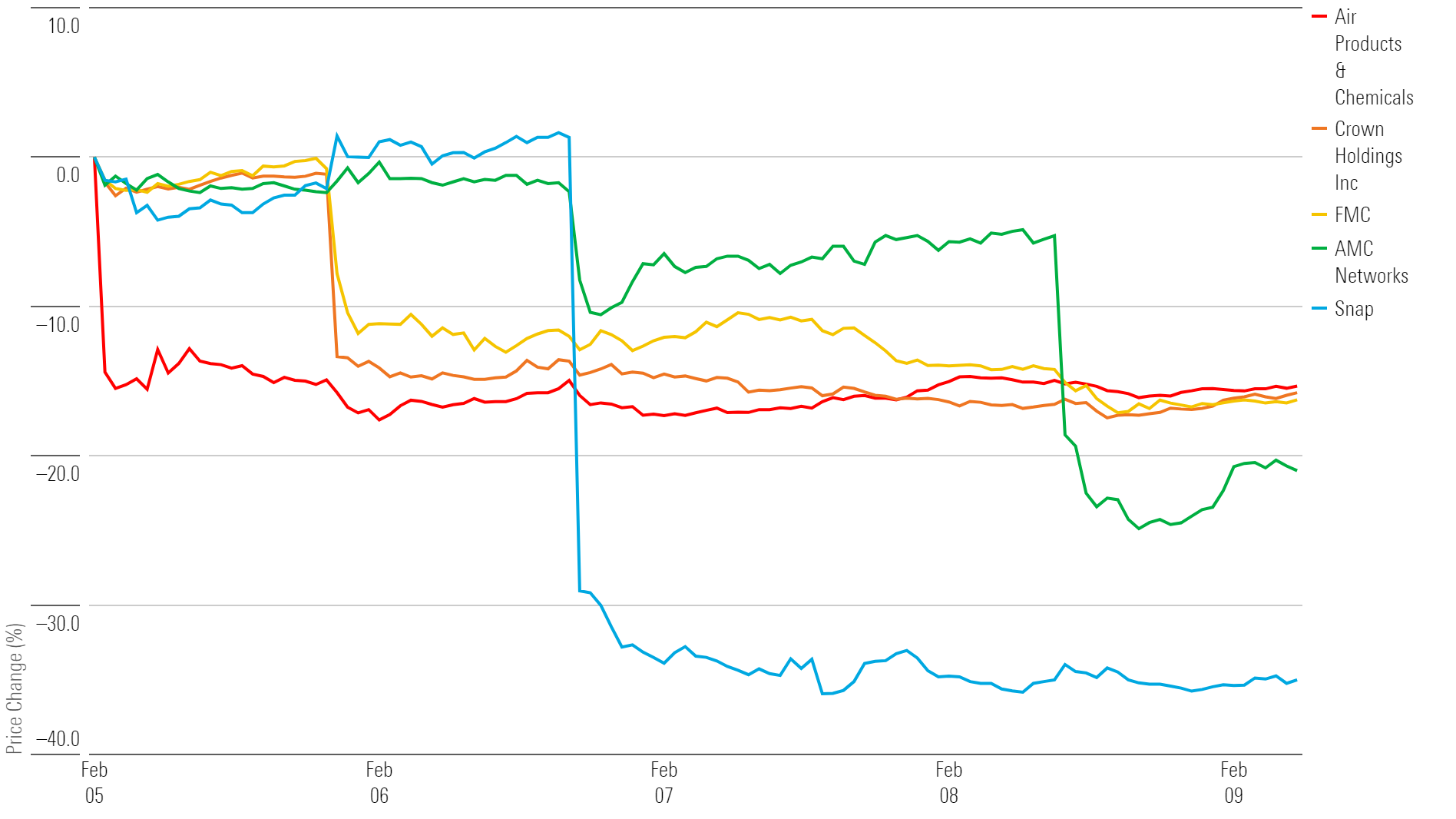

What Stocks Are Down?

Snap SNAP, AMC Networks AMCX, Crown Holdings CCK, FMC FMC, and Air Products APD.

This Week's Worst Performers

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)