How the Largest Stock Funds Performed in 2022

Total market funds lagged, while value and dividend-focused strategies remained buoyant.

Investors in many of the most widely held stock mutual funds had a painful year.

Losses were both severe and widespread among the largest U.S. stock mutual funds and exchange-traded funds. For many, it was their worst year since 2008. Only value-focused and dividend funds managed to avoid the worst of the damage.

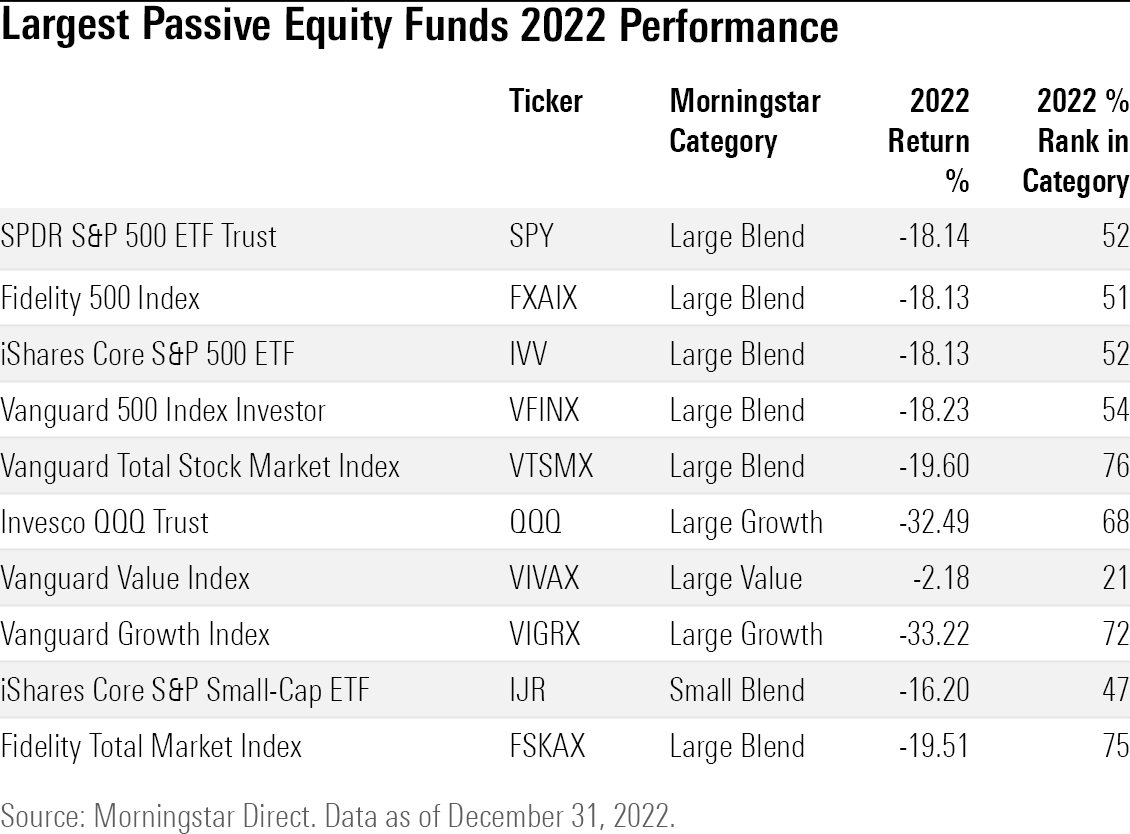

2022 Stock Index Fund Performance

Funds that track the S&P 500 index, including the $356.7 billion SPDR S&P 500 ETF SPY and the $352.8 billion Fidelity 500 Index FXAIX, fell a little over 18% for the year.

For index funds tracking indexes composed of all U.S. stocks, returns were slightly worse, as small-company stocks generally performed more poorly in 2022 than the larger stocks that comprise the S&P 500. The $261.1 billion Vanguard Total Stock Market Index VTSMX declined 19.6% for year.

Meanwhile, Invesco QQQ Trust QQQ, one of the high-flying funds in previous years, was dragged down by large losses from Amazon.com AMZN, Tesla TSLA, and Meta META. QQQ fell 32.6%, its worst year since 2008.

It was a somewhat different story for value-tilting strategies, as energy stocks buoyed value funds in 2022, leading them to outperform growth funds for the second consecutive year.

Of the most widely held passive funds, Vanguard Value Index VIVAX performed the best, losing only 2.2%.

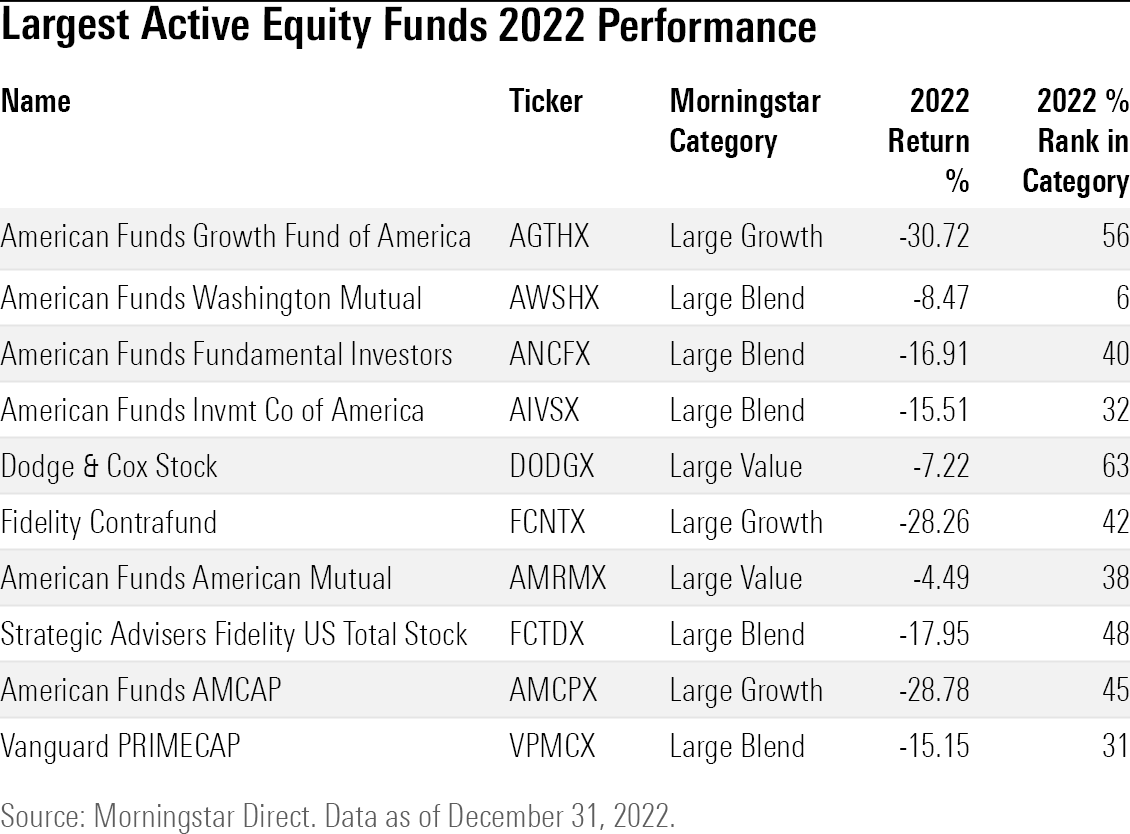

2022 Actively Managed Stock Fund Performance

With several of the largest actively managed funds landing in Morningstar’s value categories, the numbers look less bleak, even if still in negative territory for 2022.

The $86.2 billion American Funds American Mutual AMRMX lost only 4.5%, while the average large-value fund fell 5.9%. Morningstar director of manager research Alec Lucas writes, “the fund is resilient in downturns,” and 2022 was no different. The fund places in the top half of its Morningstar Category for the past one- and three-year time frames and in the top 25% for the last five years.

The $93.3 billion Dodge & Cox Stock DODGX underperformed among large-value funds in 2022, having ranked among the category’s top quartile in 2021 and ranking in the 10th percentile in 2020. The fund, which has a Morningstar Analyst Rating of Gold, has posted top-quintile returns for the last five years. For the last 10 years, the fund ranks at nearly the top, in the fourth percentile of all large-value funds.

In the large-blend category, American Funds Washington Mutual’s AWSHX dividend approach was one of the best performers. The fund lost 8.5%, while the average fund in the category declined 16.9%.

The largest active growth funds outpaced their passive counterparts, though losses were still severe. Among the largest, $91 billion Fidelity Contrafund FCNTX did the best, losing only 28.3% compared with the average loss of 30%. The fund ranks in the middle of the pack for large-growth funds for its three- and five-year performance.

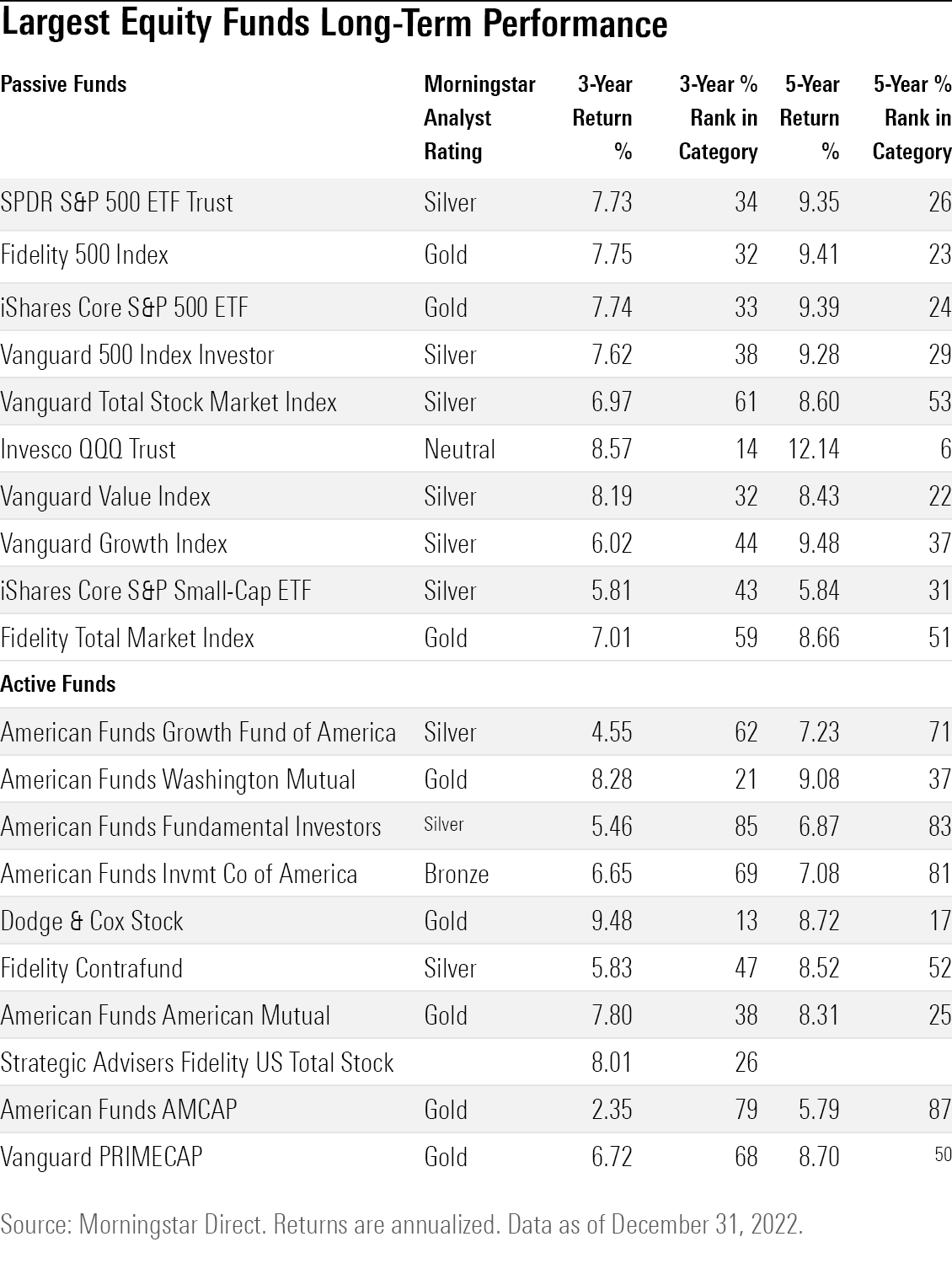

Looking at longer-term performance, the stats reflect both the recent rebound of value and the multiyear advantage of growth. Dodge & Cox Stock has returned the most among the largest funds over the last three years. However, over the past five years, Invesco QQQ Trust is ahead, having returned 12.1% on an annualized basis since 2018.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)