Bracing for AI Breakthroughs

How are portfolio managers navigating these uncharted waters?

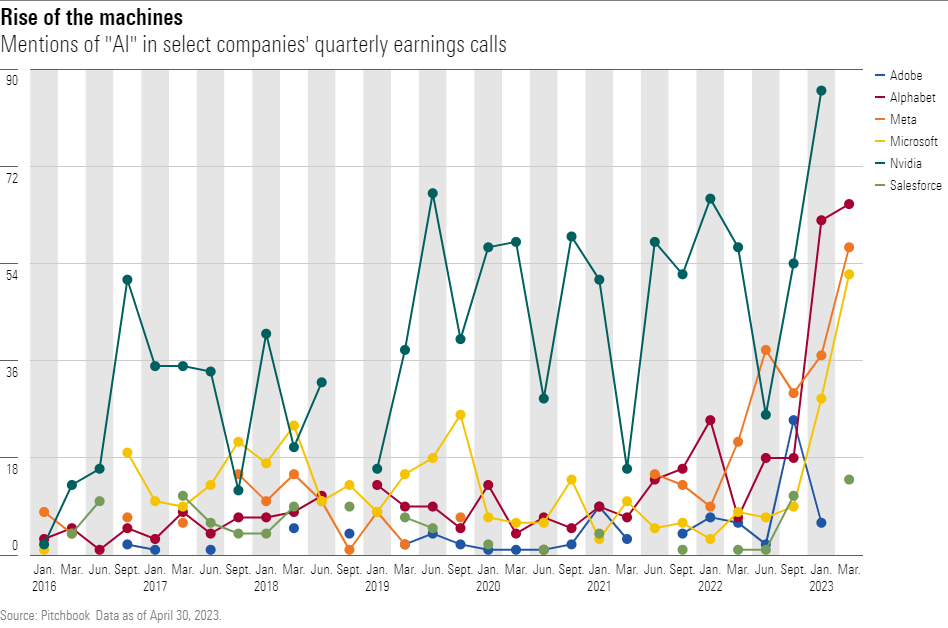

Artificial intelligence has become a top-of-mind subject for internet and technology titans in the wake of ChatGPT’s public release in November 2022. Microsoft MSFT founder Bill Gates considers AI as revolutionary as the personal computer, mobile phones, and the internet. If true, a transformation of companies’ products, business models, and strategic positions is on the horizon. AI begged for attention at last week’s Morningstar Investment Conference, where I asked three portfolio managers overseeing over $100 billion in assets for their thinking on the subject.

The consensus? AI’s impact on business and society will be huge. “I struggle to see a single company in my portfolio that won’t be impacted [by artificial intelligence] in some way,” said Spencer Adair, manager of Baillie Gifford Global Alpha Equities BGASX, who was upbeat about AI’s potential to fatten companies’ profit margins and rev up productivity.

Natasha Kuhlkin, manager of PGIM Jennison Growth PJFAX and PGIM Jennison Focused Growth SPFAX, illustrated AI’s versatility by describing use cases in advertising and media. Netflix NFLX, among her fund’s longtime holdings, can harness AI for content creation and cost-effective scene reshoots, for example. AI can also improve the effectiveness of ad targeting and boost ad prices, she said.

Adair’s colleague and manager of Baillie Gifford Health Innovation Equity BGHBX, Julia Angeles, recently pointed to AI’s potential to slash healthcare expenses. By untangling the Gordian knot of biological complexity and reducing the risks in drug development, we could see a sea change in the economics of healthcare, she suggested.

Microsoft and Alphabet GOOG, the parent company of Google, are investing furiously to establish AI beachheads. In recent months Microsoft has plowed money into OpenAI for ChatGPT, the chatbot now stitched into Microsoft’s Bing search engine, while Alphabet countered with its own bot, named Bard. Some investors think there’s a chance that widespread adoption of chatbots could throw a wrench into Google’s cash-making search machine. Dan Davidowitz, portfolio manager of Polen Growth POLRX, agrees that the firm faces somewhat higher risks than before, and so he recently trimmed his fund’s large, yearslong holding in Alphabet. But his conviction in the company remains high. The firm’s treasure-trove of data and AI capabilities of its own makes it well-positioned to improve its current offerings with the technology and, consequently, reap its benefits.

Beyond owning one these software and search behemoths—which Kuhlkin, Adair, and Davidowitz all do, as of recent filings—how might portfolio managers ride the AI wave? Many agree that Nvidia NVDA, the champ of advanced computing hardware for AI infrastructure, stands to rake in the big bucks. It is the second-largest position in Kuhlkin’s strategies at 7% or more of assets.

But although Davidowitz extols the virtues of Nvidia, marveling at its competitive edge and the growth tailwinds from AI, he finds the company’s valuation tough to stomach. High price/earnings multiples do not by themselves deter him. He is often willing to pay a premium for companies he thinks are high-quality industry leaders whose futures he thinks he can forecast with some accuracy. Nvidia is a different story, involving the varying adoption of its products in two distinct markets: training and inference. Training, though smaller, requires the use of graphics processing units, or GPUs—a space where Nvidia shines. Inference, the more expansive market, leaves room for doubt, as GPUs may not be a necessity for all applications. Nonetheless, Nvidia has forged ahead with specialized GPUs for inference, perhaps teetering on the precipice of immense success—or perhaps a more modest outcome. The wide-ranging possibilities make it tough for Davidowitz to discern whether Nvidia’s price today makes it a bargain or a rip-off.

AI can affect corporations in two ways, said Matt Fruhan, portfolio manager of Fidelity Large Cap Stock FLCSX. Industry giants could leverage their vast resources and AI prowess to further entrench their strategic positions, or AI could lower the barriers to entry for new rivals. Adobe ADBE, another of Polen Growth’s large holdings, may feel more competitive heat from AI’s text-to-picture and text-to-video prowess, Davidowitz said. On the other hand, the company’s own AI-driven product, Firefly, might sharpen its competitive edge.

In the wake ChatGPT’s release, portfolio managers agree we’re on the precipice of an AI revolution that could reshape industries and redefine competitive landscapes. As the titans of tech jockey for the pole position, portfolio managers are grappling with a spectrum of possibilities and acknowledging that much remains unknown. Investors should watch how AI’s effects ripple through their portfolios. If Gates is correct, those ripples could build quickly into a tsunami.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)