Avoiding China Has Been a Winning Bet for These Equity Funds

A gloomy economic outlook and ESG concerns have more funds and investors shunning the country’s stocks.

Chinese stocks have long dominated emerging-markets funds, but increasingly funds are avoiding investing in the country.

This year, that move has been paying off.

Out of 323 funds in the diversified emerging-markets Morningstar Category that are available in the United States, there are 31 that have no exposure to Chinese stocks, according to Morningstar Direct. Those 31 funds posted an average return of 9.8% for the year to date through Sept. 11, while funds that own Chinese stocks were up 6.3% on average. For example, the $5.2 billion iShares MSCI Emerging Markets ex China ETF EMXC was up 8.5% through Sept. 11, while the $20.5 billion iShares MSCI Emerging Markets ETF EEM was up 6.7%.

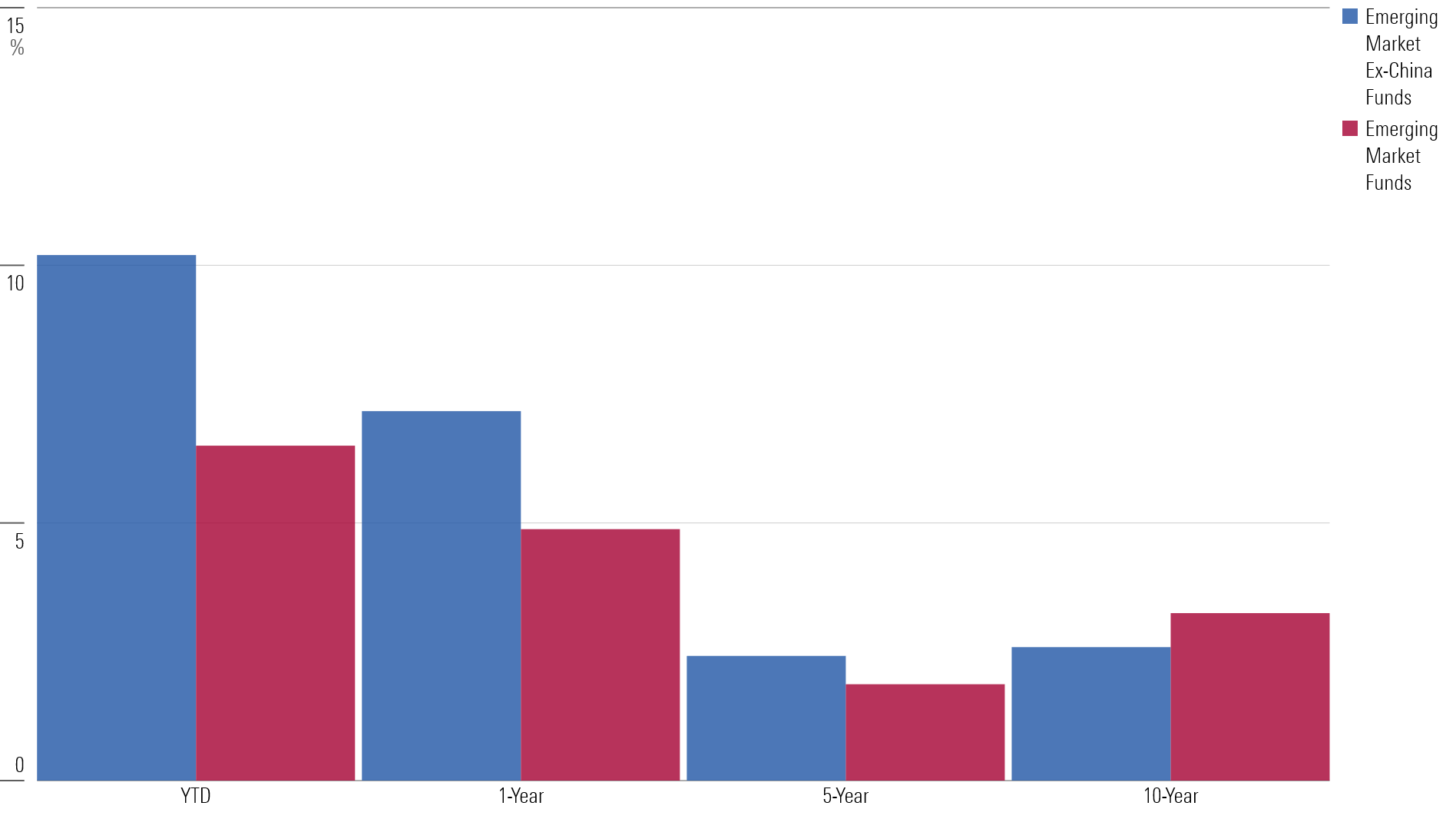

Looking longer term, diversified emerging-markets funds without Chinese stocks have outperformed over the past one- and five-year periods.

Performance of Emerging-Markets Funds vs. Emerging-Markets ex-China Funds

Chinese companies make up a third of the average diversified emerging-markets fund’s portfolio by assets. Over twenty-nine percent of the MSCI Emerging Markets Index is dedicated to Chinese stocks. However, a crop of new funds, both active and passive, that exclude Chinese companies have launched in the past year.

Investors have taken note of these new offerings. Diversified emerging-markets funds that don’t hold any Chinese companies have taken in a net $3.7 billion over the past year, while those that include China have posted outflows of $9.5 billion.

Many index providers and managers cite environmental, social, and governance concerns and geopolitical tension for avoiding Chinese companies. Meanwhile, China’s slowing economy has led other managers to make a tactical decision and avoid Chinese stocks.

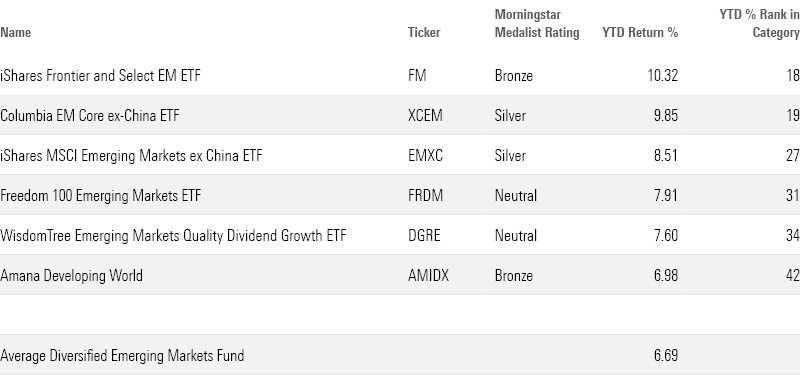

Recently Launched Emerging-Markets Funds That Have No Exposure to China

Among funds that don’t hold Chinese companies, iShares Frontier and Select EM ETF FM is up the most so far this year. It has gained 10.3% and ranks in the 18th percentile of diversified emerging-markets funds. Its focus on frontier and smaller emerging economies means that it doesn’t touch Chinese companies. Instead, its largest country exposures are to Vietnam and the Philippines.

The $619 million Freedom 100 Emerging Markets ETF FRDM tracks an index that ranks companies according to certain personal and economic freedom metrics. No Chinese companies pass the screen.

So far in 2023, FRDM is up 7.9% and ranks in the 31st percentile of all diversified emerging-markets funds. However, the fund struggled in August. Last month, the fund was hurt by investments in Chile and Poland, where it has large allocations compared with the category average. The ETF lost 7.7%, while the average peer fell only 5.3% in August.

2023's Top-Performing Ex-China Diversified Emerging-Markets Funds

The $409 million Columbia EM Core ex-China ETF XCEM was launched in 2017. The fund says it aims to avoid some of the risks that are due to China’s significant weight in traditional emerging-markets benchmarks. It’s up 9.9% this year.

The largest diversified emerging-markets fund that doesn’t invest in China is iShares MSCI Emerging Markets ex China ETF. This year, the fund has benefited from the strong performances of Taiwan Semiconductor Manufacturing TSM and Samsung Electronics, which is based in Korea.

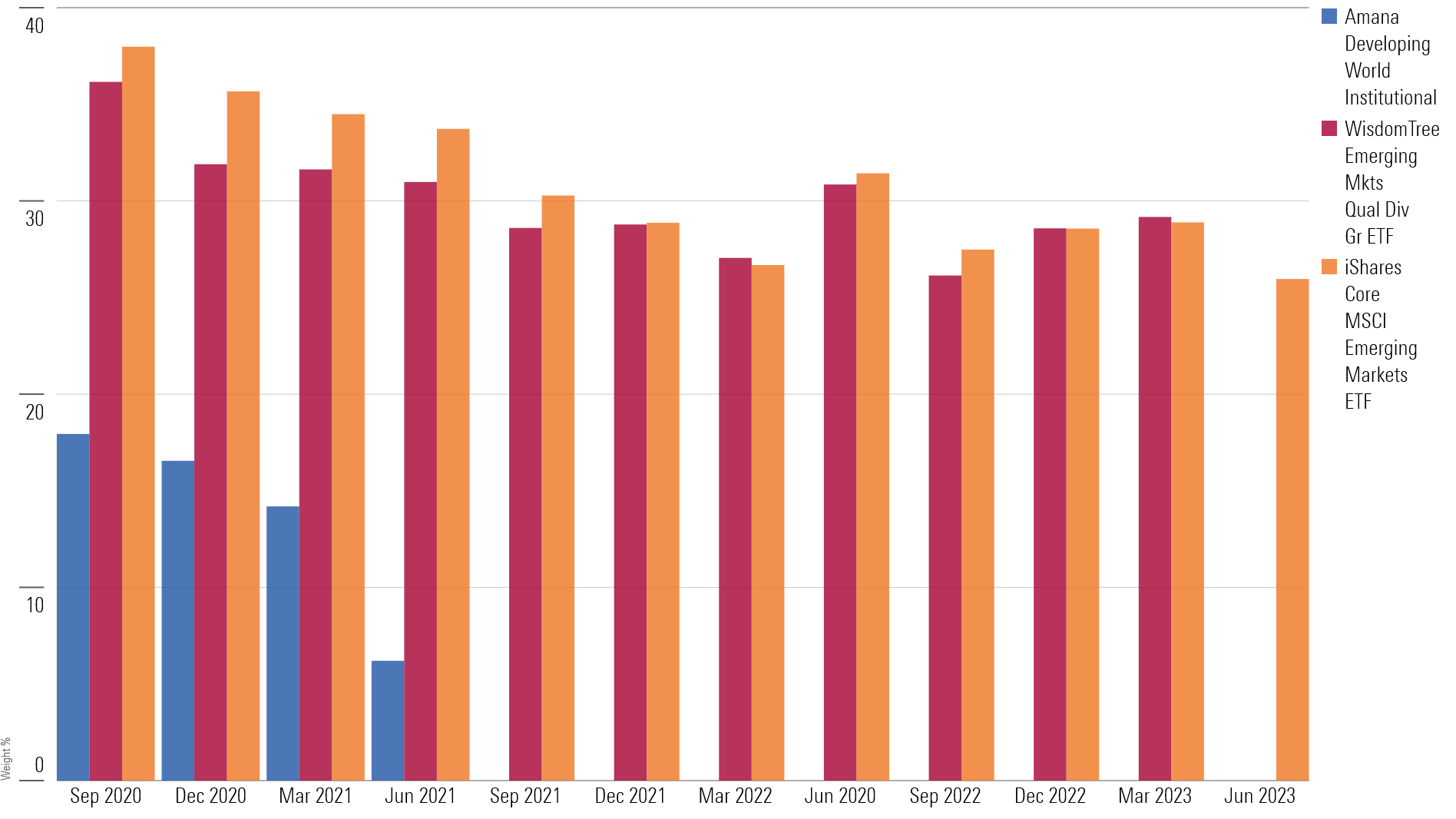

While not explicitly avoiding Chinese companies, Amana Developing World AMIDX and WisdomTree Emerging Markets Quality Dividend Growth ETF DGRE have both lowered their exposure to Chinese companies in recent years.

Amana Developing World used to invest in Chinese companies, but its managers cited “myriad environmental, social, and governance concerns” and exited all Chinese investments in the third quarter of 2021.

In 2023, the fund is up 6.7% and ranks in the 42nd percentile of diversified emerging-markets funds.

WisdomTree Emerging Markets Quality Dividend Growth ETF is an active ETF that screens for high-quality dividend-paying stocks. Up until this year, the fund held nearly 30% of its portfolio in Chinese companies. However, in May it exited all its Chinese holdings. In a post, WisdomTree wrote, “Several Chinese companies among the top 10 fund holdings were removed for risk considerations, including Tencent Holdings, ENN Energy, and Anta Sports.”

India and Korea now constitute the largest country exposures in the fund.

The Declining China Exposure of 3 Top-Performing Diversified Emerging-Markets Funds

Long-term performance is favorable for funds that avoid China. Since its inception in 2017, iShares MSCI Emerging Markets ex China ETF has outperformed iShares MSCI Emerging Markets ETF.

Over the past five years, EMXC is up 3.9%, while the average diversified emerging-markets fund advanced only 2.9%.

Long-Term Performance of Select Funds That Don't Invest in China Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)