9 Top-Performing Large-Growth Funds

Index funds have been the best-performing funds in a seesaw market for growth stocks.

It’s been a big year for funds investing in large-company growth stocks, which have ridden the wave of hefty gains in the “Magnificent Seven” and relief over the likely end of the Federal Reserve’s interest rate hikes.

But that follows the brutal time large-growth funds had in 2022, when the bear market inflicted huge losses. That came after 2021, another strong year for large-growth funds.

This has resulted in a challenging environment for actively managed funds. As a result, the top ranks over the last one-, three-, and five-year periods are dominated by index-tracking funds. That includes offerings from Vanguard, iShares, and Schwab. But it hasn’t been impossible for actively managed funds to top the charts. Case in point: Loomis Sayles Growth LGRNX.

Large-Growth Fund Performance

For investors in large-growth funds, 2023 has been very good. With interest rates steadying and inflation easing, the category has outperformed the overall stock market as measured by the Morningstar US Market Index by 10.1 percentage points so far this year. The average large-growth fund is up 34.6% in the year to date, while the US Market Index is up 25.1%.

However, over the last three years, the average large-growth fund has underperformed the index by 3.52 percentage points. This underperformance was in large part due to the category’s 29.9% loss in 2022, compared to a 19.4% decline in the market.

Large Growth Fund Category Performance

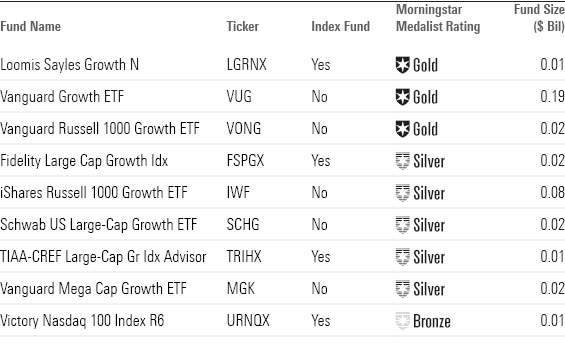

Screening for Top-Performing Large-Growth Funds

To find the best-performing large-growth funds, we looked at returns data from the past three years.

We screened for funds that ranked in the top 33% of the Large Growth Morningstar Category using their lowest share classes over the past one-, three-, and five-year periods. We then filtered for funds with Morningstar Medalist ratings of Gold, Silver, or Bronze. We then selected funds with asset bases greater than $100,000 and an analyst coverage threshold of 90% or greater.

Based on this screen, we’ve spotlighted the nine funds with the best year-to-date performance.

Top Performing Large Growth Funds

Victory Nasdaq 100 Index

- Ticker: URNQX

- Morningstar Medalist Rating: Bronze

“The fund’s principal strategy is, under normal market conditions, to invest at least 80% of its assets in the common stocks of companies composing the Nasdaq-100 Index. The fund is non-diversified.

“The fund’s 16.5% stake in the communications sector, which hosts internet powerhouses like Alphabet GOOGL and Meta Platforms META, outweighed the category benchmark by about 9 percentage points. Lighter stakes in financials, healthcare, and industrial stocks funded those outsize positions. The fund’s sector bets have worked wonders in the past, but can translate into volatile performance relative to the category benchmark.

“Over the past three years, it beat the Russell 1000 Growth Index by an annualized 1.1 percentage points, and outperformed its average peer by 5.5 percentage points. More importantly, when extended to a longer time frame, the strategy outpaced the index. On a five-year basis, it led the index by an annualized 2.1 percentage points.”

—Ryan Jackson, analyst

Loomis Sayles Growth

- Ticker: LGRNX

- Morningstar Medalist Rating: Gold

“Manager Aziz Hamzaogullari has geared this strategy for long-term investing. The team believes that patient, high-conviction, valuation-sensitive investing in companies with clear and persistent competitive advantages is the key to success. They focus on stocks in the Russell 1000 Growth Index and a decent helping of large- and mid-cap non-U.S. companies.”

“Hamzaogullari has crafted and faithfully followed a worthy approach. He and his team seek large-cap companies (mostly in the United States, but with a decent dose of non-U.S. ones as well) with strong competitive positions. Stocks of such companies can get pricey, so Hamzaogullari exercises restraint with his purchases, and even looks a little contrarian at times.”

—Tony Thomas, associate director

Vanguard Mega Cap Growth ETF

- Ticker: MGK

- Morningstar Medalist Rating: Silver

“Vanguard Mega Cap Growth provides a market-cap-weighted portfolio of the fastest-growing companies in the mega-cap market. Its razor-thin expense ratio makes it a compelling choice.

“The fund tracks the CRSP U.S. Mega Cap Growth Index, which captures the growth-oriented side of the mega-cap market. Growth stocks tend to have high valuations because of investor sentiment around their superior growth prospects. While growth stocks constitute much of the fund, value and blend stocks are also present, which should steady the fund when its growth holdings can’t meet their lofty expectations.

“From that point through May 2023, the fund’s ETF share class beat the category average by 2.9 percentage points annualized. Concentration at the top of the portfolio contributed to greater volatility over this time, but not enough to cut into its risk-adjusted advantage.”

—Zachary Evens, associate analyst

Schwab US Large-Cap Growth ETF

- Ticker: SCHG

- Morningstar Medalist Rating: Silver

“Schwab U.S. Large-Cap Growth ETF constructs a market-cap-weighted portfolio of fast-growing U.S. large-cap stocks with low fees. Despite being top-heavy, the fund broadly represents the large-growth opportunity set and comes with a fee advantage that should translate into sound performance.”

“The fund replicates the Dow Jones US Large-Cap Growth Total Stock Market Index, which selects faster-growing large-cap stocks and weights them by market cap. Its holdings tend to trade at higher multiples than the market, a reflection of their lofty long-term outlooks that’s also a source of risk. These firms may not live up to the expectations embedded in their higher valuations, which could hurt performance.”

—Mo’ath Almahasneh, associate analyst

Vanguard Growth ETF

- Ticker: VUG

- Morningstar Medalist Rating: Gold

“Vanguard Growth Index provides a market-cap-weighted portfolio of the largest and fastest-growing companies in the U.S. market. Concentration presents some risks, but its low turnover, tight tracking, and razor-thin expense ratio make this one of the best large-growth funds available.

“The fund tracks the CRSP U.S. Large Cap Growth Index, which captures the growth-oriented side of the large-cap market. Growth stocks tend to have high valuations because of positive investor sentiment around their superior growth prospects. While growth stocks constitute most of the fund, value, and blend stocks are also present, which should steady the fund when its growth holdings can’t meet their lofty expectations.”

—Zachary Evens, associate analyst

Funds Tracking the Russell 1000 Growth Index

These funds, which all track the Russell 1000 Growth Index, have also met our screening criteria, and are worthy of the spotlight based on their returns data in multiple time periods.

Fidelity Large Cap Growth Index

- Ticker: FSPGX

- Morningstar Medalist Rating: Silver

TIAA-CREF Large-Cap Growth Index

- Ticker: TRIHX

- Morningstar Medalist Rating: Silver

Vanguard Russell 1000 Growth ETF

- Ticker: VONG

- Morningstar Medalist Rating: Gold

iShares Russell 1000 Growth ETF

- Ticker: IWF

- Morningstar Medalist Rating: Silver

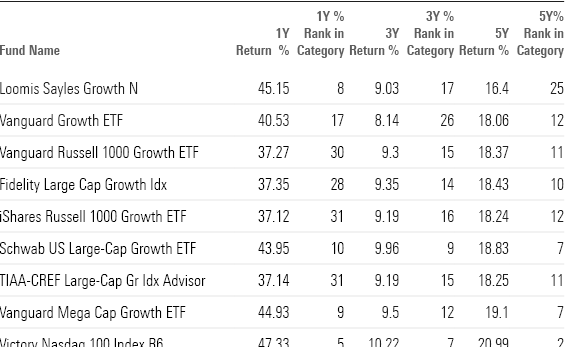

Long-Term Returns for Top-Performing Large Growth Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)