Dividend-Paying Stocks Can Help Tilt the Scale in Your Favor

Five charts that matter to investors now.

Artificial intelligence was the dominant theme in the markets last year. AI helped propel technology stocks to podium position, and they were up 56% for the year while contributing most of the market’s gains.

But as Newton’s third law of motion states, every action has an equal and opposite reaction. While AI-adjacent companies pushed the market higher, valuations for high-dividend-paying companies quietly fell in comparison.

As background, dividend payers usually trade at a discount to the market. Why? While oversimplified, the typical high dividend payer usually grows slower than the overall market, thus warranting a lower multiple.

But sometimes the valuation pendulum swings too far, and that may be happening now. Data from Capital Group show the price/earnings ratio discount for high dividend payers has been about 13%, on average, since 1980. Through last year-end, that P/E discount ballooned to 26%.

Access to Cheaper Areas of the Market

At a high level, there seem to be two parts of the U.S. large-cap market:

1) The higher valuation (expensive) part that is driving most of the performance and headlines.

2) The lower valuation (cheaper) part that feels largely ignored.

A simple thought exercise would be to peel back the layers on U.S. large caps. For example, the S&P 500 trades at nearly 20 times earnings, which is the high end of its historical valuation range.

But if you isolate value stocks inside the index, much cheaper valuations can be accessed. For example, the P/E of the top 10 holdings in the Russell 1000 Value Index is 14.6, a nearly 30% discount to the overall average.

Top 10 Holdings: Russell 1000 Value Index

There are opportunities to be found if you turn over enough rocks. Rather than chasing the so-called Magnificent Seven, investors might be well served to ensure their portfolios are broadly diversified to potentially capture the returns of companies that might be ascending in the future.

Diversification Away From Big Tech

The world’s shortest summary of last year’s stock market would read: Seven companies sucked up most of the oxygen, and everyone else was left fighting for air.

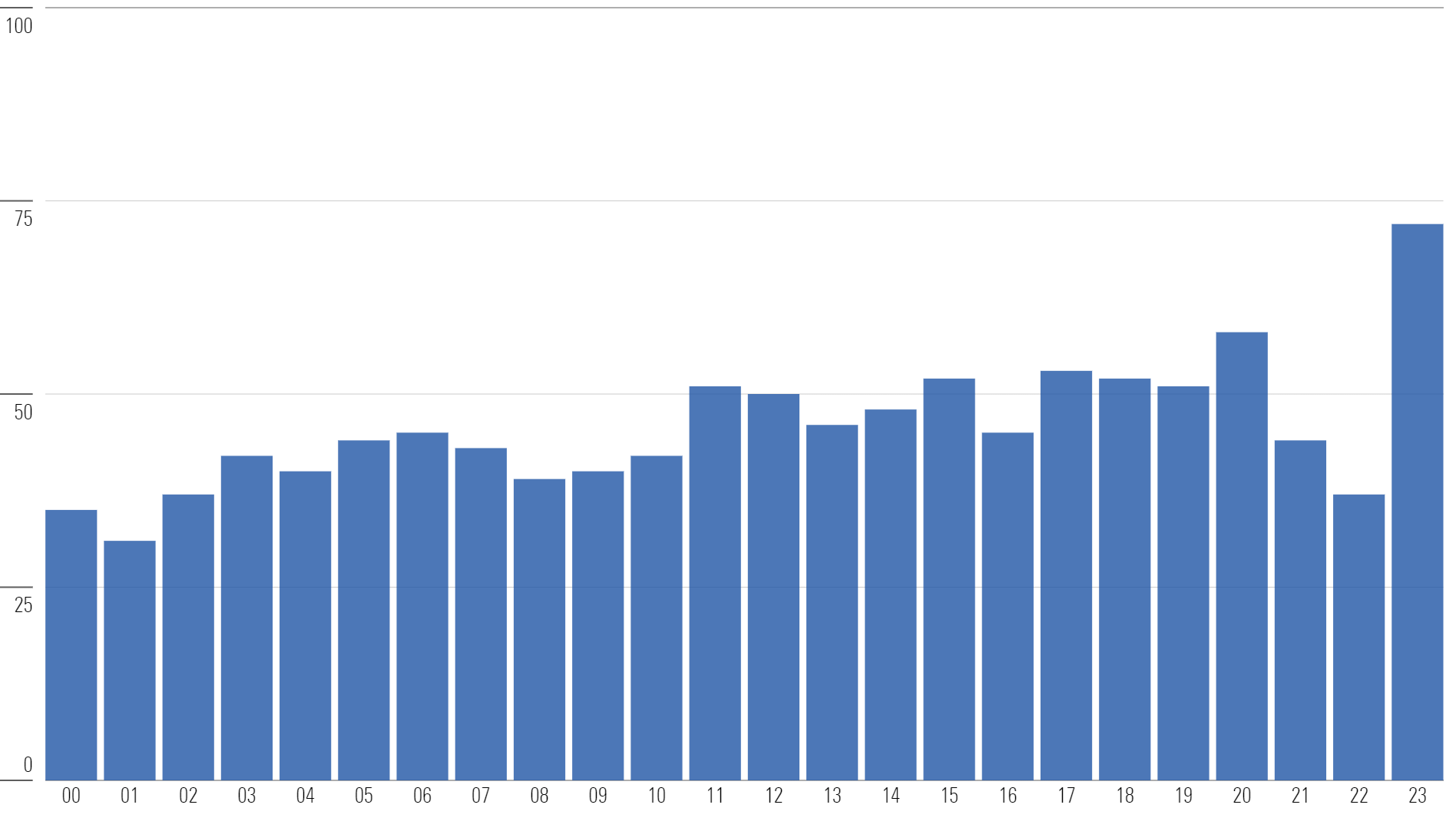

For example, the S&P 500 was up 27%, but 72% of the stocks inside the index returned less than that.

Percentage of Stocks Underperforming the S&P 500 Each Year

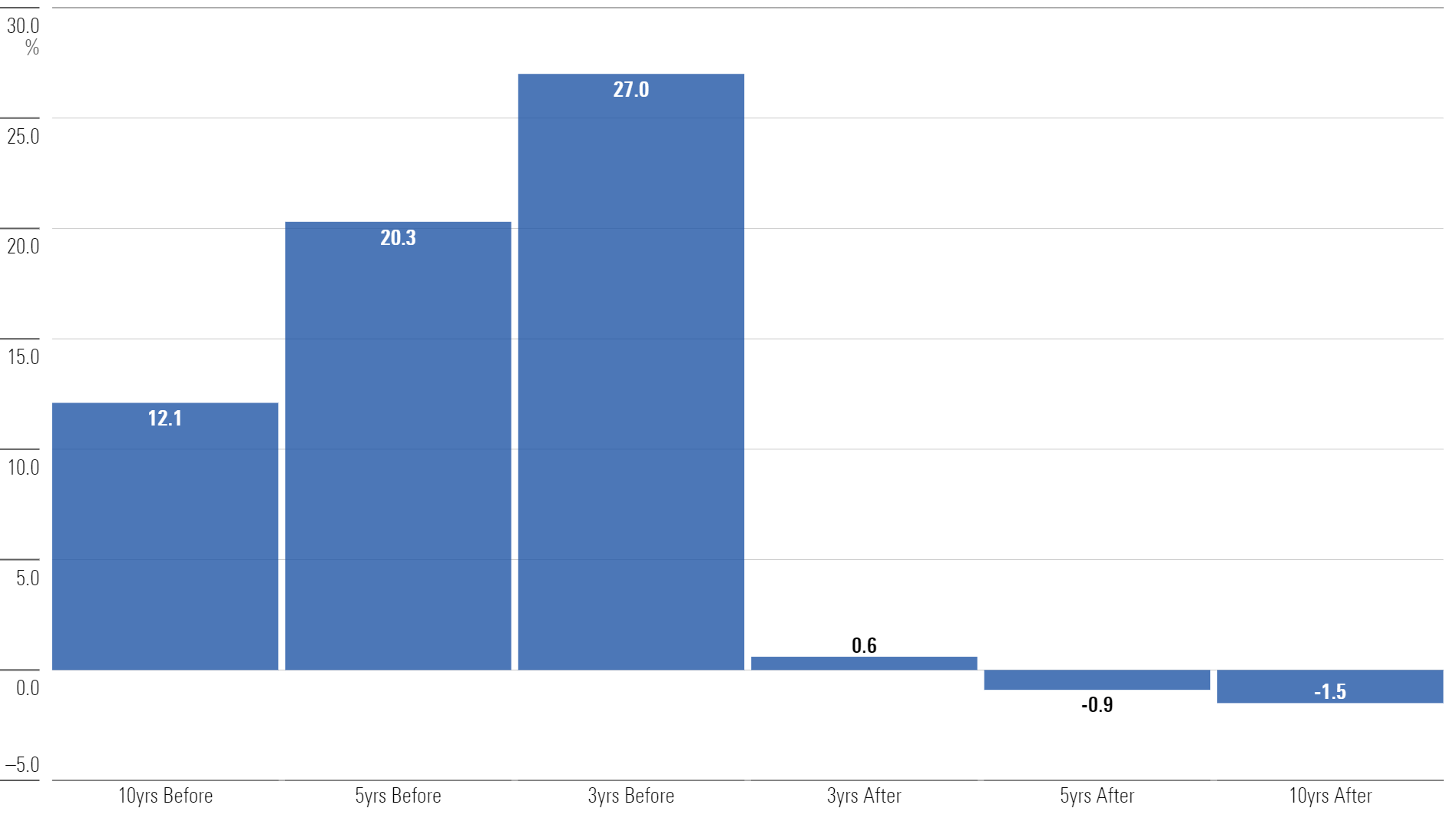

Using data from Dimensional Fund Advisors, the strongest period of returns for the top 10 stocks by market cap tends to happen before they become the largest stocks in the market.

We must admit that data isn’t exactly profound. The only way a stock gets into the top 10 is through extreme outperformance. But what happens after a stock breaks into the top 10?

Nearly 100 years of data show that leading stocks—once established in the top 10—tend to lag the market.

Annualized Returns in Excess of U.S. Market Before and After Joining the Top 10

This data brings to mind Howard Marks’ concept of second-level thinking. Second-level thinking goes beyond the first level, which is simplistic and consensus-driven.

For example, “Tesla is dominating,” might be an example of first-level thinking. Everyone knows Tesla TSLA is dominating. It’s been one of the best-performing stocks for a decade and is in the news regularly.

Second-level thinking might say, “Everyone knows Tesla is dominating. The stock price already reflects that and possibly more.”

To be clear, we’re only using Tesla as an example and not wagering a specific opinion on its future. But this type of deep thinking and analysis can sometimes go missing when companies enter top-10 status. It’s a cautionary tale to some extent, investors suspend belief and believe outperformance can last forever.

But it never can. Though, we admit we can never say when the market will inflect.

The remedy? Likely diversification.

Consistent and Growing Income When Rates Are Falling

The motivation to enter the stock market is limited when investors are earning 5% in cash risk-free.

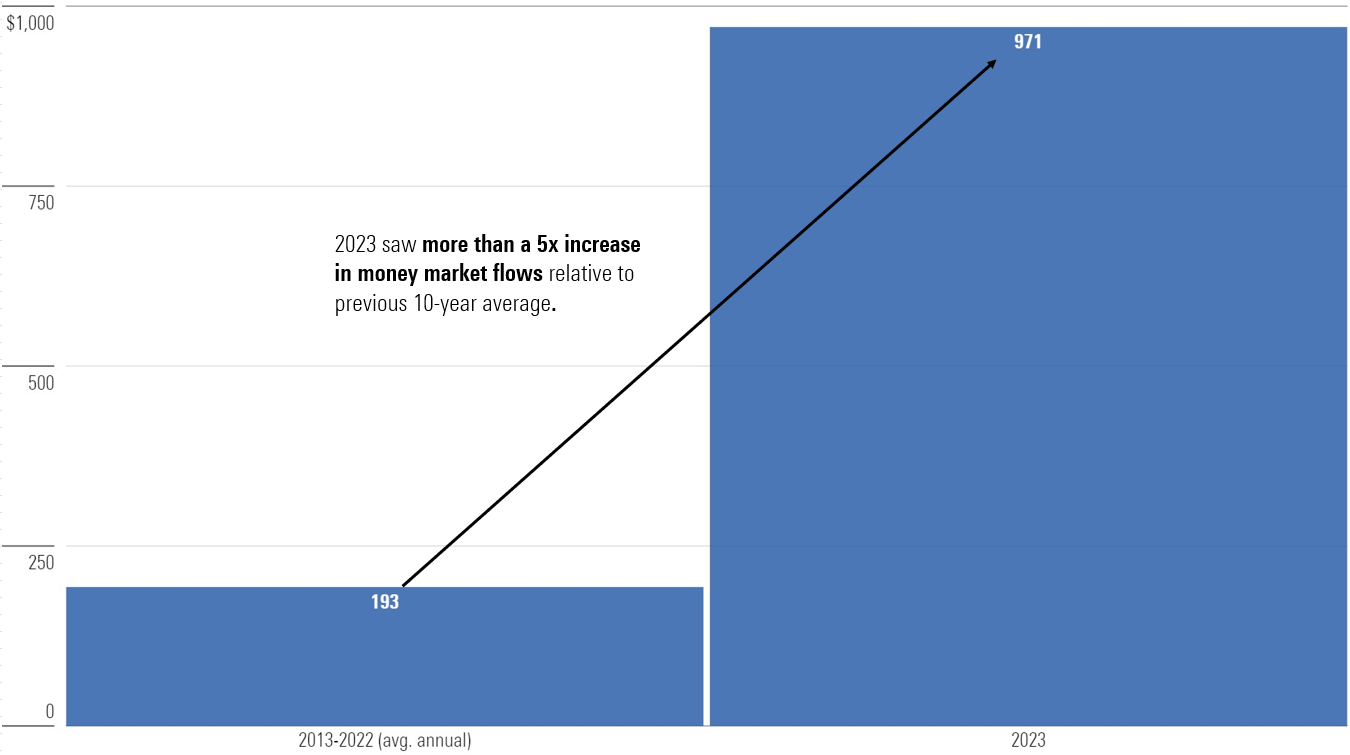

This idea was on full display last year when nearly $1 trillion flowed into money market funds, the highest on record.

In fact, 2023 saw 5 times the annual average flows into money markets versus the previous 10 years.

Money Market Flows (USD, Bil)

But trends change from year to year. Last year’s love affair with cash may face a tougher test this year.

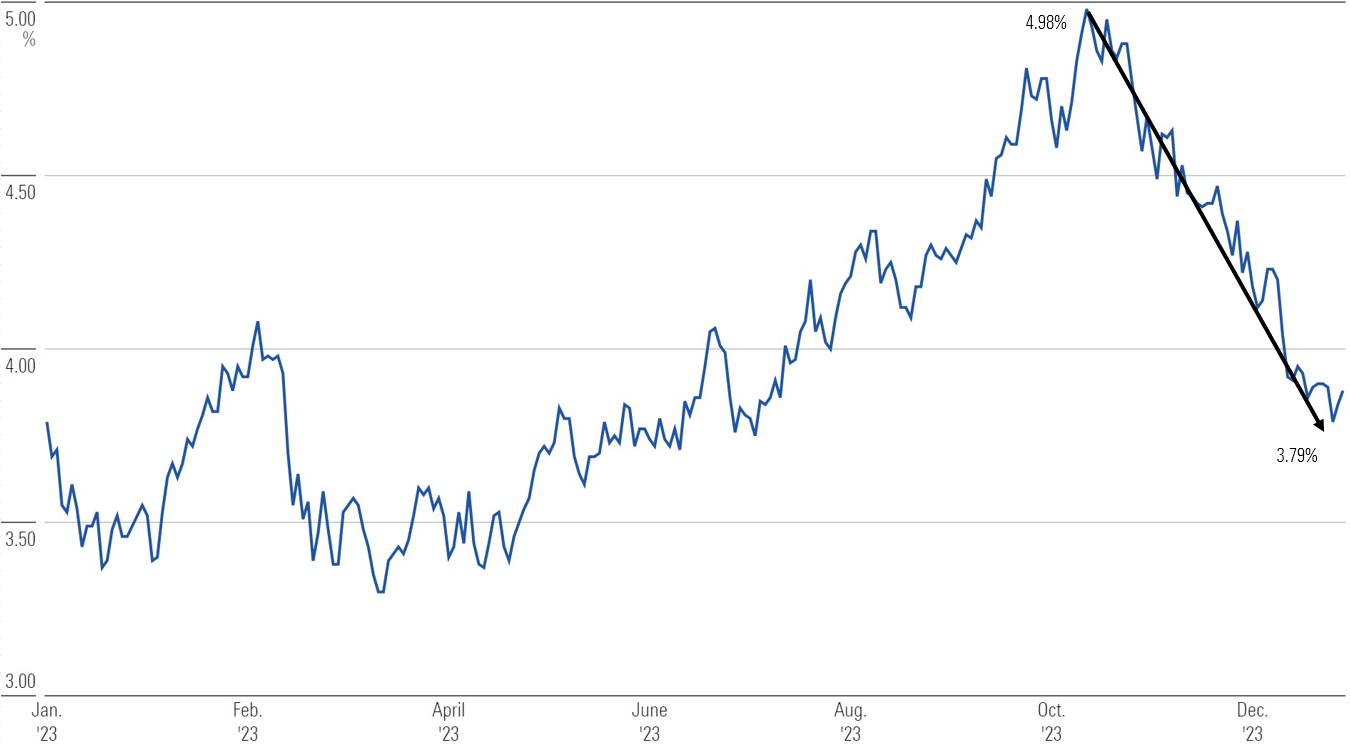

Why? Rates are falling. The 10-year Treasury nearly hit 5% in October 2023 but then fell more than 100 basis points through year-end.

10-Year U.S. Treasury Rate

Rates appear to be falling in anticipation of the Federal Reserve’s move to cut rates, possibly as soon as March.

Investors loved cash when rates were at 5%, but will they love the rates equally if they keep trending lower?

We can’t say with certainty what level of rates will cause investors to flee money markets. But a sea change in the rate backdrop could cause that money to go looking for a new home if rates do continue to fall.

Of course, we should acknowledge that just because rates have been falling does not mean they will keep falling. Predicting the direction of interest rates is a little bit like predicting natural disasters: We have inputs that can help inform us, but it’s not a hard science.

But as the saying goes, money likes to go where it will be treated best. Investors may go hunting elsewhere if money market rates continue to tick lower, especially considering that inflation still sits at more than 3%, ready to act as a tapeworm on that yield.

Dividend Payers Are Worth Including in a Portfolio

Valuations are a great starting point, but they never serve as a form of final analysis.

In the case of dividend payers, valuations are certainly attractive. But it’s not just valuations. There are other elements that build out the foundation for a solid investment case, including diversification benefits and the possibility of an increasing income stream while the Fed potentially lowers rates.

No alarm will go off to let us know when the proverbial music will stop playing in hot areas of the market, but dividend-paying companies appear to be a worthwhile point of emphasis in portfolios.

Consistently attempting to add small edges to your portfolio and letting them compound over a long period can yield wonderful results.

Dividend payers might be one of those small edges.

This article was a condensed version of an article from Morningstar Wealth. The longer article can be accessed here.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)