Navigating Nvidia: Talking With Clients About the Elephant in the Room

While Nvidia has become the shiniest object in the market, advisors may consider exploring diversification opportunities with clients.

It’s Nvidia’s NVDA world—the rest of us just live in it. That comment is made in jest, but its success is undeniable.

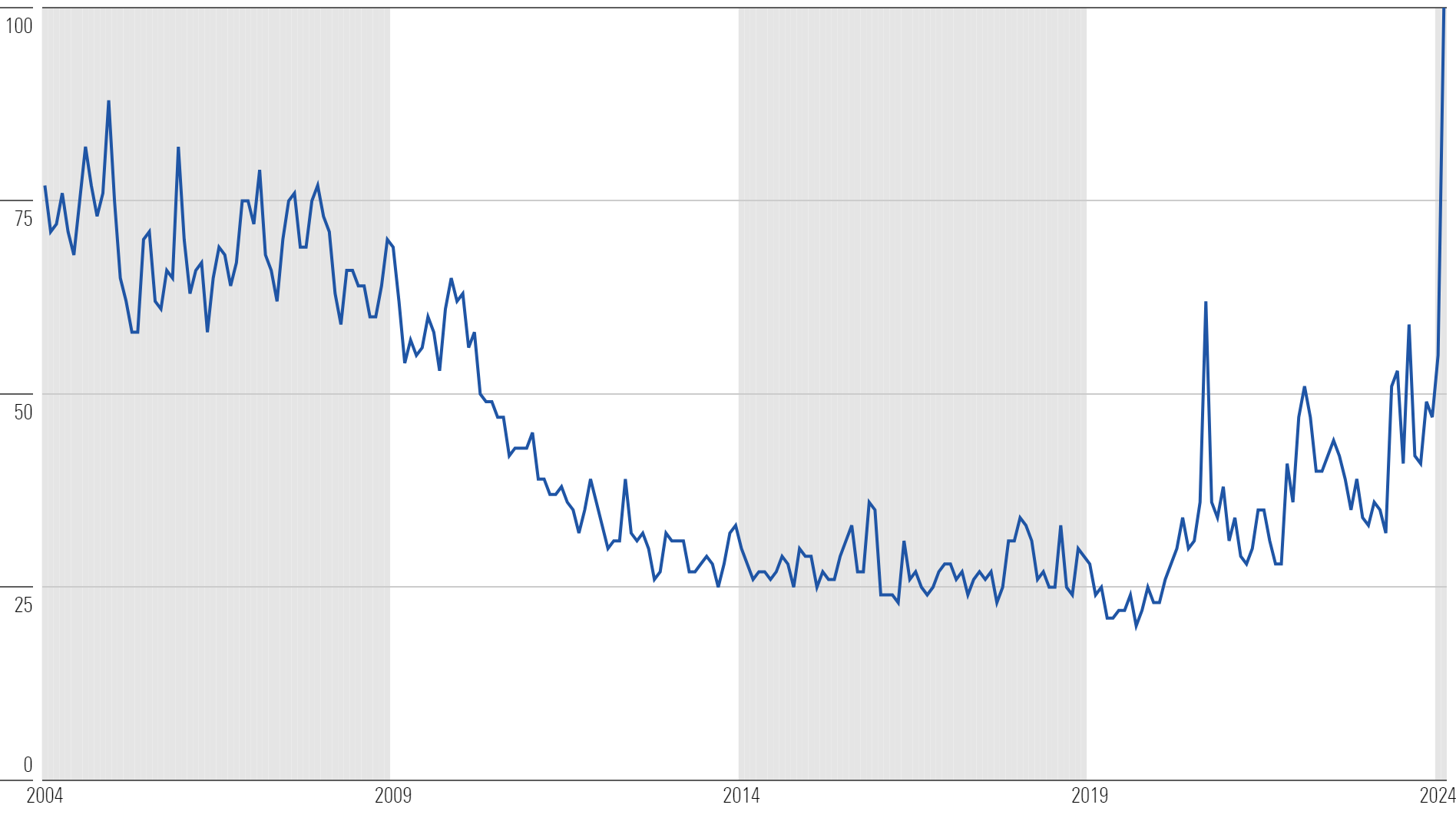

It’s captured the cultural zeitgeist—one visual that reflects how dominant it has become is a graph of Google searches.

Google Trends: Searches for "Nvidia"

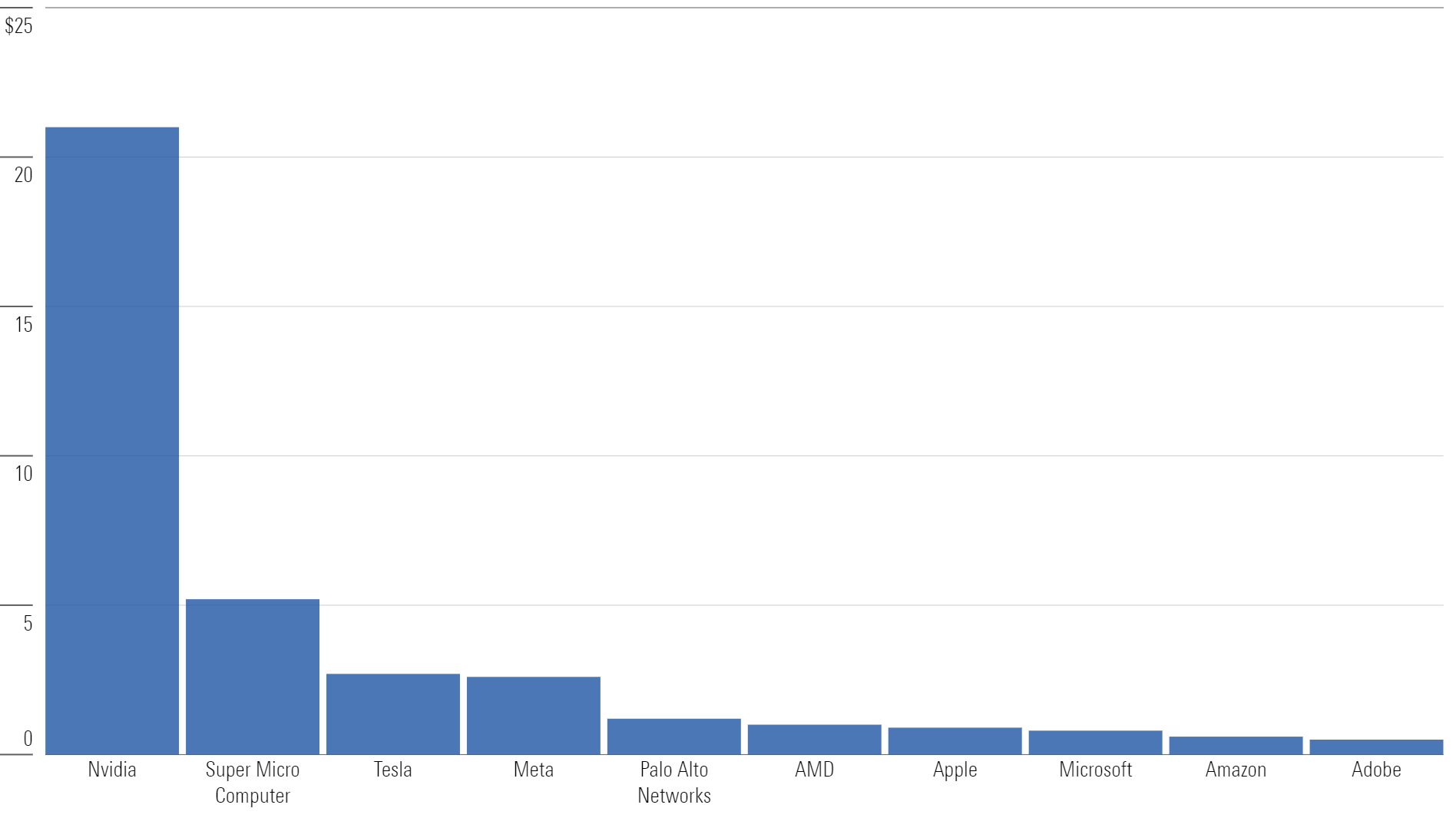

Obviously, stock performance is a major reason for that. And to its credit, that performance has been a function of strong business results. A few people sarcastically mentioned, “Nvidia carried the weight of the market on its shoulders,” prior to reporting earnings last month.

According to the market, it delivered. Another $277 billion was tacked onto its market cap, which was the largest single-day market-cap gain in history.

Market-Cap Addition on Earnings Announcement

The earnings SparkNotes read like this:

Nvidia Quarterly Results - Financial Summary

After the results, CEO Jensen Huang shared one interesting note with investors that speaks to the complexity it manages through:

“[One of our graphic processing units has] 35,000 parts. It weighs 70 pounds. These are really complicated things we’ve built. People call it an AI supercomputer for good reason.”

It’s a fascinating company, but the reality for most investors is that it’s not going to fall inside their circle of competence. It’s difficult to handicap. Technology moves fast, and a disrupter can become disrupted rather quickly.

Jeff Bezos often said his competitor’s margin was his opportunity. Well, Nvidia’s competitors—and customers!—feel the same way.

The Wall Street Journal ran this headline shortly after the earnings announcement.

“Nvidia’s Stunning Ascent Has Also Made It a Giant Target: In the AI-driven bonanza, even the chip maker’s own customers are looking to move on its business”

The competition is coming. And the overwhelming majority of the population will have no idea whether Nvidia can maintain or grow consistently from its current position.

Nvidia designs advanced semiconductors, or “the brain of computers, robots, and self-driving cars,” as its website states. The creation of these semiconductors requires expert lithography, etching, doping, and deposition to create intricate transistor structures at nanometer scales.

How many people truly understand what that means? Very few.

The good news? You don’t have to. Making every topic under the sun your business is an easy way to fall outside your circle of competence.

Signs of that happening are visible.

Options Premium Spent on Top Stocks - Week of Feb. 19

There’s also been a recent rise in products designed for the single purpose of trading Nvidia stock.

Investment Vehicles Designed for Trading Nvidia

Ultimately, Nvidia is a microcosm of a larger story, which is increasing concentration among a few very large companies.

Marta Norton, Morningstar Wealth’s chief investment officer, recently tackled this topic. As she wrote, “thirty-two cents of every dollar that goes into an S&P 500 index tracker heads to the top 10 companies.”

Put simply, the diversification inside the S&P 500 is decreasing. A prudent response for most investors would be to consider increasing diversification.

Why? For the simple reason that whenever the masses agree, it’s often a good idea to pause and think.

To borrow from George Patton’s principles, “If everybody is thinking alike, nobody is thinking.”

Considering what the masses agree on right now, it could be argued there’s deep consensus that:

- The US is the best global market to invest in.

- Growth stocks are better than value stocks.

- Technology is the best sector in the market.

You can’t really argue these ideas based on recent returns. But what happened recently is not indicative of what may happen in the future.

As Mark Twain is often credited, “It’s what you know for sure that just ain’t so.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)