All-Time Stock Market Highs Are Nothing to Fear

The question on many investors’ minds: Is there anywhere to go but down?

Boston Red Sox legend Ted Williams was famous for the described batting style of “waiting for the fat pitch.” This meant he only looked to swing when the pitch was in the zone where he had the highest probability of making great contact.

This statement is often applied to investing. As the theory goes, we should invest the same way—when the market is offering us the fat pitch.

Few would disagree. The logic is sound.

But there is a problem. Which is, it’s only obvious in hindsight when the market provides a fat pitch.

Stocks bottomed in October 2022, a time when many professional investors wanted nothing to do with stocks.

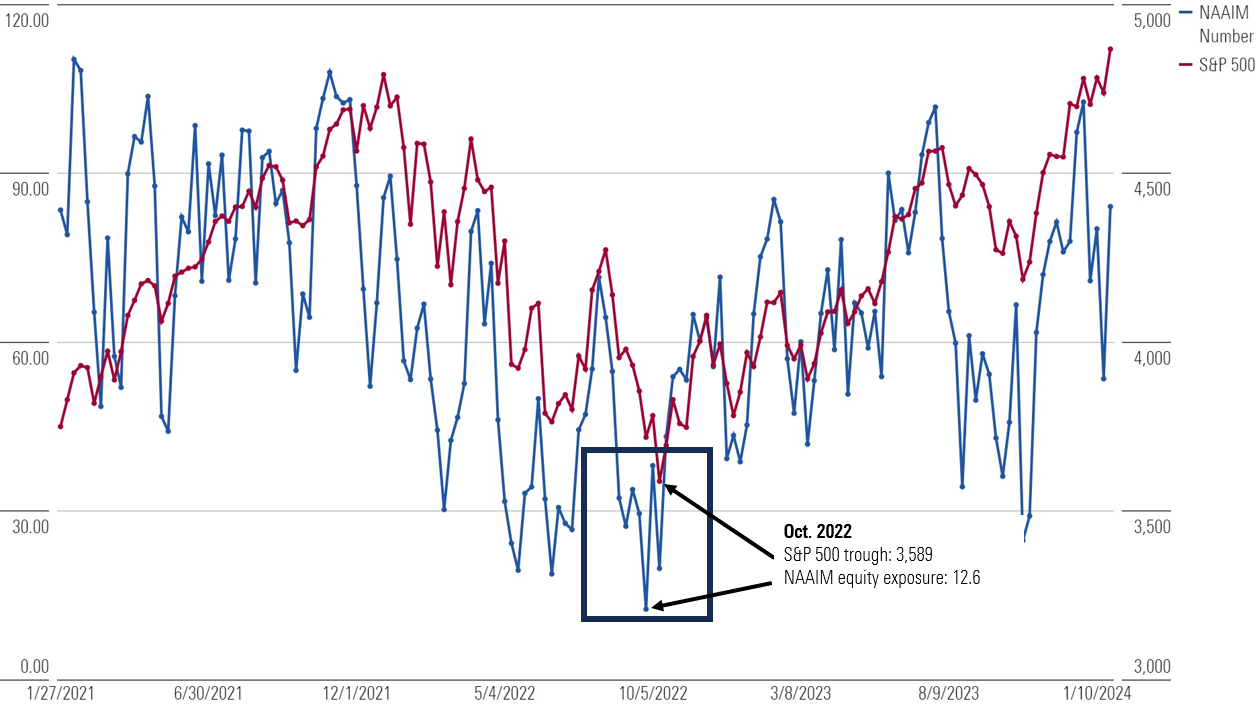

The National Association of Active Investment Managers, or NAAIM, Index represents the average exposure to U.S. stocks reported by active managers. When the S&P 500 bottomed in October 2022, active equity managers held their lowest allocation to stocks in roughly two years.

Active Equity Manager Exposure vs. S&P 500 Price Level

The reason is obvious: The news was horrible!

But that’s when stocks usually bottom. When the news is so terrible, Pepto-Bismol helps when opening account statements.

The good news is that turbulent periods eventually pass, and it seems like we’ve finally reached that point.

Welcome Back, All-Time Highs

Author Morgan Housel has a great quote about market declines. In his words: “All past declines look like an opportunity; all future declines look like a risk.”

The October 2022 market lows officially transitioned to opportunity last month, as the S&P 500 made its first new all-time high in over two years on Jan. 19.

S&P 500 Price Level

Two years was the longest streak without making a new all-time high since 2008.

Now, this is great news for those who were fully invested. But as any advisor knows, many clients are not fully invested after large market drawdowns.

And as markets fire back to new highs, many clients who missed the ride up will likely be skittish reentering the market. This is human nature.

But context matters, and while the S&P is up more than 37% since the October 2022 lows, it’s only up 3% over the past two years.

S&P 500 Price Level: January 2022 - January 2024

And the median stock in the index is actually negative during that time!

So, while some investors may convince themselves, “I missed it!”—there’s ample evidence that may not be the case.

Deeper analysis tells an even more interesting story. Specifically, all-time highs usually don’t happen for no reason. In fact, all-time highs generally tend to be a great indicator of more all-time highs.

For example, the last time the market made a new all-time high after a pronounced bear market was in March 2013, which was the first new all-time high since 2008. In the year that followed, we saw 52 new all-time highs.

S&P 500 Price Level

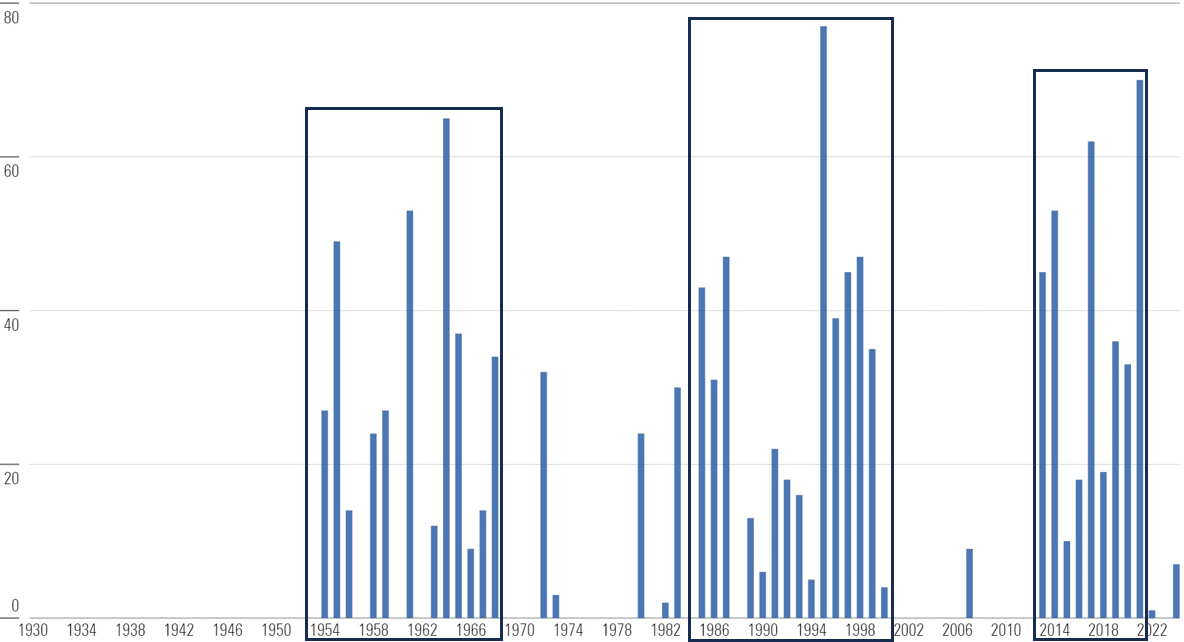

Expanding the dataset to 1929, you can see a larger pattern emerge, showing all-time highs tend to cluster.

S&P 500: New All-Time Highs by Year

It’s not abnormal for all-time highs to be persistent, lasting for many years. Persistence is true for other aspects of markets as well—for example, volatility. Periods of extreme volatility are often followed by more volatility.

Human nature is likely the easiest explanation for why markets cluster and trend. A herd mentality is a common observation across stocks, bonds, and other asset classes. As prices go up, investors buy more and vice versa. But as we reflect on all-time highs, we should keep in mind they are usually not a negative indicator. In fact, the opposite.

That doesn’t mean a correction won’t happen; it will at some point, of course. But if you’re a true long-term investor, you should feel confident that recent all-time highs won’t be the last ones you’ll see.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)