Dow 1 Million? A Possibility in Many Investors’ Lifetime

But it could be a long road to get there.

Warren Buffett gave an interview to Forbes in 2017 where he made a bold prediction.

The prediction? The Dow Jones Industrial Average would eclipse 1 million at some point over the next 100 years.

1 million???

At face value, it seemed ridiculous. The Dow was slightly above 22,000—near all-time highs—when Buffett made the remark.

But Buffett showed how the math might work, pointing out the Dow was at 81 a century prior. The climb from 81 to 22,000-plus was a nearly 280 times return. A potential rise from 22,000 to 1 million would only require a 45 times return.

The prediction captured the news cycle for a day or so but quickly faded as more immediate and pressing stories took the attention.

An Update to Buffett’s Prediction

Barron’s recently hosted its annual investing roundtable with a few prominent investors to discuss markets, trends, and general outlooks. The group was asked to make a prediction on what the market might return this calendar year.

Answers were what you might expect:

“Up 5%.” “Down 5%.” “Positive midsingle digits.”

Nothing that stopped you in your tracks. Then Mario Gabelli—CEO of Gabelli Asset Management—spoke:

“The Dow will be the equivalent of 1 million in 40 years, and it was under 1,000 40 years ago. So, invest long term.”

One million in 40 years???

Today, the Dow sits just shy of 39,000.

In Morgan Housel’s new book, Same as Ever, he makes an interesting point about how easy it is to discount the progress that is achievable. He uses the example: If someone were to say, “What are the odds the average person will be twice as rich 50 years from now?”—it sounds preposterous.

It feels far too ambitious.

But if that same person said, “What are the odds we can achieve 1.4% average annual growth for the next 50 years?”—it sounds extremely reasonable. Maybe even pessimistic.

But those two sentences, of course, are the same.

It’s an interesting reference point while sorting through Gabelli’s prediction.

The Dow would need to return 8.8% annually between now and 2064 to hit 1 million. If you look at capital market assumptions, an 8.8% annual return for U.S. stocks is well above any long-term forecast.

But if you look at the previous 40 years of U.S. stock returns, it’s slightly below what investors actually experienced. Over the past 40 years, U.S. large-cap stocks returned more than 10% annually, using Morningstar data.

In short, the Dow reaching 1 million in 40 years is in the realm of possibility, even if unlikely.

Einstein’s quote, “Compound interest is the eighth wonder of the world” comes to mind. Most of us are not very good at understanding the exponential function or, in simpler terms, rapid and continuous growth.

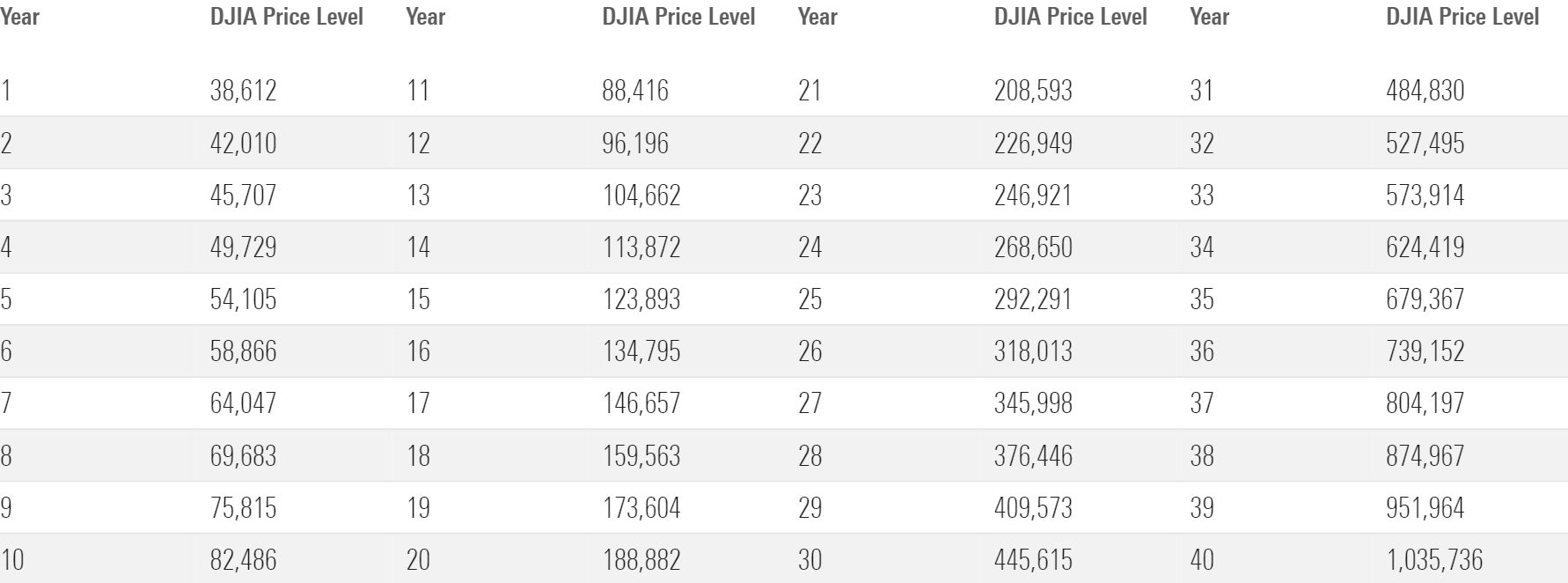

Specific to compounding, one fact that usually flies under the radar: Most of compounding’s magic doesn’t happen until the end. The early years of compounding have a “yawn factor” (translation: boring) associated with them. For example, the path to Dow 1 million—under Gabelli’s assumption—likely wouldn’t be what you expect.

If the Dow were to hit 1 million over the next 40 years, it would take 32 years before the Dow even reached 500,000. Then eight years later, it would eclipse 1 million.

Dow Jones Industrial Average Assuming 8.8% Annual Growth Rate

The simple takeaway? If you’re investing for decades, the biggest gains in absolute dollars happen during the last couple of years of the investing period.

As Einstein suggested, compounding is like magic. But it takes a while, which makes it easy to ignore.

For most advisors, the minutia of the day is where many conversations with clients reside.

“Can the ‘Magnificent Seven’ hold up?”

“Should I derisk as the market moves to new all-time highs?”

“Will the election bring volatility?”

Each question could be debated for hours. The easiest response would be “the future is uncertain—always ready to deliver bumps and bruises”—but of course, that’s not intellectually satisfying.

So, as these items are debated, we should try to keep in mind there is always slow and subtle progress taking place that isn’t visible. And pay heed to the fact that a lot more might be achievable than we often realize.

This article is a condensed version of an article from Morningstar Wealth. The longer article can be accessed here.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)