These Bad Habits Hold Investors Back From Peak Performance

Investors will be better served focusing on what they can control.

The Wall Street Journal columnist Jason Zweig wrote in recent years:

“Investors are always searching for good ideas, when what they need are good habits.”

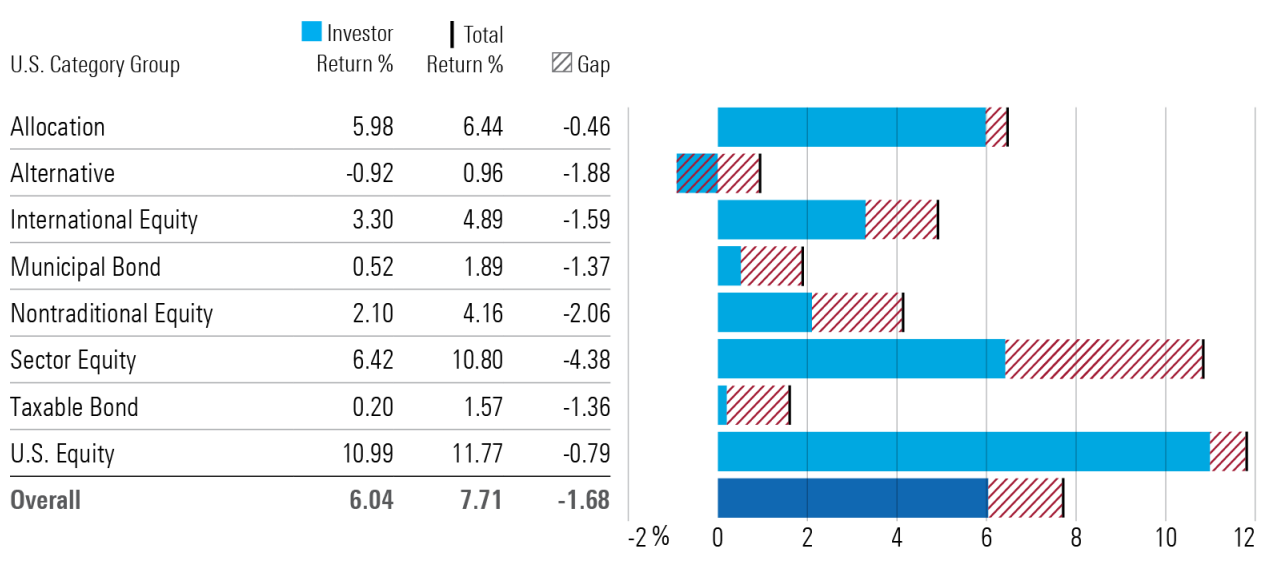

Morningstar conducts an annual study—Mind the Gap—that shows most investors underperform the funds they invest in.

The Gap by US Category Group (10-Year Returns)

Why do they underperform? Bad habits, mostly driven by poorly timed purchases and sales of fund shares. Put simply, most investors tend to buy the most at the top and sell the most at the bottom.

Peter Lynch—the former manager of Fidelity Magellan FMAGX—returned 29% annually in the decade he managed the fund. This was one of the greatest track records of all time, but by Lynch’s calculations, the average investor in his fund only returned 7%.

The shortfall comes from human behavior, which is why it’s referred to as the behavior gap. This is not a concept many are familiar with, but it’s an area where financial advisors add tremendous value, specifically in their efforts to shrink the gap.

In a new book, Money, Simplified, Peter Mallouk—CEO of Creative Planning—details one topic where investors often hurt themselves: excess activity.

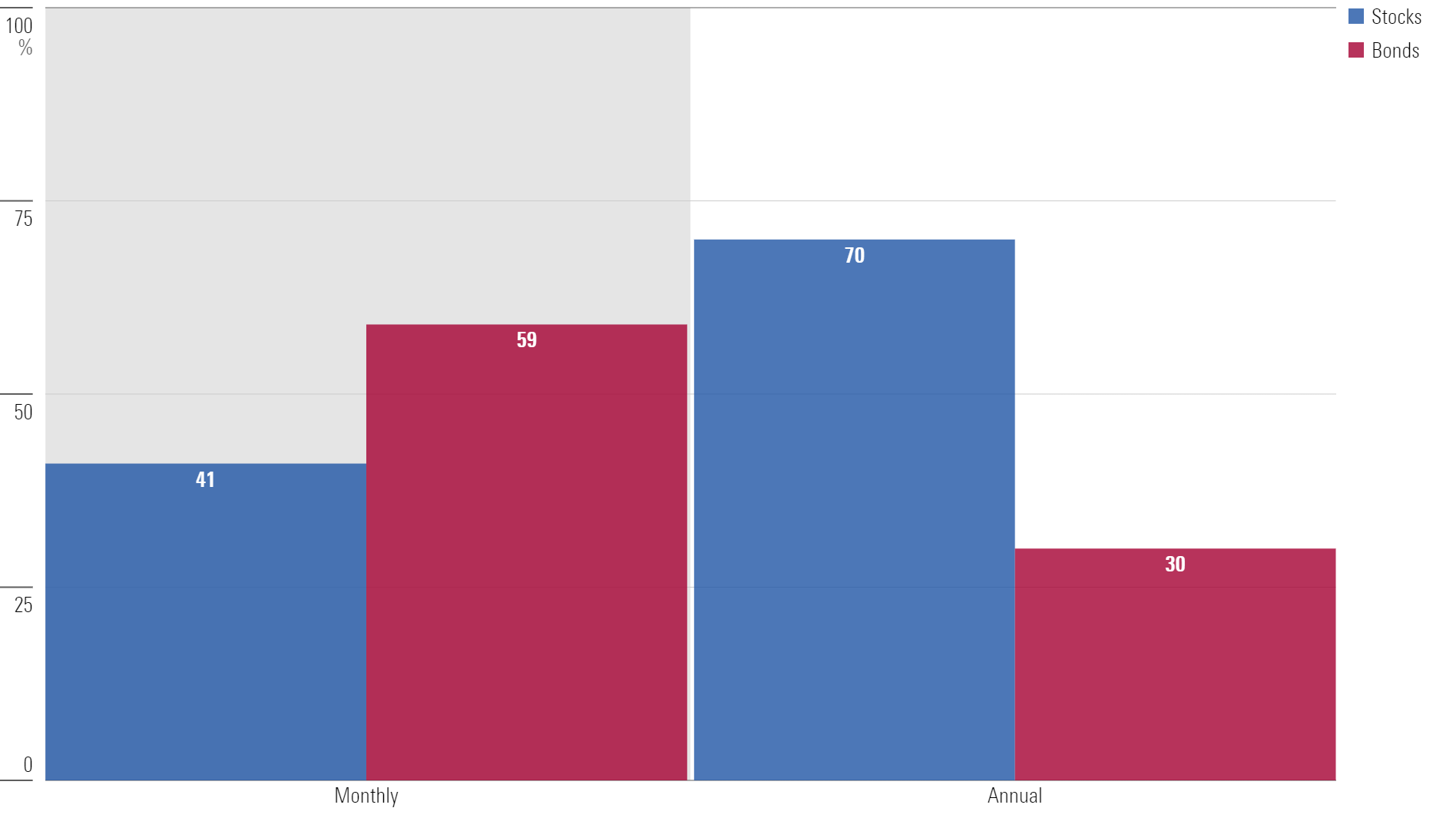

Mallouk cites a study that shows investors who look at investment statements monthly have an allocation of about 41% stocks and the rest in bonds. Conversely, investors who look at statements once per year have about 70% stocks and 30% bonds.

Impact of Feedback Frequency on Investment Allocation

Investors who look at their statements monthly are generally more defensive—making changes more frequently, and those changes are often detrimental to performance.

Good news? More stocks.

Bad news? Fewer stocks.

Mallouk further added that these groups generally resemble investors who have similar financial goals and risk profiles.

Now, why are these studies relevant? Well, a few behavioral traps are potentially being set in front of us.

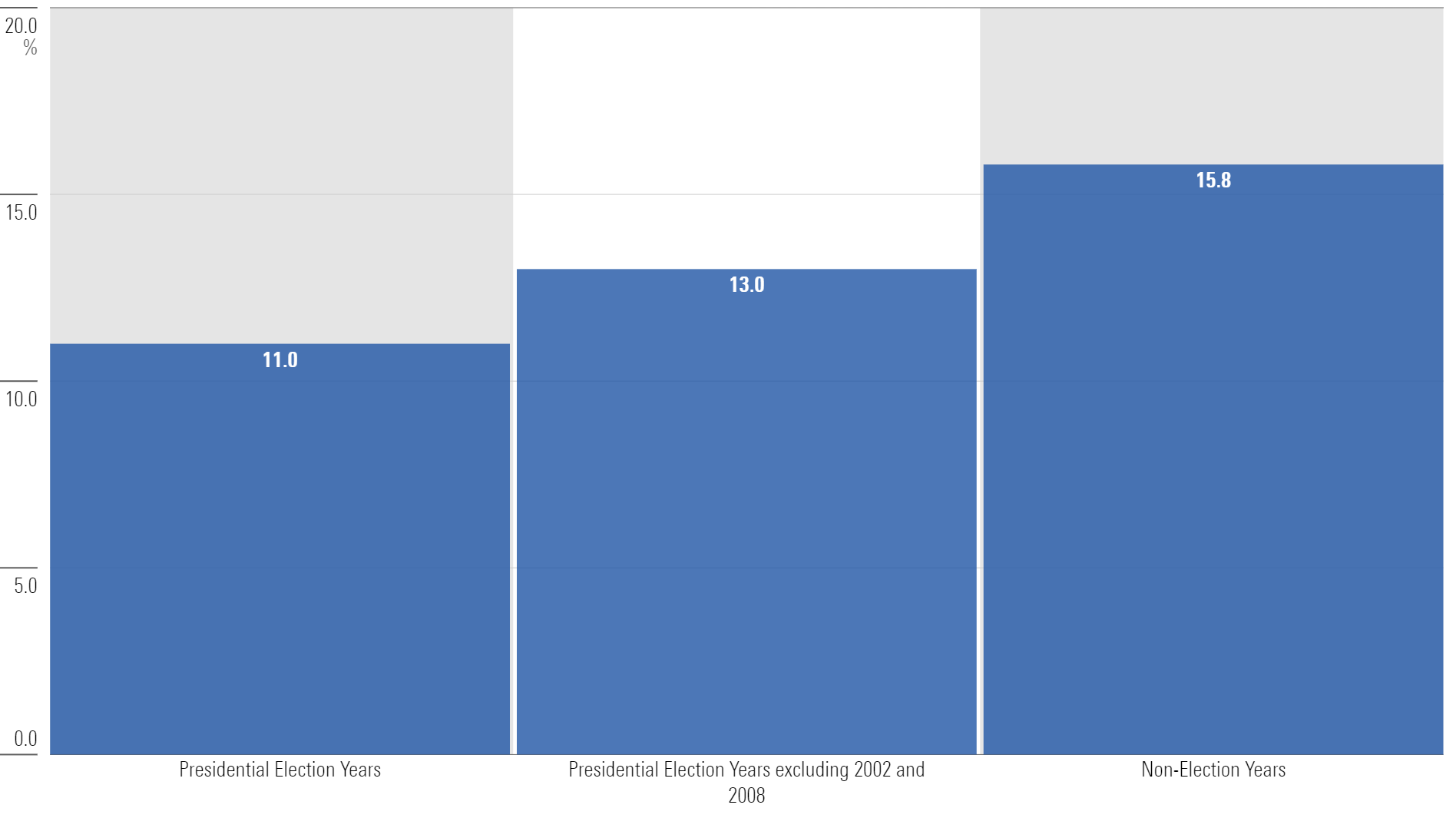

One comes in the form of an election year. Politics often brings negativity, and that will likely be true again this year. It’s not uncommon for investors to let political turbulence inform investment decisions. But it’s better to treat the two like oil and water—they don’t mix!

For example, since 1933, we’ve had 15 presidents (seven Republicans and eight Democrats), and the path of least resistance for stocks has been higher. While there is some difference between election and nonelection years, the key point is that both periods show positive average returns. Excluding 2002 and 2008, which had little to do with elections, the return difference shrinks even further.

Stocks in Election Years - Since 1933

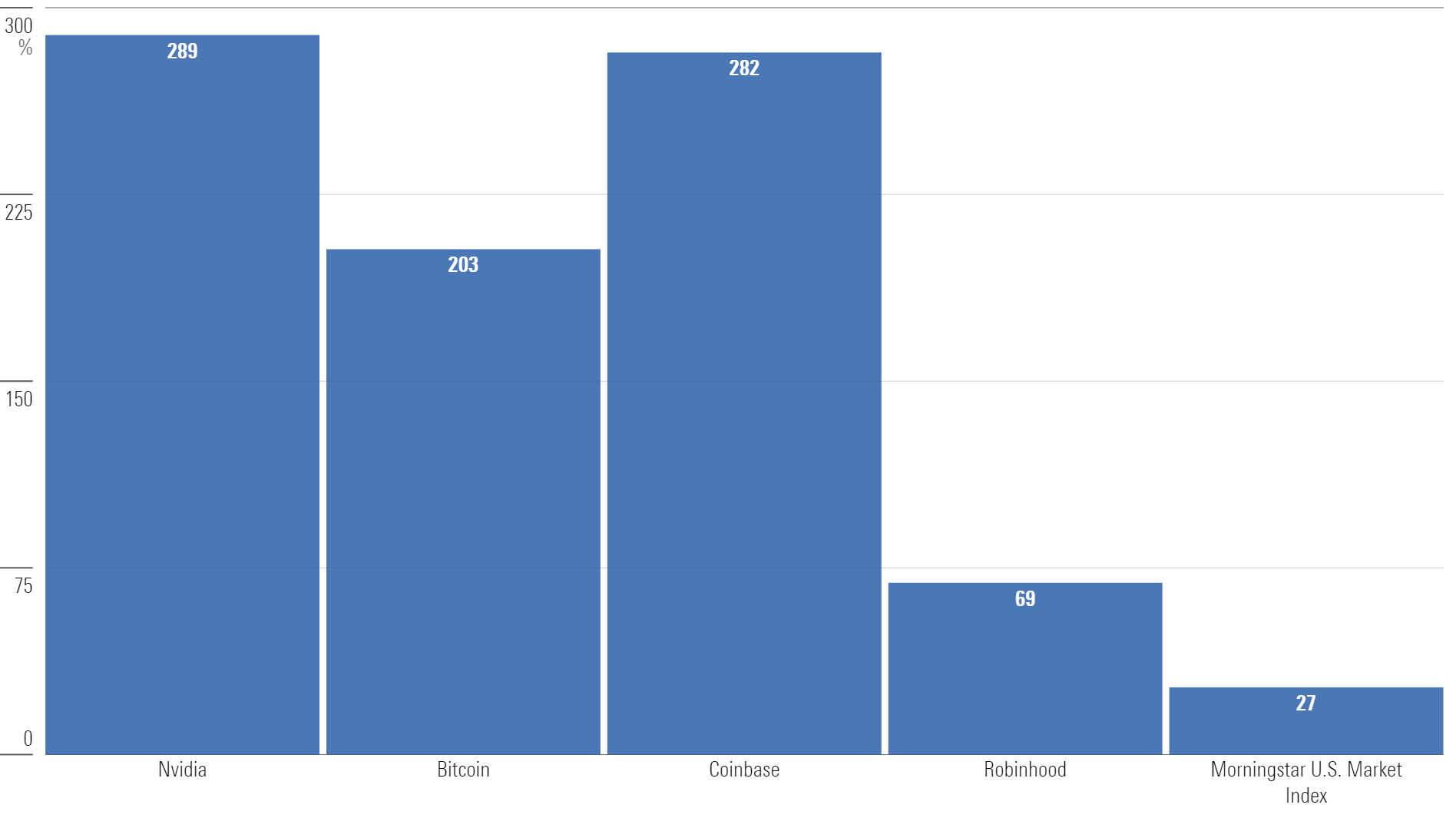

Another trap may be the fear of missing out, or FOMO, in high-performing areas of the market, particularly technology stocks.

Trends observed in 2020 appear to be resurfacing.

Technology stocks adjacent to the artificial intelligence wave are soaring. Nvidia NVDA is an obvious example. Another one, Super Micro Computer SMCI (yes, that’s a real name), is already up nearly 300% this year. Bitcoin is back near all-time highs, and the broader crypto ecosystem is climbing as well, which appears to be reflected in Coinbase COIN stock. There’s also been a resurgence at Robinhood HOOD.

Trailing One-Year Performance

In short, speculative fervor is making a comeback, and it’s natural to feel like you might be missing the party.

Trying to manage the emotions associated with rising prices is a difficult task.

One simple idea to keep in mind: When the score gets added up many years from now, you will find getting to the right long-term investing destination will be driven more by good habits than by trying to react to big news items.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)