How the Most Widely Held Bond Funds Did in the Second Quarter

Rising rates, growing credit concerns leave investors with widespread losses.

Investors in the most widely held bond funds saw across-the-board losses in the second quarter, as stubbornly high inflation and rising interest rates took their toll on returns.

By the end of the quarter, worries about the strength of the economy began to hurt more credit-sensitive strategies as fears of recession raised concerns about the possibility of higher rates of default on corporate debt.

But the driving force between bond market returns was inflation holding at higher-than-expected levels heading into midyear. With the Consumer Price Index posting its largest increases in more than four decades, the Federal Reserve shifted its interest-rate increases into overdrive. That led to June’s three fourths of a percentage point hike in the federal-funds rate, the first tightening of that size since 1994.

For bond investors, that meant a second consecutive quarter of losses across the vast majority of funds, including those most widely held by investors. And at midyear, bond fund investors are facing some of the worst losses in the market's history.

The largest bond strategy, Vanguard Total Bond Market Index VBMFX, which holds $317 billion, lost 4.74% in the quarter. The fund, which owns investment-grade, fixed-rate, and taxable U.S. bonds, was down 10.4% through the end of June. Before this year, the worst calendar loss for the 35-year-old fund was 2.7%, chalked up in the bond bear market of 1994.

During the quarter, funds that invest in bonds globally also posted sharp declines as central banks raised rates. The Vanguard Total International Bond Index fund VTIFX dropped 5.15%.

However, it was funds with higher levels of credit risk that fell even further. The iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, with $31.4 billion in assets, slid 8.6% in the second quarter.

Funds with a focus on shorter-term bonds, which are less sensitive to changes in interest rates, held up better. The Vanguard Short-Term Bond Index VBISX was down 1.2% in the second quarter.

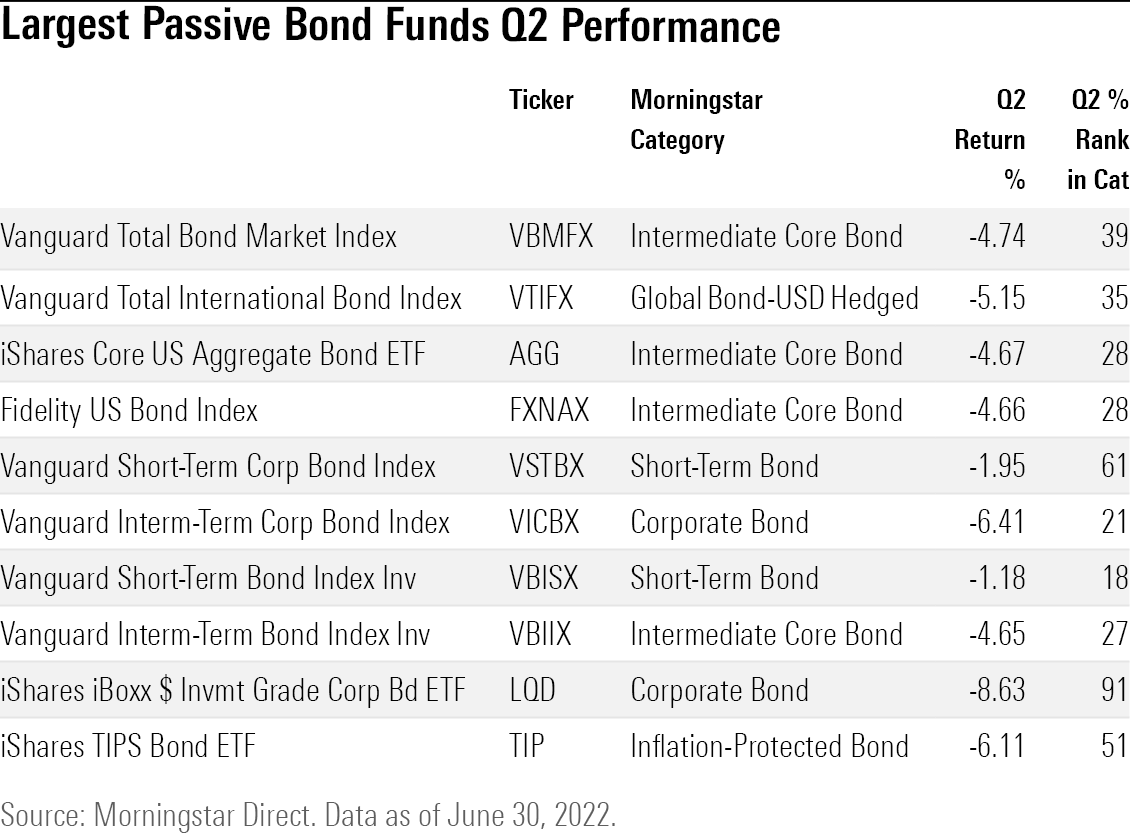

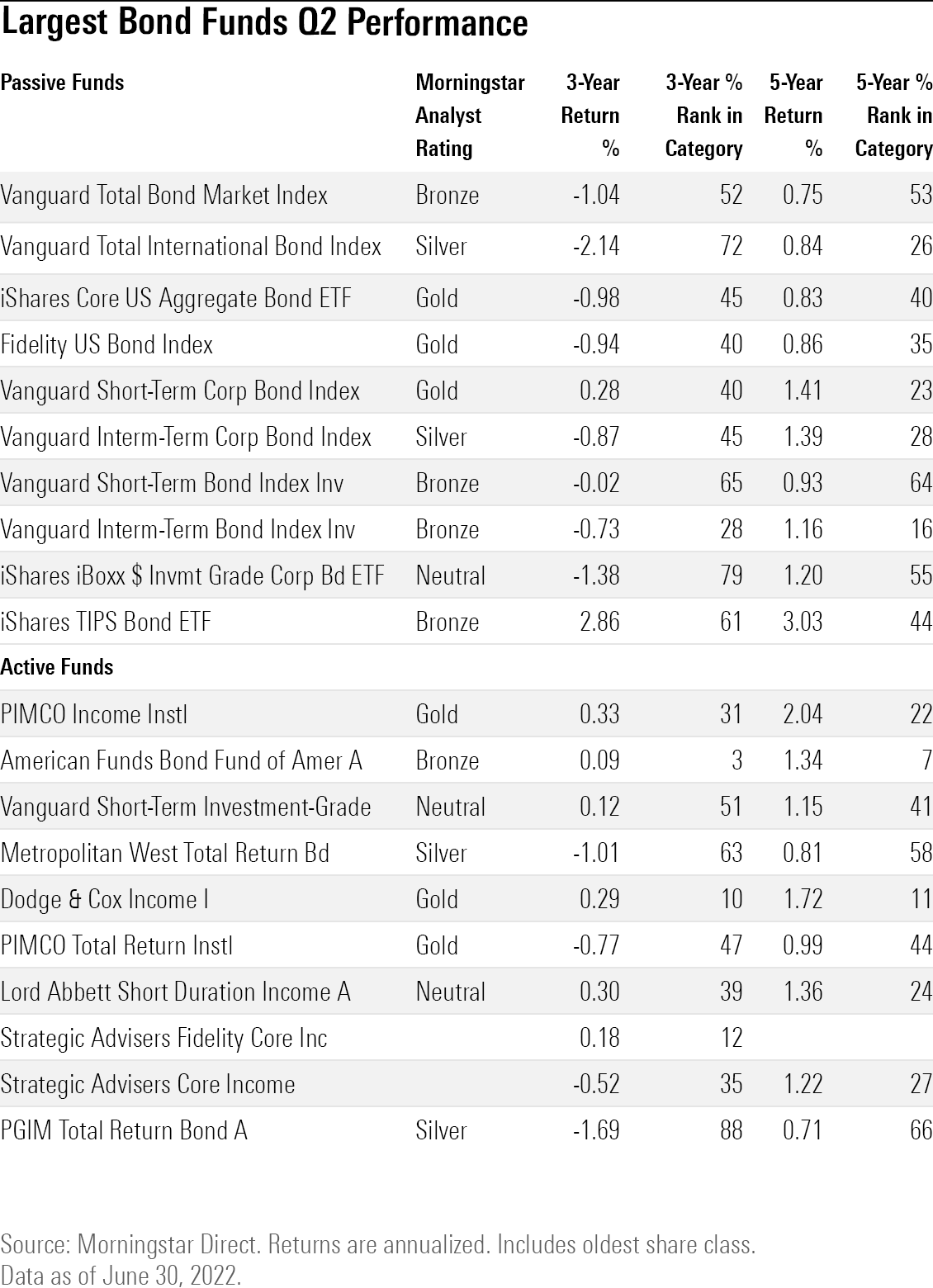

Here’s a look at results for the 10 largest passively managed U.S. bond funds, and the 10 largest actively managed U.S. bond funds, according to Morningstar Direct. A table with long-term results for all 20 funds can be found at the end of this article.

Largest Passively Managed Bond Funds Second-Quarter Performance

Tracking the overall declines in bond prices during the second quarter was the iShares Core U.S. Aggregate Bond ETF AGG, which lost 4.7%. The Gold-rated exchange-traded fund mirrors the widely followed Bloomberg U.S. Aggregate Bond Index, which includes taxable, investment-grade U.S.-dollar-denominated bonds.

"The fund's category-relative performance will largely hinge on the performance of credit-risky bonds," writes Bryan Armor, Morningstar's director of passive strategies research, North America. "It should hold up well during periods when credit markets are stressed, but it will lag when they rally. As it takes little credit risk, the primary driver of the fund's absolute performance will be interest-rate risk."

Among the largest index-tracking bond funds, Vanguard Short-Term Bond Index VBISX posted the best returns compared with its category peers. The fund's conservative approach "is much less sensitive to credit risk relative to the category average," the latest report on the fund notes.

The worst performer at the category level was iShares iBoxx $ Investment Grade Corporate Bond ETF, with its 8.6% decline. Through the end of June, the fund was down 16.1% in 2022. The fund tracks the Markit iBoxx USD Liquid Investment Grade Index, which includes U.S. investment-grade corporate bonds with at least three years until maturity. "The fund's omission of bonds with less than three years until maturity creates greater exposure to interest-rate risk than most of its category peers," the fund's latest analyst report says.

Even inflation-protected bond funds were unable to avoid the downdraft in the bond market. While funds that own U.S. Treasury Inflation-Protected Securities offer a hedge against rising inflation, they aren't immune from the negative effect of rising rates. Relative to its category peers, the iShares TIPS Bond ETF carries more interest rate sensitivity. As of the end of June, the fund's 9% loss landed it in the 62nd percentile of the inflation-protected bond category.

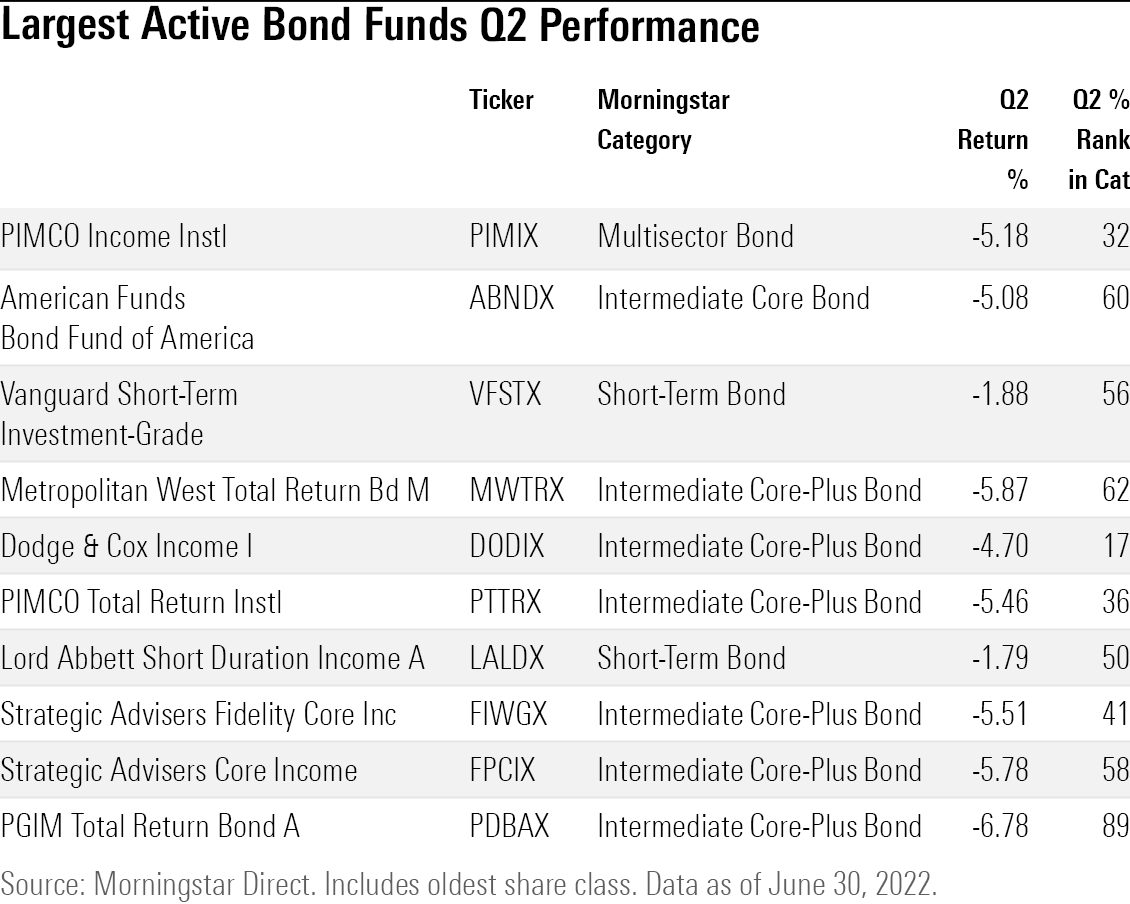

Largest Actively Managed Bond Funds Second-Quarter Performance

Among actively managed bond funds, Lord Abbett Short Duration Income LALDX held up best. The fund lost 1.8%, which put it in the 50th percentile of the short-term bond category.

Vanguard Short-term Investment-Grade VFSTX was down 1.9%. Morningstar associate director Elizabeth Foos writes that the fund has "a well-structured process and benefits from ultralow fees, making it a sensible candidate for short-term bond exposure."

Dodge & Cox Income DODIX performed the best among the largest intermediate core-plus bond funds. It lost 4.7% during the in quarter, compared with the average loss of 5.7% in the category. Senior analyst Sam Kulahan says the fund outperformed mainly due to its short duration, meaning that it has less sensitivity to changes in interest rates.

“As of March 2022, its duration was 1.3 years shorter than the core-plus category median,'' Kulahan says. “In March 2022, it also held healthy allocations to agency mortgages, asset-backed securities, and shorter-term Treasuries, all of which outperformed over the quarter relative to investment-grade and high-yield corporates and longer duration fare.”

PGIM Total Return Bond PDBAX fared the worst of the largest bond funds when compared with its category. It was down 6.8%, putting in the 89th percentile in the intermediate core-plus bond category. In March, Morningstar strategist Eric Jacobson wrote that the "offering has felt the heat of late, but it's been a cool customer over the long haul." The fund's "higher-than-average volatility isn't unexpected and is kept in check by a strong risk management framework."

In the multisector bond category, Pimco Income PIMIX held up well. The fund declined 5.2%, putting it in the 32nd percentile. Jacobson notes that the fund "endured some pain in early 2022, having carried a 2%-3% combination of bond and currency exposures to Russia going into the year."

“Still, the strategy fared better than many multisector bond Morningstar Category peers in the face of rising global bond yields by entering the year with a 1.15-year duration, much of it coming from a 5.5% exposure to inflation-indexed bonds,” he writes.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)