Where to Find Low-Cost ESG Funds

Investing in sustainable funds doesn't have to cost more than traditional funds, thanks to a raft of newer funds with lower costs.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

A growing body of research has debunked the idea that investors give up returns with sustainable investing strategies. The recent performance of environmental, social, and governance mutual funds in the coronavirus-driven market turmoil has provided more evidence that these funds can offer more cushion to portfolios in market downturns that many traditional funds.

But what about fees? Are mutual fund investors paying a premium for helping to do good in the world?

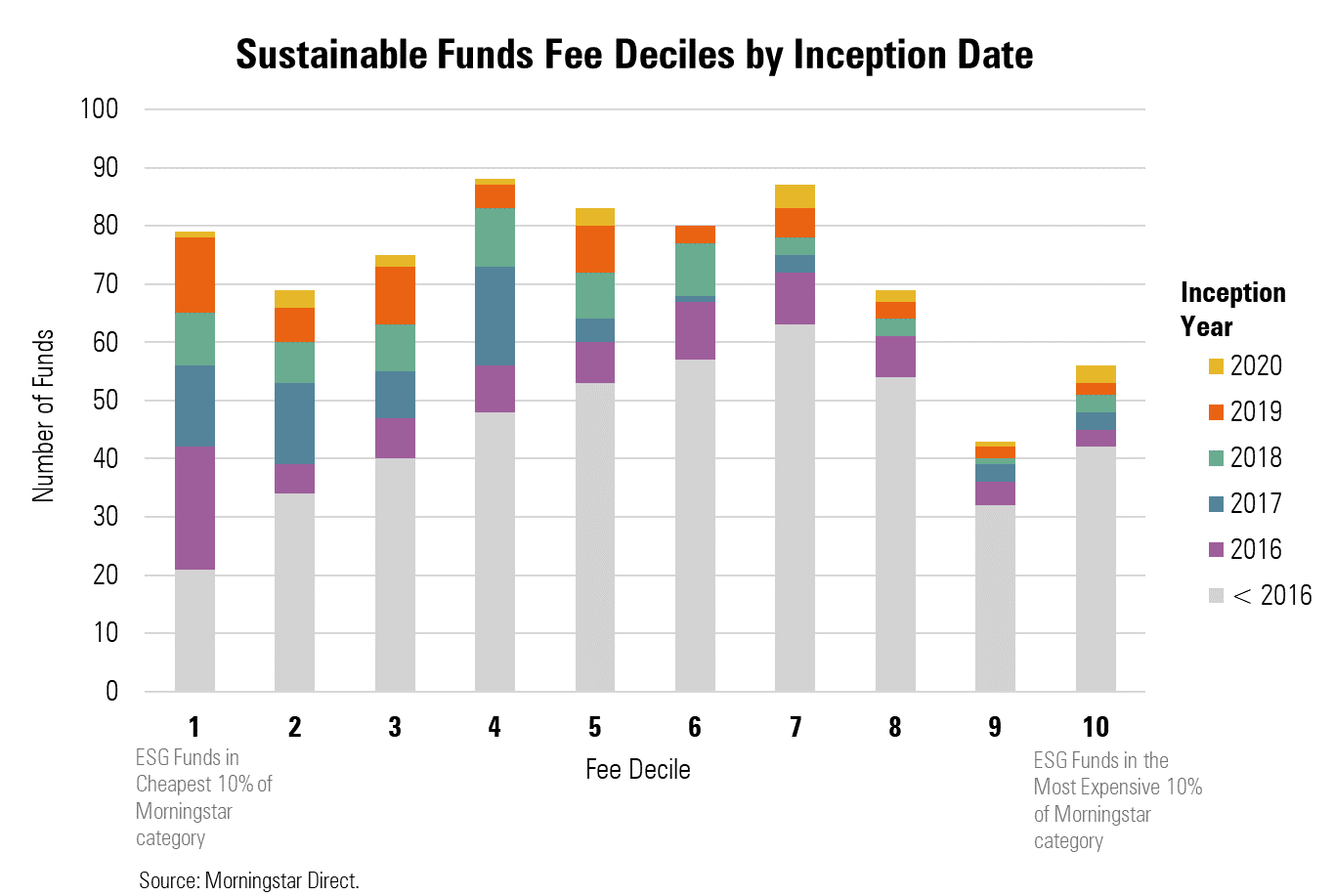

It turns out there is good news for sustainable-fund investors. The number of ESG mutual fund options has grown by leaps and bounds in recent years. And among those that have opened to investors in the last five years, more are likely to land among the cheapest 10% of their Morningstar Category than those launched before 2015.

Of the 30 ESG funds launched in 2019 alone, 23% of the share classes ranked in the cheapest 10% in their Morningstar Category. And it’s not just ESG index funds that are coming in with lower price tags; more lower-cost actively managed ESG strategies are now available.

Where Are ESG Funds the Cheapest? We recently took a close look at fees on ESG strategies to see where they land in the spectrum of fees among all funds. (Morningstar Direct? and Morningstar Office? clients can find the full report here.) There are still relatively few funds that have ESG strategies as their primary mandate--only 311 make the cut using the methodology from Jon Hale, Morningstar's head of sustainability research.

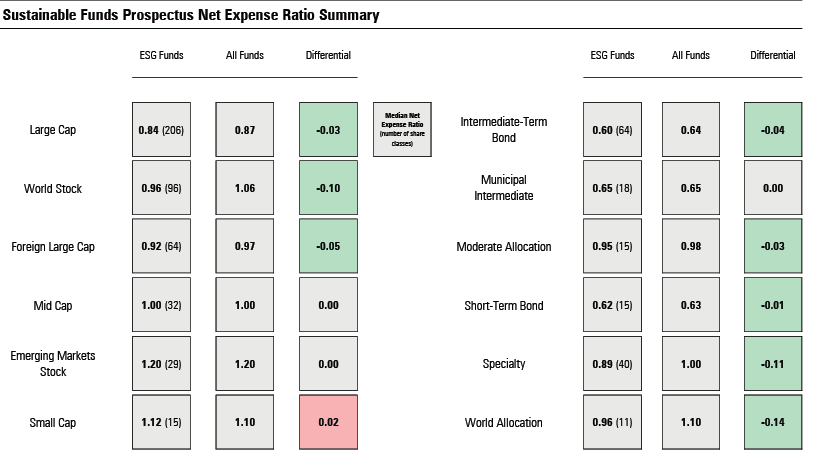

When these funds are categorized by broad strategy groups as shown in the following image, we found that median ESG fund-expense ratios are lower or match broad fund medias in 11 out of the 12 fee groups. The biggest overall fee advantage for ESG funds came among world-stock funds, intermediate-term bond funds, and foreign large-cap funds. Only small-cap ESG funds posted higher median fees.

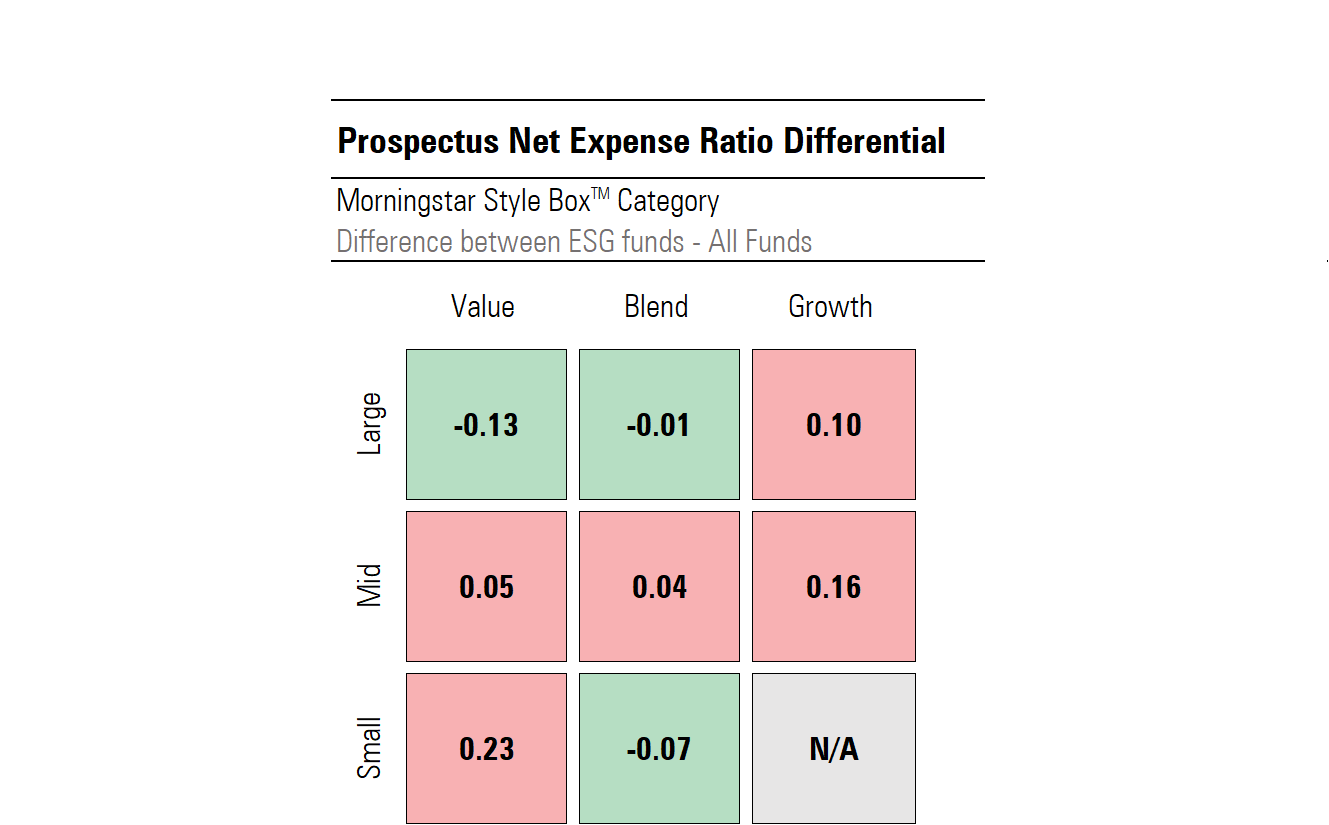

The large-blend and large-growth categories are home to the most ESG funds and here it is more of a mixed picture. Overall, large-blend ESG funds are just a touch cheaper than the category average, but large-growth ESG funds show a significantly higher median cost.

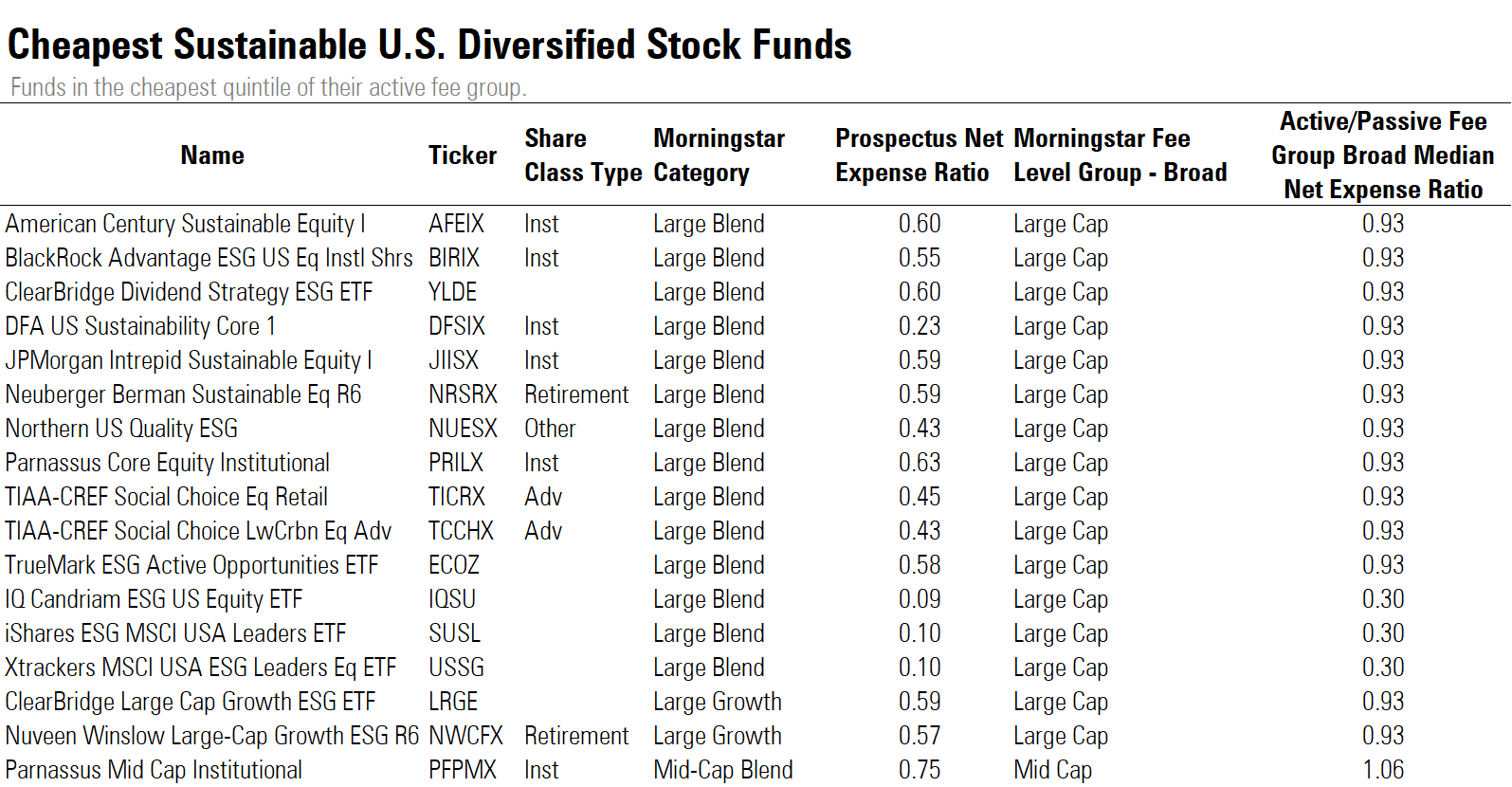

A number of large-blend funds fall among the cheapest 20% of all funds in the category.

The largest sustainable fund in the large-blend category at $17.7 billion is Parnassus Core Equity Investor PRBLX--with a Morningstar Analyst Rating of Silver--which has a net expense ratio of 0.86%, 4 basis points below the active large-blend median of 0.90%.

Vanguard FTSE Social Index VFTNX--also with an Analyst Rating of Silver--is the largest passive large-blend fund with $7.6 billion under management. And with an expense ratio of 0.12%, its expenses are well below the median passive large-blend net expense ratio of 0.20%. Morningstar analyst Alex Bryan writes that the fund takes an exclusion approach, filtering out firms with business tied to fossil fuels, tobacco, alcohol, nuclear power, adult entertainment, and gambling.

IShares ESG MSCI USA Leaders ETF SUSL and Xtrackers MSCI USA ESG Leaders Equity ETF USSG --with Analyst Ratings of Silver and Bronze ratings, respectively--are among the cheapest ESG large blend funds. Both have expense ratios of 0.10%. IQ Canadian ESG US Equity ETF IQSU has an expense ratio of 0.09% and is the cheapest ESG fund not just in the large blend category but of all ESG funds.

Morningstar analyst Alex Bryan writes that in addition to low expenses on USSG, the fund has consistently beaten its benchmark: “ From its inception in March 2019 through April 2020, the fund beat the Russell 1000 Index by 1.76 percentage points annually, with slightly lower volatility.”

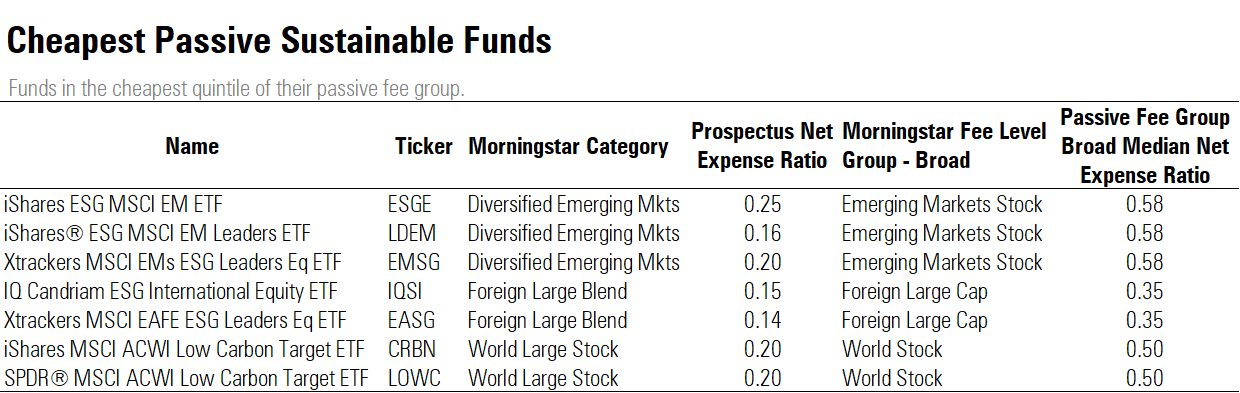

Among non-U.S. stock funds, emerging markets and world stock are two categories where passive funds have below-median expenses.

IShares ESG MSCI EM Leaders ETF LDEM and Xtrackers MSCI EMs ESG Leaders Equity ETF EMSG both track ESG-focused indexes and have expenses of 0.16% and 0.20%, respectively--well below the median net expense ratio of all passive emerging-markets stock funds of 0.50%.

Similarly, iShares MSCI ACWI Low Carbon Target ETF CRBN and SPDR MSCI ACWI Low Carbon Target ETF LOWC both track the MSCI ACWI Low Carbon Target Index and also fall into the cheapest 20% of all world large-stock funds.

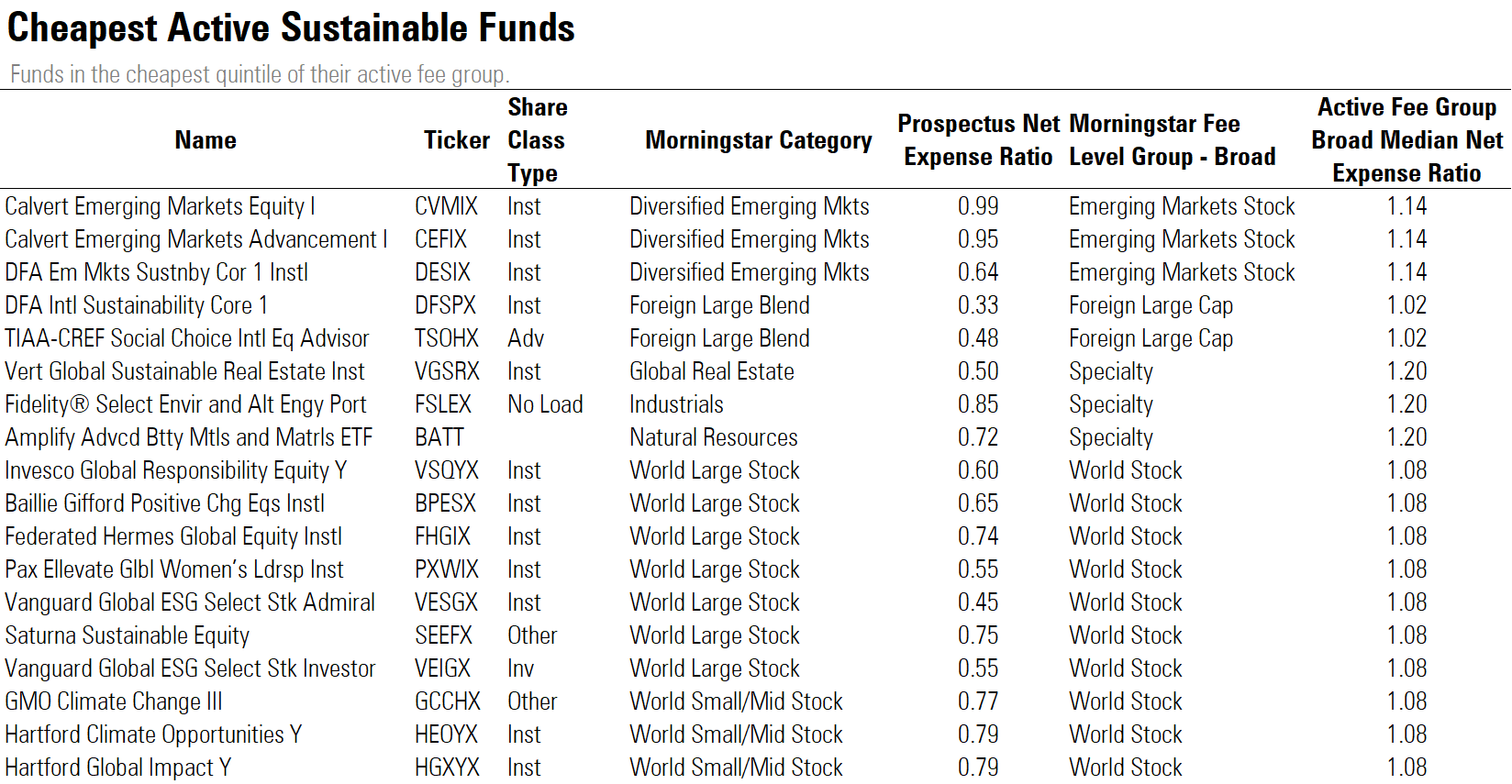

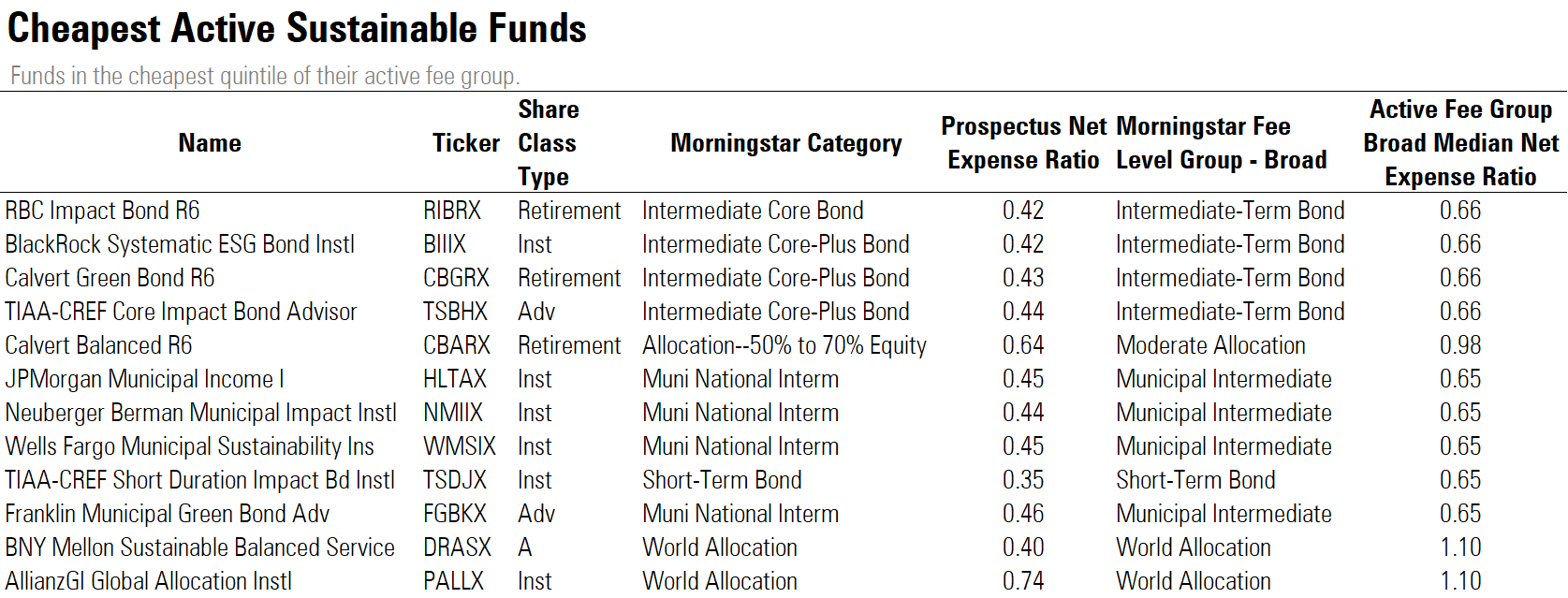

Seventy percent of sustainable funds are actively managed, compared with 60% of all funds in the U.S. market and many lower-cost options.

The world-stock fee group has the largest number of sustainable funds that fall in the cheapest quintile of the broad category.

Some of the cheapest world-stock funds include Invesco Global Responsibility Equity VSQYX and Vanguard Global ESG Select Stock VEIGX. Invesco Global Responsibility Equity has an expense ratio of 0.60%, and Vanguard Global ESG Select Stock has expenses of 0.55%, both below the active world-stock median net expense ratio of 1.08%.

Sustainable active specialty funds are also much cheaper compared with the broad universe. Specialty funds, also known as sector funds, include strategies focused on clean energy or global water stocks, such as Eventide Healthcare & Life Sciences ETAHX and AllianzGI Water Class AWTAX. Eventide Healthcare & Life Sciences has an Analyst Rating of Bronze and AllianzGI Water Class has a Silver rating.

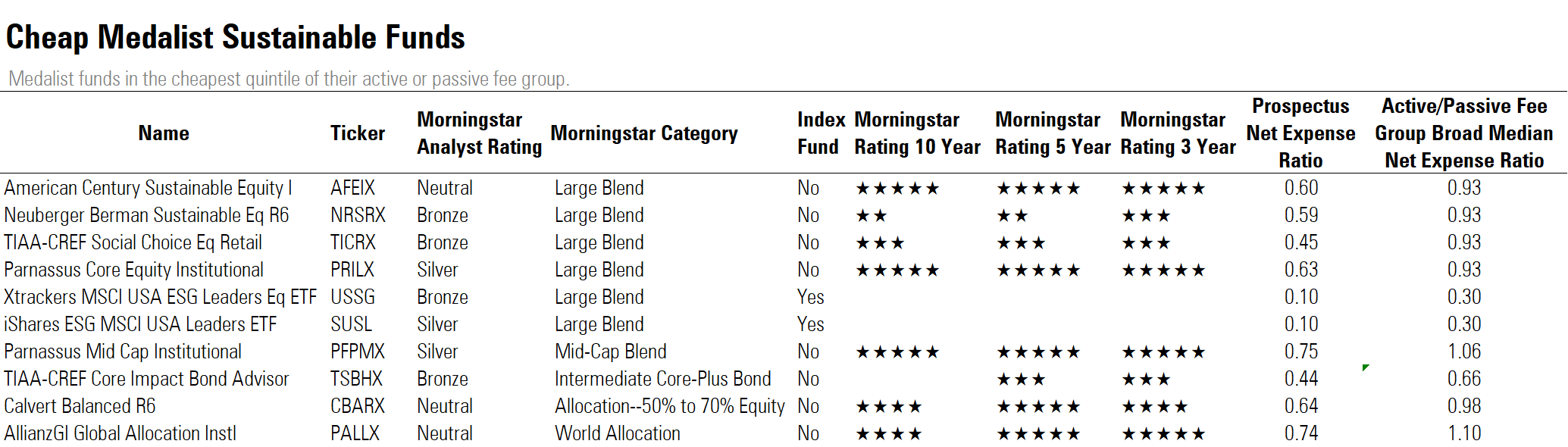

Medalist ESG Funds Among Morningstar Medalist funds, 10 ESG funds fall into the cheapest quintile of their fee group. Both Parnassus Core Equity and Parnassus Mid Cap have a Silver rating and have had a 5-star rating for their past three-, five-, and 10-year returns. Parnassus Core Equity's 10-year return of 12.9% and Parnassus Mid Cap's 10-year gain of 11.6% puts the funds in the top 20% of their Morningstar Category and the cheapest 20% of their fee group.

In terms of passive strategies, iShares ESG MSCI USA Leaders maintains an Analyst Rating of Bronze. Morningstar analyst Alex Bryan points out that “the fund delivers on its ESG mandate but keeps many advantages of traditional index funds--including a low fee and low turnover.”

Vanguard offers multiple ESG funds, but none rank in the cheapest 20% of their category. Vanguard ESG US Stock ETF ESGV and Vanguard FTSE Social Index VFTNX both have Silver ratings and both have expenses of 0.12%, just above the 0.11% cutoff. It’s the same story for Bronze-rated Fidelity U.S. Sustainability Index FITLX, which carries an 0.11% expense ratio.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)