Second Quarter in U.S.-Stock Funds: The Winners and Losers

The Brexit made waves.

After a volatile first quarter, U.S. stocks steadily rose for most of 2016's second quarter until Friday, when stocks were hammered across the globe after Britain unexpectedly voted to leave the European Union. This knocked the S&P 500 into negative territory for the quarter to date through June 24, though the Russell 2000 Index is still up 1.5%. The Federal Reserve shelved plans to raise short-term interest rates at its mid-June meeting amid the Brexit vote and the May jobs report that indicated U.S. employers added just 38,000 jobs--the worst month since 2010.

Brent crude prices temporarily climbed above $50 per barrel for the first time since November 2015, and prices are currently up 22% for the quarter to date. As a result, the equity energy Morningstar Category posted a gain of 9.4%. Waddell & Reed Energy WEGAX has outperformed 88% of its equity energy peers this quarter thanks to its large holdings in

The hunt for yield in this persistently low interest-rate environment led the dividend-heavy utilities and real estate categories to post gains of 2.9% and 1.3% this quarter, respectively. Hennessy Gas Utility GASFX has outperformed 99% of its utilities peers this quarter--Northwest Natural Gas NWN and Southwest Gas SWX were both up more than 10%. Fidelity Real Estate Income FRIFX outperformed 96% of its real estate peers this quarter thanks to large holdings in Senior Housing Properties Trust SNH and Lexington Realty Trust LXP.

The consumer cyclical category was the worst-performing sector category this quarter, dropping 4.0%. Several specialty retail stores such as

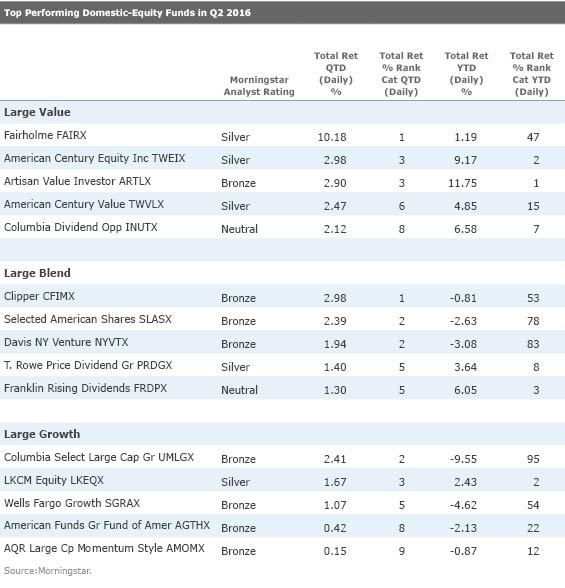

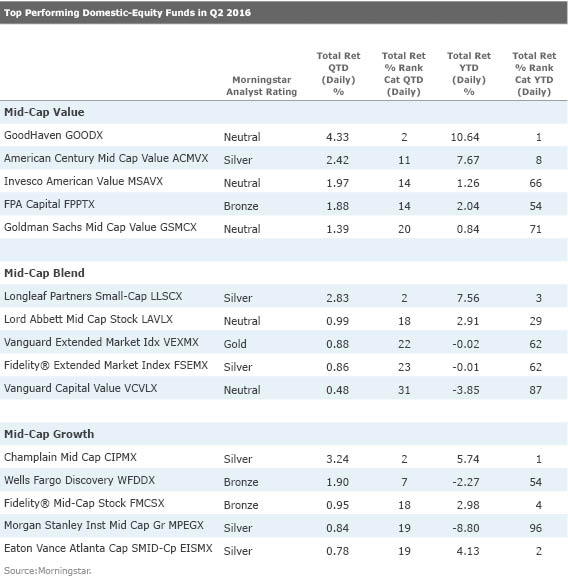

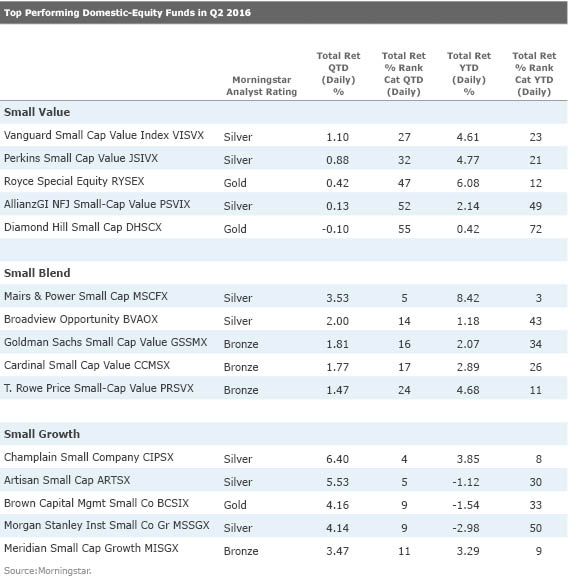

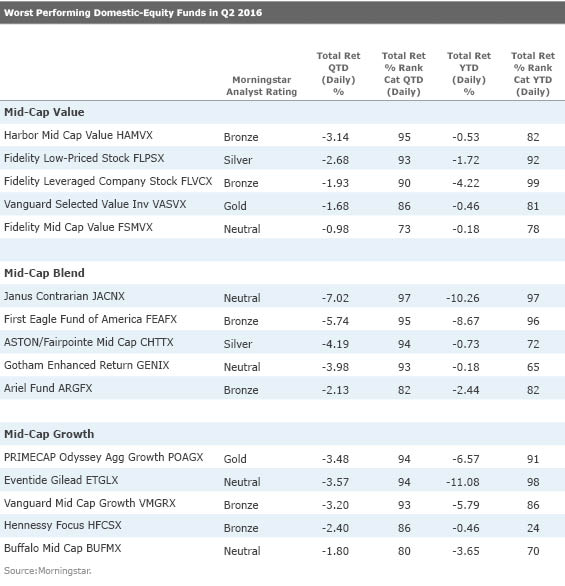

Morningstar Style Box Categories

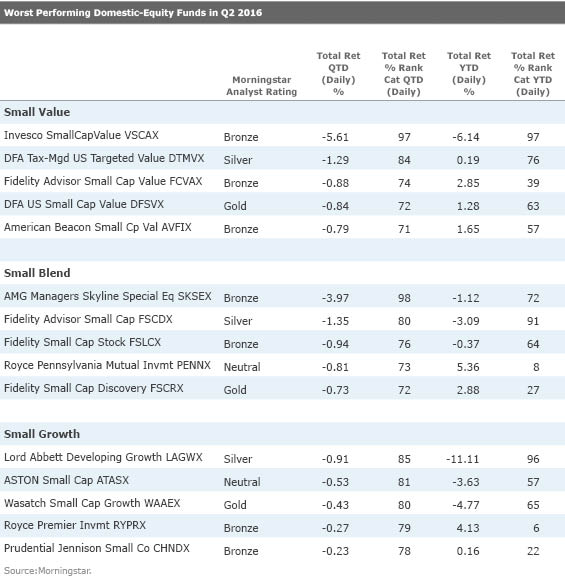

After dropping 4.4% during the first quarter, the small-growth category was the top-performing Morningstar Category in the Morningstar Style Box for the second quarter, gaining 1.3%.

The small-value category also posted positive results in the second quarter, gaining 0.3%. Wells Fargo Special Small Cap Value ESPAX, which gained 2.0% for the quarter to date, outperformed 87% of its small-value peers. Overweightings to the materials sector and industrial machinery firms--specifically Kadant KAI and Douglas Dynamics PLOW--contributed to results.

Among mid-cap blend funds, concentrated Silver-rated

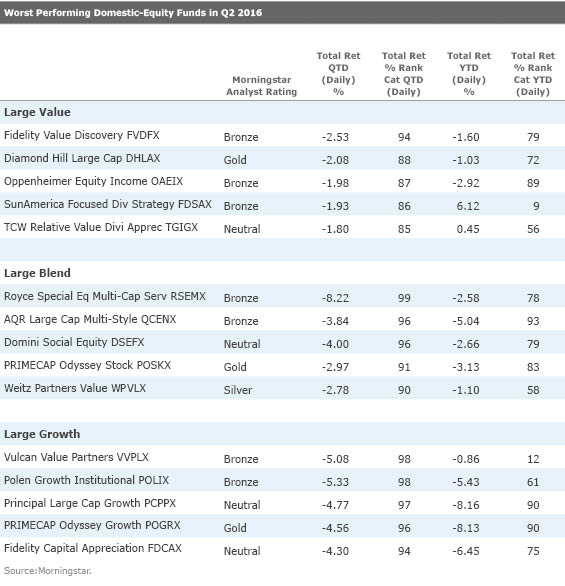

The large-value category did better than the large-growth category for the quarter to date, bucking the trend of recent years. Bronze-rated

The weakest-performing category in the Morningstar Style Box for the second quarter was large-growth, which dropped 2.0%.

It wasn’t all bad in the large-growth category, though. Bronze-rated

For additional details on Morningstar Categories, please click here.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)