Markets Brief: Fading Recession Fears, Cheap Valuations Have Small-Cap Stocks Looking Attractive

Some say small-caps could be poised to take the lead in the market.

Check out our weekly markets recap—including a look at stocks making some of the week’s biggest moves—at the bottom of this article.

It’s been an ugly market for small-company stocks, but with rock-bottom valuations and an economy that appears to be avoiding recession, they may be at their most attractive point in years.

In fact, some strategists say that small-cap valuations could be signaling that the most down and out of all asset classes might be on the verge of a new leadership cycle, its first in almost 24 years.

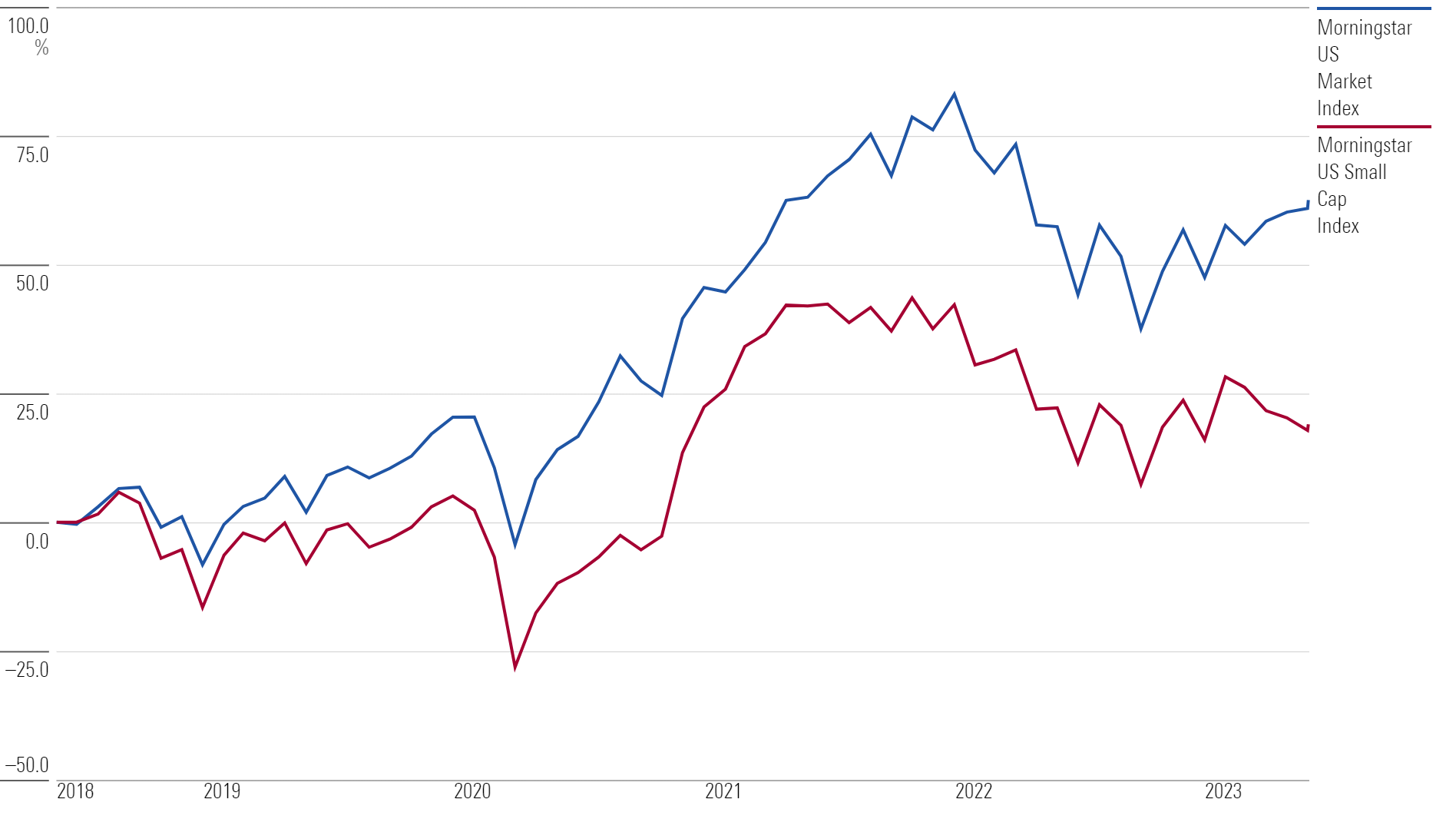

Investors seemed to be thinking that was the case on Friday, as a much stronger-than-expected May jobs report showed that the U.S. economy remains healthy, which could be good news for small stocks and their generally heavier exposure to domestic markets. The Morningstar US Small Cap Index jumped 3.2% on Friday, while the Morningstar US Large Cap Index rose 1.3%, and the overall market, as measured by the Morningstar US Market Index, gained 1.6%.

“I don’t know how anyone could be talking about a recession with these kinds of numbers,” says Ed Yardeni, president and chief investment strategist at Yardeni Research, pointing to the increase of 339,000 in nonfarm payroll employment in May.

“Small caps have been held back by fears of a recession, and so this should be good for them,” Yardeni says.

However, so far this year, small caps have been left in the dust by the stock market bounce. The Morningstar US Market Index was up more than 11% after extending its gains following Friday’s jobs report. The Morningstar US Large Cap Index was up north of 14%. Meanwhile, the Morningstar US Small Cap Index gained just above 5% so far in 2023, with most of the gains coming from its rally on June 2.

Morningstar US Market Index vs. Morningstar US Small Cap Index

The performance gap is broader going back further in time.

Small caps are down about 21% from their peak in November 2021 as measured by the Morningstar US Small Cap Index. The group has turned in a relatively flat performance in the five years since its prior peak in August 2018, producing total annualized returns of 2.6%. In contrast, the Morningstar US Market Index has produced annualized total returns of 9.5% in that time frame.

According to Doug Ramsey, the chief investment officer at Leuthold Group, an independent provider of investment research to institutions, for the first time since 1946-47, small caps failed to participate in what’s been historically a bullish period for all stocks—the six months between November and April of a midterm election year. Small caps posted a loss of 3.5% compared with a gain of 8.6% for large caps. Small caps’ failure to surge despite bullish technical indicators, cheap valuations, and during a period that’s historically been favorable for them is sounding a bell.

“It’s an economic warning that’s as strong as the counsel of the yield curve,” Ramsey says. “Small caps are discounting a severe slowdown and a recession would disproportionately affect small caps.”

Small-cap stocks, often innovative startups, are more sensitive to changes in economic conditions. Many of them are unprofitable, adding to their riskiness and making them more susceptible to tighter credit conditions that are associated with downturns, which have been exacerbated this year by the turmoil and instability surrounding some regional banks. Tighter credit makes it harder to refinance existing debt.

But that laggard performance has left small-cap valuations at unusually cheap levels.

Not since 1999, when small caps entered a 12-year period of outperformance, withstanding two recessions and two severe bear markets, has there been such a disparity in valuations between large-cap and small-cap stocks, Ramsey says. And small-cap stocks are trading 6.5% below the level they bottomed at on March 31, 1999, before embarking on their extended run.

Small Caps at a Rarely Seen Discount

Small caps are too cheap for investors to continue to ignore, some strategists say.

Morningstar’s senior U.S. market strategist David Sekera points to the small-stock category as the most undervalued in the market, trading at a 30% discount to fair value, with the subset of small-cap value the biggest bargain of all at a whopping 40% discount.

While the near term remains uncertain and the length and severity of a possible recession are unknowable, much of the concern is already priced into the small-cap market.

“It’s a moment in time you rarely get,” says Francis Gannon, co-CIO of Royce Investment Partners, a specialist in small-cap stocks with $11.8 billion under management. “It’s a forgotten asset class, and it represents a great opportunity. We could be on the cusp of a new small-cap cycle.”

A typical small-cap cycle lasts about a decade, if not longer, says Gannon.

Gannon also says that the small-cap and small-cap value indexes are the only indexes trading below their historical 25-year averages based on median enterprise value/EBIT, or earnings before interest and taxes.

“The cheaper smalls are relative to large caps, the more likely they are to historically outperform,” says Denise Chisholm, director of quantitative market strategy at Fidelity Investments, adding that small caps are extremely inexpensive when measured on a price/book value basis compared with large caps. “The two signals together can’t time bottoms, but they help size the magnitude of the potential opportunity on the upside, which looks historically quite significant.”

Chisholm favors small-cap semiconductor stocks in the current environment, noting that their “cheap valuations provide support in an industry with a strong history.”

“Sales, cash flows, and earnings for small caps are up considerably since 2018, but the stocks have gone nowhere,” Leuthold’s Ramsey says.

Focus on Quality Small Caps

At this stage in the cycle, Gannon says investors should increase their weighting to small caps selectively by focusing on quality companies with high returns on invested capital and great balance sheets that are generating enough cash to operate without requiring tapping the capital markets to finance their businesses.

Gannon says 43% of the stocks in the Russell 2000 small-cap index were “nonearners” at the end of the first quarter. “The highest number we’ve ever seen,” he says. Of the different sectors, 80% of the healthcare names were unprofitable, as were 62% of the IT companies and 53% of the communication-services companies.

He advises sticking with economically sensitive sectors such as industrials and, in the IT arena, semiconductors.

Gannon highlights three companies held in Royce funds that fit the bill:

Rogers ROG, a maker of specialty engineered materials used in a wide range of industries from footwear to mobile devices to automotive and medical devices, is down nearly 40% in the past year at $158.64. A $5.2 billion agreement to merge with DuPont DD was scuttled in early November after Chinese regulators failed to approve the deal. Rogers has bounced off its lows, however, and is up 33% year to date.

Simpson Manufacturing SSD, a maker of structural engineering products and building materials, has gained 42% so far this year, trading at a recent $125.98 per share, just below its 52-week high of $128.82 set on May 19 as the housing market appears to be stabilizing.

Air Lease AL, an aircraft leasing company whose customers include 118 major airlines in 63 countries, is up 5.36% for the year to date at $40.48, about flat with its one-year return of 5.12%.

Events Scheduled for the Coming Week

For the Trading Week Ended June 2

- The Morningstar US Market Index rose 2.0%.

- All 11 stock sectors were up for the week, with real estate and consumer cyclical as the top performers. Real estate stocks were up 3.3%, while consumer cyclicals rose 3.1%.

- Yields on 10-year U.S. Treasuries declined to 3.69% from 3.80%.

- West Texas Intermediate crude prices fell 1.3% to $71.74 per barrel.

- Of the 849 U.S.-listed companies covered by Morningstar, 669, or 79%, were up, and 180, or 21%, declined.

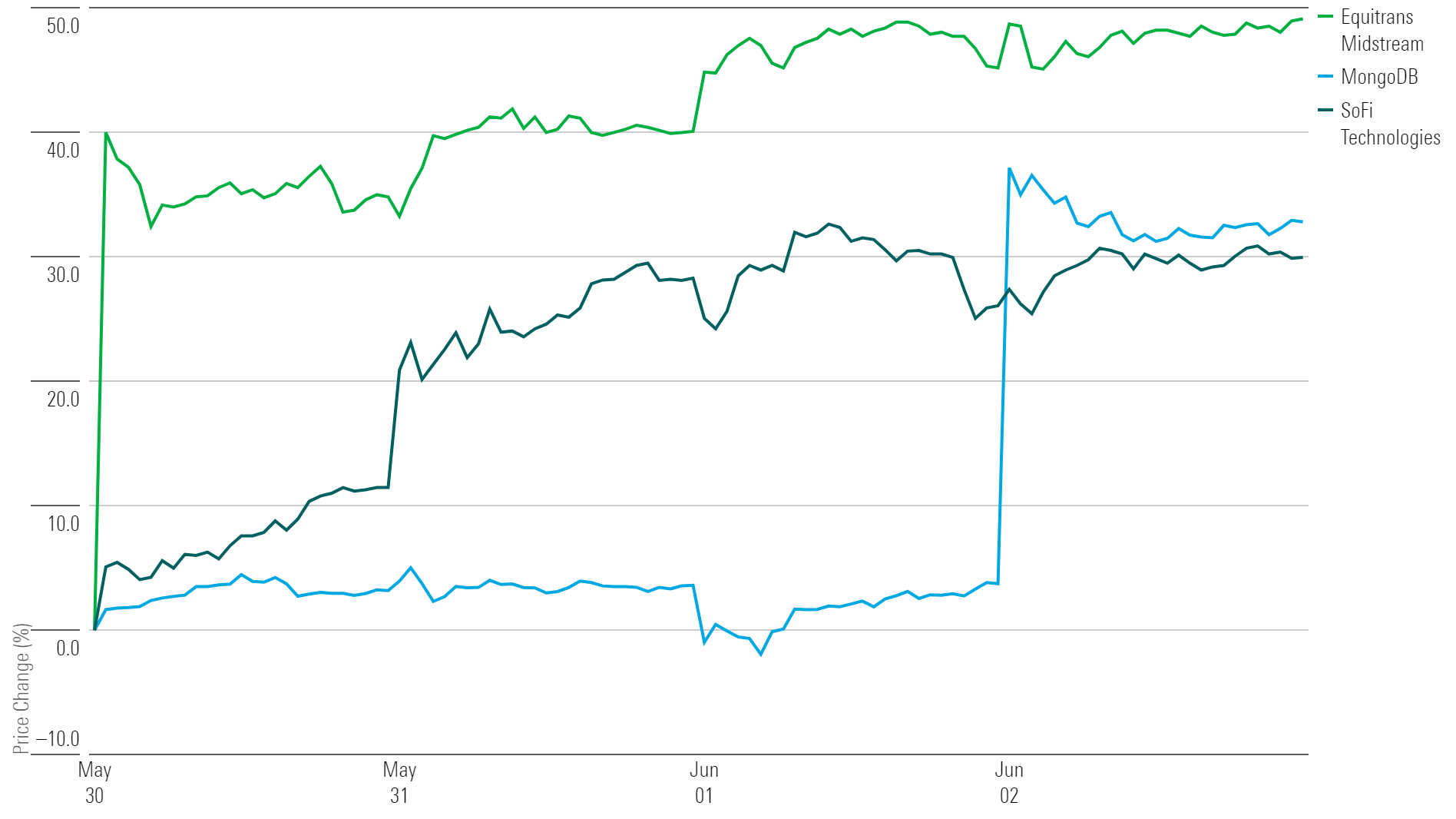

What Stocks Were Up?

Equitrans Midstream ETRN stock surged on news that its Mountain Valley Pipeline would be supported as part of the debt-ceiling deal that was passed by both sides of Congress. “The legislation essentially removes all further roadblocks to the pipeline entering service,” says Stephen Ellis, Morningstar sector strategist. “In the scenario where the MVP moves forward and into service, our fair value estimate would likely be $15 per share.”

Database storage provider MongoDB MDB reported strong first-quarter results, with earnings per share coming in at $0.56, above guidance of $0.19. The company also increased sales guidance for full-year 2023 to a range of $1.52 billion to $1.54 billion from $1.48 billion to $1.51 billion previously.

SoFi Technologies SOFI stock also popped because of strong growth in the company’s net interest income, which was driven by “impressive” deposit growth and rising interest rates, says Morningstar analyst Michael Miller. SoFi saw its net interest income more than double by 113% from a year ago to $201 million.

Highlighted Advancers

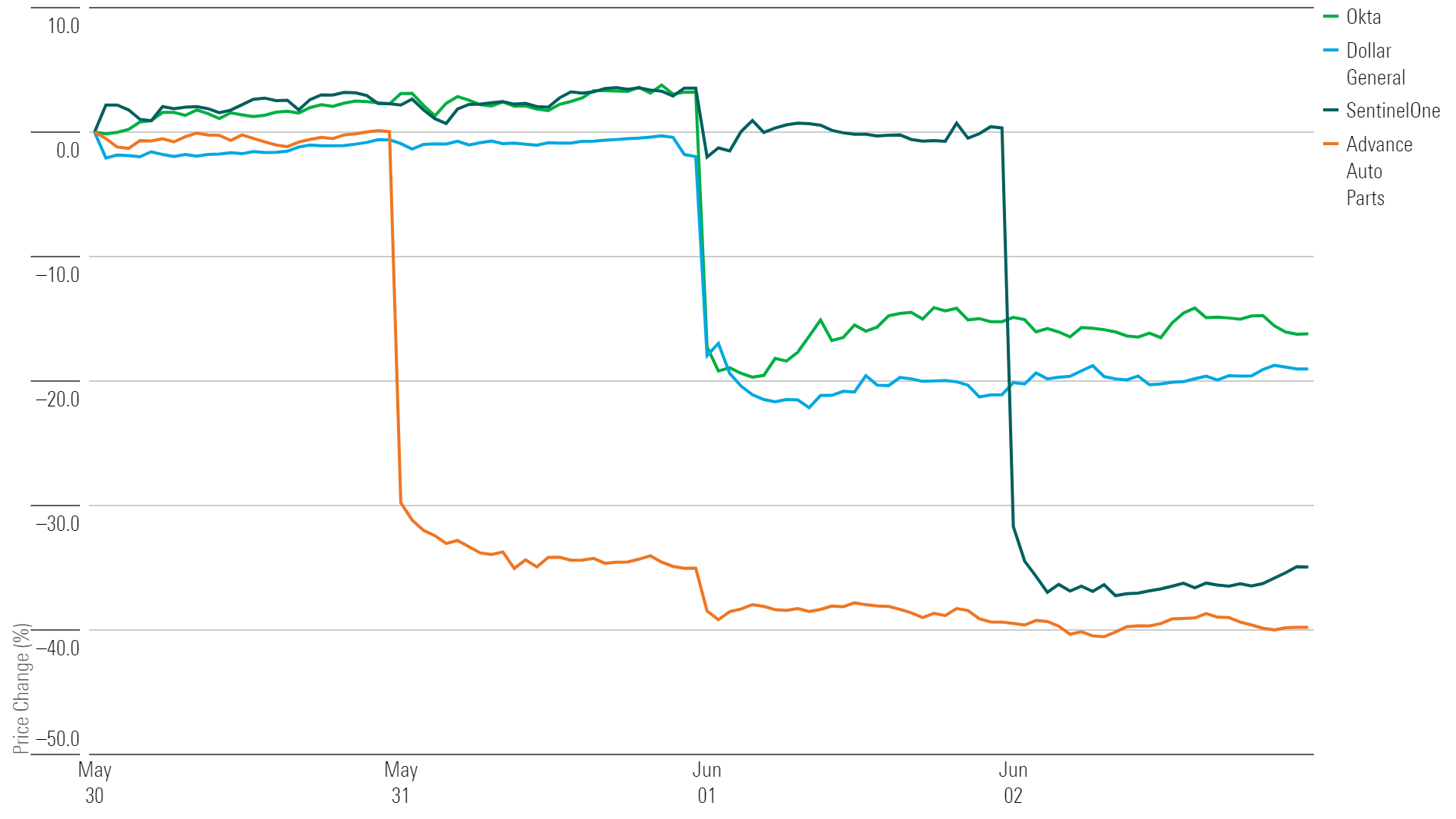

What Stocks Were Down?

Advance Auto Parts AAP stock plunged in the wake of poor first-quarter results. Earnings per share came in at $0.72 per share versus FactSet mean estimates of $2.56. Operating margins also fell to 2.6% from 6.0%. Additionally, the firm announced a dividend cut to $0.25 per share from $1.50 previously.

Cybersecurity software stocks Okta OKTA and SentinelOne S also slid as tougher macroeconomic pressures are expected to continue weighing on near-term financial results, says Morningstar analyst Malik Ahmed Khan. “Customers across the spectrum seek to recalibrate their IT spending in light of the uncertainty,” he says.

Dollar General DG stock fell after management cut its guidance for fiscal-year 2023. Full-year earnings per share are expected to be between $9.83 and $10.68, down from a range of $11.11 to $11.32 previously. “Shoppers’ pullback on discretionary spending continued at a faster pace than anticipated,” Morningstar analyst Zain Akbari says. Customers shunned more lucrative nonconsumable products in favor of lower-margin consumable fare.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)