How Sustainable Indexes Beat the Market in Q1 2023

The Big Tech rebound lifted ESG benchmarks after a challenging 2022.

The first quarter was a recipe for sustainable-investing success as Big Technology stocks staged a rebound while energy stocks slumped.

Many of the Big Tech stocks that made the biggest gains in the first quarter of 2023—such as Nvidia NVDA, Salesforce CRM, and Microsoft MSFT—also have some of the strongest scores on environmental, social, and governance criteria, so sustainable investment strategies benefited from their outperformance. At the same time, sustainable strategies were broadly able to dodge the hit taken by stocks in the energy sector as oil prices lost ground.

As a result, the stocks of companies that lead the ESG investing space leapt ahead of the broader market during the first quarter. But there were exceptions: as dividend-paying stocks lagged, trailing the market by nearly 7 percentage points, ESG-friendly dividend payers also fell behind.

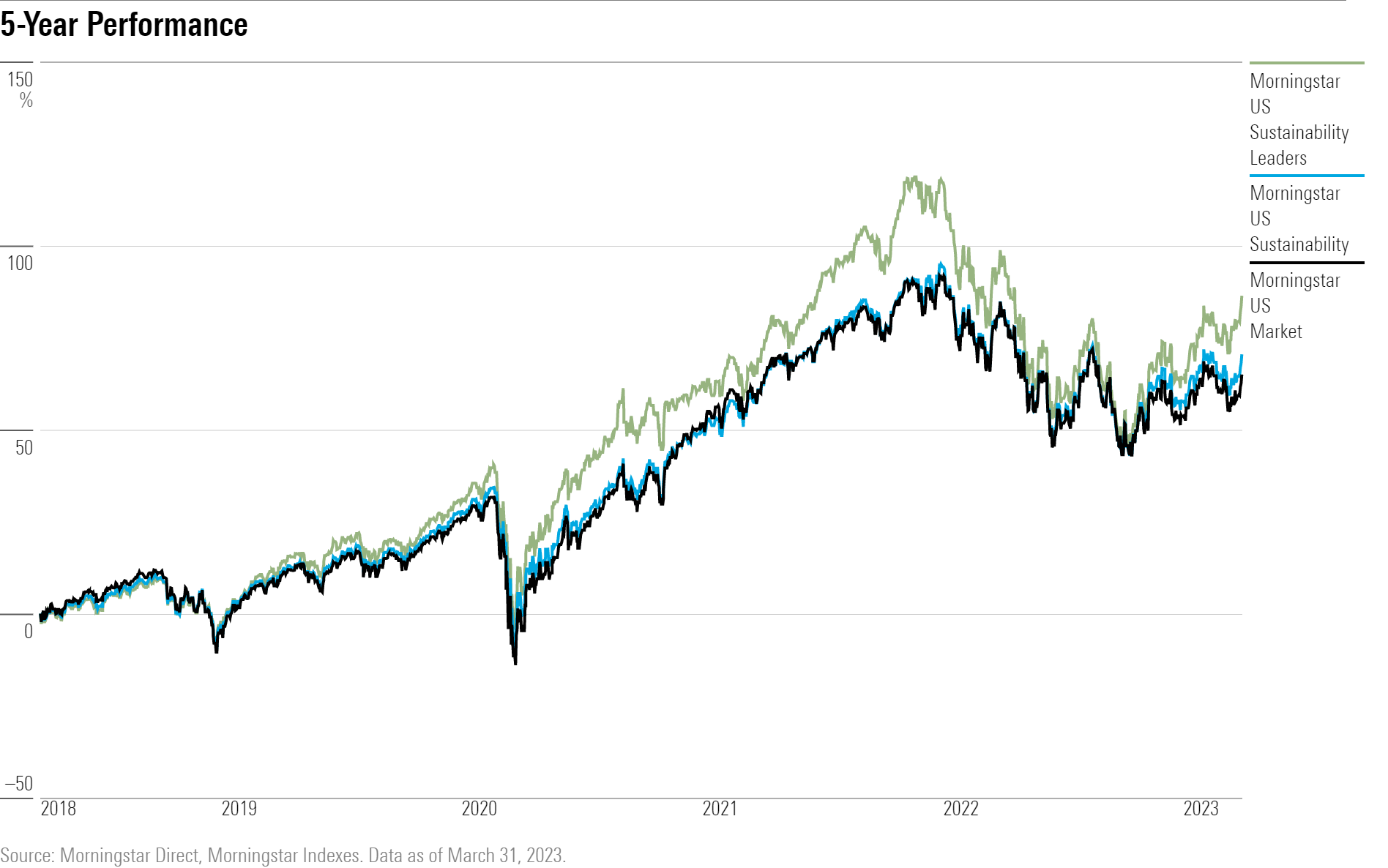

Looking back over the longer term, U.S.-based sustainable investment strategies of all kinds are edging out the rest of the stock market.

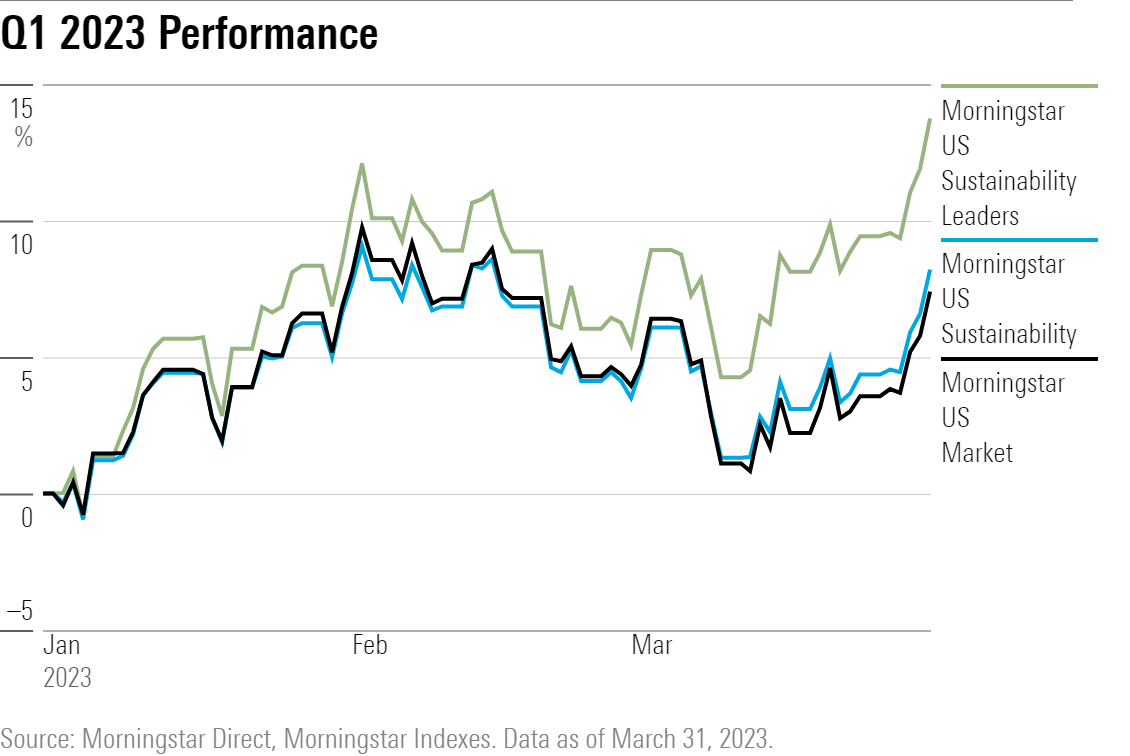

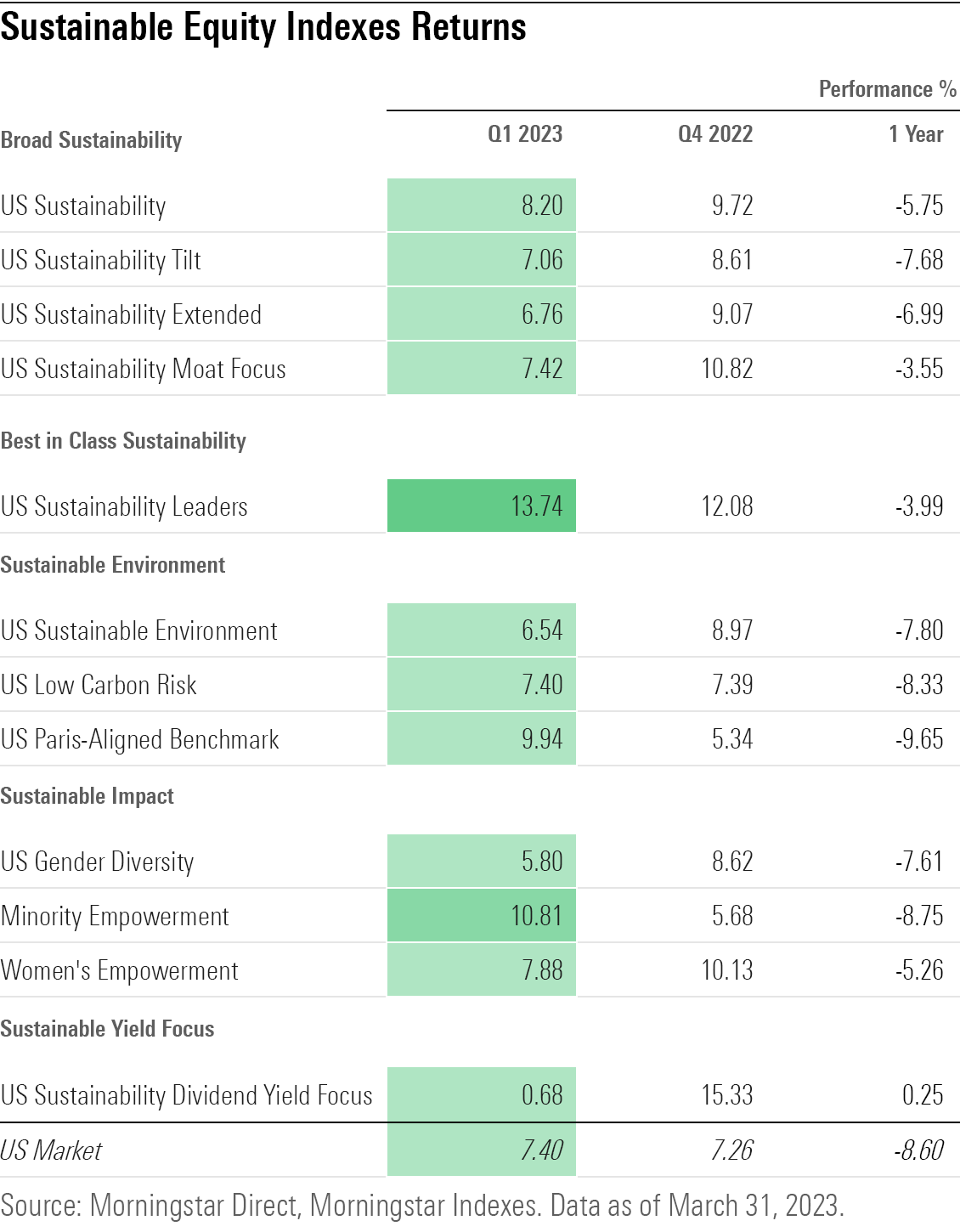

The Morningstar US Sustainability Index, which tracks the broader U.S. equity market but screens out companies with the highest ESG risk, gained 8.2% during the first quarter. That’s nearly a full percentage point ahead of the broader equity market, which rose 7.4%, as measured by the Morningstar US Market Index.

The top-scoring sustainability stocks beat the market by an even wider margin during the first quarter. The Morningstar US Sustainability Leaders Index, a collection of 50 U.S. large-cap stocks with the very best sustainability scores, rose 13.7% in the first quarter.

Sustainable-Investing Performance in Q1 2023

Globally and across markets, 11 of the 21 Morningstar standard sustainability indexes—which are indexes for the respective regions with overlays that screen out companies with higher ESG risk ratings—outperformed their broader market benchmarks during the first quarter. Over the past five years, 13 of the 21 indexes beat their benchmarks.

For U.S.-based sustainable-investing indexes, 11 of 20 outperformed or fell in line with the broader market during the first quarter.

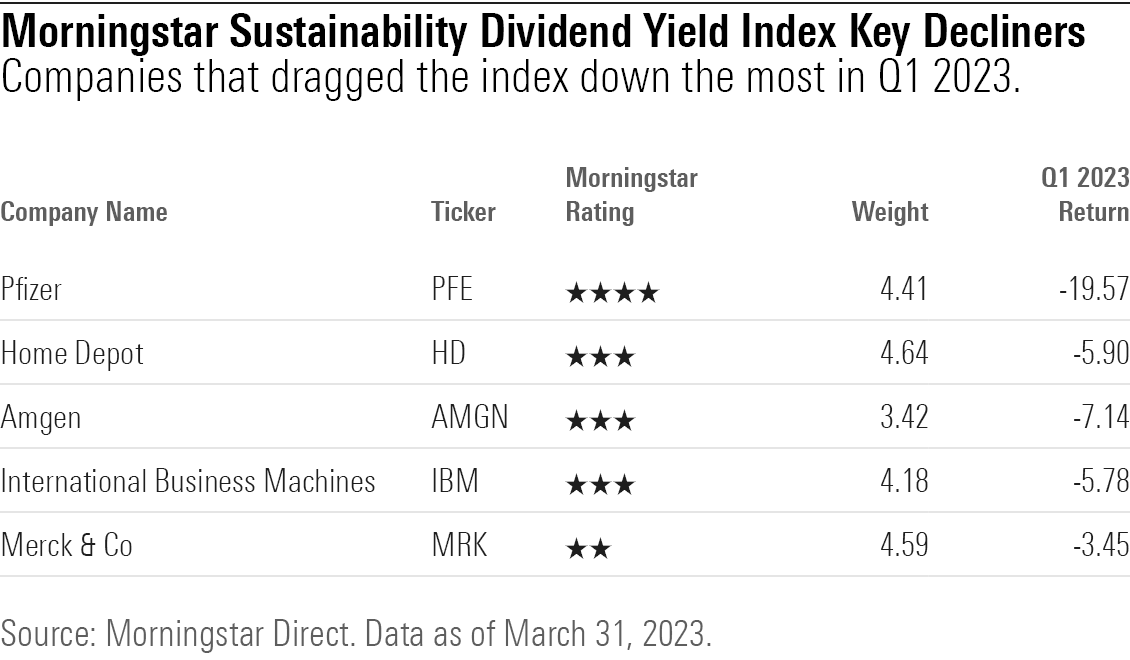

The value-leaning Morningstar US Sustainability Dividend Yield Focus Index was hit the hardest, trailing the U.S. market by nearly 7 percentage points. The Morningstar US Sustainability Leaders Index and the Morningstar Minority Empowerment Index, which includes companies that have embedded strong racial and ethnic diversification policies into their corporate culture, topped the group for the first three months of the year.

Longer-Term Sustainable-Investing Performance

For the trailing five-year period, the Morningstar US Sustainability Leaders Index gained 86.4%, while the standard Morningstar US Sustainability Index advanced 70.4% for the same period. Both beat the broader equity market, which rose 64.9% as measured by the Morningstar US Market Index.

ESG Gets a Boost from Tech Stocks

For the first quarter, the companies that led the Morningstar US Sustainability Leaders Index came primarily from the technology and communication-services sectors—the same kinds of stocks that led the broader U.S. market. At the industry level, semiconductor companies and software infrastructure providers made the biggest contributions.

On the opposite side of the spectrum, the Morningstar US Sustainability Dividend Yield Focus Index, which tracks the performance of companies with attractive dividend yields, strong financial quality, and a proven ability to mitigate ESG risk, was dragged down by healthcare stocks in the drug manufacturing industry and consumer cyclical stocks from the home improvement retail industry.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)