Do Multifactor Funds Deliver on Their Objective?

Our latest paper tries to unlock the mysteries of multifactor funds.

Multifactor funds rose to popularity in the mid-2010s, and they controlled more than $250 billion of investors’ money by the end of September 2022. These strategies attempt to diversify their portfolios across two or more risk factors, or characteristics shared by a group of stocks, such as low price multiples (value) or strong recent performance (momentum). The appeal of these characteristics ties back to their potential for better long-term risk-adjusted performance than the market.

The idea behind these funds is generally sound. These factors don’t always offer an advantage, and they don’t move in sync with one another. Diversifying across multiple factors should protect a portfolio when one performs poorly while still harnessing their long-term potential. But just because the argument for factor diversification is simple doesn’t mean that selecting and sticking with a multifactor strategy is easy. These funds are among the more complicated strategic-beta funds available to investors, and many of the most popular ones didn’t perform as well as expected in the years after they were launched.

Looking closer at multifactor funds reveals a wide range of strategies that vary from simple to complex. Each has its own nuances, which creates challenges in evaluating their long-term potential. Our recent paper, “Is the Sum Greater Than the Parts?,” presents a simple framework that has helped Morningstar analysts sort through the clutter. It can be applied to most multifactor funds to assess their long-term merit, regardless of a strategy’s underlying complexity.

The analysis framework consists of three basic steps:

1) Identify a multifactor strategy’s targeted factors.

2) Uncover the factors that its portfolio actually captures.

3) Determine whether the multifactor fund’s observed factor exposures influence its performance in a predictable way.

The paper walks through these steps in detail for two exchange-traded funds: SPDR MSCI USA StrategicFactors ETF QUS and VictoryShares US Value Momentum ETF ULVM. In doing so, it demonstrates how investors can evaluate multifactor funds’ investment merit with a few simple steps.

What’s a Multifactor Fund’s Objective?

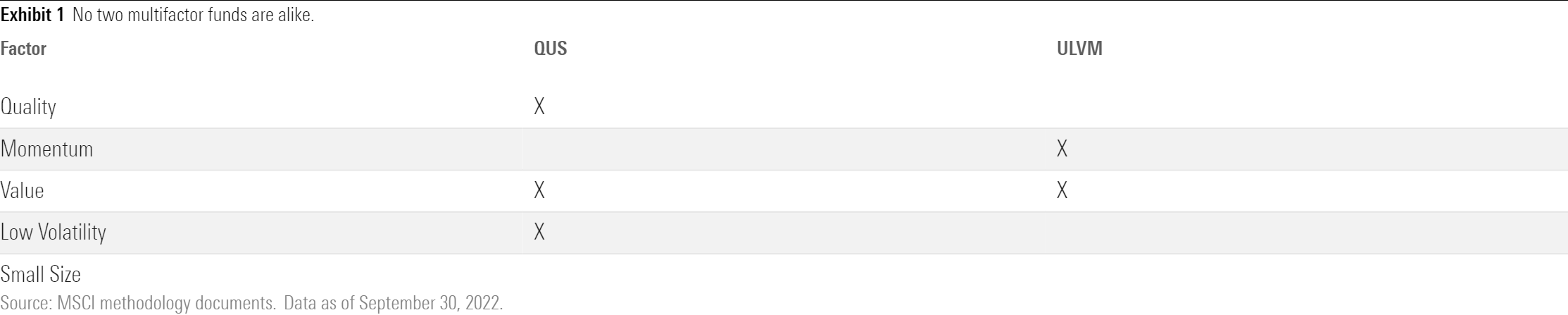

The first step identifies a multifactor strategy’s targeted factors. At this stage, there are no right or wrong factors to pursue, and more factors don’t necessarily lead to a better process. Some funds go after two, while others aim for more. Exhibit 1 shows the factors that QUS and ULVM target.

What Actually Shows Up?

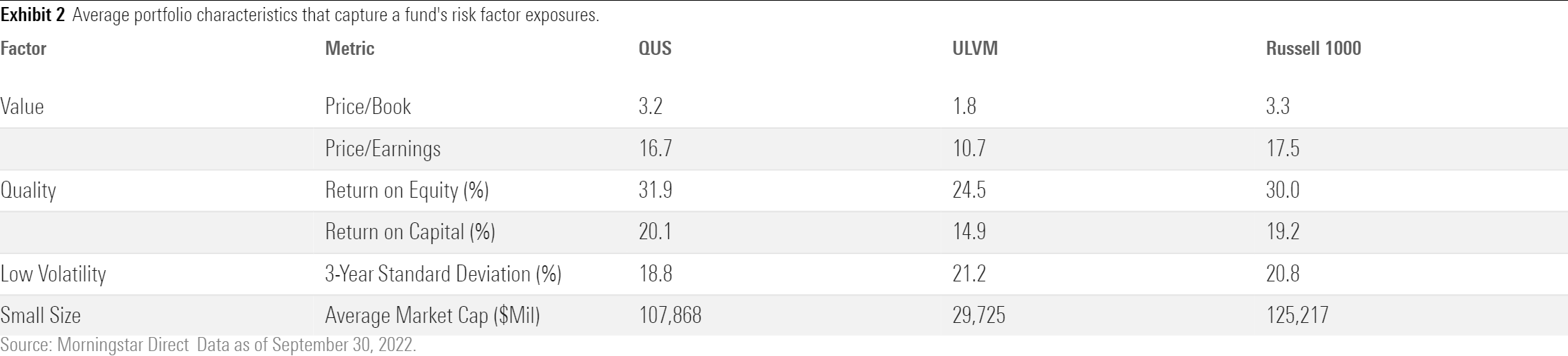

Regardless of what factors a strategy targets, the factors that matter are those that show up in its portfolio. To that end, comparing a multifactor portfolio’s average characteristics with those of its starting universe—the broader pool from which it draws holdings—can reveal its true factor exposures.

Average price multiples shed light on the strength of a portfolio’s value orientation: Lower multiples indicate a stronger value orientation. Average profitability metrics are a decent proxy for the quality factor, as greater profitability is often linked to companies with stronger financial statements. Average market capitalization directly reflects a portfolio’s exposure to smaller stocks. Finally, the historical standard deviation of a fund’s total return is a simple way to assess its exposure to the low volatility factor. The momentum factor is the lone exception: It cannot be measured through average portfolio characteristics, so it requires a more advanced analysis.

Exhibit 2 shows these characteristics for QUS, ULVM, and the Russell 1000 Index (a proxy for their parent universe) at the end of September 2022. This information provides two important insights. First, not all of a fund’s targeted factors show up in its portfolio. ULVM and QUS both pursue the value factor, but QUS has average price multiples that look similar to the Russell 1000 Index’s. ULVM’s average price multiples land well below those of the index, indicating that it’s successfully leaning toward cheaper stocks.

Exhibit 2 also reveals unintentional factor exposure in these portfolios. Both ETFs had a lower average market cap than the Russell 1000 Index, indicating that they’re emphasizing smaller stocks. The effect was more obvious with ULVM, whose average market cap was roughly one fourth that of the index.

Do Factors Drive a Multifactor Fund’s Performance?

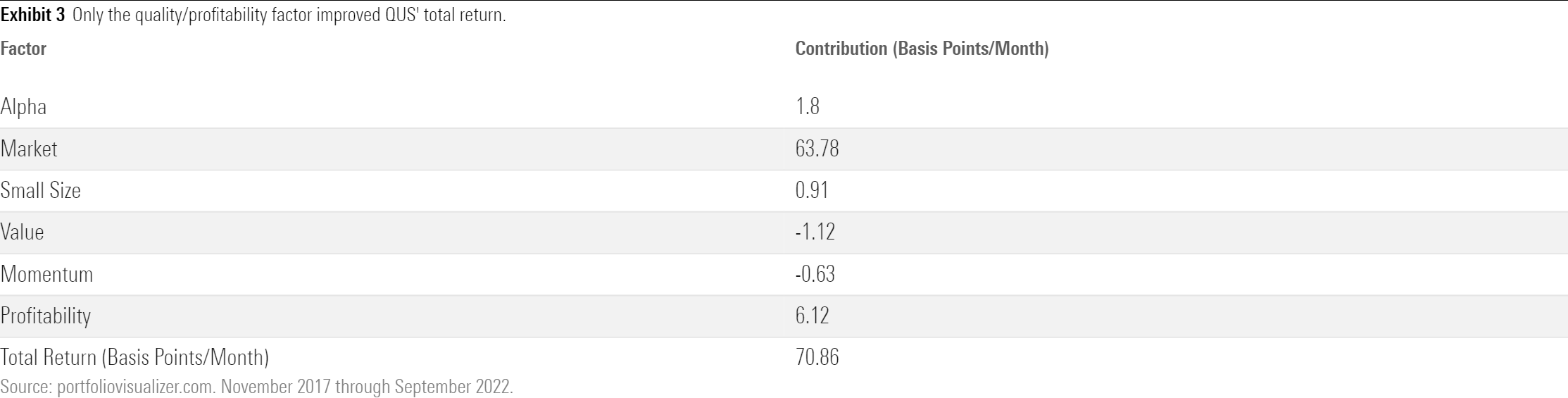

In an ideal world, a multifactor fund’s market exposure and observed factors should account for almost all of its total return. Exhibit 3 shows the monthly contribution of each factor to QUS’ total return between November 2017 and September 2022. The market returned about 73 basis points per month over this period (not shown), of which QUS captured about 64 basis points. Less exposure to the market’s risk aligns with QUS’ lower standard deviation. Its exposure to more-profitable stocks also aided performance, contributing another 6 basis points per month.

The other factors in this model, including the small size factor, value factor, momentum factor, and alpha, had little influence on QUS’ historical performance. Those results align with its average portfolio characteristics observed earlier. Its observed factors have clearly had an impact on its performance in a predictable way, which imparts a high degree of confidence that QUS will continue to follow the trajectory of a low-volatility portfolio.

The alpha term in these models is a catch-all that includes the contribution from other sources of risk, such as the influence of single stocks. Multifactor funds should diversify away these sources of risk, so the alpha term should be negligibly small.

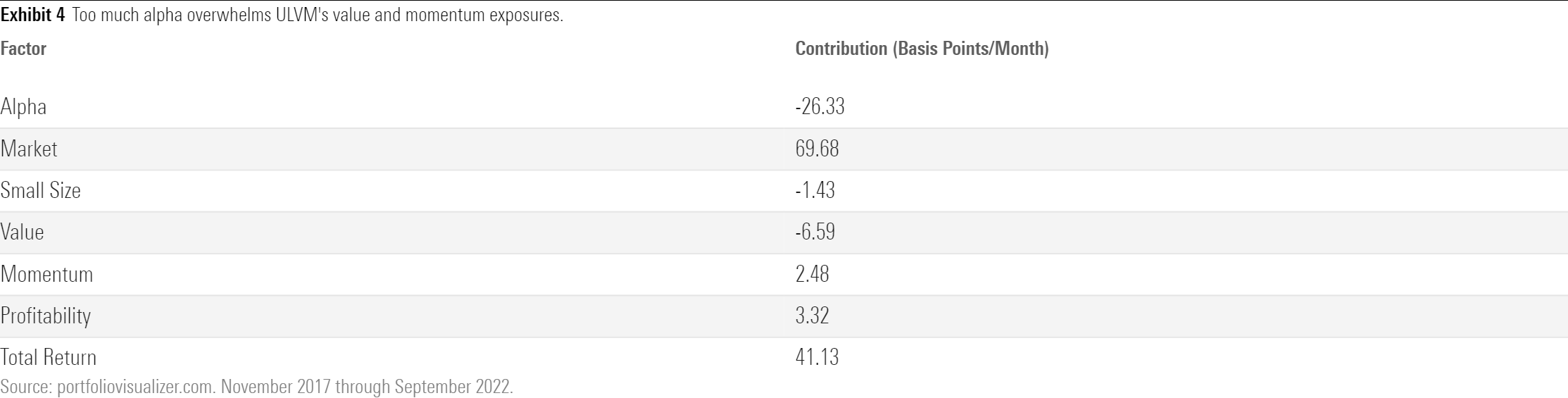

Along those lines, ULVM’s attribution in Exhibit 4 (for the same period) looks noticeably different. Its alpha term was far bigger in magnitude, at negative 26 basis points per month (or about negative 3.2 percentage points per year), more than enough to affect its total return. Large amounts of alpha add a layer of unpredictability to a multifactor fund’s expected performance. The risks captured in this term are often difficult to understand, regardless of whether they help or hurt. Those uncertainties usually dim our outlook for a given strategy.

ULVM isn’t the only multifactor fund whose alpha term overpowers its factor tilts. Other multifactor funds suffer from the same issue, and there’s a way to identify most of them without working through a rigorous attribution analysis.

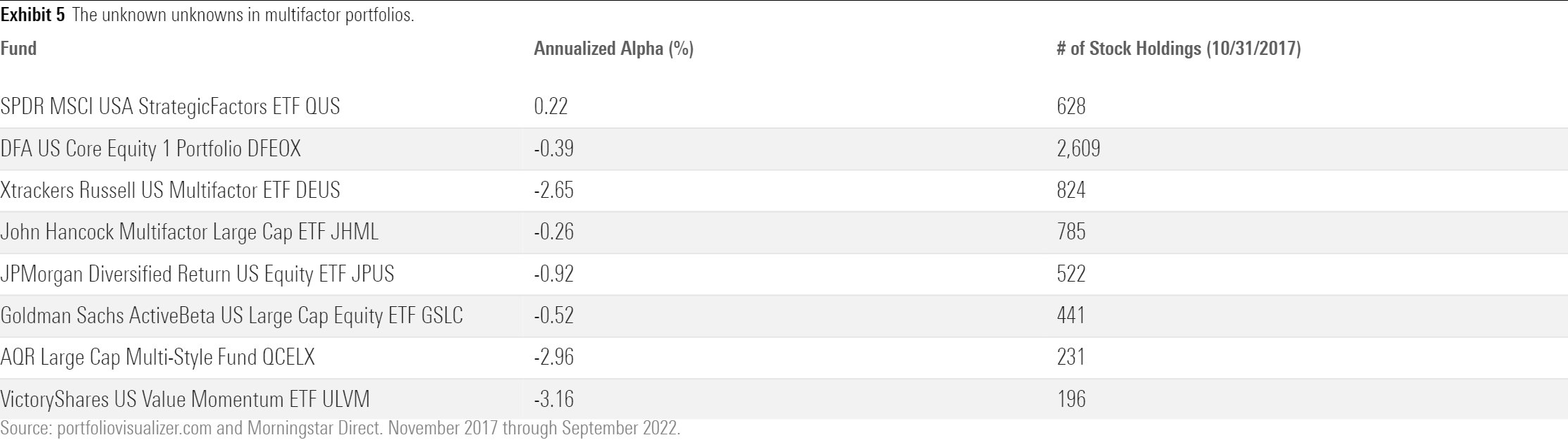

Exhibit 5 lists eight multifactor ETFs, their five-factor alpha for the November 2017-September 2022 period (a common period for all eight funds), and the number of stocks they held at the start of the period.

Portfolios that held multiple hundreds (or thousands) of stocks tended to have lower alphas, indicating they incurred very little “unknown” risks. The broad reach of these portfolios likely diversified away those other risks. Along the same lines, narrower portfolios tended to have higher alphas. Xtrackers Russell US Multifactor ETF DEUS stood out the lone exception to this observation, with a broad portfolio of 800-plus stocks and relatively high alpha.

What It All Means

All multifactor strategies target at least two factors. Examining their average portfolio characteristics indicates how well these funds actually deliver on those pursuits. One or two factors tend to emerge above the rest, and the small size factor usually creeps into the picture whether the fund explicitly targets it or not.

Multifactor funds’ performance patterns should follow the path that its observed factors carve. If a fund flounders when its observed factors thrive, or vice versa, unintentional risks may be the ones that primarily drive performance. The best multifactor strategies—and likely the easiest ones to stick with—are those that keep these incidental risks under wraps and rely on their observed factors to drive returns. Broadly diversified portfolios that span hundreds or thousands of stocks tend to fit this description the best.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)