A Closer Look at Vanguard’s Newest Core Bond ETFs

Will low fees and an active approach pay off?

Vanguard launched two actively managed bond exchange-traded funds in December 2023: Vanguard Core Bond ETF VCRB and Vanguard Core-Plus Bond ETF VPLS. The ETF wrapper is the only thing that’s new about the pair. They’re the second and third actively managed fixed-income ETFs from Vanguard, and the underlying strategies mimic those that Vanguard has offered through mutual funds for several years. Vanguard Core Bond VCOBX dates back to March 2016, and Vanguard Core-Plus Bond VCPAX launched more recently in October 2021.

The term “actively managed” doesn’t fully capture what these ETFs or their sibling mutual funds are about. Both ETFs attempt to outperform an index that roughly represents a comparable pool of bonds. But Vanguard designed them to function as core components in an investor’s portfolio, and they have guardrails in place to control the amount of risk they incur. Both hold a wide range of bonds across different maturities, credit qualities, and sectors. Most important of all, they’re inexpensive.

A closer look provides a little more insight into the risks that these ETFs will bear to achieve that objective.

More Than Core

The risk profile distinguishes core bond from core-plus bond. The core strategy attempts to outperform the Bloomberg U.S. Aggregate Float-Adjusted Index, while the core-plus strategy gets weighed against the Bloomberg U.S. Universal Index. The aggregate index mainly represents the U.S. investment-grade universe. The universal index stretches further to include riskier non-investment-grade (junk) bonds and those denominated in dollars but issued in emerging markets.

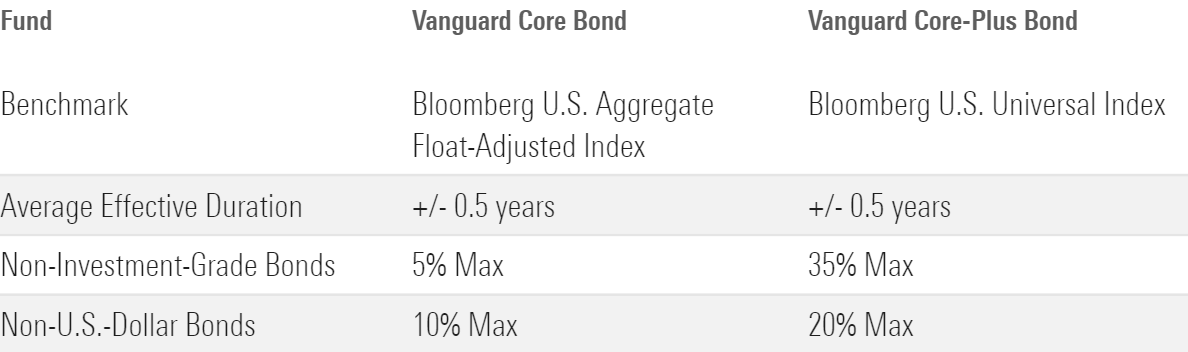

Vanguard’s managers can deviate from those benchmarks within some predetermined limits to aim for a better total return. They can place more emphasis on lower-quality bonds within the investment-grade universe in either strategy. The core bond strategy will generally stick to investment-grade bonds, but it has a small provision for non-investment-grade bonds and those issued in foreign currencies. The same rules apply to the core-plus bond strategy, but it’s allowed to have higher allocations to non-investment-grade bonds and foreign bonds. As such, it should have the higher risk/reward profile of the two. Exhibit 1 outlines the main differences for each strategy relative to its benchmark.

Guardrails on Vanguard's Core Bond ETFs

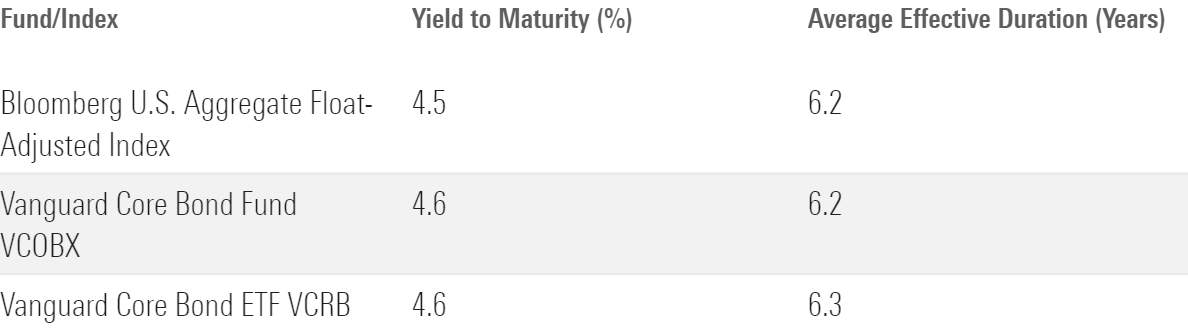

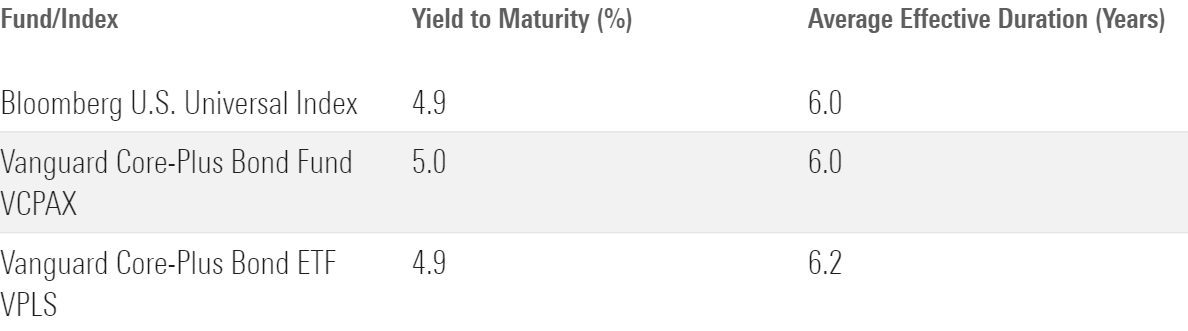

Vanguard expects most of the index-relative performance to come from a combination of greater credit risk and the individual bonds selected for each portfolio. Interest-rate bets account for the small remainder, and the managers intentionally keep each ETF’s effective duration within a six-month band of their respective benchmark. So, they shouldn’t dramatically out- or underperform when interest rates change. Exhibits 2 and 3 compare each ETF’s average yield to maturity and effective duration to its benchmark and corresponding mutual fund.

Vanguard Core Bond's Key Traits

Vanguard Core-Plus Bond's Key Traits

Some small differences will likely appear between the ETFs and mutual funds. For example, Vanguard Core Bond had a 3.7% greater allocation to A rated bonds than its ETF counterpart VCRB at the end of December 2023. But the discrepancies rarely deviate by more than a few percentage points and shouldn’t have a large influence on future performance.

Those gaps largely stem from differences in launch dates and the amount of money in each portfolio. Bond markets and interest rates change over time as the economy evolves. The bonds that were available several years ago may not look as attractive today. That leads to differences in the exact bonds that wind up in the ETF and mutual fund to produce the desired portfolio, even when they’re following the same strategy. The ETFs also have less money to put to work, so it’s more cost-effective for them to hold fewer bonds. Those differences should shrink over time as the ETFs increase in size.

So Far, So Good

The incremental risks incurred by both strategies appear to have rewarded their investors. It’s too early to size up the ETFs, but the mutual fund versions of both strategies have outperformed their benchmarks. Broad credit risk and individual bond picks drove most of their index-relative advantage.

The Vanguard Core Bond mutual fund beat the Bloomberg U.S. Aggregate Float-Adjusted Index by 46 basis points per year from its March 2016 inception through December 2023. Most of that outperformance occurred over the last nine months of 2020. Vanguard Core-Plus Bond Fund carved out an advantage of 60 basis points annualized over the Bloomberg U.S. Universal Index from its 2021 launch through the end of 2023.

That said, Vanguard isn’t swinging for the fences when it comes to index-relative performance. Neither strategy, whether in ETF or mutual fund form, should look radically different from its corresponding benchmark. Each will favor bonds at the higher-quality end of the credit-rating spectrum, with provisions for increased credit risk and foreign bonds.

The rock-bottom fees attached to these mutual funds and ETFs are their biggest advantage. All else equal, cheaper always translates to better performance. That means Vanguard’s managers can run a more conservative strategy than their more expensive actively managed peers and still have a good shot at outperforming. Vanguard charges 0.10% for VCRB and 0.20% for VPLS—the same fees attached to the corresponding mutual funds’ Admiral share class. Both expense ratios landed among the lowest across all share classes in their respective Morningstar Category.

Vanguard’s Funds, ETFs and More in 2024

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)