Does It Pay to Diversify by Factor?

A general upward trend in correlations has reduced the diversification value, but recent performance has shown more divergence.

Equity factors are a way of measuring the underlying factors that help drive equity market returns. Since the 1990s, asset managers and other researchers have focused considerable effort on trying to identify additional characteristics (beyond traditional metrics such as sector, market cap, and value/growth) that help to explain investment management styles and resulting performance differences. Theoretically, each factor should have its own set of performance characteristics and succeed or fail in different types of market environments.

In our recently published 2022 Diversification Landscape Report, we looked at how different asset classes performed in the past couple of years, how correlations between them have changed, and what those changes mean for investors and financial advisors trying to build well-diversified portfolios. We found that factor performance has generally landed in a narrow range but has shown signs of divergence lately.

Recent Performance Trends

For full-year 2021, yield was the best-performing factor, partly because many dividend-paying stocks are in the strong-performing energy and industrials sectors. Quality stocks also fared well thanks to the market's increasing interest in reliable stocks with high profitability, low leverage, and consistent earnings, as well as solid earnings results for these firms. Both factor benchmarks ended the year ahead of the Morningstar US Market Index's 28.0% total return. Small-cap stocks ended up at the bottom of heap with a 16.5% gain for the year.

These stocks benefited from the strong economic rebound in late 2020 and early 2021, but later suffered when fears about new coronavirus variants and rising inflation touched off a flight to quality. Similarly, momentum stocks suffered a sharp reversal after leading the market in 2020, as investors sold off previously hyped stocks with high valuations.

In early 2020, however, all six of the major factors--value, yield, small cap, momentum, quality, and low volatility--were down at least 30%. At the margins, quality and momentum-driven stocks held up slightly better, while small-cap, yield, and value-oriented stocks suffered the deepest losses. Many of the stocks in the three latter categories have heavier weightings in economically sensitive sectors, which suffered deeper losses during the downturn.

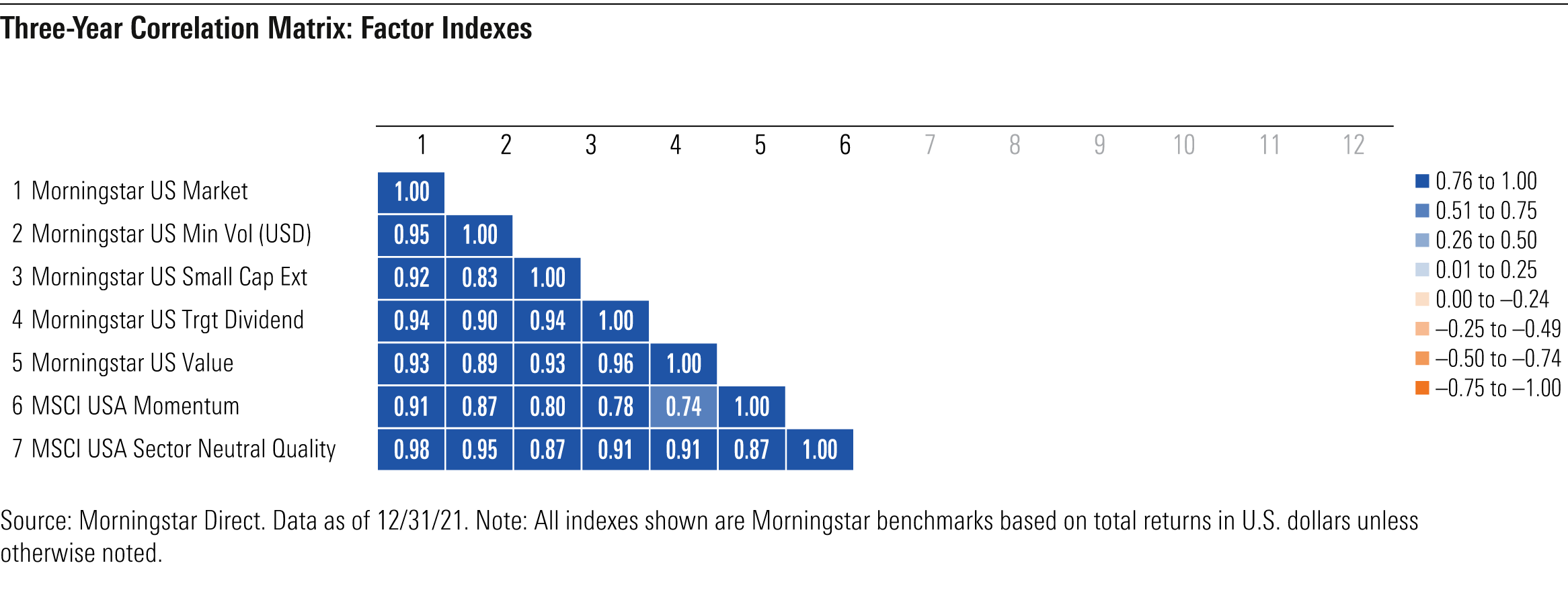

Over the past three years overall, factor profile correlations landed in a fairly narrow range. The quality factor showed the highest correlation with the broader equity market, followed by low volatility, yield, and value. The small-cap and momentum factors, while slightly lower, still showed correlations of 0.92 and 0.91 with the Morningstar US Market Index. As mentioned above, though, we've recently started to see larger divergences by factor. In recent months, for example, performance for momentum stocks has dropped off sharply, while yield and quality stocks have pulled ahead.

Longer-Term Trends

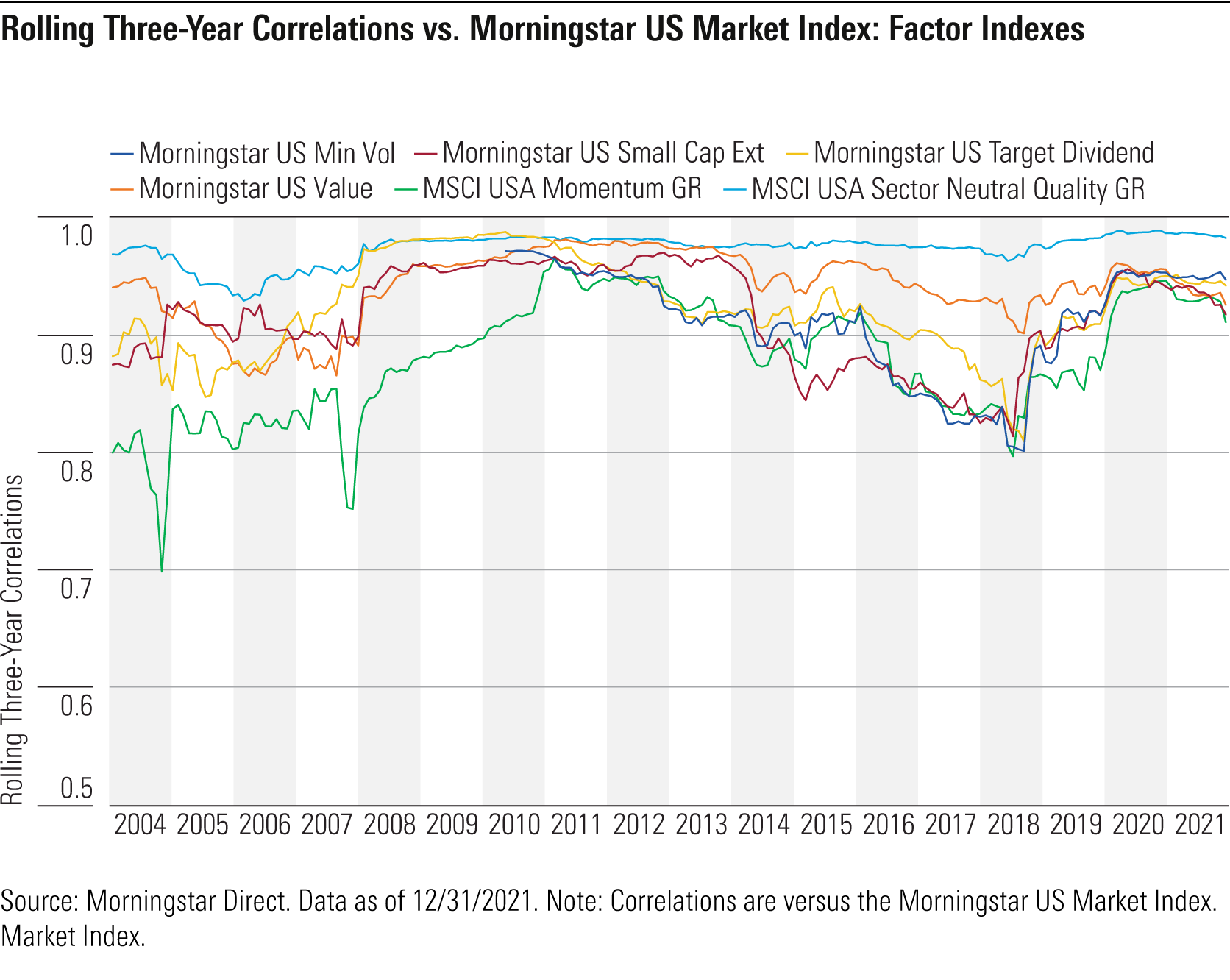

These patterns are generally consistent with patterns shown over longer periods, with quality showing the strongest correlation with the broader equity market and small-cap and momentum factors the weakest. Over time, though, correlations for all six factor indexes have generally trended up, as shown in the graph below. Both smaller-cap stocks and momentum issues decoupled from the Morningstar US Market Index to some extent between 2015 and 2018, but correlations have generally increased since then.

With performance moving more in line with the overall market, correlations between factor profile benchmarks have also converged. Now that factors are so widely studied and embraced by asset managers, one possible cause for this convergence could be that so many investors are following the same factors that their performance has become less and less discrete. As mentioned above, though, market performance has recently started showing more divergence between stocks with different factor profiles.

Portfolio Implications

A general upward trend in correlations previously reduced the diversification value of factor profiles. But now that the market is grappling with a major shift in regimes--from low inflation and interest rates to higher trends in both measures--the recent divergence in factor performance could continue. As a result, a factor-based approach to portfolio construction might be worth consideration.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)