Is the Market Still Undervalued After the Recent Rally?

We expect more turbulence ahead.

In our view, this market rally has been supported by a number of factors:

- Stock valuations in October had fallen to rarely seen undervalued levels and are now rising back toward fair value.

- Commentary from Federal Reserve Chair Jerome Powell that the Fed will begin to slow rate of monetary tightening.

- Third-quarter earnings results were not as bad as the market feared.

- Economic activity thus far in the fourth quarter has been better than expected.

- Inflation continued on a downward trend.

Today’s Market Valuation

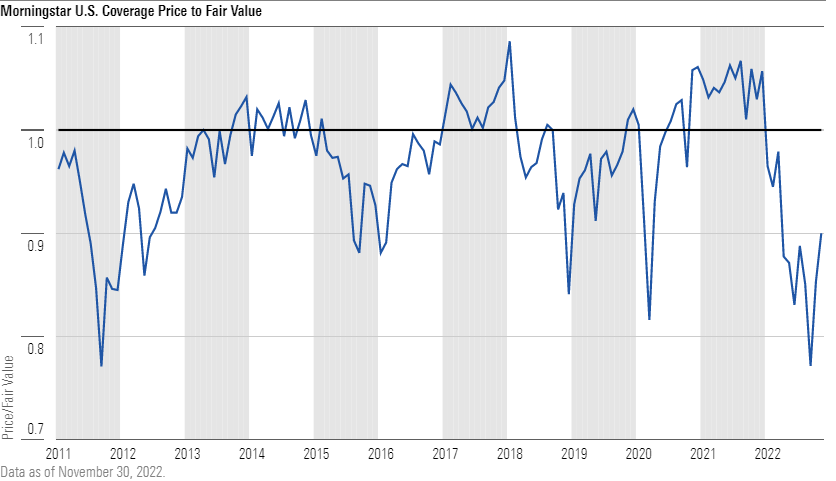

According to a composite of our equity coverage, as of Nov. 30, 2022, the broad U.S. stock market was trading at a 10% discount to our valuations. This discount had been as low as 23% when the market bottomed out in mid-October. Since 2010, the market had only ever traded at such a large discount to our fair value a handful of times. In fact, even at the current discount, the market has only traded at the current or lower discount 15% of the time over the past 12 years.

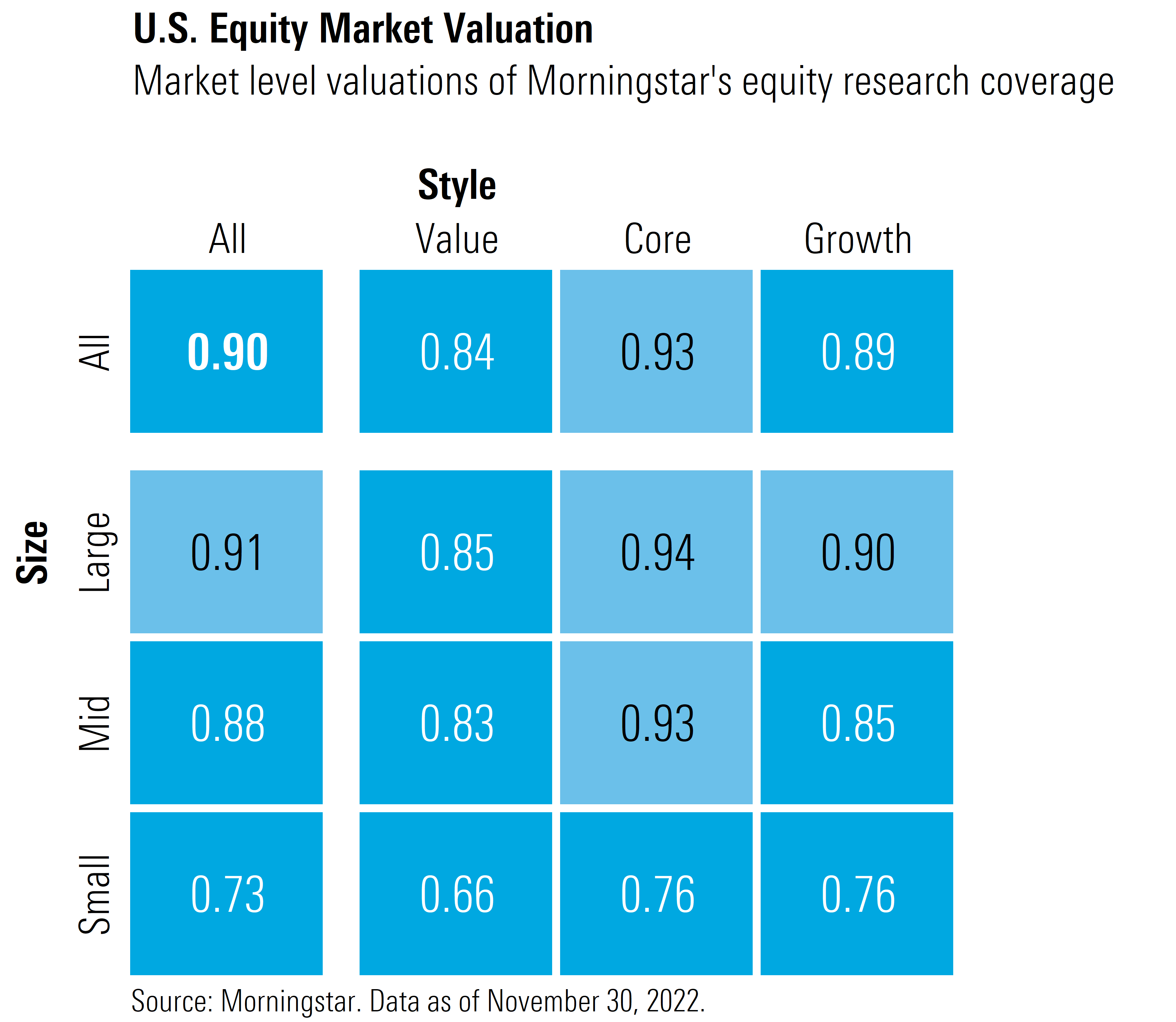

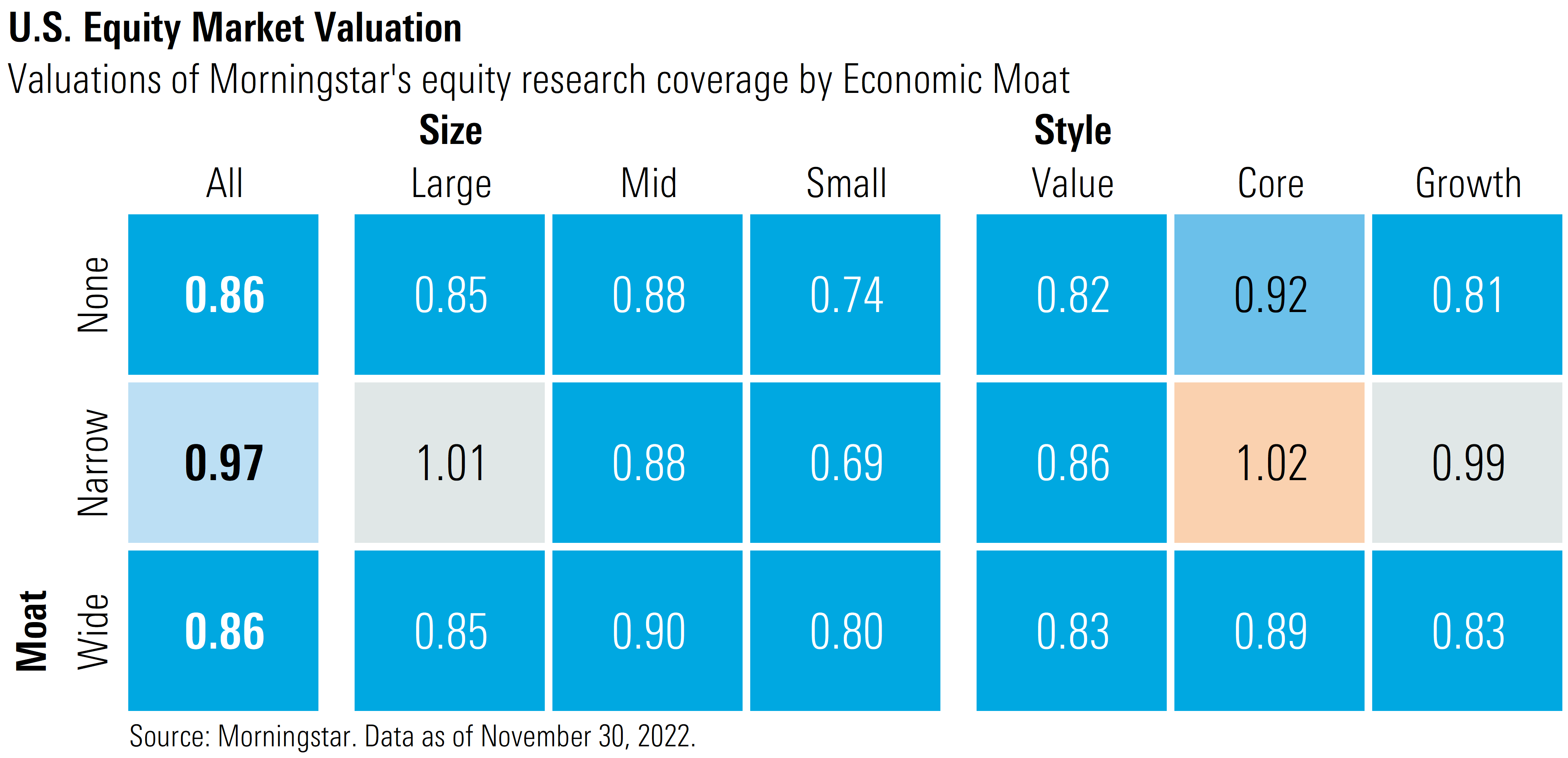

Breaking our valuations down by the Morningstar Style Box categories, investors appear best positioned with a barbell-shaped portfolio in which they overweight the growth and value categories and underweight core/blend category. Large- and mid-cap stocks remain near the broad market average, whereas small-cap stocks remain significantly undervalued.

Communications and Cyclical Sectors Stand Out as the Most Undervalued

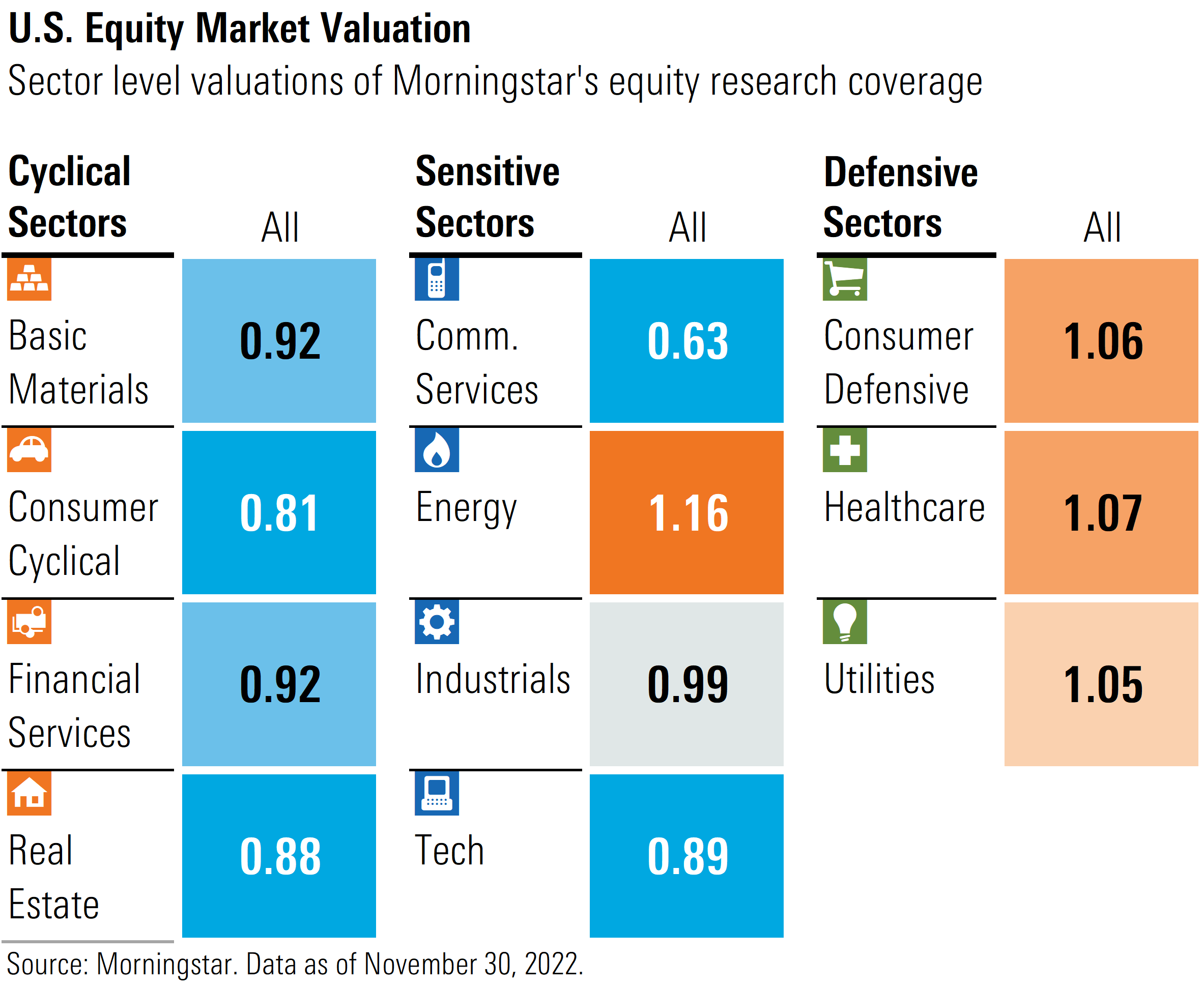

During November, sectors leading the upside included basic materials, which rose 11.68%, industrials with a 7.22% increase, and a 6.94% gain across utilities. Among the lagging sectors, energy only rose 1.42%, and consumer cyclical increased only 2.77%. We continue to see the best opportunities in the communications and cyclical sectors, whereas the defensive sectors are trading at premiums over our fair values.

Energy

Across our sector coverage, we continue to recommend exercising caution in the energy sector. While energy was the most undervalued sector coming into the year, it has registered a 69% gain thus far in 2022 and is now trading well into overvalued territory at a 16% premium over our fair value.

Consumer Cyclical

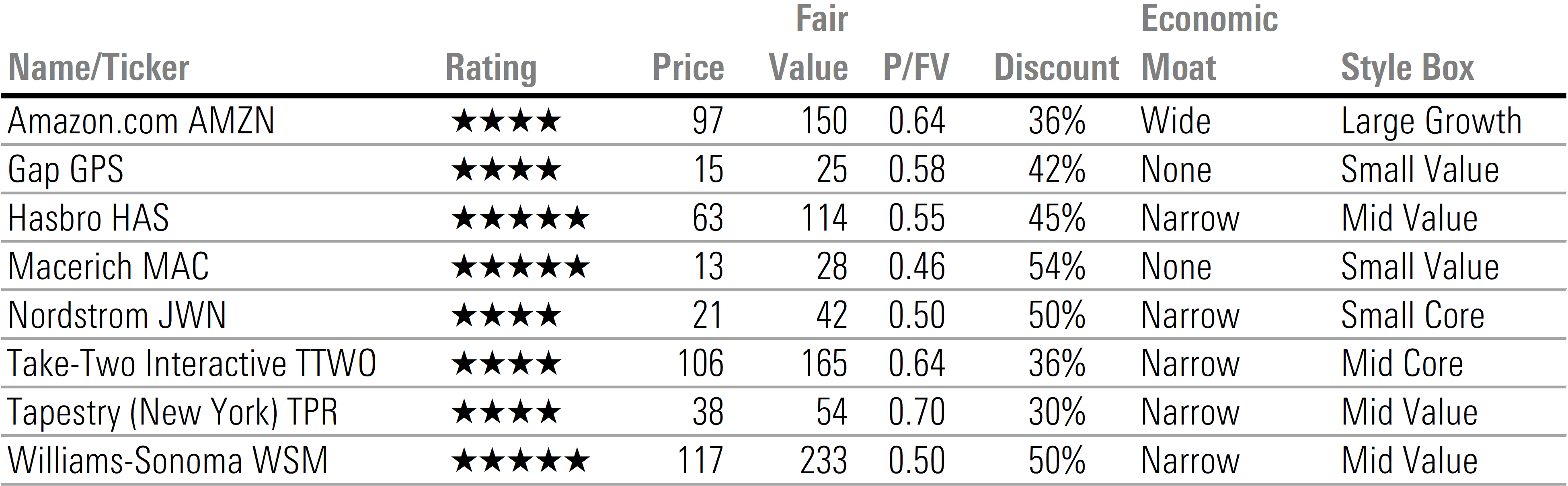

Among the more undervalued sectors, we continue to think that the market is overly pessimistic regarding the long-term prospects for the consumer cyclical sector. While we agree that the sector has been under fundamental pressure in the short term, we think the current valuations more than capture this weakness and are overextrapolating lower growth and tight margins too far into the future.

For example, between a shift in consumer spending to services, high inflation, and lagging wage growth, we forecast fourth-quarter total modified retail sales will only rise 3.2% this year as compared with last year. Modified retail sales is how we measure goods that are subject to holiday sales, bought either in a physical store or online. (This metric excludes categories such as automobiles, fuel, building materials, and groceries.) Yet, with stocks for many retailers down in some cases more than double the market’s decline, we are finding a lot of undervalued opportunities in stocks that are leveraged to holiday sales. Examples include:

Technology

Coming into 2022, we noted that technology was one of the more overvalued sectors. Yet, after falling 25.29% for the year to date, well in excess of the broader market’s decline of 14.39%, we think the pendulum has swung too far and that the sector is attractive for long-term investors.

Based on our valuations, we think long-term investors should have a full to overweight position in the technology sector as it is trading at a slightly greater discount to fair value than the overall market. However, we caution that technology stocks may remain under pressure in the short term as we forecast the U.S. economy will be relatively stagnant in the first half of 2023. Semiconductor stocks may be especially volatile; the sector is facing a choppy operating environment as the industry moves to rightsize its production levels in the face of changing demand.

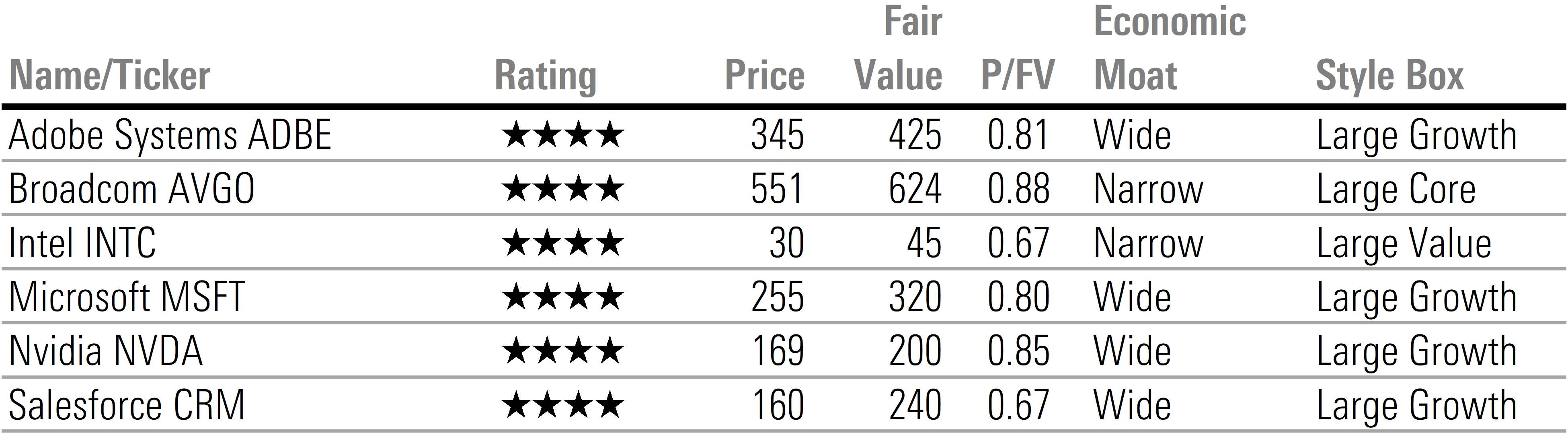

Across the technology sector, we see numerous stocks that are significantly undervalued with Morningstar Ratings of 4 or 5 stars. (We use a star rating scale between 1 and 5 stars. One-star-rated stocks are those that we view as most overvalued, and 5-star stocks are those that are most undervalued.) Examples include:

Wide-Moat Stocks Remain Significantly Undervalued

In a volatile environment such as today’s, we think investors should focus on those companies that have an economic moat. Companies with Morningstar Economic Moat Ratings are those that we deem to exhibit long-term, durable competitive advantages that will allow them to generate excess returns over the long term. These are the types of companies that we think will be best positioned to weather any short-term economic disruptions, to quickly pass-through inflationary cost increases in order to maintain their margins, and to take advantage of the next economic upcycle.

Tesla Drops Into 4-Star Territory

Tesla’s TSLA stock has plunged from its year-ago peak. On Nov. 4, 2021, the stock traded at an 80% premium to our fair value estimate, and we rated the stock at 1 star, indicating we thought it was extremely overvalued. Now that the stock has sold off 55% from that peak, it has moved to 4 stars, meaning we think the stock is now undervalued. This is just one example of many that we have seen within the span of a year. We think the market has gone from being overly optimistic regarding its long-term prospects to now being overly pessimistic.

Headwinds Beginning to Abate, but Any Deviation Will Drive Volatility

While we think equities remain undervalued, we expect heightened volatility over the foreseeable future. In order to continue their rally back to fair value, we think the markets will be looking for indications that economic growth is accelerating and for further data that inflation has peaked and remains on a downward trajectory.

Looking forward, the four headwinds we identified at beginning of the year are still constraints on the market, although indications appear that these headwinds are beginning to abate. Over the foreseeable future, we expect:

1. Gross domestic product will be sluggish in the first half of 2023 but will accelerate in the second half.

2. The Federal Reserve will conclude tightening monetary policy in early 2023 and begin easing by the end of 2023.

3. The preponderance of rising long-term rates has already occurred.

4. Inflation to moderate over the next few months and subside to an annual average rate of 2.9% in 2023.

Over the next few months, any economic metrics that signal the economy is heading into a recession or data that indicate a resumption in inflation could send the markets reeling.

Before such volatility may return, now is a good time for investors to revisit their portfolio allocations and investments to confirm that their current allocations balance their long-term investment goals with their risk tolerances.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)