A Harder Landing for the U.S. Economy Now Looks More Likely

Recession in 2023 now looks like a coin-flip probability as the Fed’s war against inflation continues to escalate.

The latest economic and market data point toward a bumpier path for the U.S. economy in the near term. Inflation has remained stubbornly high, while economic activity continues to trend up. This points to a more aggressive stance from the Federal Reserve, which has led interest rates to soar higher. In turn, higher interest rates will lead to weaker gross domestic product growth in 2023 than we previously expected.

A recession now looks like a 50% likelihood between now and the end of 2023. Still, we’ve consistently argued that the binary question “Will there be a recession?” misses the point; any recession should be relatively mild and short-lived, in our view. Either way, we expect growth to accelerate again in 2024 as the Fed lifts off the brakes and pivots to monetary easing.

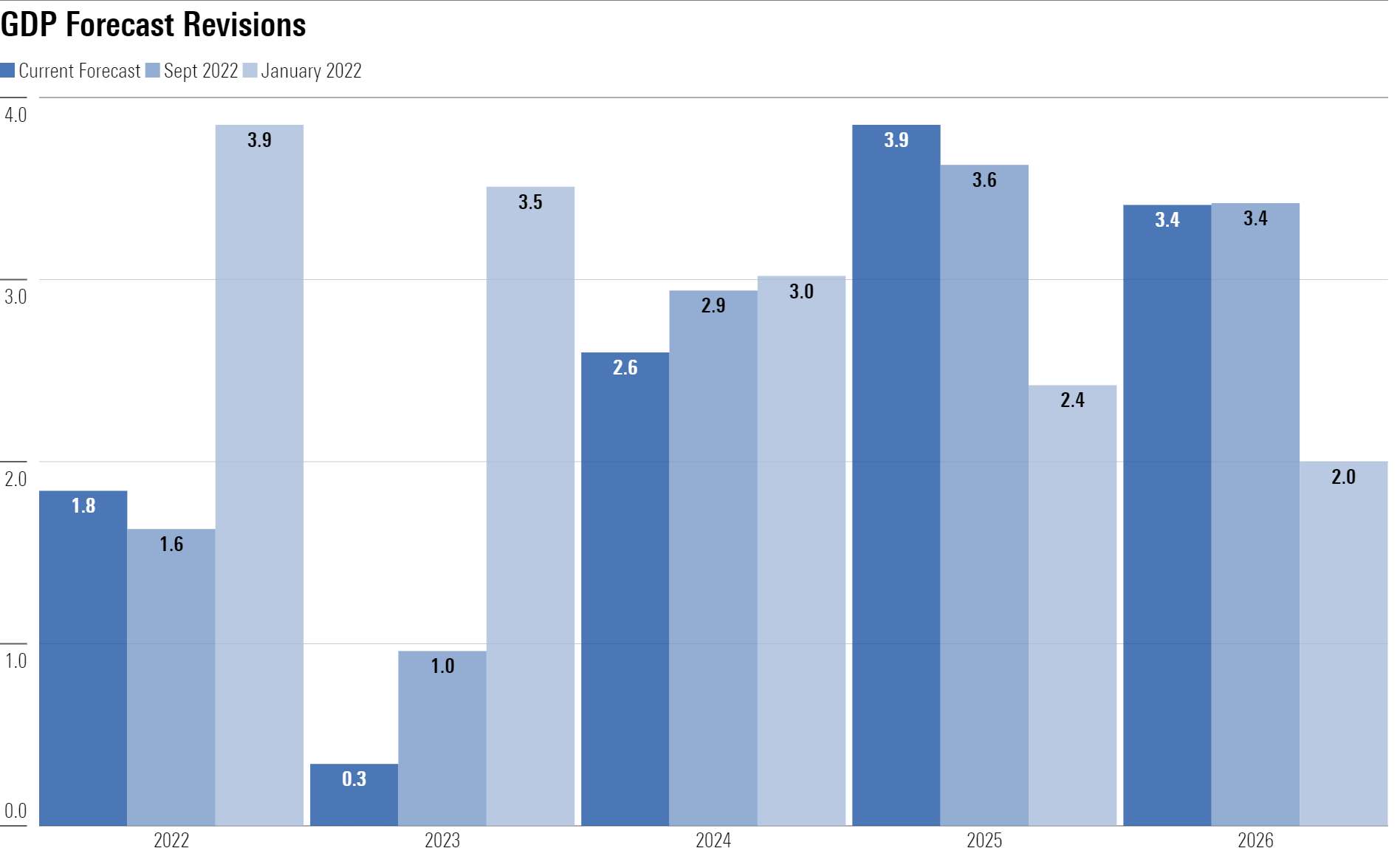

We Expect GDP Growth to Trough in 2023 and Then Accelerate in 2024

Since our last update, we’ve reduced our 2023 and 2024 GDP forecasts owing to our increased expectations of Fed interest rate hikes. We now expect a 2023 average federal-funds rate of 4% compared with 3.15% previously. Higher interest rates (including surging mortgage rates) will continue to batter a housing market already in steep decline, among other areas of impact.

We expect GDP growth to accelerate in 2024 as the Fed starts cutting rates in order to stimulate demand. Once inflation comes under control, the Fed will shift focus to shoring up economic growth.

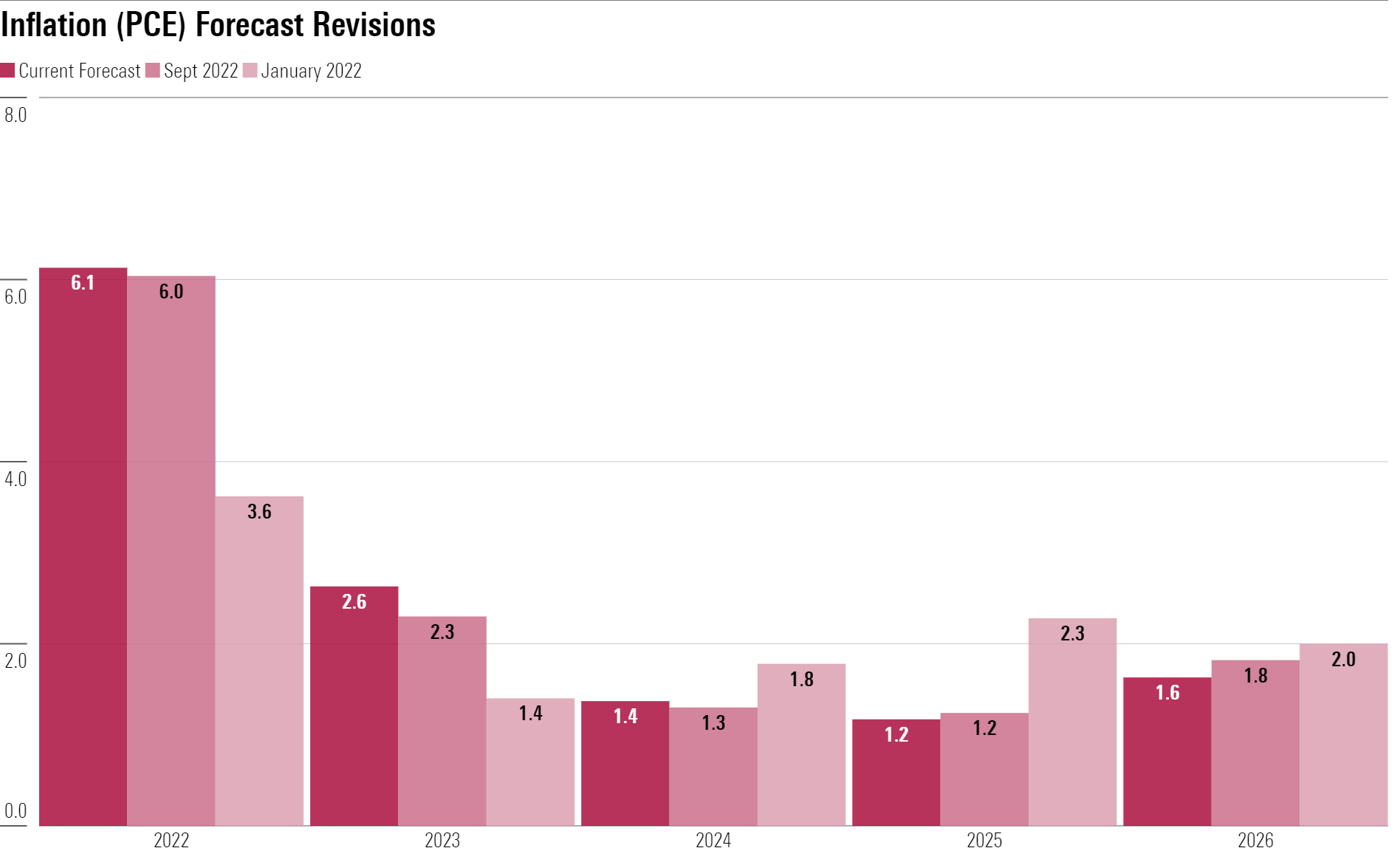

Inflation Still Expected to Return to Normal in 2023

High inflation has proved stickier than expected in recent months, so we’ve increased our 2023 inflation forecast, as measured by the Personal Consumption Expenditures Price Index. Still, we expect inflation to come down dramatically in 2023 and even undershoot the Fed’s 2% inflation target by 2024. The Fed’s hawkish response means that inflation will still come under control, though at greater cost to near-term economic activity. The resolution of supply chain issues will go a long way to bringing down inflation.

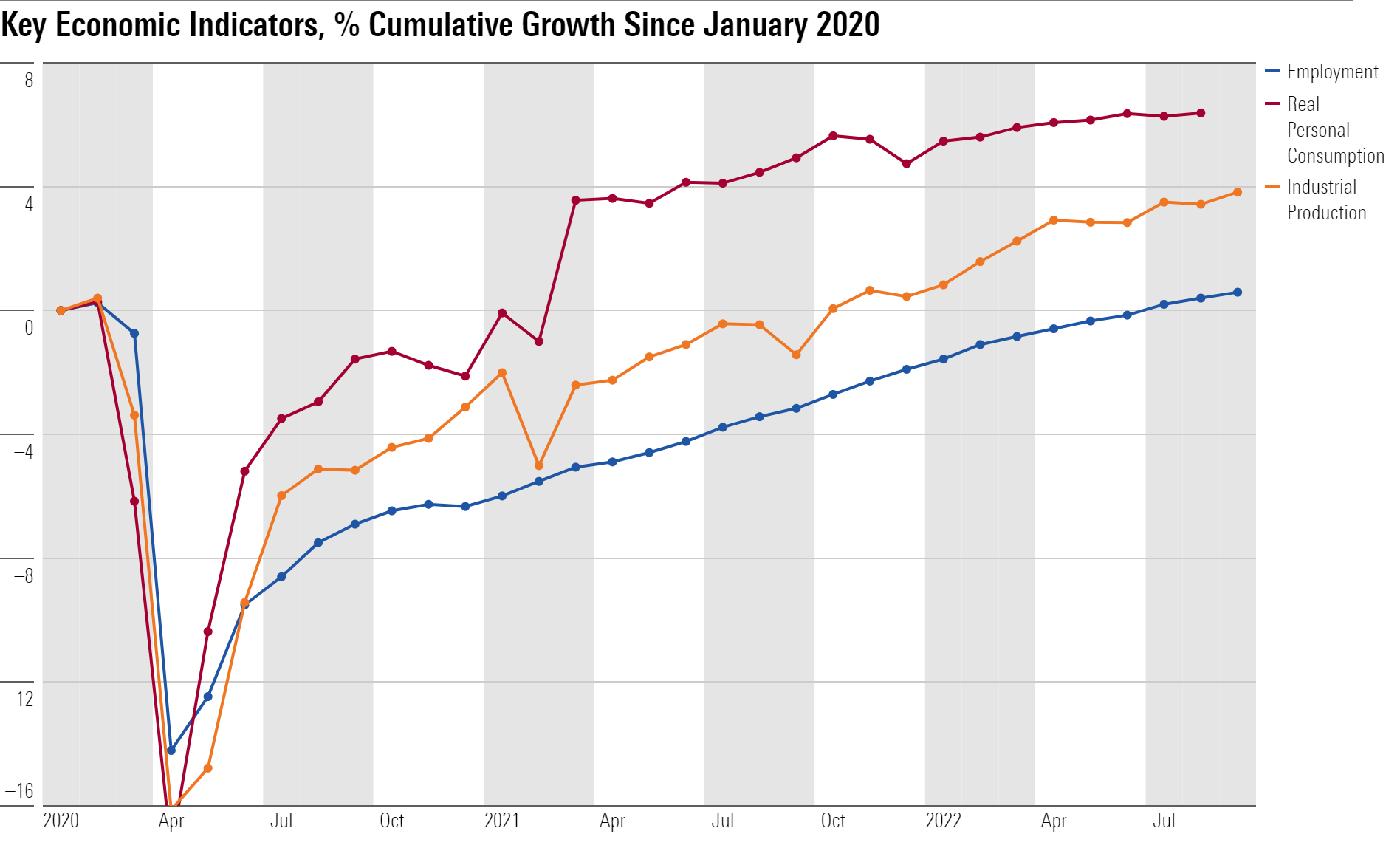

The Latest Data Shows No Signs of a Recession—Yet

The U.S. economy is still showing no signs of contracting, with employment, real consumption, and industrial production all still trending up through September as in the first half of the year. The slight drop in real GDP in the first half of 2022 was driven by the noisiest components of GDP (inventories and net exports) and very likely did not constitute a genuine economic slowdown.

A recession has certainly not occurred yet. This shouldn’t be surprising, given the usual lag between monetary tightening and its impact on economic activity. Headwinds to growth will peak in 2023, when the effect of Fed tightening crests.

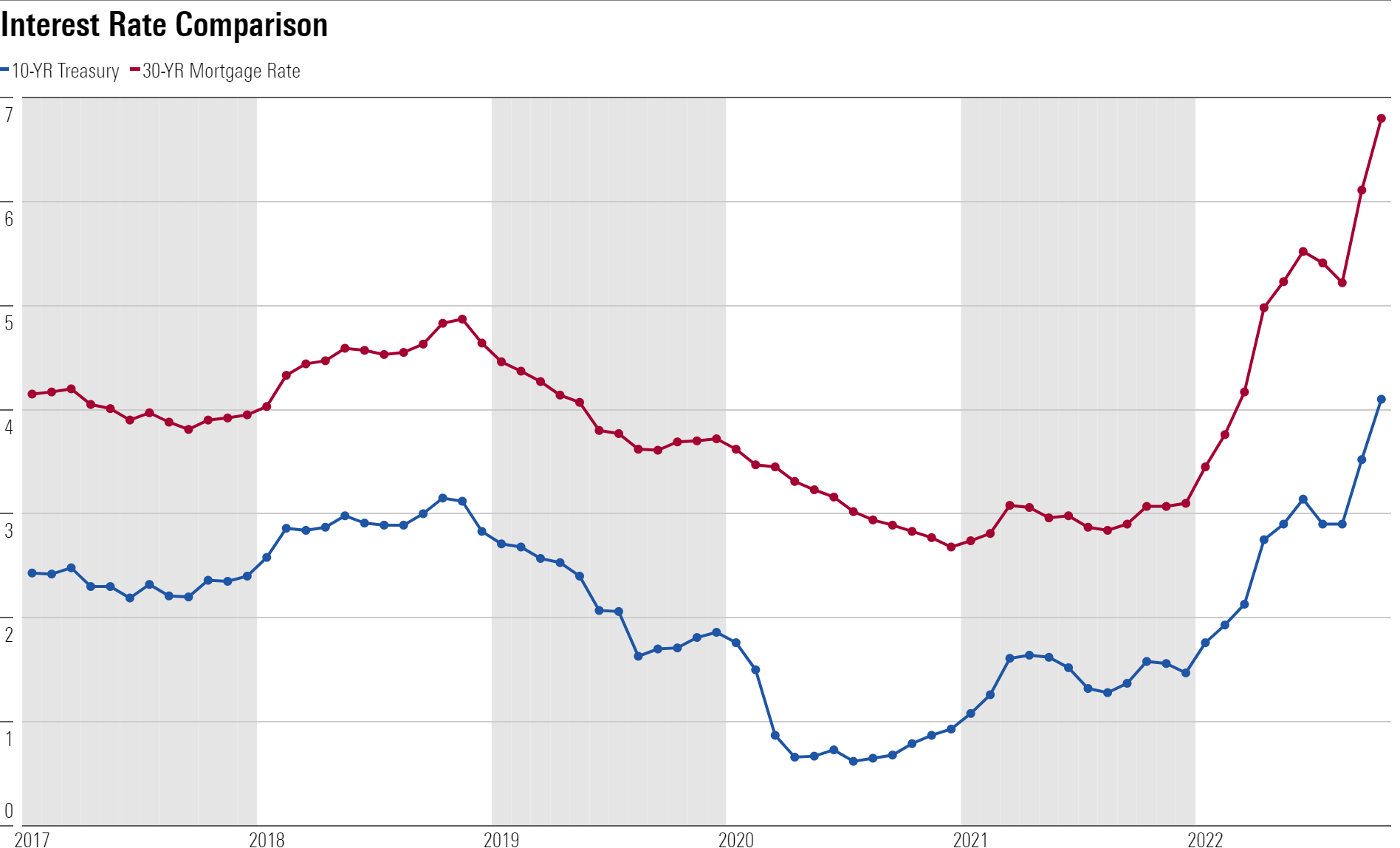

Interest Rates Have Continued to Soar Higher

Stubbornly high inflation means the Fed will continue to hike interest rates at a fast pace through the end of 2023. Accordingly, bond yields have continued to soar higher. The 10-year U.S. Treasury yield has jumped about 0.5% over the past month. The 30-year mortgage rate has jumped around 1% to 6.9% as of Oct. 20—its highest level in almost two decades.

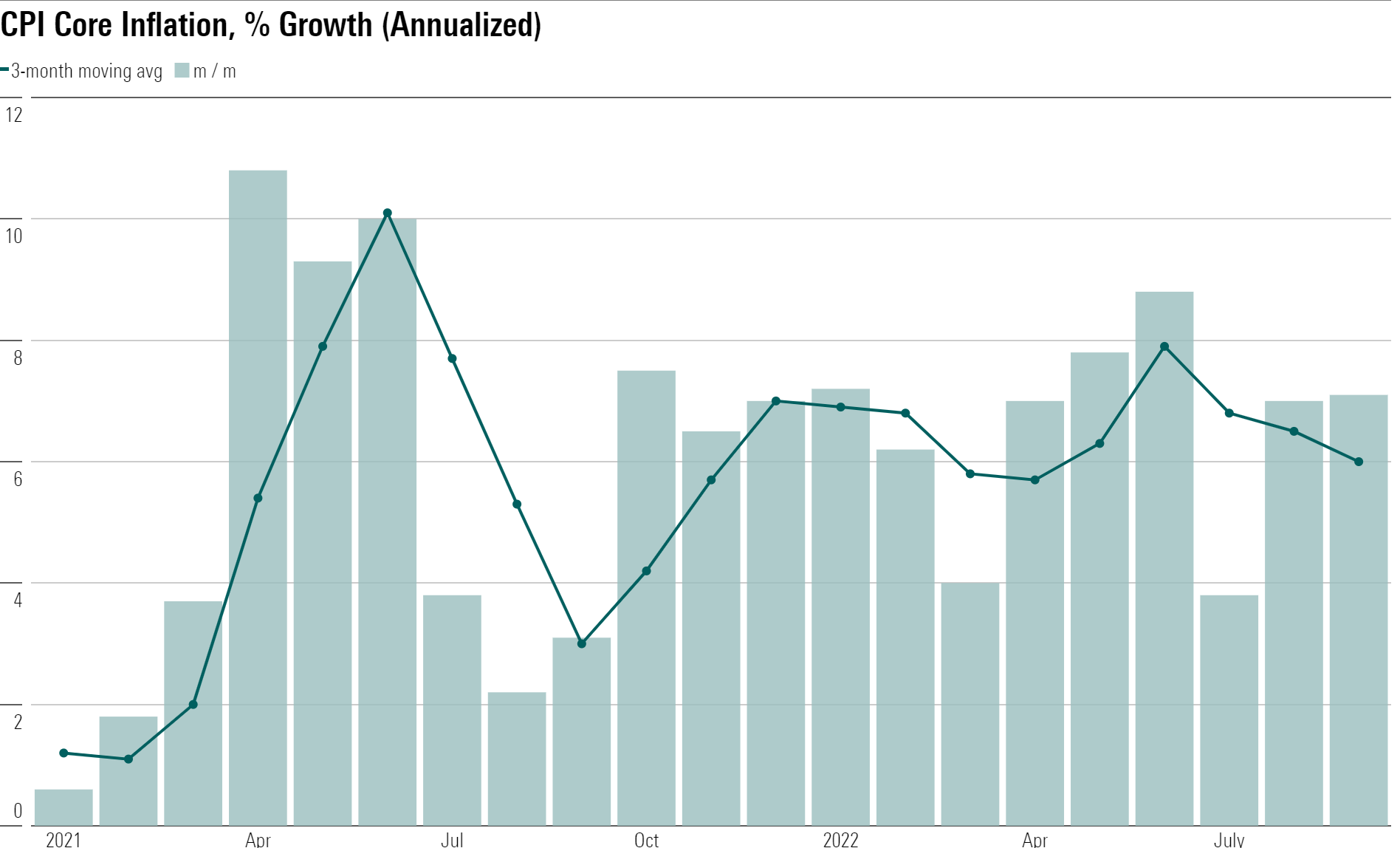

Inflation Still High for Now, but Relief Should Be on the Way

Core inflation (in terms of the Consumer Price Index) has averaged around 6% to 7% annualized since the start of 2022, thus far defying hopes that easing supply constraints and Fed tightening would begin to push inflation down. This has been the primary driver of soaring expectations for rate hikes, along with falling asset prices in recent months. Core inflation (which strips out food and energy from the overall index) is held to be a better predictor of underlying inflationary pressure in the economy than the overall number.

Among the components of core CPI inflation, goods prices have started to move lower as supply chain issues resolve. This factor has much more room to run and should continue to push inflation down through 2023.

On the other hand, shelter (housing) inflation has continued to accelerate. Shelter inflation responds with a lag compared with leading-edge data on housing and rent prices, so it’s not time to panic. The incipient housing downturn should cause shelter inflation to start falling in 2023.

Cooling Labor Demand Will Help to Relieve High Inflation

Private hourly wage growth has averaged just 4.4% in the last three months. This is consistent with inflation running only about 3%—far lower than the recent 6% average for core CPI. Thus, the impact of tight labor markets is fading as a driver of high inflation.

Furthermore, labor markets should loosen substantially over the next year as labor demand falls. Employers will taper off their hiring to match the slowdown in economic activity. We see an early sign of this in the recent drop in the job openings rate (total job openings divided by total employment).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)