Has Holding Cash Helped Equity Fund Managers?

Holding more cash can be a tactical decision as managers wait for deals.

In a volatile year for stocks, equity fund managers are increasingly sticking with cash.

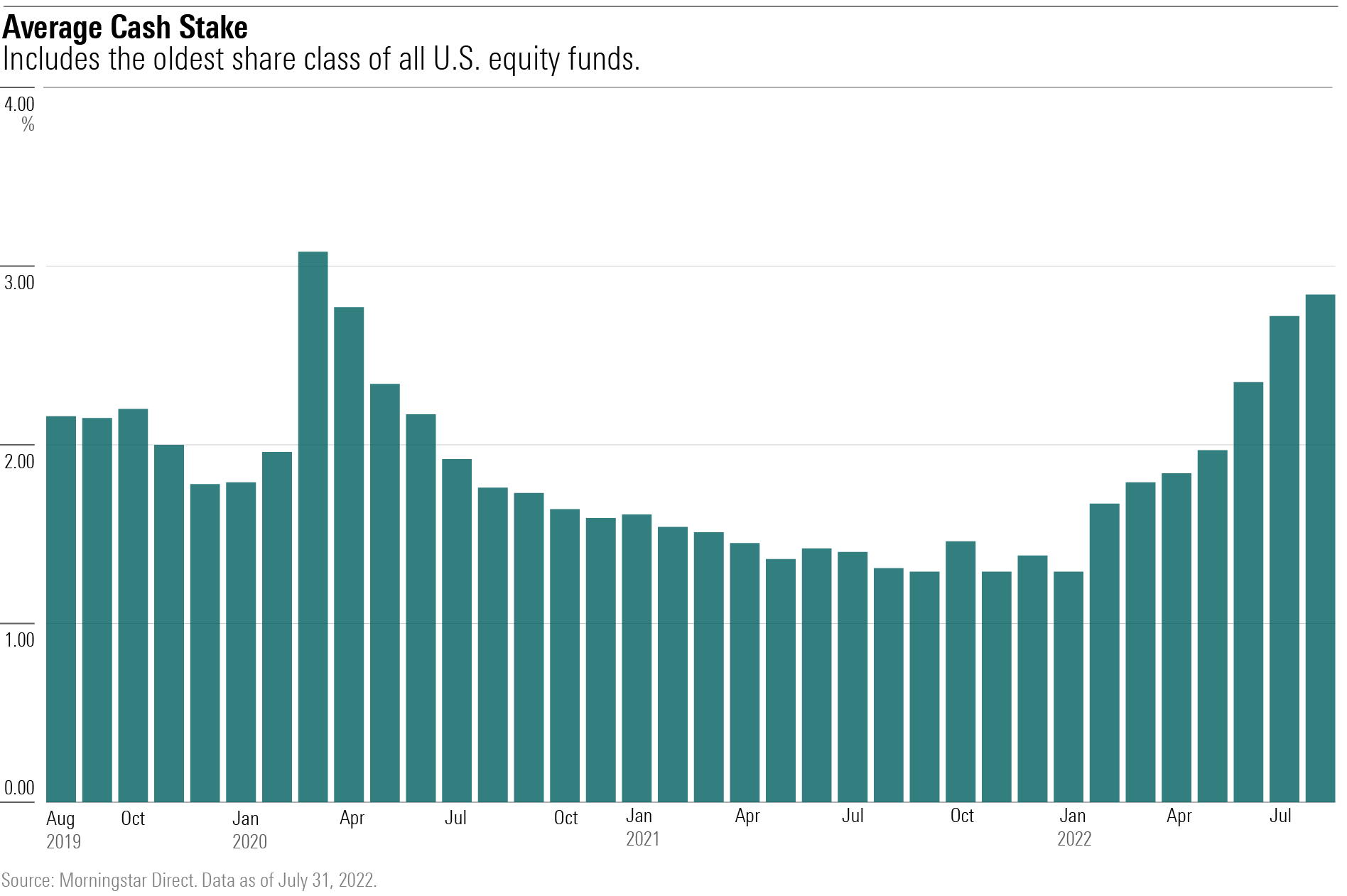

Of the 415 U.S. equity funds covered by Morningstar, 63% have increased their cash allocation since the end of last year. In July 2022, equity funds reported their highest average cash level since March 2020, and before that, since February 2016.

Managers may be responding to a volatile market that has sent major stock indexes down 10% or more this year.

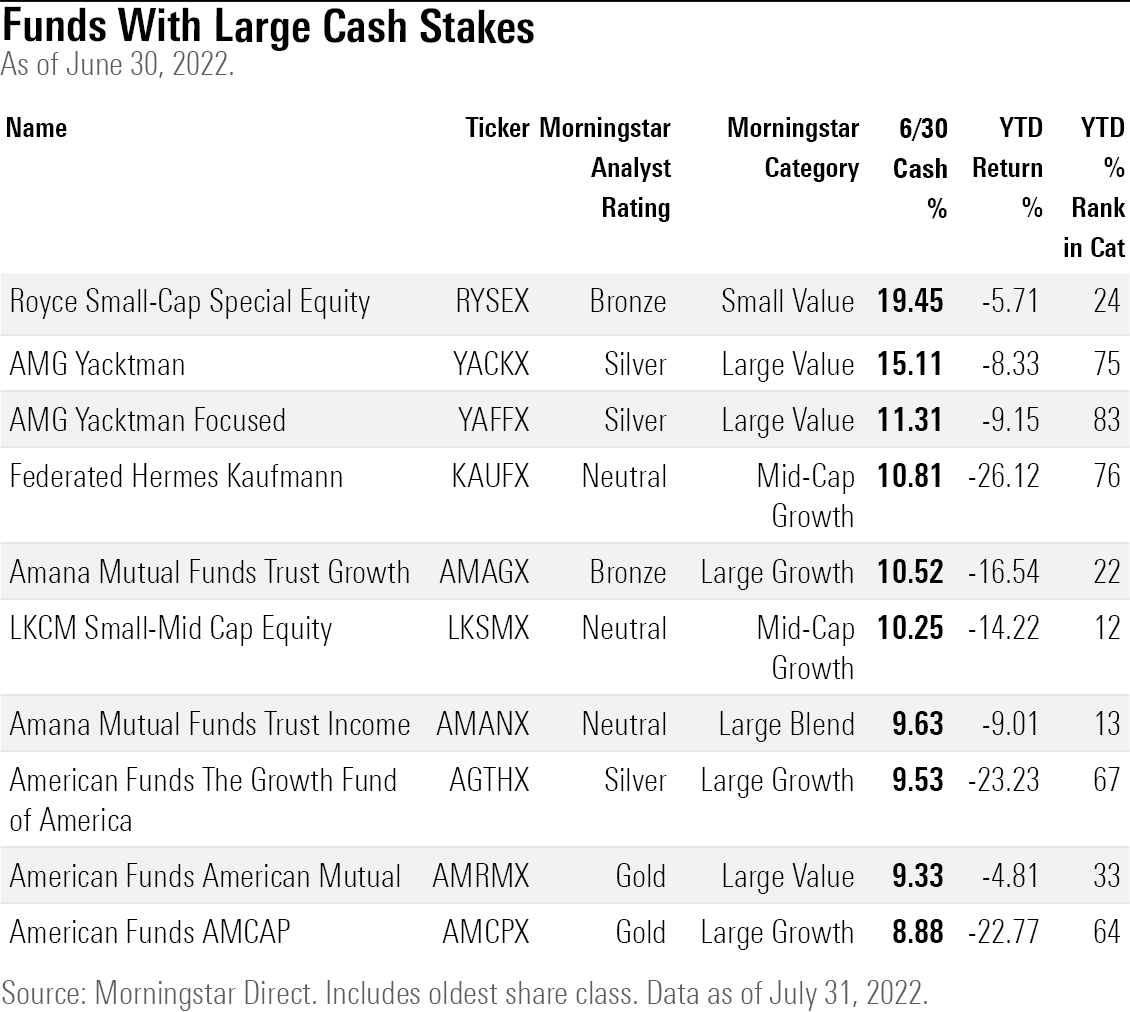

One of the largest mutual funds has increased its cash stake the quickest. The $220 billion American Funds Growth Fund of America AGTHX increased its cash allocation from 3.3% of the portfolio at the end of 2021 to 9.5% as of June 30. Its current level is its highest since June 2010. Morningstar analyst Stephen Welch writes that the "fund's cash stake has typically been less than 7% of assets the past five years but has risen to roughly 15% during periods of market stress." Market uncertainty may be causing managers to keep cash on the side more than before, he says.

The average U.S. equity fund held 2.84% of its portfolio in cash as of July 31, according to Morningstar data, up from 1.29% at the end of 2021. This figure hovered around 1.87% the past five years, most dramatically spiking in March 2020, to 3.08%.

Holding cash can be a benefit when markets are going down, but keeping cash on the sidelines can be a burden on performance when markets are rising unless managers are effective at putting it to work, says Tony Thomas, associate director of equity strategies for Morningstar.

Holding more cash can be a tactical decision as some managers like to wait for good deals, though both redemptions and inflows also can affect a fund’s cash level, Thomas adds.

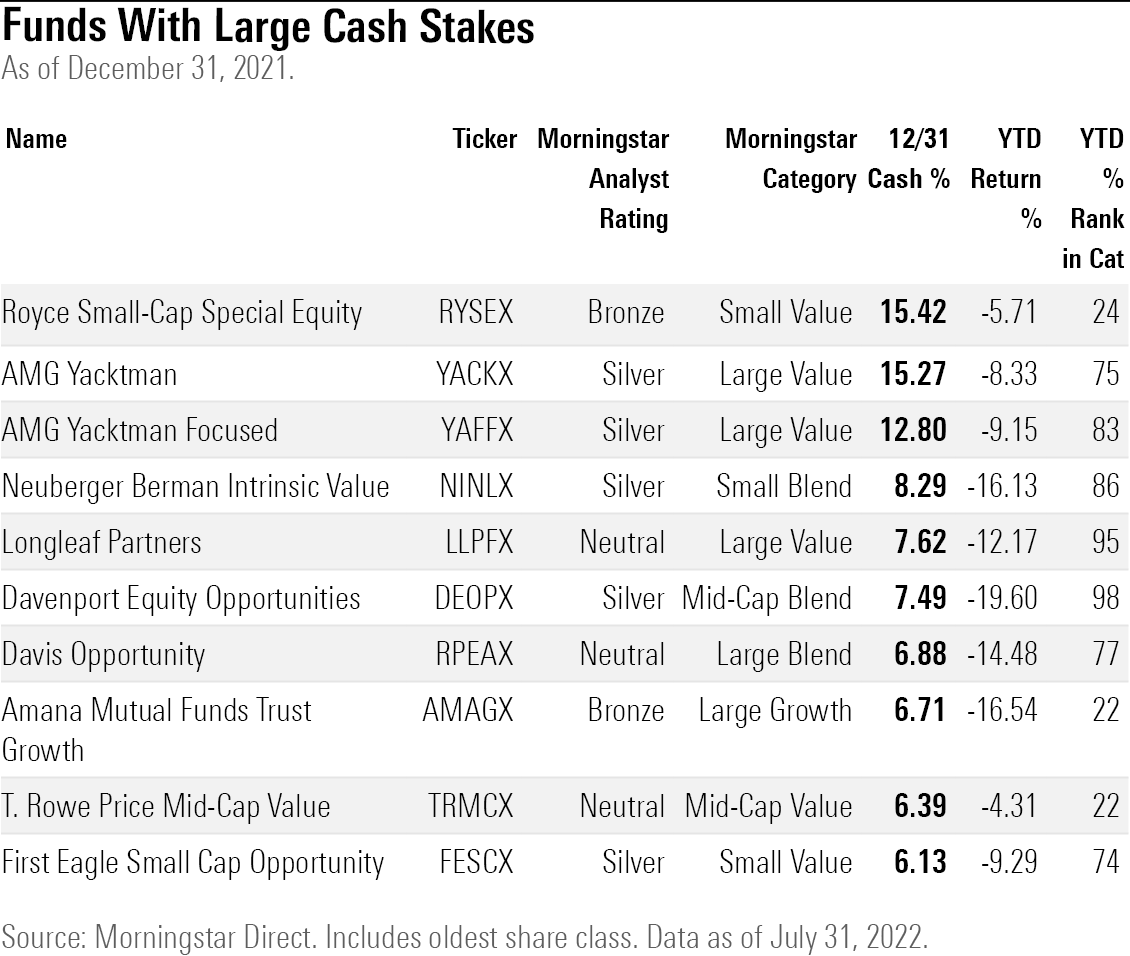

Among funds that held the largest cash stakes at the beginning of the year, year-to-date performance is mixed.

Royce Small-Cap Special Equity RYSEX held 15.4% of its portfolio in cash at the start of the year. Its large cash stake seems to have had a positive effect on the fund this year, along with the industrials and communication-services sectors, according to Morningstar Direct. The fund was down only 5.71% year to date through July compared with the average small-value fund's 7.74% drop.

However, as stocks have rallied the past four weeks, it has lagged and now ranks in the 64th percentile year to date. Managers have continued to put more cash on the sidelines, allocating another 4% of the fund to cash as of June 30. Thomas writes that the "managers will allow cash to build when they can't find enough ideas that meet their stringent quality and valuation standards."

For AMG Yacktman YACKX, it wasn't the first time the managers turned to cash, but its sizable cash stake of 15.3% hasn't prevented the fund from dropping 8.5% this year, putting it in the 75th percentile of the large-value Morningstar Category.

In 2020, managers Stephen Yacktman and Jason Subotky executed their "defense to offense" playbook in a steep selloff. "Entering that period with a 25% cash stake helped the fund lose 8 percentage points less than the Russell 1000 Value benchmark through the market's March 23 trough," writes Morningstar senior analyst Adam Sabban.

Multiple managers have quickly moved into cash this year. Federated Hermes Kaufmann KAUFX increased its cash stake by 7.7 percentage points from the start of the year to 10.8% of the fund. In his analysis of the fund, Thomas writes that "lead managers Hans Utsch and John Ettinger sometimes raise cash in times of uncertainty, but the sector managers might also hold cash if they can't find the right opportunities."

The portfolio's cash stake can fluctuate. "It was as high as 23% in June 2019 but was just 1% in June 2021," Thomas says.

A pair of Fidelity funds went from holding less than 1% in cash to now dedicating more than 5% to cash. Fidelity Mid-Cap Stock FMCSX now holds a 6.76% cash allocation, and Fidelity Equity-Income FEQIX holds a 5.56% stake.

Amana Growth AMAGX upped exposure to cash by 5 percentage points in the first six months of 2022 to put its total stake at 10.52%, one of the largest allocations to cash in the large-growth category. Cash was one of the few sectors to contribute positively to the fund's year-to-date decline of 16.5%, which still put the fund in the 22nd percentile in the category.

The fund's cash allocation is still relatively light compared with previous periods. Morningstar senior analyst David Kathman writes, "The portfolio's cash stake peaked at more than 30% in late 2008 and was one of the reasons it held up so well in that brutal bear market."

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)