Volatility Sparks Investor Exit From Stock Funds

Record monthly outflows hit stock funds in April, but overall investors are staying put for now.

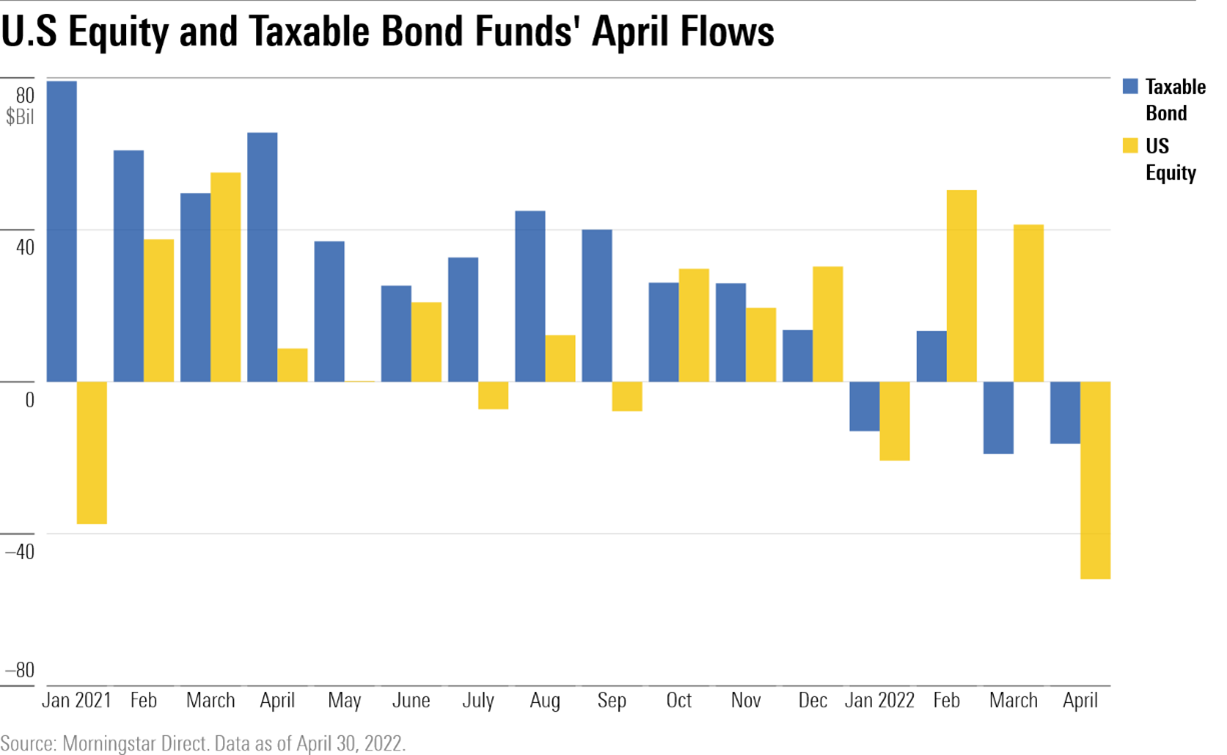

It seems this year's market volatility finally started to get the attention of fund investors in April. While that upheaval was inflicting losses on the holders of stocks and bonds for months, fund investors had been largely patient in sticking with their holdings through the first quarter. That appears to have ended in April as investors decided it was time to take some of their chips off the table, pulling a record amount of cash from diversified U.S. stock funds.

About $51.9 billion exited from U.S. open-end and exchange-traded stock funds in April, the most on record for the group. That topped the $50.7 billion withdrawn from stock funds in August 2020.

However, when compared with the total amount of money invested in stock funds overall, April’s outflows amounted to a trickle, representing less than 0.5% of assets.

That suggests that at least for now the overwhelming amount of fund investors are staying the course.

In fact, outflows appear to have faded in May, although the trend is volatile. Through May 10, investors have moved $10 billion back into U.S. stock exchange-traded funds.

Investors also pulled $16.3 billion from taxable-bond funds in April, bringing year-to-date outflows from fixed income strategies to $34.9 billion. Bond investors are facing some of their worst losses in years with inflation at its highest levels in four decades and the Federal Reserve raising interest rates. However, those outflows are just a drop in the bucket: Year-to-date net withdrawals equal 1.3% of bond fund assets.

Investors Turn Tail on Growth Funds

Withdrawals were particularly large from growth stock funds, the corner of the market most damaged in the year's selloff. Investors pulled $10 billion from large growth funds in April, including $2.8 billion from the $165.9 billion Invesco QQQ Trust QQQ, and $1.3 billion from the $110.5 billion Fidelity Contrafund FCNTX.

The one notable exception is the battered Ark Innovation ETF ARKK. It is down 57% this year, but has seen inflows of $305 million.

Large value funds, which have been relatively buoyant during the selloff, added $2.1 billion in April. Investors have also hung in with international equity funds. Flows were flat in April and the group has taken in $41 billion this year. Both alternative and commodity fund flows were also positive in April. Among sectors, defensive and natural resources were popular, while investors sold out of financials.

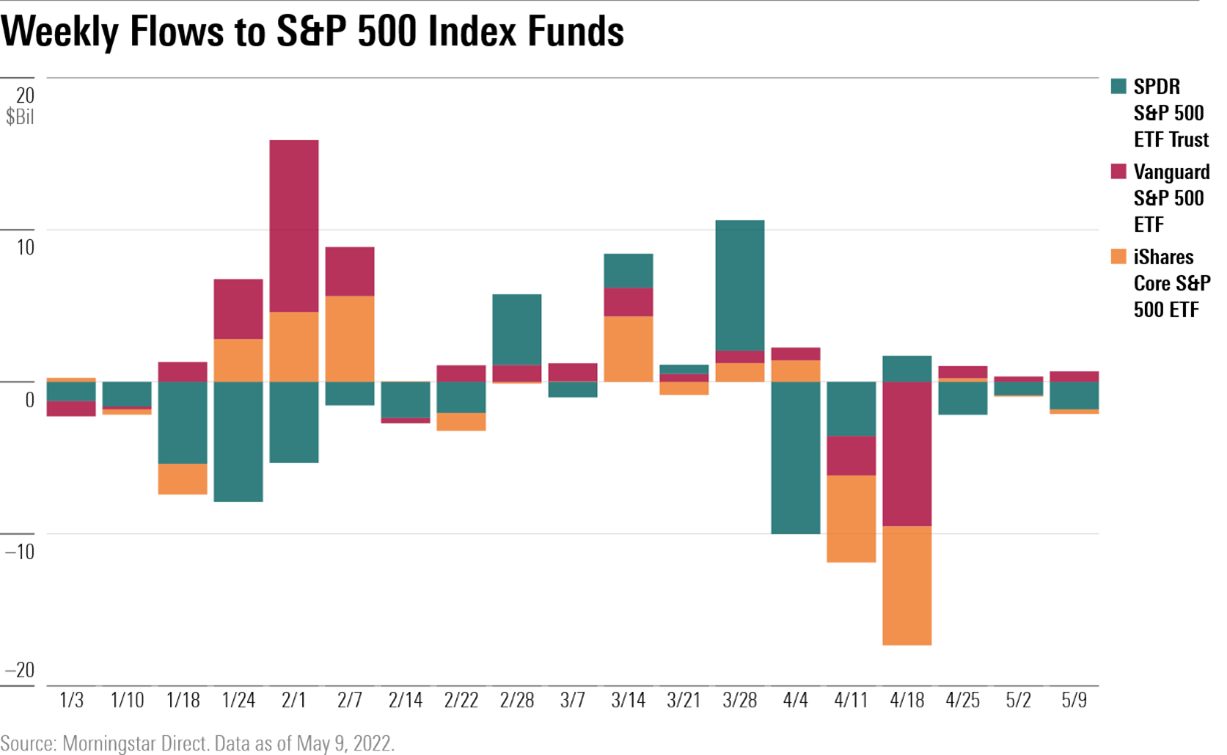

The shift in sentiment built over the course of April as stocks began a new downleg, having stabilized in late March from the selloff that began the year. SPDR S&P 500 ETF SPY, iShares Core S&P 500 ETF IVV, and Vanguard S&P 500 ETF VOO each saw more than $10 billion of outflows in

. However, these outflows represent just 3% of assets for each of the funds.

Small Outflows From Bond Funds

After years of steady inflows, investors continue the more recent trend of cashing out of bond funds in April, but amounts are relatively small. Intermediate core-plus bond funds, registered $8.7 billion of outflows. Short-term and high-yield bond funds also saw large outflows. Pimco Short-term Bond fund PTSHX alone saw $2 billion leave.

Still, not all groups of taxable-bond funds saw outflows. Investors on net purchased intermediate core bond funds, the building block for many investors’ portfolios. Intermediate and long government bond fund categories each took in $3 billion of new money.

Bank loan funds, often used as a hedge against rising interest rates, experienced $5.2 billion of inflows.

Municipal bond funds have experienced the steepest outflows of any category this year. Nearly $23 billion exited the category in April, bringing year-to-date outflows to $47.3 billion.

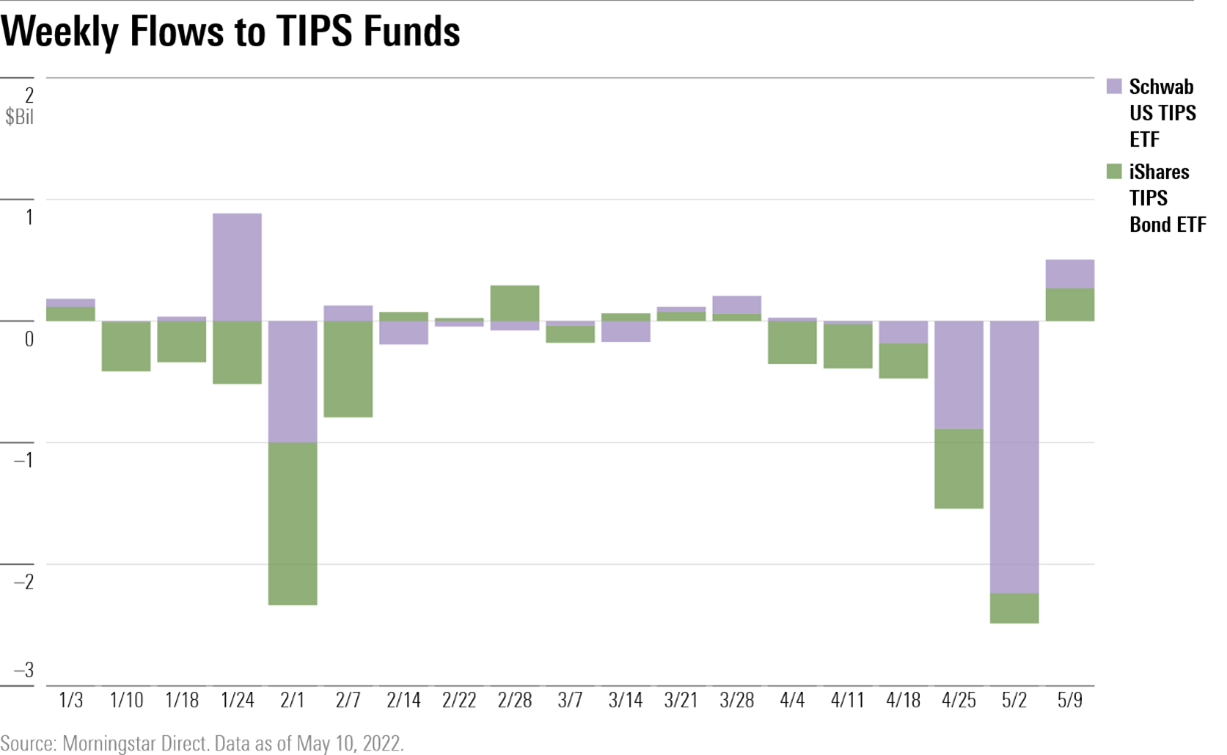

In recent weeks, investors began hitting the sell button in inflation-protected bond ETFs. The performance of Treasury Inflation-Protected Securities, also known as TIPS, has been volatile in 2022 after strong returns last year. Investors pulled out a net $1.4 billion in the last week of April and another $2.2 billion the first week of May.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)