Inflation-Protected Bond Funds’ Wild Ride Continues

In a volatile market, TIPS funds are down but still performing better than most bond funds.

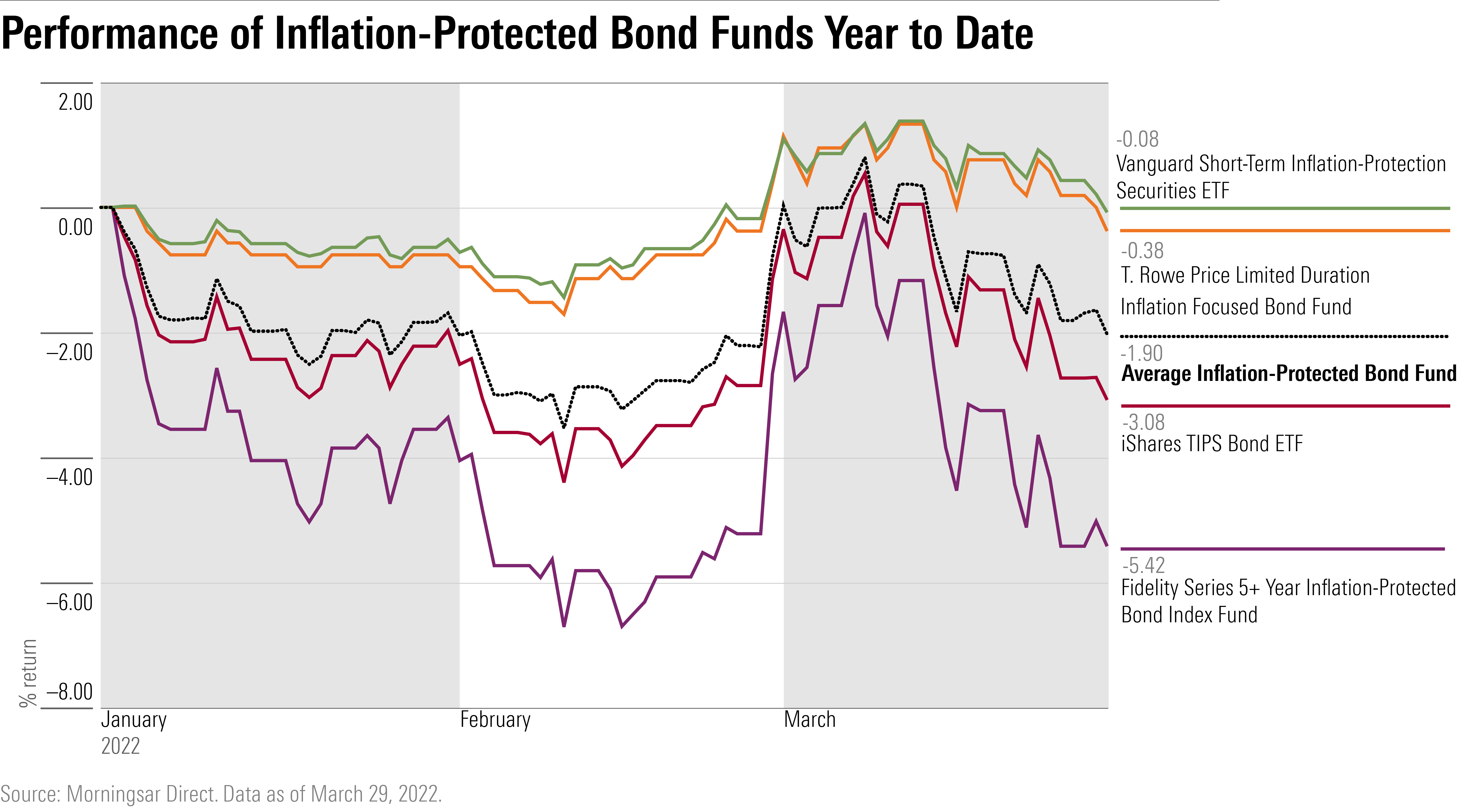

It has been a volatile start to the year for inflation-protected bond funds, and while most are posting losses, they’ve still proven to be a haven for bond investors.

Heading into 2022, funds focused on Treasury Inflation-Protected Securities--or TIPS--were top performers as worries about inflation surged. Then as the Federal Reserve shifted into inflation fighting mode, those fears began to fade, cooling TIPS fund performance.

After oil prices surged in the wake of Russia’s invasion of Ukraine, inflation-protected bond funds are again providing investors an offset to losses elsewhere in the bond market. Since Feb. 10, the average inflation protected bond fund has risen 1.21%, while the average intermediate core bond fund fell 3.95%.

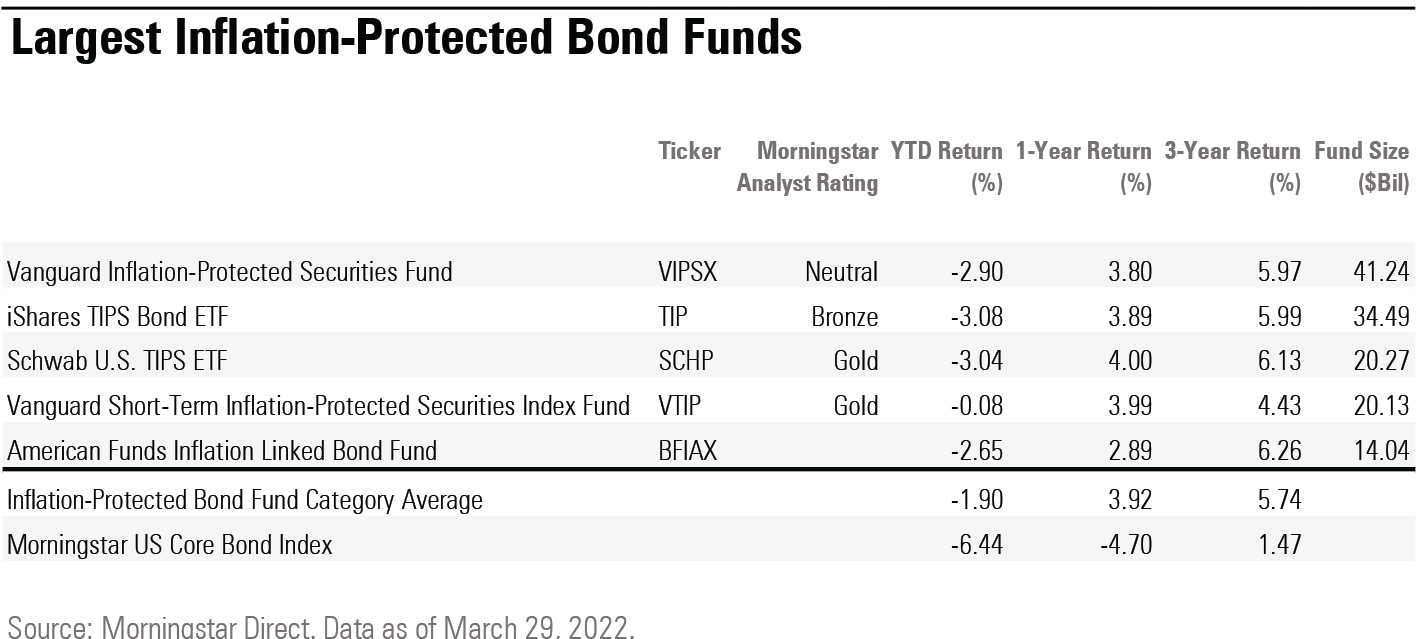

The average TIPS fund is still posting a 1.9% loss on the year. Two of the biggest funds, Vanguard Inflation-Protected Securities VIPSX and iShares Bond ETF TIP, are down roughly 3% in 2022. But those returns are far better than the losses on traditional fund funds. The average intermediate core bond fund, for example, has lost 6.4% so far this year.

This back and forth highlights the complicated mechanics of investing in inflation-protected bond funds at a time of a sharp spike in inflation, big swings in oil prices, and rising interest rates.

“As you transition from a lower inflation to a higher inflation regime you would expect to see a lot of volatility and that’s what we’ve seen,” says Thanos Bardas, co-head of global investment-grade fixed income at Neuberger Berman. “Higher inflation brings higher volatility.”

How Do TIPS Funds Work?

The bonds underlying TIPS funds are designed to offer investors protection against rising inflation, and along the way perform better than a traditional bond during a time where inflation expectations are climbing.

Yields on traditional bonds factor in expected inflation, but with TIPS, the principal amount due to a holder of the bond is adjusted to reflect changes in the consumer price index. If the CPI climbs 5%, the amount investors receive will also rise by 5%. (You can find a fuller explanation of TIPS and TIPS mutual funds here.)

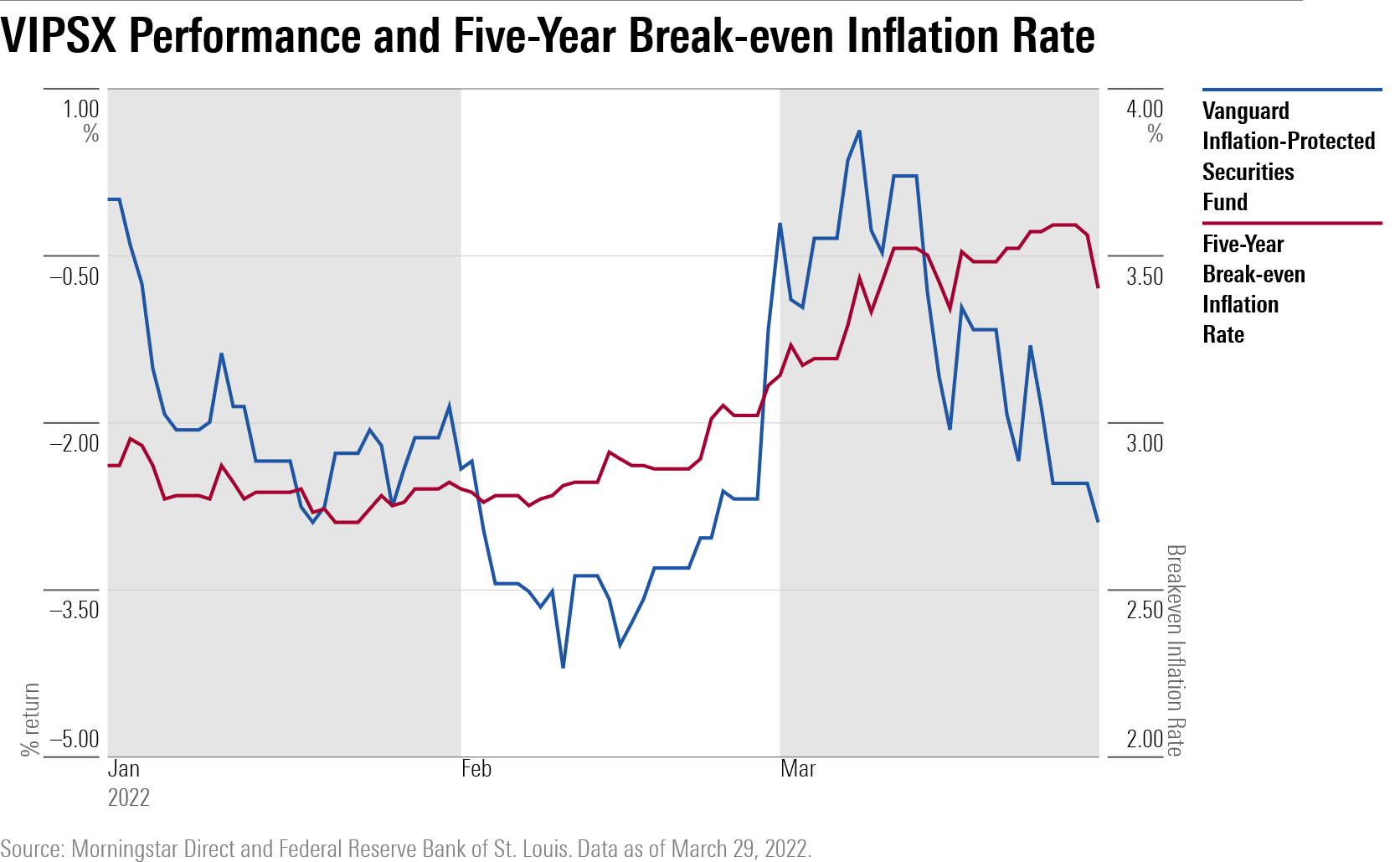

One of the key metrics for understanding performance of TIPS bonds and TIPS funds is the break-even rate. These rates are derived from comparing yields on a TIPS bond against the nominal bond of the same maturity. More simply, the break-even rate can be thought of as the market's expectation of future inflation over the life of the bonds. Most bond market players track break even rates for the coming five- and 10 year periods.

TIPS outperform normal treasury securities when inflation is trending higher than expected and inflation expectations are rising, as was the case in 2021. As explored here, the dynamic shifted earlier this year as the Fed signaled a more aggressive approach to fighting inflation, and it’s been a back-and-forth story for TIPS performance ever since.

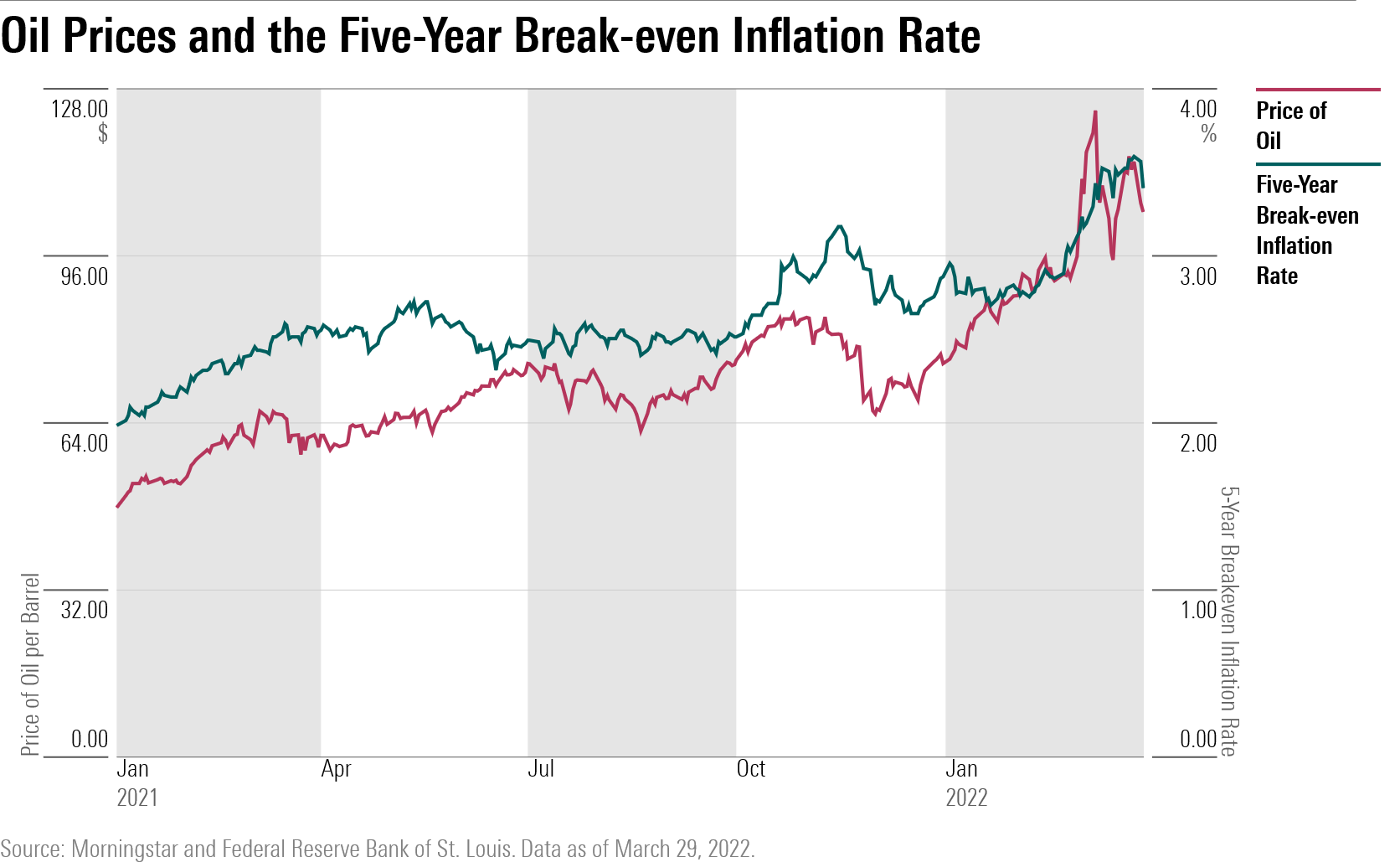

With inflation expectations on the rise after Russia’s attack on Ukraine, in part because of the jump in oil prices, TIPS performance improved. But as investors shifted toward expecting the Fed to raise rates higher and faster, TIPS fund performance has cooled off.

With the latest move in the market, the five-year break-even inflation rate has dipped to 3.4% from 3.59% hit March 25, which is the highest level on record, according to the St. Louis Federal Reserve's database. The five-year break-even rate was 2.87% at the start of the year.

Neuberger’s Bradas says that as inflation expectations rose north of 2% volatility in the TIPS market has increased, and that’s especially the case lately. “Before it was a one-way trade where break evens were going up but now it’s more of a two-way trade where they can go down or they can go up,” he says.

One of the dynamics driving TIPS performance this year has been a greater-than-usual focus on oil prices, says Neuberger’s Bradas. That was particularly visible when oil prices moved over $100 after Russia invaded Ukraine. “Investors allocating to the asset class now should be aware of that relationship,” he says.

Even with negative returns, inflation protected bond funds are holding up better than most bond categories. The average intermediate-government fund is down 5.13% this year. Only ultrashort and bank loan bond fund categories are performing better than the inflation-protected bond category.

The negative returns on TIPS funds also reflect the big jump in Treasury yields as the market anticipates future rate hikes from the Fed. The 10-year Treasury yield hit 2.48% on March 25, it's highest level since 2019, and up sharply from 1.51% at the start of the year. With the sharp decline in bond prices, TIPS returns can turn negative even with the benefit of the higher CPI inflation adjustment.

Which TIPS Funds Have Outperformed?

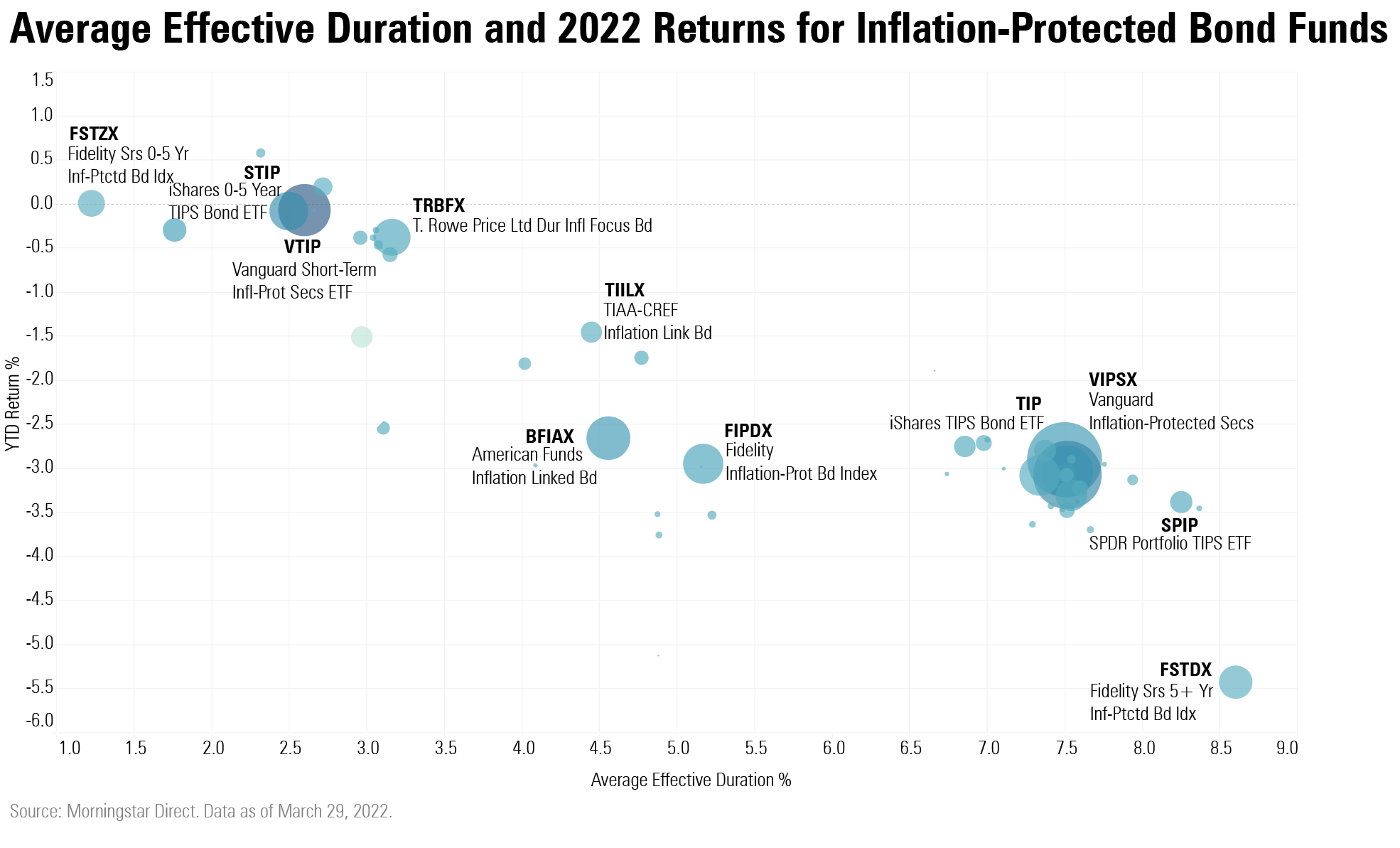

Similar to any bond fund, inflation-protected bond funds are sensitive to interest rates, and the degree of that sensitivity depends on the maturities in the portfolio. Longer-dated maturities are more sensitive to interest rate changes than their shorter-dated counterparts.

With yields rising substantially in 2022, funds exposed to higher interest rate risk have seen sharper declines. With a Morningstar analyst rating of Gold, the $20.3 billion Vanguard Short-term Inflation Protected Securities ETF VTIP is down 0.08% this year, while the $42 billion Vanguard Inflation-Protected Securities VIPSX is down 2.9%. Meanwhile, the $730 million Pimco 15+ Year US TIPS ETF LTPZ is down 9.49%.

The difference can be seen when comparing TIPS fund performance based on their average effective duration, which helps investors assess a fund’s sensitivity to interest rate changes. The higher the duration the more vulnerable to moves up or down a fund is to changes in rates.

The Vanguard Short-term fund has an average-effective duration of 2.6 years compared to 6.7 for the category average. That’s made it a better performer at a time when the CPI has risen sharply, but so have interest rates. “Targeting short-term TIPS diminishes the likelihood that the fund will outgain category peers, but it also strengthens the fund’s sensitivity to CPI because short-term interest rates are more correlated with CPI than long-term rates,” the most recent Morningstar

on the fund says.

Among the other large TIPS funds, performance has been similar in tracking duration metrics. After the Vanguard Short-term fund, the best performer has been American Funds Inflation Linked Bond--with an average effective duration of 4.6 years--and is down 2.65% this year. Both Vanguard Inflation-Protected Securities Fund and iShares TIPS Bond ETF carry an average duration of roughly 7.5 years. The iShares ETF "courts a fair amount of interest-rate risk," the Morningstar analyst report notes.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)