Retail Stocks Jump as Inventory Fears Are Sent Packing

Third-quarter earnings reports are easing worries about the holiday season, but many names remain overvalued.

Worries about empty shelves are fading ahead of the holiday shopping season, leading retail stocks higher.

The shift in sentiment from concern to optimism has come as retailers have reported healthier-than-expected earnings and top executives have sounded reassuring notes in quarterly earnings conference calls with Wall Street analysts.

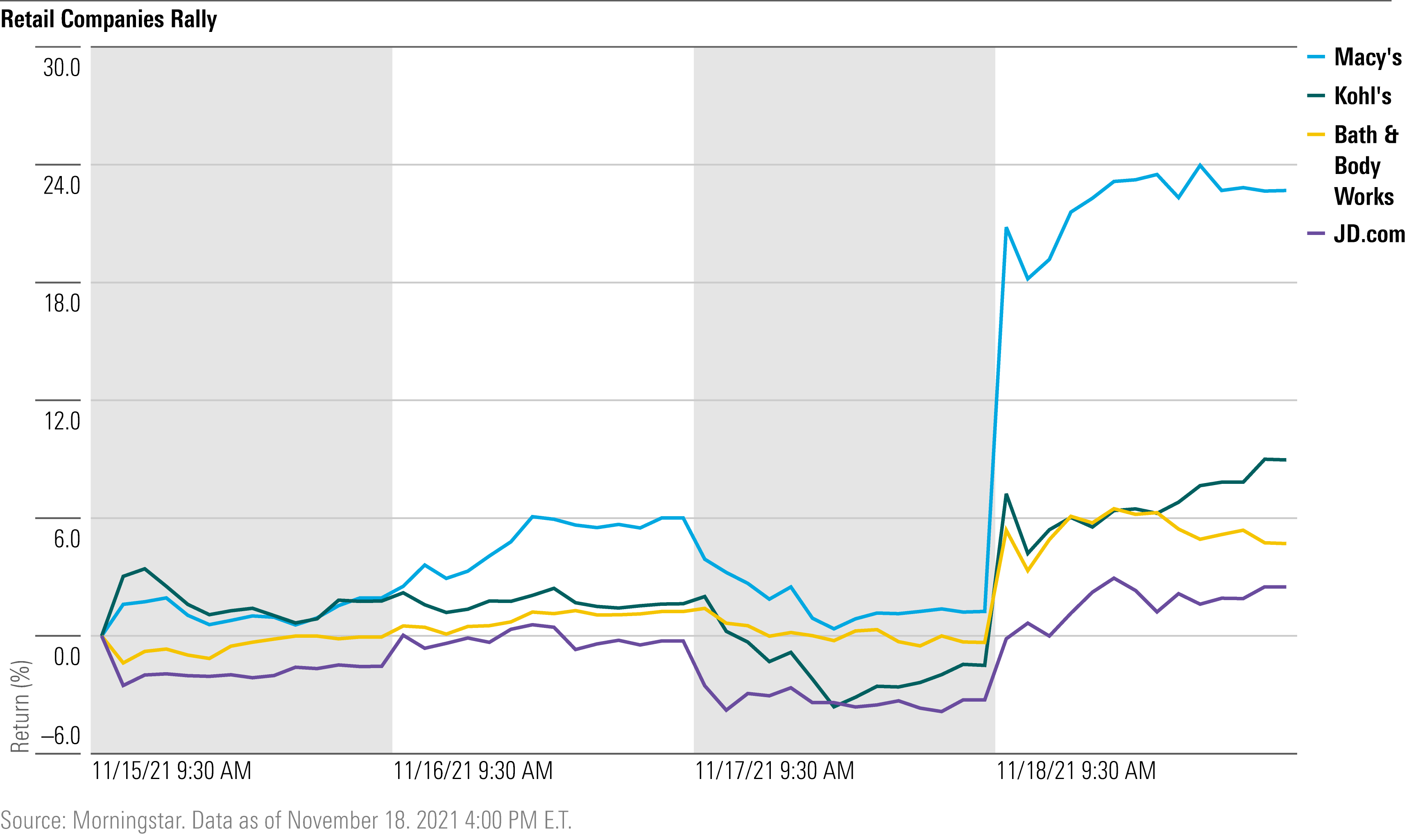

On Thursday, both Macy's M and Kohl's KSS reported earnings that beat consensus estimates by a wide margin. In addition, retailers reported being able to stockpile inventory in preparation for what some forecasts say may be the most profitable holiday season yet despite a growing focus on supply chain snarls.

"I think people were relieved that neither Macy's nor Kohl's reported any big problems related to the shipping delays," says Morningstar analyst David Swartz. "Pricing has been strong, so they've been able to absorb the extra cost. Some items will still be out of stock, but this is not entirely bad. Since inventories are low across the industry, markdowns are low, so there is higher full-price sell-through."

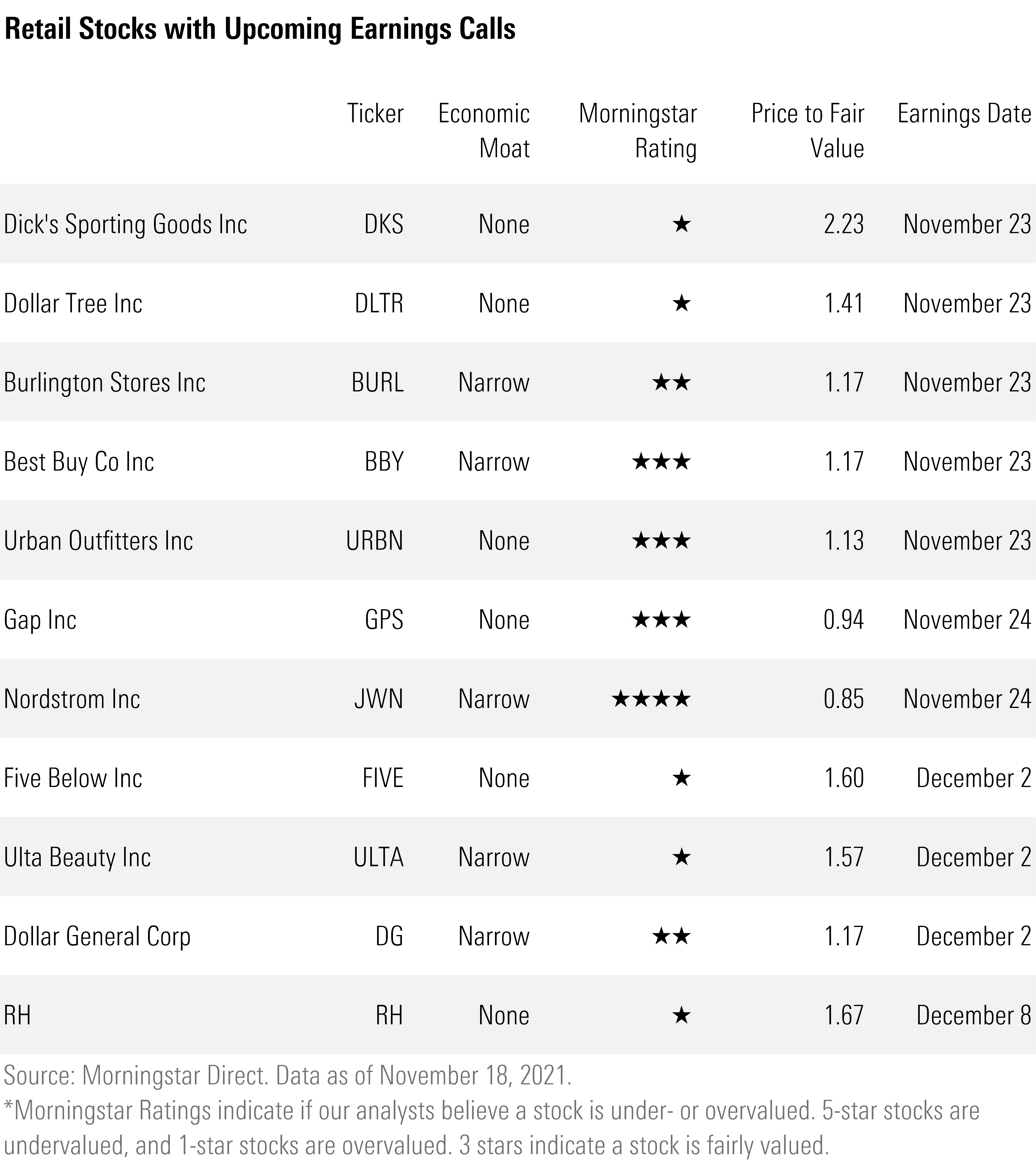

However, many retailers that have yet to report are trading at prices above or near Morningstar analysts' assessments of the companies' values.

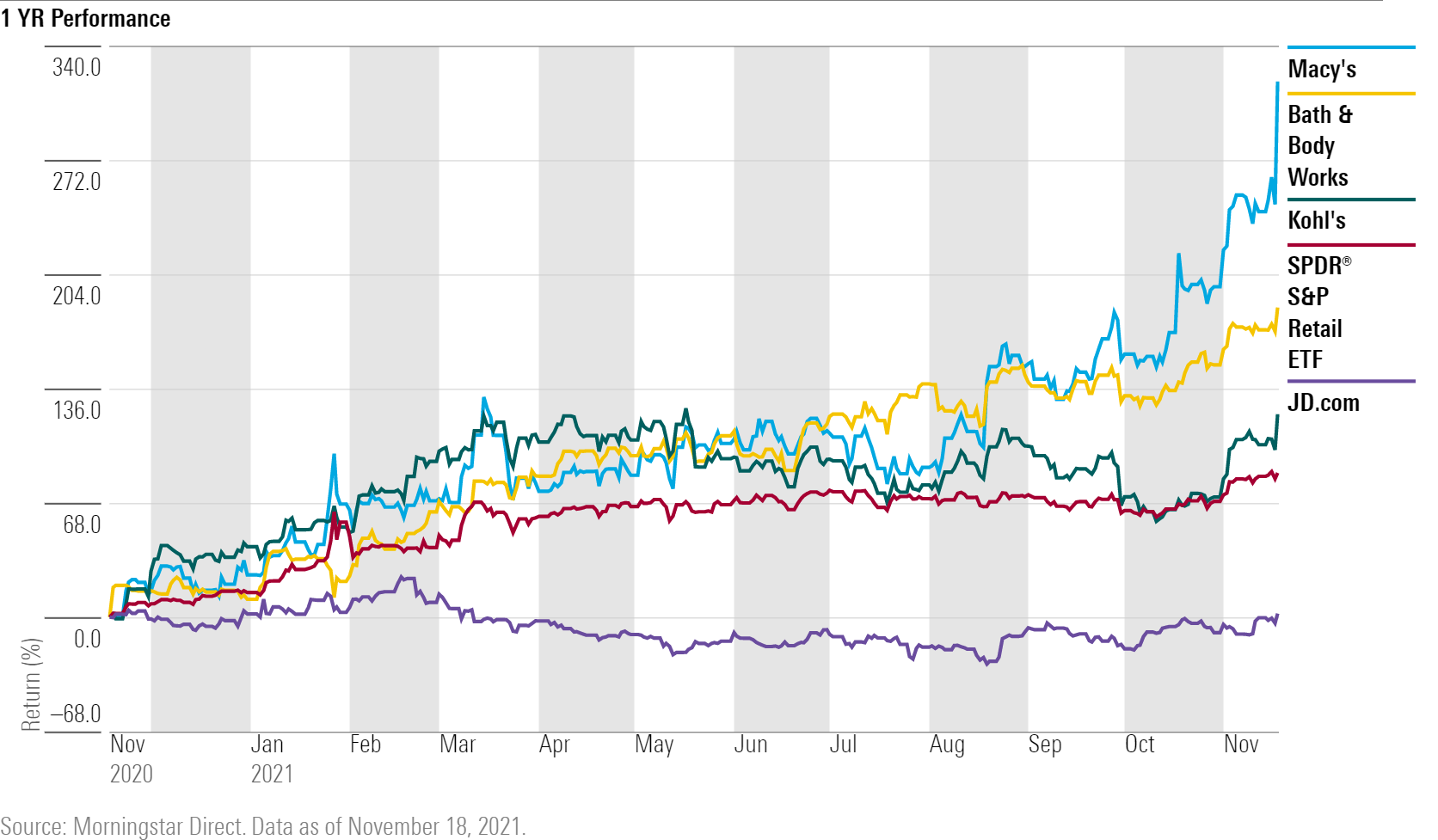

"We are possibly seeing more enthusiasm from investors than is warranted," Swartz says. "Macy's and Kohl's earnings per share are likely to be lower next year than this year. The stocks have been hot throughout most of the year as the economy has reopened."

Macy's reported sales and margins that beat levels seen before the pandemic. The retailer topped FactSet consensus estimates by over 290%, and the company's stock price rallied 21.1% following the earnings report.

Alongside its earnings announcement, Macy's revealed plans to launch a digital marketplace for third-party brands during the second half of 2022. Activist investor firm Jana Partners called for the company to separate on- and offline operations. "We do not expect this will happen, as Macy's continues to put a high value on integrating its e-commerce with its physical store base," says Swartz. While Swartz expects to raise his fair value estimate by a high-single-digit percentage, the company has been overvalued for much of this year and will remain so even after the fair value increase.

Kohl's rose 10.1% on Thursday after beating consensus estimates by 136%. Swartz sees shares as fully valued, despite anticipating a mid-single-digit raise to the company's fair value estimate.

Bath & Body Works BBWI rose 5.3% after a 52% earnings beat. "We plan to bump up our $79 fair value estimate by $3 to $4 to account for recent results and cash earned since our last update but view the shares as fairly valued," says Morningstar senior analyst Jaime Katz.

Senior analyst Chelsey Tam said JD.com's JD third-quarter results appeared to be tracking ahead of 2021 assumptions. The stock rose 6% after reporting earnings that were 59% above expectations. JD.com is one of the few retail companies that remains undervalued following recent results, trading at a 25% discount to its fair value.

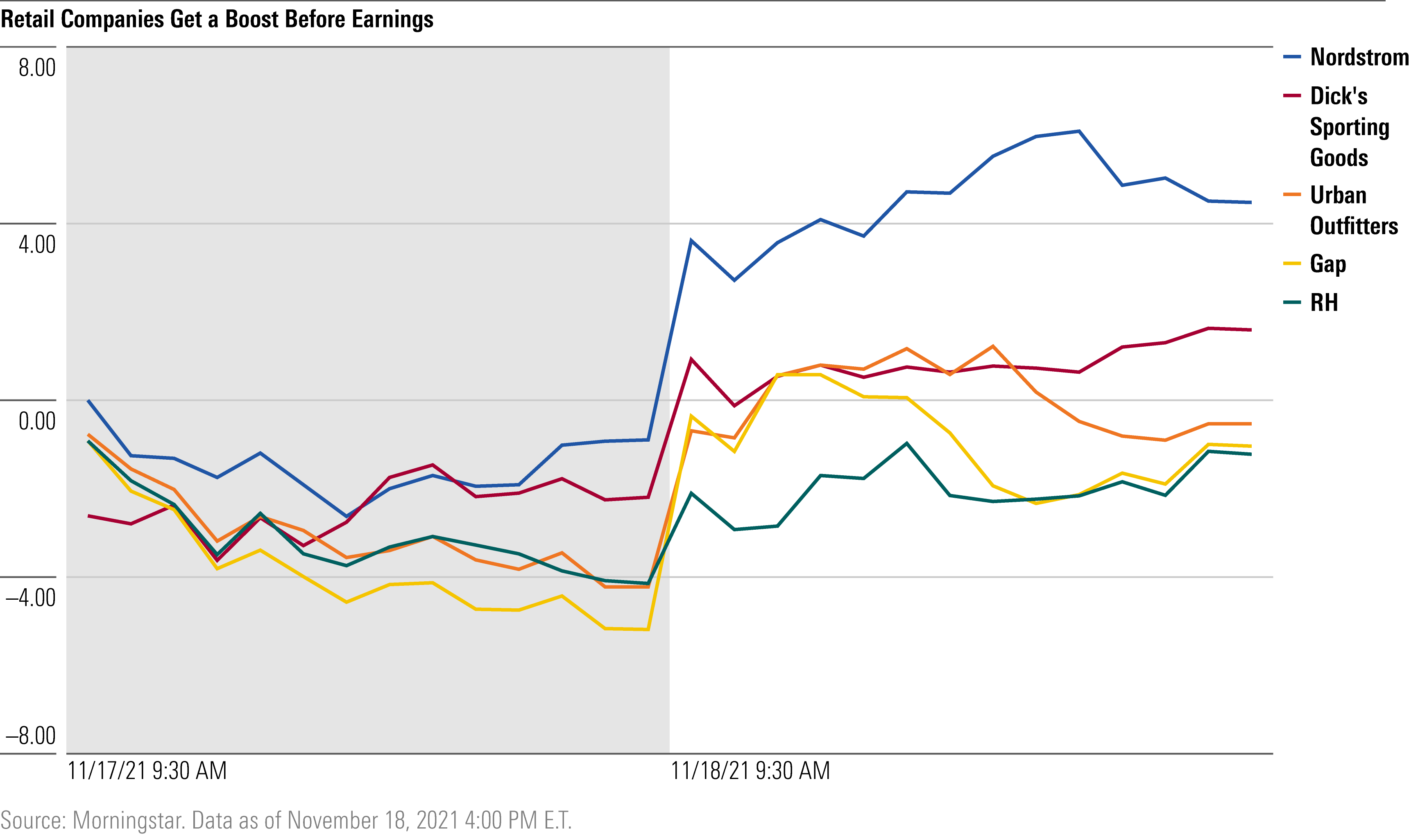

The enthusiasm stemming from earnings reports spread to some retailers that have yet to report. On Thursday, Nordstrom JWN rose 5.5%, Gap GPS rose 4.4%, while Dick's Sporting Goods DKS and Urban Outfitters URBN both rose 3.9%. RH RH trailed behind but bumped up 3.1%. Apart from RH, each company is set to report earnings Thanksgiving week. RH will report in early December.

"Since Macy's beat estimates by a wide margin and the stock was up more than 20%, it's not surprising that investors would look for some comps that might beat earnings as well," Swartz says.

However, Morningstar analysts currently see many of these stocks as significantly overvalued. Dick's Sporting Goods is one of the most overvalued retailers on our coverage list, trading at a 123% premium to its fair value, while RH is trading at a 67% premium at recent prices. Urban Outfitters and Gap are both within fair value range. Nordstrom is the only company that remained undervalued following Thursday's rally, trading at a 15% discount.

Below is a table that shows retail stocks covered by Morningstar analysts with upcoming earnings reports.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)