5 Value Stocks With Room to Run

These wide-moat stocks are currently undervalued.

After years in the doghouse, value stocks are seeing their day in the sun as investors have shifted cash out of pricey, fast-growing company stocks.

However, many value stocks (which are technically defined as stocks with relatively low prices given pre-share earnings, book value, cash flow, sales, and dividend expectations) aren't such a bargain anymore. But that doesn't mean there aren't high-quality, undervalued stocks to find.

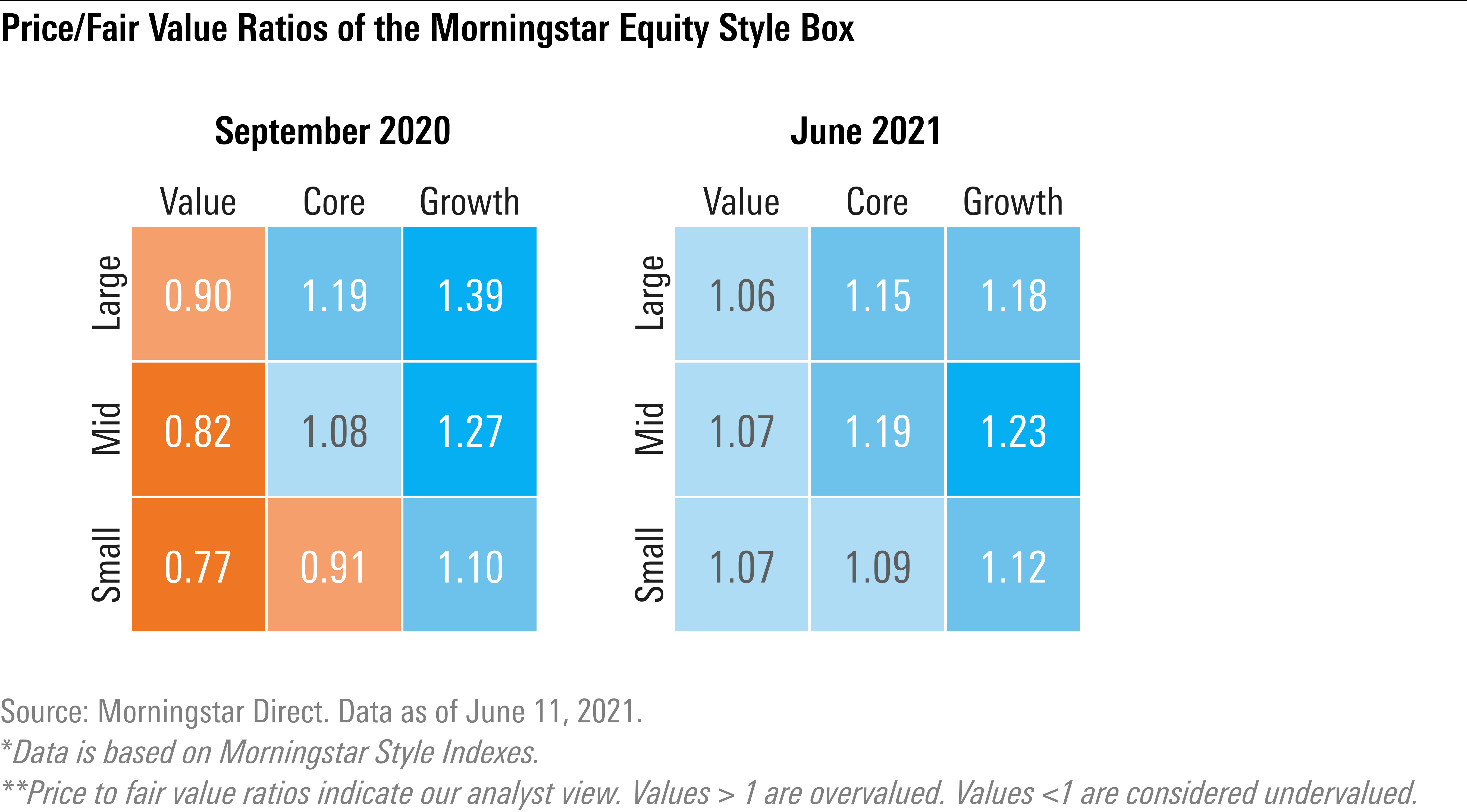

As a starting point, we can see a clear shift since the end of the third quarter in 2020 by applying Morningstar's price/fair value estimate metric across the Morningstar Style Box for stocks.

At the end of September, value stocks were broadly trading far below their Morningstar fair value estimates, while growth stocks were for the most part expensive by a wide margin. Large growth and small value were at opposite ends of the valuation spectrum. Fast forward to June 2021 and the landscape looks significantly different on the value side of the box.

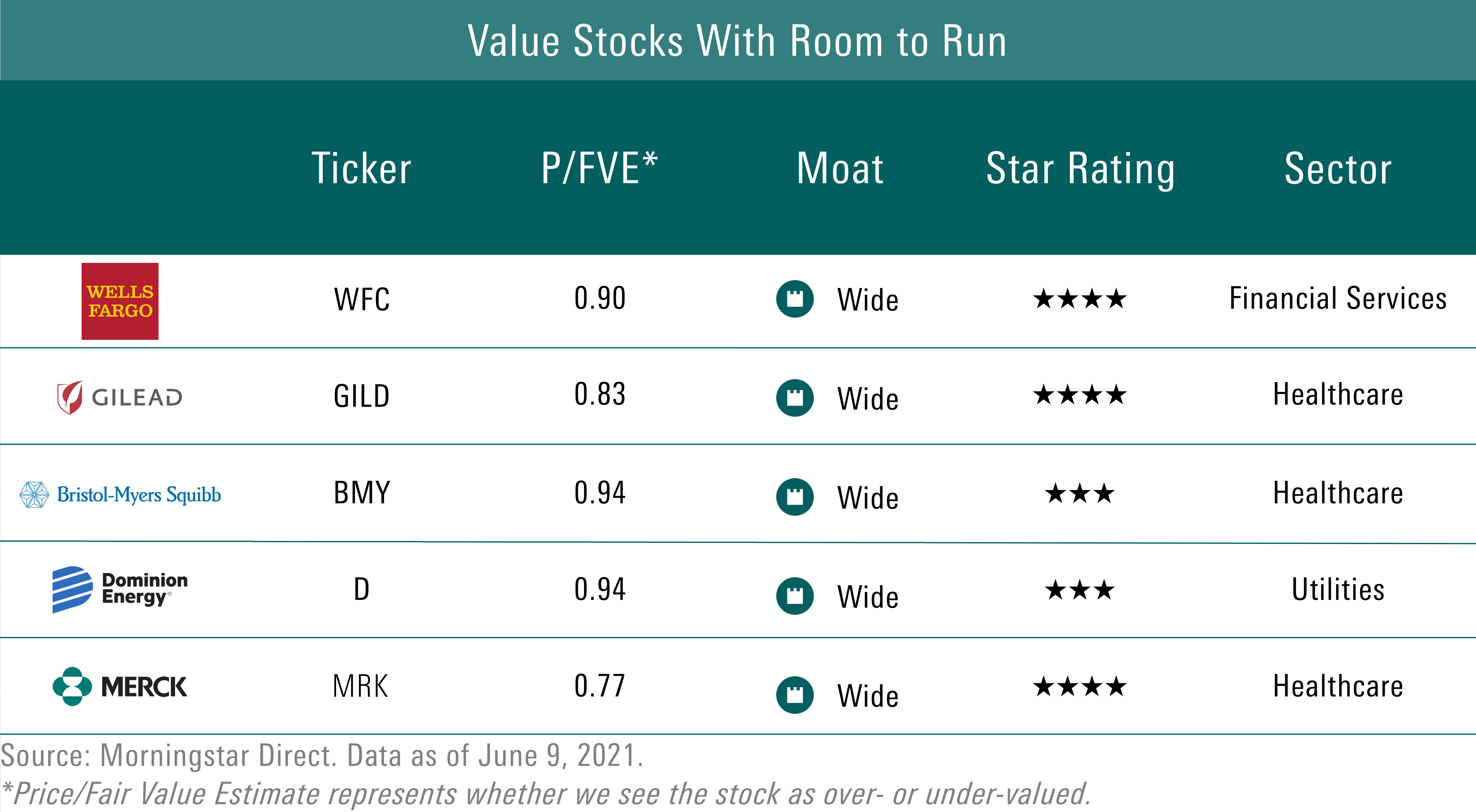

However, there are stocks with room to run based on their fair value estimates.

To find them, we screened both the Morningstar US Large Value and the Morningstar US Mid Value indexes to find stocks trading below our analysts' fair value estimates and are also classified as wide-moat companies--a Morningstar designation for companies with long-term competitive advantages that allow them to earn oversize profits over time. The companies in our screen also have stable Morningstar Moat Trend Ratings, meaning that their competitive positions are expected to remain steady over time.

The undervalued stocks we found all lie within our Morningstar US Large Value Index, mostly clustered in the healthcare sector.

While we also screened the Morningstar US Mid Value Index, we didn't find any stocks with a wide moat and stable moat trend. A notable mention, however, is Kellogg K. With lower-priced competitors encroaching on Kellogg's shelf space with retailers, the company's waning competitive advantage is reflected with a negative moat trend rating, according to Morningstar's consumer sector director Erin Lash. However, Lash argues the company's efforts to expand its product line with snacks and frozen fare have been overlooked. "Kellogg has also worked to organically and inorganically beef up its presence in faster-growing emerging markets, and we don't suspect this diversification is appreciated," she says.

As a result, Kellogg is currently trading at a 20% discount to what Morningstar believes is its fair value. Kellogg shares have risen 5% since the third quarter of 2020.

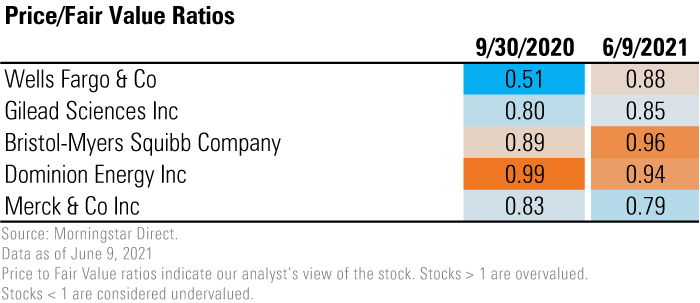

Meanwhile, the five stocks that made the final cut on this screen are undervalued, but not as cheap as they were last fall.

Gilead Sciences GILD and Merck MRK stand out. The two drug manufacturers currently have the deepest discounts to their fair values among the stocks in our screen, Gilead at 17% and Merck at 23%. Wells Fargo is trading at about a 10% discount despite its stock price doubling since last October.

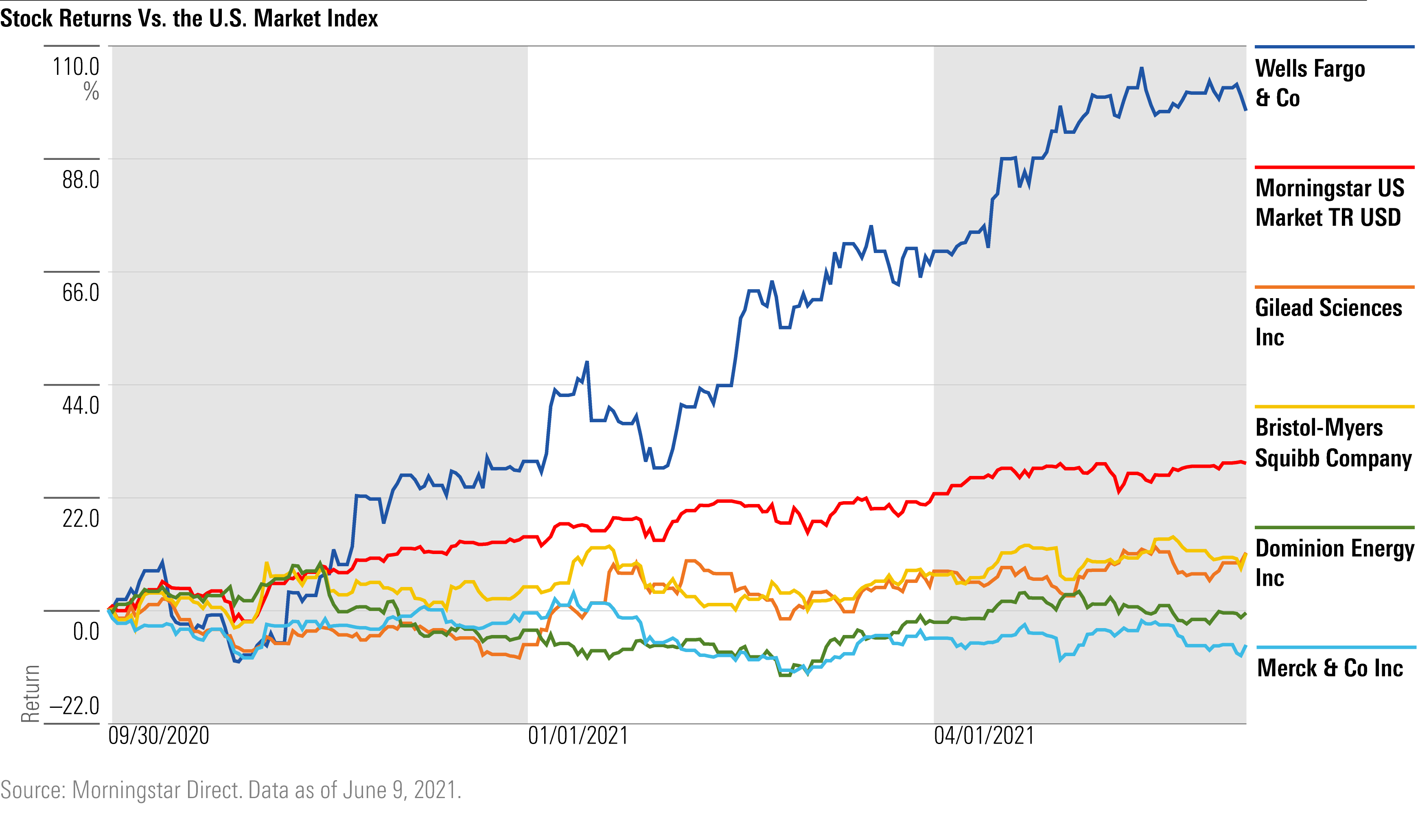

Here's a snapshot of how the five stocks from our screen have performed versus the Morningstar US Market Index since the end of third-quarter 2020.

Wells Fargo WFC soared over its peers, returning 100.2% since 2020's third quarter. Our large-value index returned 33.3%, hovering over the rest of our picks. Gilead and Bristol-Myers returned 9.3% and 8.1%, respectively.

Here are the most recent Morningstar analyst takes on each of these five stocks:

Wells Fargo

"We believe Wells Fargo possesses a wide moat based on sustainable cost advantages and switching costs that are consistent with our bank moat framework. The biggest overhang on Wells for the past several years has been regulatory troubles, including an asset cap and sizable fines. There are tangible signs that the regulatory pressure may be starting to wane, which should give the bank some more breathing room, and could bode well for the stock.

"From a macroeconomic perspective, Wells Fargo's profitability will be materially affected by the interest-rate cycle and the effects of credit and debt cycles, all of which are not under management's control."

--Eric Compton, senior equity analyst

Gilead Sciences

"Gilead Sciences generates stellar profit margins with its HIV and HCV portfolio, which requires only a small salesforce and inexpensive manufacturing. Gilead is also in the process of establishing an oncology portfolio. We recently raised our estimates for Trodelvy sales to $5 billion annually by 2030, and data is coming for multiple other oncology programs later this year that could provide support for long-term growth outside of HIV, which would further bolster Gilead's wide moat built on infectious disease treatments. However, the company needs HCV market stabilization, strong continued innovation in HIV, solid pipeline data, and smart future acquisitions to return to growth.

"Patent protection on newer HIV regimens and Gilead's continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades. However, both these markets' competition and pricing pressures are risks for the firm. Overall healthcare costs and tight budgets could lead to continued, elevated pricing pressure in both the United States and Europe."

--Karen Andersen, healthcare sector strategist

Bristol-Myers Squibb Company

"Adept at partnerships and acquisitions, Bristol-Myers Squibb BMY has built a strong portfolio of drugs and a robust pipeline. Their patent protection allows the firm to price its drugs at levels that translate into superior returns on invested capital compared with its cost (particularly in cancer drugs, an area of focus for Bristol). Bristol's entrenched salesforce enables the company to partner with the smaller drug companies to gain access to externally created drugs, augmenting its internal drug-development efforts. We believe the strong overall pipeline helps support its wide moat and steady growth potential.

"Additionally, while the company is exposed to risks facing the entire pharmaceutical group, including generic threats, decreasing pricing power owing to managed-care constraints, and product liability cases, we view the firm's strong focus on innovative new drugs as helping to mitigate these pressures. Overall, we see the firm's uncertainty as medium."

--Damien Conover, director

Dominion Energy

"Since 2010, Dominion D has focused on the development of projects with conservative strategies, exited the exploration and production business, sold or retired no-moat merchant energy plants, and made plans for significant investments in moaty utilities infrastructure. Dominion has the largest and the most visible regulated decarbonization opportunity among U.S. utilities.

"Utilities regulation is also the primary source of uncertainty. Over 85% of Dominion's earnings come from regulated gas and electric utilities. However, regulation in Dominion's jurisdictions has historically been constructive for investors, with some having the most attractive growth potential in the country."

--Charles Fishman, equity analyst

Merck

"Following the spin-off of Organon, Merck is a more focused company. The business is well positioned with several key products, including immuno-oncology drug Keytruda, cancer drug Lynparza, and HPV vaccine Gardasil. As the bedrock of Merck's wide moat, patent protection should continue to keep competitors at bay while the company strives to introduce the next generation of drugs. The company's enormous cash flows also support a powerful salesforce that not only sells currently marketed drugs, but also serves as an enticement for partnerships by smaller developing drug companies needing support to develop and launch new emerging drugs."

--Damien Conover, director

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)