Don't Be Impressed by Your Stock Fund's 50% Return

These eye-popping results highlight a major quirk in shorter-term rolling returns.

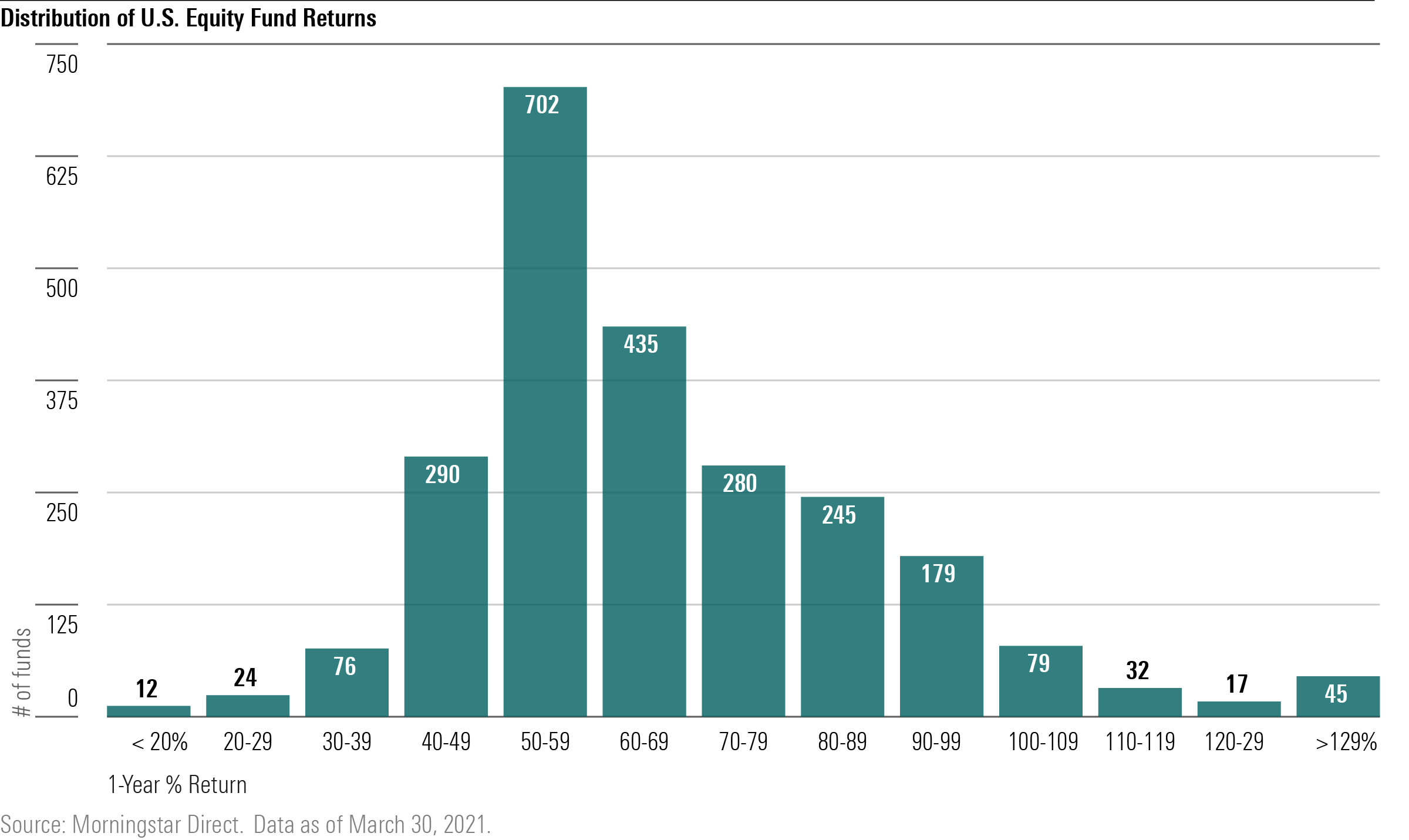

As the first quarter of 2021 draws to a close, U.S. stock funds are recording eye-popping one-year returns. Over 2,000 U.S. equity funds finished March up 50% or more from a year ago.

While certainly striking, investors should take these returns with a grain of salt, and the situation highlights a major quirk in shorter-term rolling returns. Essentially, the returns reflect the combination of sharply lower stock market prices during the coronavirus-related market collapse one year ago and the subsequent strong rebound, resulting in what appear to be outsize returns.

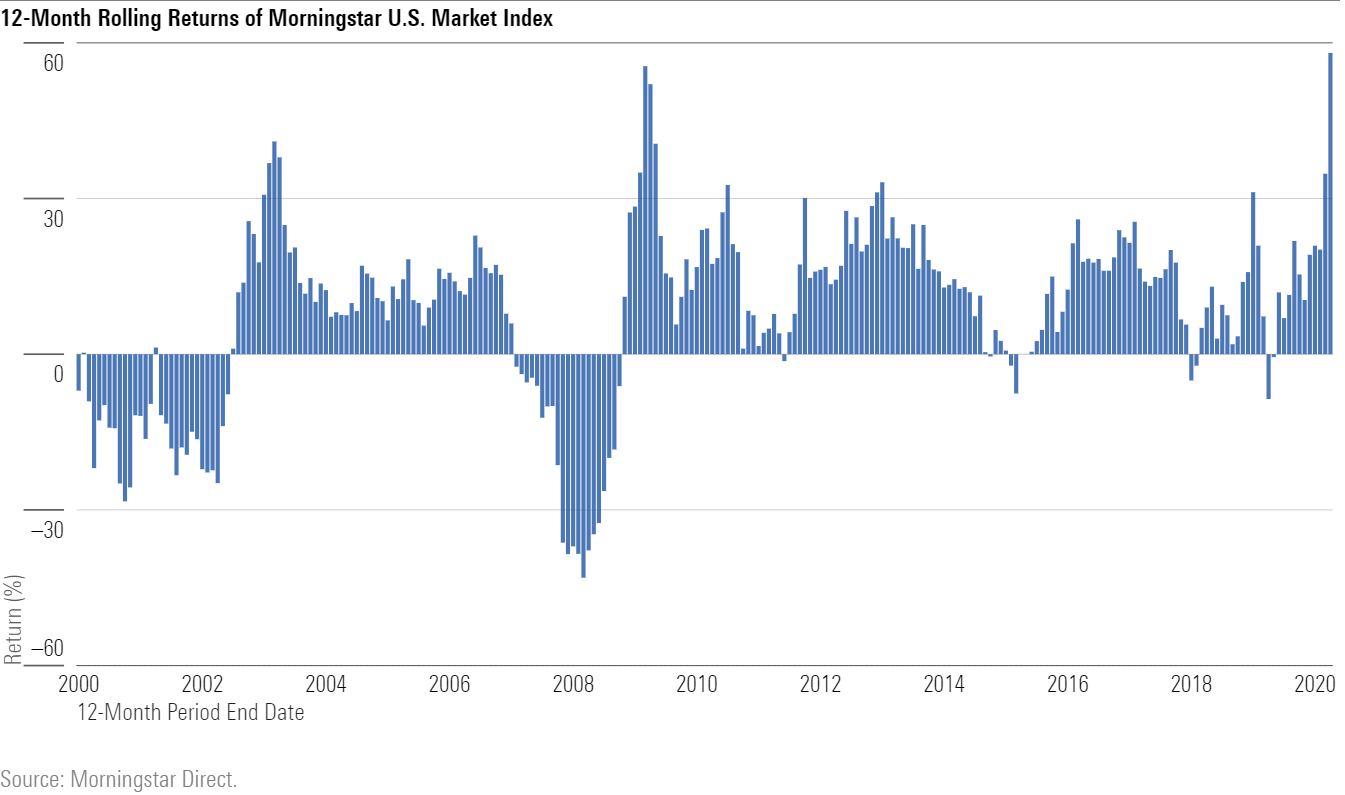

In addition, when these big fund returns are put in context of a comparison benchmark, their performance is much less impressive. For example, the Morningstar US Market Index is up roughly 58% from a year ago. This reflects the importance of selecting and looking at performance relative to a benchmark.

This dynamic plays out in extreme ways infrequently but has its precedents. The last time year-over-year returns were as large was in the wake of the 2008 global financial crisis.

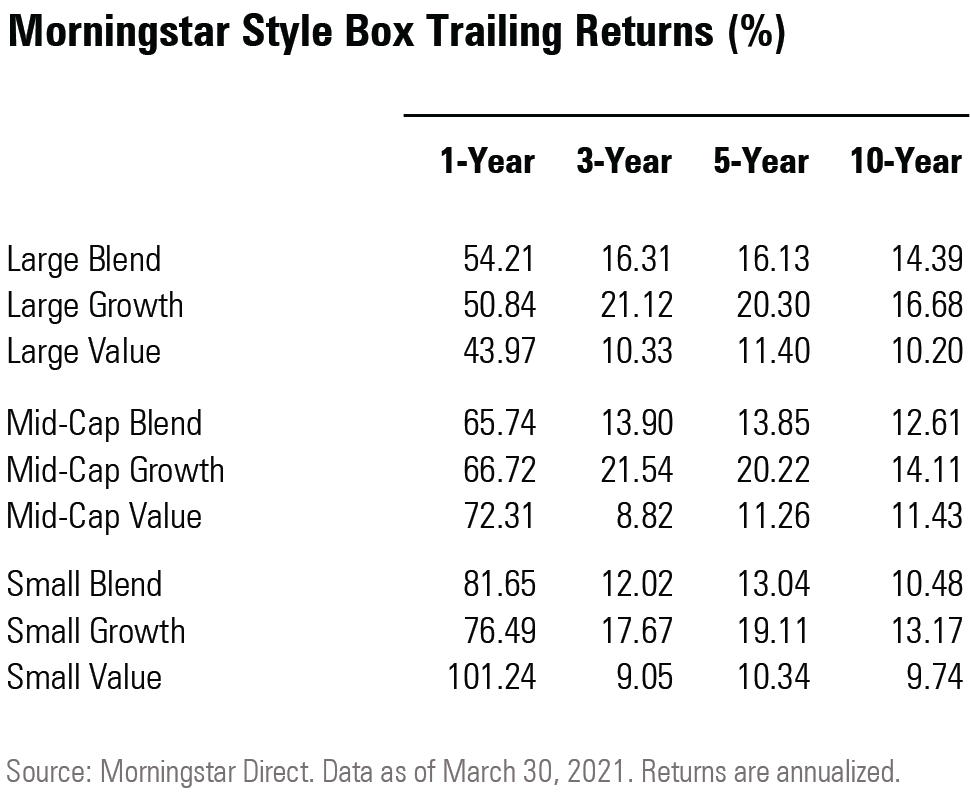

Here's a look at one-year returns versus longer time periods for average U.S. diversified stock funds across the Morningstar Style Box. The impact of the outsize one-year returns diminishes when spread out over multiple years.

The style-box-leading triple-digit average returns for small-value funds especially jumps out in comparison the laggard three-year average returns. For the small-value category, the year-over-year comparison distortion comes on the heels of a strong rebound in small-value funds from an extended period of poor performance compared with other fund categories.

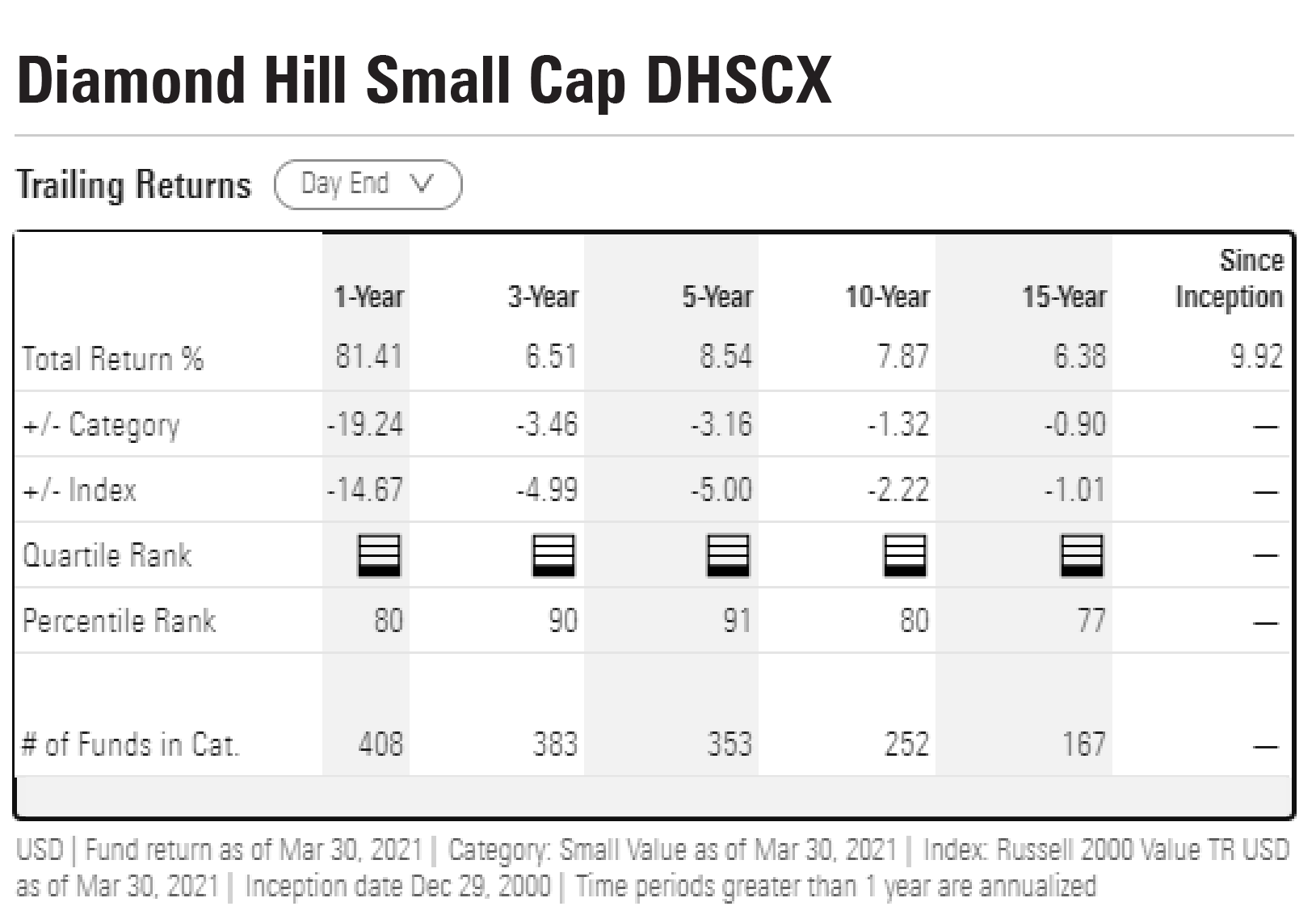

Drilling down to individual fund returns, we can look to Diamond Hill Small Cap DHSCX, which is up 81% year over year. That's the largest rolling one-year rolling month-end return in the fund's history. Yet when compared with the Morningstar Category benchmark, the fund underperformed by 19 percentage points.

Furthermore, when measuring the fund against other funds in the small-value category, its performance only ranks in the 80th percentile of all small-value funds.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)