Value vs. Growth: Widest Performance Gap on Record

Large-growth funds smashed large-value funds last year.

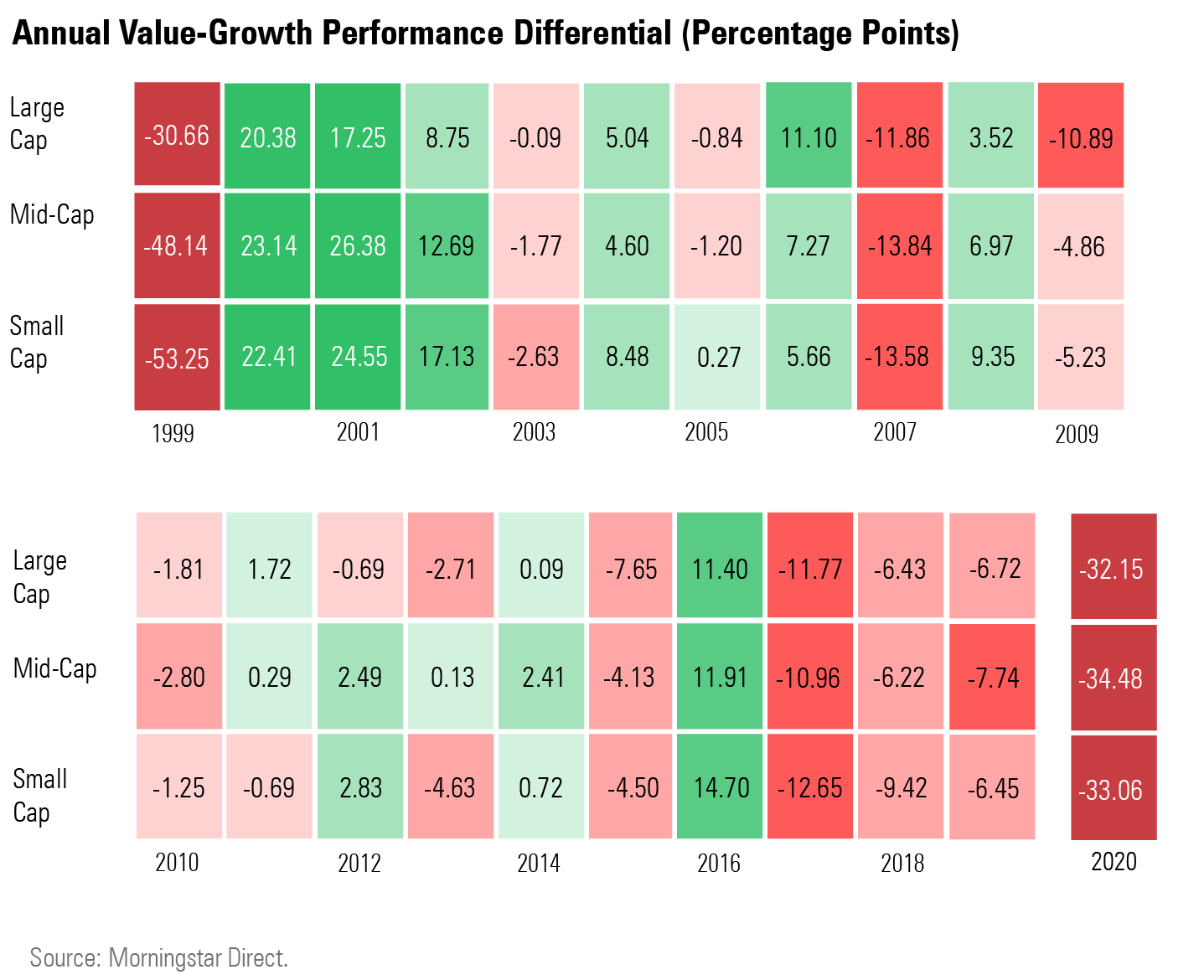

Despite a fourth-quarter surge, U.S. stock funds following value investing strategies suffered one of their worst years on record relative to growth funds in 2020, with the large-cap growth stock funds trouncing large-cap value funds by an even wider margin than during the dot-com bubble year of 1999.

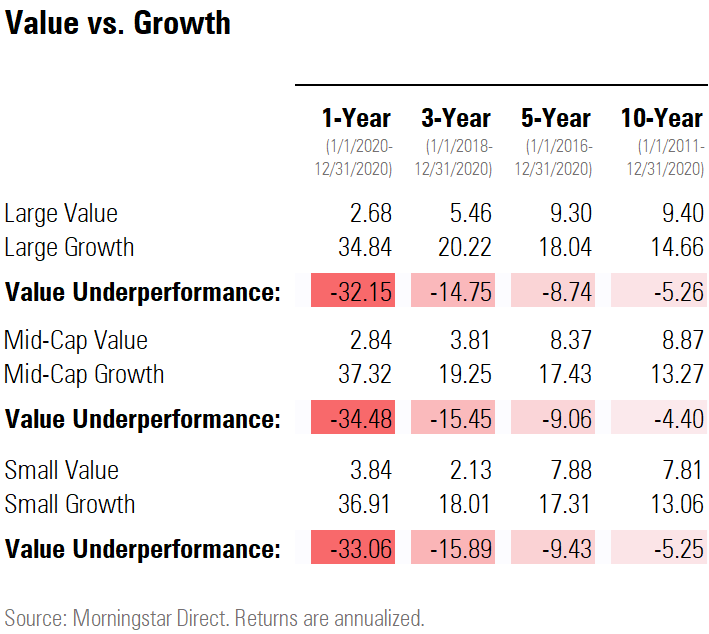

Large-growth stock funds--which generally invest in companies with strong earnings growth profiles--returned an average of 34.8% in 2020. That was 32 percentage points ahead of the average large-value fund, which have portfolios of companies that are deemed cheap compared with their potential or are seen as turnaround stories. That exceeded the gap registered in 1999, when growth beat value by 30.7 percentage points.

While the value versus growth performance gap wasn’t a record for small- and mid-cap stock funds, the average margins for those groups were the widest since 1999. And the woeful relative performance for value significantly widened the longer-term return gaps across the board.

We've been tracking the gap between value and growth strategies as it has widened to these massive levels with heatmaps. (A longer version of this article and the PDF heatmap are available for Morningstar Direct and Office clients here.)

For the purposes of heatmap images in this article, the gap between value strategies and growth strategies is presented from the basis of value funds. Therefore, a negative figure reflects a time period in which value’s returns were less than the comparable growth category. Also, we have included both active and passive strategies, open-end funds, exchange-traded funds, and obsolete funds.

As can be seen clearly in the heatmaps, 2020 marks the fourth year in a row that value funds have underperformed growth across all market caps and the fifth such year out of the past six.

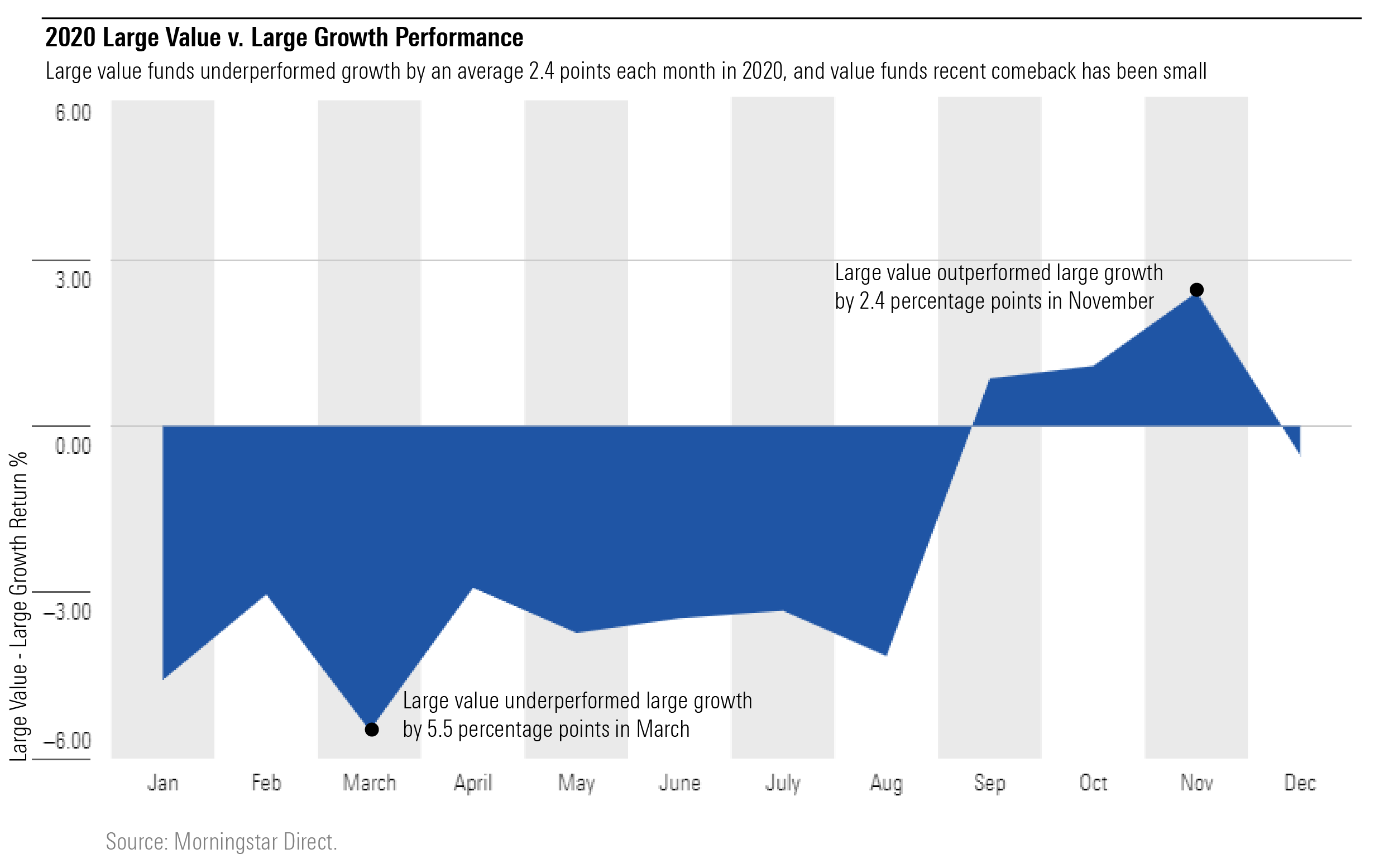

Value's Woes and Rebound In 2020, value funds on average lost more than growth in the first-quarter market collapse and again lagged behind growth funds when the market bounced back. The average large-value fund lost 37.3% from Feb. 19 through March 23, compared with growth losing only 31.3%. Since then, large-value funds on average rose 56.4% through the end of 2020. That compares with an average return for growth funds of 79.1% since the market's low.

And value’s recent comeback has been small. Value funds bested growth by an average 1.5 points each month from September to November, but in the three months prior, growth beat value each month by an average 3.7 points. The divergence was most extreme in March--the average large-growth fund lost 11.3% compared with the average large-value fund losing 16.8%.

At the same time, the comeback for value has thus far been small in comparison to value’s revival in 2000 after the tech stock collapse ended years of growth stocks’ dominance.

While small, the fourth-quarter revival in value stocks has raised questions about whether the tide has finally turned back in its favor. Large value hasn’t beaten growth three months in a row since 2016. The last time value unperformed growth to the current degree, the value resurgence was meaningful in size. Morningstar analyst Linda Abu Mushrefova points out that, in November 2000, as small-value stocks were emerging from the shadow of the then-deflating Internet stock bubble, the value index beat the growth index by 16.1 percentage points after lagging it by 17.2 percentage points nine months earlier.

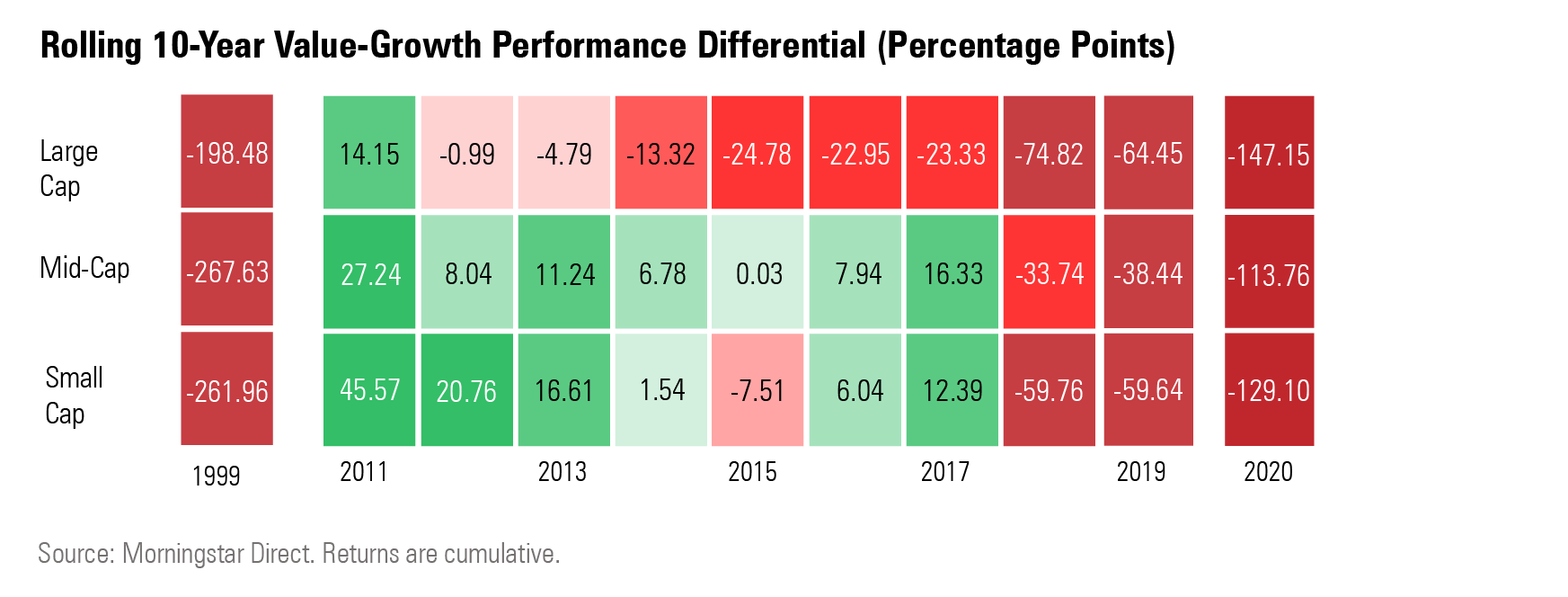

Long-Term Returns This run of underperformance for value funds, especially the huge gap in 2020, also resulted in a significant widening of value's longer-term underperformance against growth. That goes for three-year average annual returns, five-year track records, and even 10-year returns.

For the 10-year period ended Dec. 21, 2020, large value underperformed growth by 147.2 cumulative points, the widest difference since 1999.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)