What Could a Democratic Clean Sweep Mean for Policy, Taxes, and the Economy?

Macroeconomic impact will likely be muted, and the boost in taxes and spending won't be unprecedented.

Days before the election, the Democrats stand a solid chance of achieving a clean sweep, with Joe Biden winning the presidency and the Democrats recapturing the Senate. Regardless of the exact probability of this event, we think this is the top election outcome that investors should be focusing on, as a Donald Trump win would preserve the status quo and a Biden win without a Democratic Senate would bring legislative gridlock. Biden's platform proposes trillions of dollars of new spending on clean energy, infrastructure, healthcare, education, and other areas. However, the degree to which these plans can be enacted is highly contingent on the size of a future Senate Democratic majority, as a slim Democratic majority will struggle to coalesce around more sweeping changes.

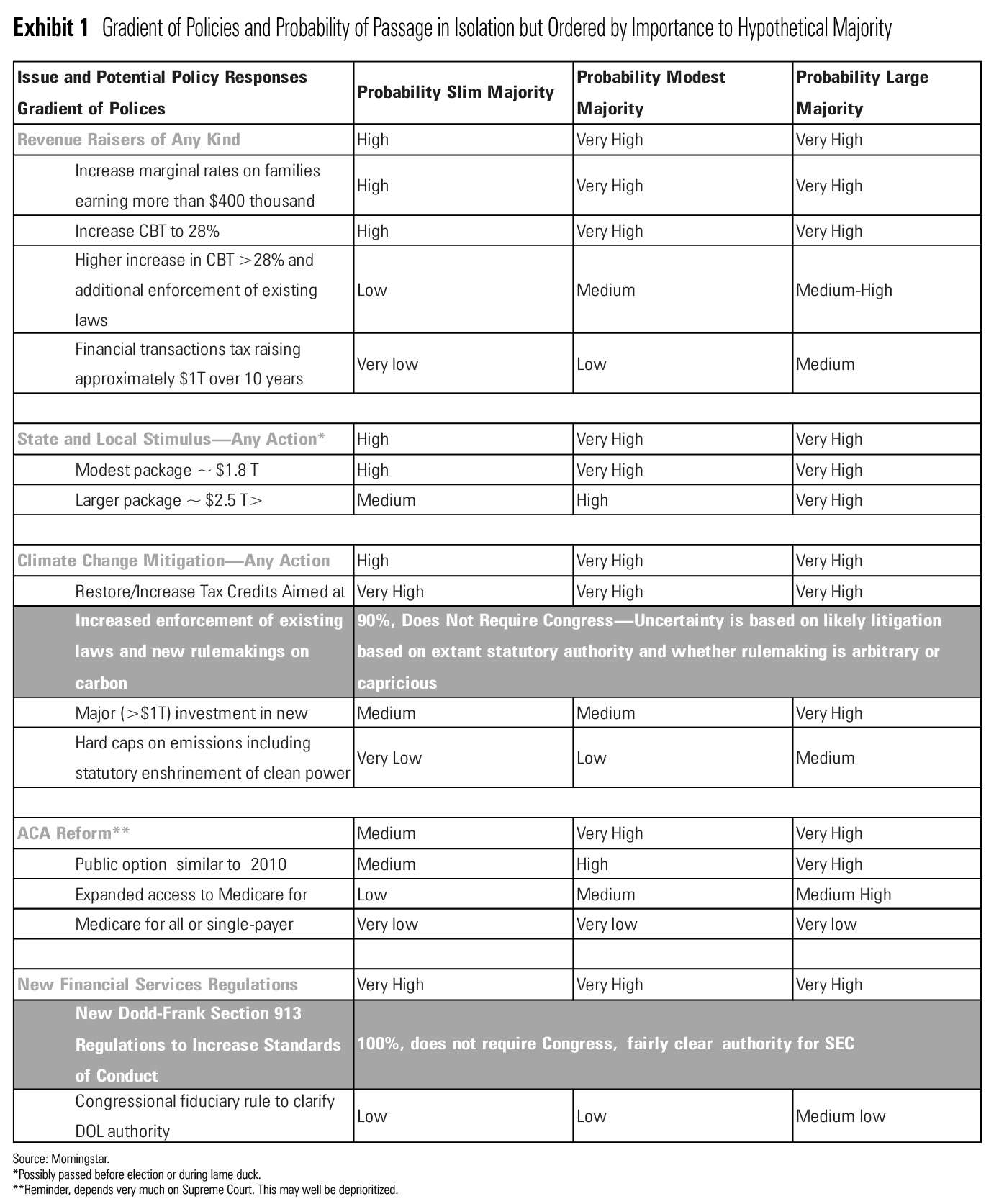

Policy Will Be Highly Sensitive to Size of Democratic Senate Majority In this section, we assign the probabilities for different Democratic priorities, assuming Democrats take control of the Senate and Joe Biden wins the presidency, which is around a two thirds probability. In the scenarios in which the Democrats win the Senate, we believe there is a roughly one third probability of three possible sizes for the Democratic majority, with important differences in what they can likely accomplish given the size of their possible majority. We believe that there are inflection points between a slim majority of just one or two seats, a three- or four-seat majority, and a five-seat or more majority. We include the vice president in these calculations, so a 51-seat majority includes the vice president. Given how unusual ticket-splitting is in American politics today, we do not think the Democrats would win the Senate if President Trump is reelected.

At the top of any Democratic agenda will be new revenue raisers because their other policy priorities require new infusions of money. Democrats have generally followed “pay-go” rules, meaning they will attempt to pay for new policy initiatives with new revenue or cuts over a 10-year window. While these provisions may rely on gimmicks such as deferred revenue-raisers to some extent, there are still enough centrist Democrats that the caucus will insist on increasing revenue to pay for new programs.

Next, depending on what the lame duck Congress (which convenes after the election and before new members are sworn in on Jan. 3, 2021) accomplishes, the new potential majority will likely need to pass a stimulus bill. Unlike other policy efforts, Congress will likely suspend “pay-go” rules for this emergency response to the pandemic and resulting economic dislocation. Democrats will look particularly hard at stabilizing state and local governments’ finances.

Exhibit 1 illustrates the gradients of policy action we expect depending on the size of the Senate majority. However, it is important to keep in mind that these probabilities have some interdependency on each other. Congress can only do so much in the 2021-22 legislative session. To the extent that Congress needs to do more to respond to the pandemic, there will be less room for other legislative priorities. Should a Democratic Congress prioritize healthcare over climate change policy, for example, the probabilities of accomplishing major reform would increase.

Exhibit 1 Gradient of Policies and Probability of Passage in Isolation but Ordered by Importance to Hypothetical Majority

Our preelection assumptions presume a generic Senate, but the specific composition of a potential Democratic caucus will matter a good deal. For example, a one-seat Democratic majority with a freshman Democratic senator from Montana is very different from with a freshman senator from Maine.

Also, implicit in our assumptions is that there will be very high levels of party cohesion, at least as high as we saw from Democrats during the 2009-10 legislative session and from Republicans in the 2017-18 legislative session. We assume Democrats will need to act unilaterally to accomplish most of their priorities, and given the low levels of ticket-splitting among voters as well as the highly nationalized environment for most races, there is a reasonable chance they will have enough party cohesion to do so, particularly with a larger majority.

One other implicit assumption we make is that Democrats will weaken the filibuster by either eliminating it for certain kinds of legislation or using reconciliation to pass major priorities. In either case, we do not expect that a 60-vote threshold will be necessary for Democrats to pursue their top legislative objectives.

Also note, a handful of Democratic policy priorities can be accomplished solely through executive action, and we expect a potential Biden administration to pursue these regulatory avenues.

Tax Policy

Outside of increasing marginal tax rates on high earners, the most obvious place to raise revenue is from reversing the corporate business tax cuts that were reduced to 21% from 35% as the centerpiece of the 2017 “Tax Cuts and Jobs Act.” We think an increase to around 28% is very likely, particularly since candidate Biden has repeatedly said he will not increase taxes on those earning less than $400,000 annually, leaving few opportunities to raise revenue. In terms of an individual tax increase, much of those funds will likely be used to shore up and expand social security, making it important for Democrats to pursue other revenue raisers. A financial transactions tax on every sale of a security could conceivably raise hundreds of billions of dollars over 10 years, but it would probably reduce asset values in the short term and be met with sharp resistance from a diverse coalition of business interests. Nonetheless, it may be one of the few ways to raise revenue that does not explicitly violate Biden’s campaign promise not to raise taxes on those earning less than $400,000.

Stimulus

In terms of stimulus, Democratic leadership will try to get a large stimulus to cope with the effects of the pandemic. Even if the lame duck Congress passes something, it seems likely that Democrats will still want to engage in aggressive fiscal stimulus. Conventional wisdom in Democratic circles is that the 2009 stimulus was too small, and, as the party associated with it, they owned the outcome of that too-small stimulus.

Climate/Clean Energy

We think addressing climate policy via a large spending bill will be more politically feasible than hard caps on emissions or other harsh regulations. Given the geographic and economic skew of the Senate, a Democratic caucus will have senators from coal-producing states and senators from states that skew more to the political right than the country. Unless there is a bipartisan momentum on climate policy--which we think is unlikely--Democrats will need a fairly large majority to maintain enough votes for the kinds of greenhouse gas regulation that Biden has floated on his campaign’s website. However, investments in clean energy--while not without controversy--should be more attainable for Democrats.

In order to further sweeten the pot, this package may also include large conventional infrastructure investments (that are also mentioned in the clean energy plan on Biden's website). Of course, we'd expect that a Democratic majority would include a large mix of green investments as part of any infrastructure plan.

Supreme Court rulings around the power of the administrative state to regulate based on legislative directives could limit what Biden can do with the executive branch alone. Such rulings could spur congressional action on issues such as regulating greenhouse gas emissions.

Healthcare

Finally, we think that while Democrats have largely run on healthcare since the 2018 cycle, they will likely only make marginal changes to the Affordable Care Act unless the Supreme Court were to invalidate the law and require a legislative fix.

Democrats have primarily run on defending some of the protections in the Affordable Care Act, and while some Democrats want a “Medicare for All” universal single-payer system, their nominee has been clear since the primaries that he does not support these efforts. Should Democrats focus on healthcare, it seems very likely that they will be able to add a public option for the individual marketplace. However, that marketplace covers a fraction of the people covered by the workplace market, and Democrats may wish to simply defend the status quo while pursuing other policy objectives.

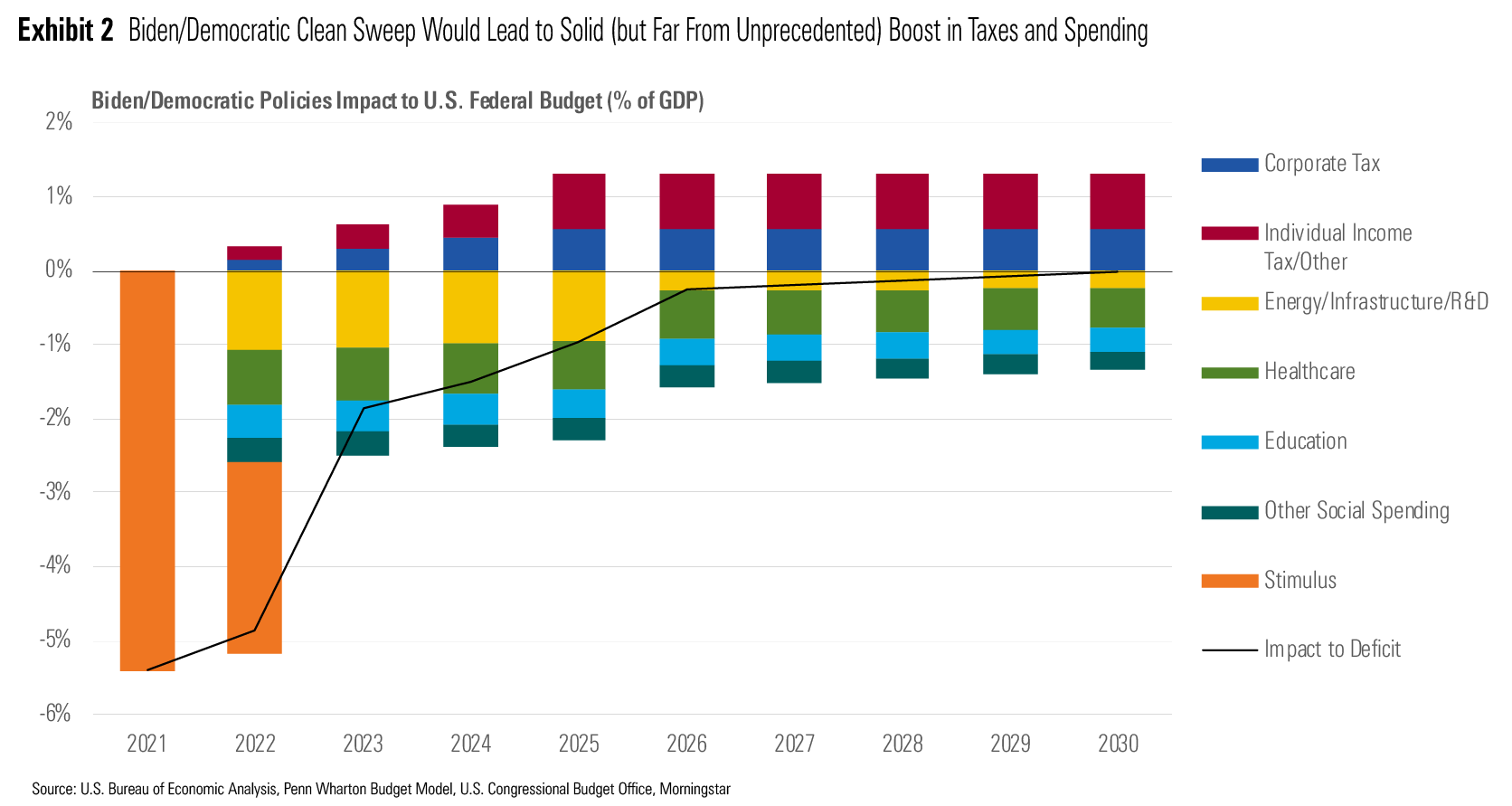

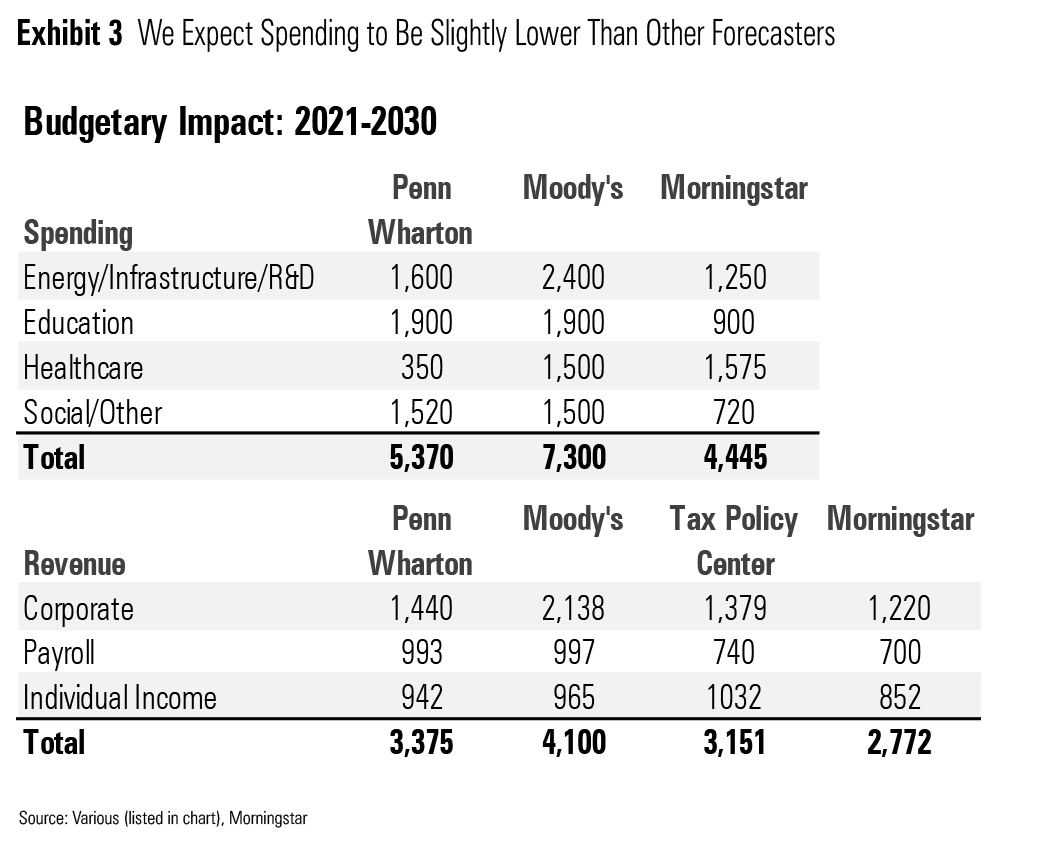

Sizing Up the Taxes/Spending Impact of Biden's Plans In Exhibit 2, we show our projected federal budget impact in a scenario in which Biden wins and the Democrats capture the Senate with a large majority (five seats or more). We incorporate the policies we've assessed as being "very likely" to pass in this scenario (Exhibit 1). Our analysis draws heavily on other public estimates for the budget impact of various policies, especially the Penn Wharton Budget Model, Moody's, and the Tax Policy Center.

We expect a hefty boost to spending in the next five years, due greatly to a new $1.8 trillion stimulus package. Note that we also think another stimulus bill is likely if Trump wins reelection. Exhibit 2 illustrates the impact relative to current policies, rather than relative to anticipated policies (including stimulus) should Trump win reelection.

By contrast, the large up-front boost to spending in the "energy/infrastructure/R&D" category would be unique to a Biden/Democratic win. This largely corresponds to Biden's Clean Energy program. The plan references large investments in energy conservation, electric vehicles, and clean energy R&D. The plan also makes reference to items like highway infrastructure and affordable housing, suggesting the bill could become an omnibus for all sorts of spending whether specifically related to clean energy or not.

Exhibit 2 Biden/Democratic Clean Sweep Would Lead to Solid (but Far Unpresented) Boost in Taxes and Spending

Biden's website mentions a price tag of $2 trillion for the Clean Energy plan but doesn't provide a concrete breakout of spending. We assume the plan will generate $1.250 billion in spending over the 2021 to 2030 period, as centrist Democrats may balk at a $2 trillion price tag. Furthermore, the plan is somewhat scant on details, and it's not clear that there are truly $2 trillion in good ideas to fund what would fall under the heading of the Clean Energy bill.

Ongoing Spending Will Be Constrained by Need to Fund With Revenue

The other major contributors to Biden's spending plans are largely social programs like healthcare and education. Any plans in these areas will create ongoing expenditures rather than merely one-time costs. We expect that these ongoing expenditures will be constrained by the need to raise revenue to create a neutral impact on the long-term budget deficit. As shown in Exhibit 2 above, we expect a near-zero impact on the deficit from the Biden/Democratic policies for years 2026-30.

Biden has proposed several tax increases that we think are likely to pass. This includes raising the corporate tax rate to 28% from 21% (previously at 35% prior to the 2017 Tax Cuts and Jobs Act). Also, he has proposed overhauling rules to increase taxes on corporations hiding in offshore tax havens. This includes an overhaul of the global intangible low-taxed income, or GILTI, as well as a new alternative minimum book tax.

On the individual income tax side, he's proposed a slew of tax increases on earners with more than $400,000 in annual income. We think these plans stand a good chance of passing with a strong Democratic majority. Most sources expect these tax increases to boost federal revenue by around 1% of gross domestic product annually. Generating additional revenue will be hard to come by if Biden is to stick with his pledge not to increase taxes on those making less than $400,000 per year. We don't incorporate impact of a financial transactions tax in this forecast, as the chances of it passing with even a large Democratic Senate majority are much smaller than the individual income and corporate tax increases.

Our views on spending are slightly more conservative than other forecasters, partly because we are assuming that ongoing expenditures will need to be close to deficit-neutral by the end of our forecast period, although some deferred revenue-raisers may never become effective.

We assume healthcare spending will be about $1.575 trillion. This would be mainly driven by the public option, along with the possibility of other piecemeal initiatives (such as lowering Medicare eligibility to 60 years from 65, bolstering the ACA with additional subsidies/tax credits, and public health spending).

With ongoing healthcare expenditure absorbing much of the new revenue created by Biden's tax hikes, we don't think he'll be able to accomplish all of his agenda on education or other social programs. On the education front, his plans include universal pre-K and public colleges becoming tuition-free for families with income below $125,000. All of this could easily cost around $2 trillion. In terms of other social spending, Biden has proposed a new paid family and medical leave program, boosts to Social Security benefits, affordable housing spending, and other initiatives. This could add another $1 trillion or so. There won't be room in the budget to pass all this while remaining long-run deficit-neutral, so we expect the actual amounts passed for education and other social spending to be about $900 billion and $720 billion, respectively. We don't think political support for these programs will be strong enough to compel further tax hikes to support the full extent of the proposed spending.

Exhibit 3 We expect Spending to Be Slightly Lower Than Other Forecasters

Revenue/Spending Increases Would Be Less With Smaller Majority

As we've indicated in Exhibit 1, the probabilities of Biden's plans getting passed in full diminish if the Democrats' Senate majority is smaller. While the prospects for a massive stimulus bill are still strong, other large tax and spending plans are less likely. As such, we think with a slim (one- or two-seat) Senate majority, the increase in long-run federal revenue and spending would probably only be about 0.5% of GDP, versus 1.3% of GDP with a large majority (the scenario shown by Exhibit 2).

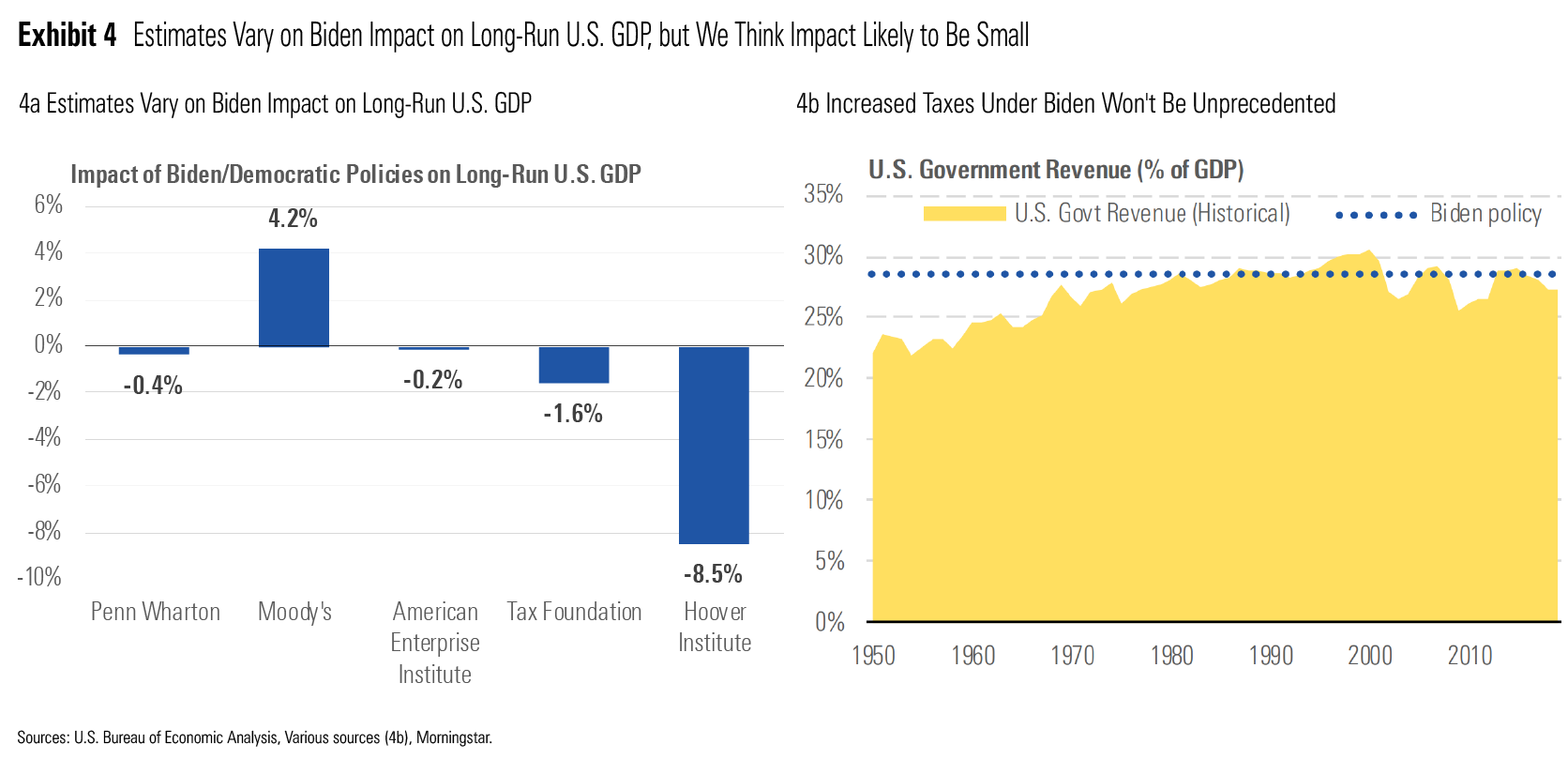

U.S. Election Outcome Won't Have Major Impact on Our Economic Forecasts We wouldn't expect a large impact on our U.S. GDP forecasts from a Biden/Democratic victory. Other papers assessing Biden's proposed policies have varied quite a bit in their conclusions. Exhibit 4a shows these papers' estimates for the cumulative impact on U.S. GDP by 2030.

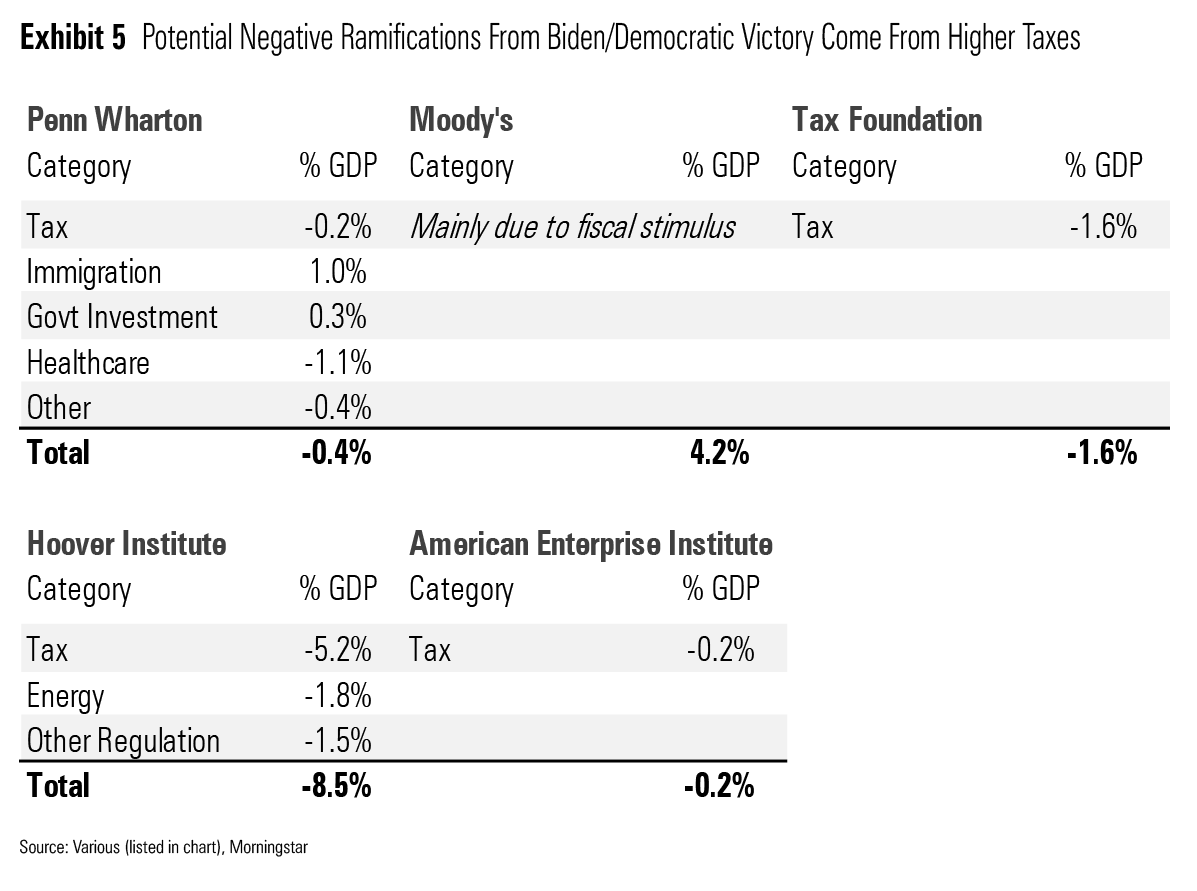

We suspect the more extreme estimates come from analysts with a partisan ax to grind. In particular, the very negative assessment by the Hoover Institute was authored by Trump administration veterans Kevin Hassett (former chair of the Council of Economic Advisers) and Casey Mulligan. We think Penn Wharton is a more unbiased source, and it projects just a negative 0.4% impact from Biden's policies. Note that this is just negative 0.4% cumulatively over a 10-year period; the annual impact on growth is roughly one tenth of that--a minuscule 0.04% annually. Furthermore, even other right-leaning think tanks (American Enterprise Institute and the Tax Foundation) project a far smaller impact than the Hoover Institute. On the other hand, we don’t think the large positive impact from Biden assessed by Moody's is realistic.

Most of the negative impact from Biden's policies projected by these papers comes from higher taxes. In the long run, the main theoretical effect of higher taxes is to decrease the amount people work and invest (as the rewards to doing so are lower). By decreasing the supply of labor and capital, this lowers the sustainable level of GDP. However, the question of exactly how sensitive long-run GDP is to changes in taxes has been an unresolved debate for decades.

We're expecting an increase in U.S. government revenue/GDP of about 1.3% as a result of a Biden/Democratic victory (even with a large Senate majority). This only returns the ratio of government revenue/GDP to about where it was prior to the 2017 Tax Cuts and Jobs Act (Exhibit 4b). This revenue level would even be below the revenue level during the late 1990s, which hardly lacked economic dynamism (4.3% real GDP growth from 1996-2000, well above the post-1970 average of 2.8%).

Exhibit 4 Estimates Vary on Biden Impact on Long-Run U.S GDP, but We Think Impact Likely to Be Small

Exhibit 5 breaks into further detail the impact estimates provided by various sources. The Hoover Institute is projecting a large negative impact from higher taxes, but we think the effect will be much more modest given other sources. In particular, the Hoover analysis is projecting a 2% reduction in employment plus a 12% reduction in the capital stock because of the higher taxes. Compare that with the Tax Foundation, which estimated about a 0.3% reduction in employment and a 4% reduction in the capital stock.

Exhibit 5 Potential Negative Ramification From Biden/Democratic Victory Come From Higher taxes

Moody's stands out with its large positive assessment of the impact of Biden's plans on GDP. An exact breakout isn't provided, but the analysis indicates qualitatively that the impact of fiscal stimulus on closing the output gap is very important. However, our current economic forecasts are that the U.S. economy will experience a robust recovery, with the output gap mostly closing by the mid-2020s. This incorporates expectations that some stimulus is passed in 2021 if Trump remains president. Without extra slack in the economy in the long run, there's little room for extra stimulus to move our GDP forecasts.

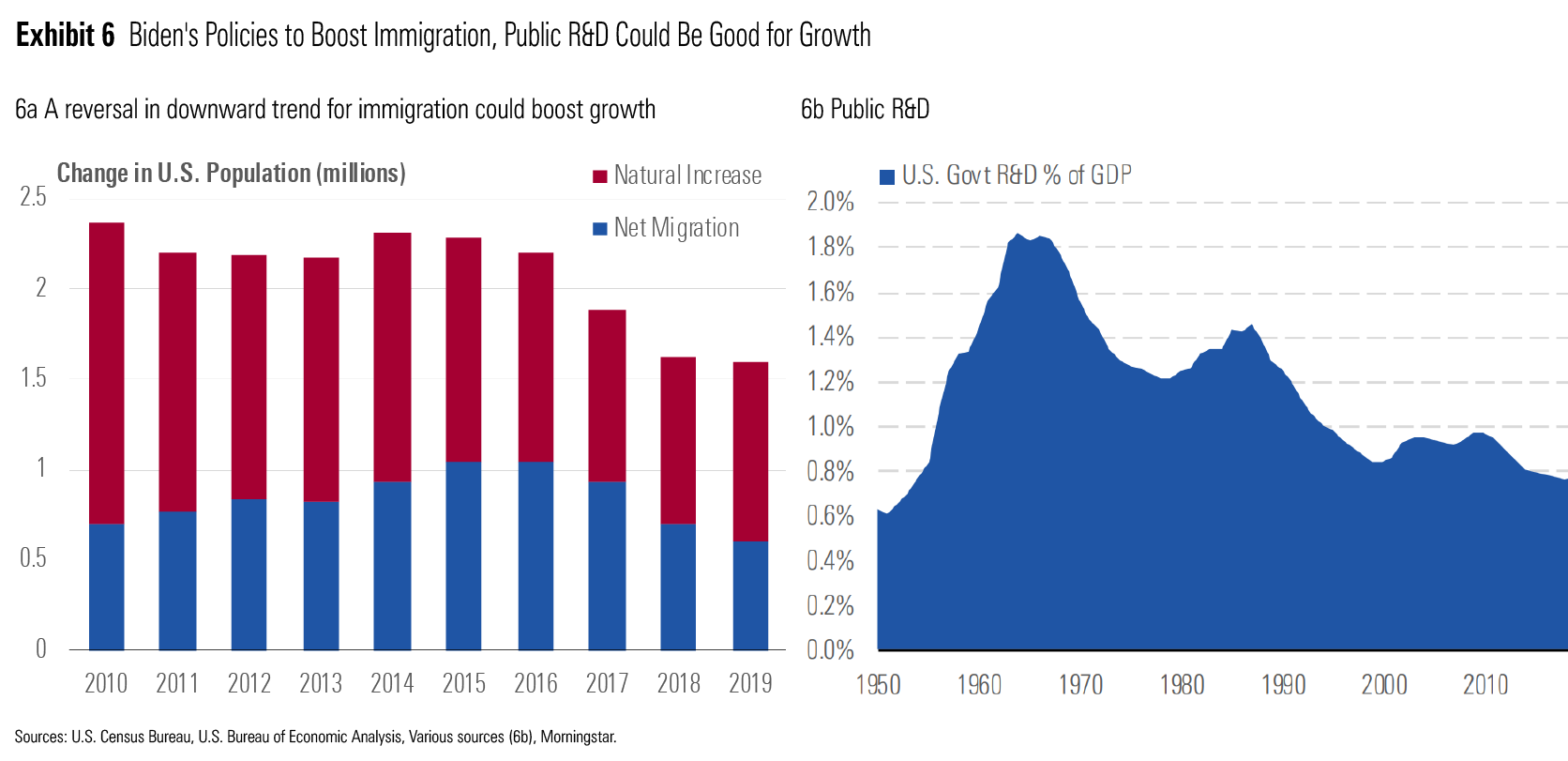

While we do agree that additional taxes from a Biden/Democratic victory would be a modest headwind on growth, we see two areas where Biden could have an offsetting positive impact. First, immigration has fallen off sharply since Trump became president (Exhibit 6a). It seems likely that Trump's policies have played a role in this, including tougher enforcement against undocumented immigrants plus increased restrictions on legal immigration. We think Biden could reverse this trend. Penn Wharton estimates this could boost long-run GDP by 1%.

Second, we think many of Biden's proposed spending programs could boost long-run output. In particular, Biden is proposing a surge in R&D spending. U.S. government R&D spending has languished in the decades after the Cold War ended (Exhibit 6b). We think the returns to public R&D are likely to be especially high given that funding has been starved for so long.

Exhibit 6 Biden's Policies to Boost Immigration, Public R&D Could Be Good for Growth

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)