Target-Date Funds’ Glide Paths Don’t Always Match Plan Participant Needs

Workers are often subject to the same glide path despite differences in salary and expected retirement age.

My colleague John Rekenthaler recently observed that the problem with target-date fund research is that researchers need to find dramatic conclusions to get any attention, and this has led to widespread coverage of research that tends to argue these strategies do not work.

Morningstar’s Center for Retirement and Policy Studies’ new research on target-date funds is not a dramatic polemic, but it yields some important findings for people using target-dates in their 401(k)s.

In the research, we examine whether employers offer target-date funds with glide paths that match their participants’ needs. The answer: sometimes!

Of course, no target-date fund is going to meet the needs of every participant in a plan. But employers can account for their participant’s characteristics, and we find that some of them do.

On the other hand, across sectors we see sponsors who tend to use the same glide paths, despite huge differences in wages and the percentage of people working past age 65. This means these asset allocations are likely often misaligned.

On some level, this is not massively surprising. As Morningstar’s Target-Date Landscape Report shows, there has been huge convergence of glide paths over time. That doesn’t mean it’s not a problem.

Most obviously, people who will likely have a high rate of wage replacement from Social Security should tailor their asset allocations to account for this fixed-income-like source of income. The solution, unless they are very risk-averse, is likely to assume more equity risk.

How Do 401(k) Plans Actually Use Target-Date Funds?

Off-the-shelf target-date funds are the most prevalent investment type in defined-contribution plans such as 401(k)s. Target-date funds adjust investments based on a participant’s age or projected retirement date, usually shifting from more equities to more bonds as participants get closer to retirement.

Off-the-shelf target-date funds are not customized but offer the same glide path to multiple plans. In contrast, a small number of plans choose customized glide paths for their participants.

Drawing on database linking plan filings with the Department of Labor to Morningstar Inc.’s investment databases, we find that 58% of defined-contribution plan assets are invested in off-the-shelf target-date funds.

Wide Range in Plan Sponsors’ Glide Path Offerings

Let’s start at a macro level. We examined the glide paths plan sponsors use in different sectors and found that despite large differences in salaries and likely retirement ages, plan sponsors tend to use similar glide paths.

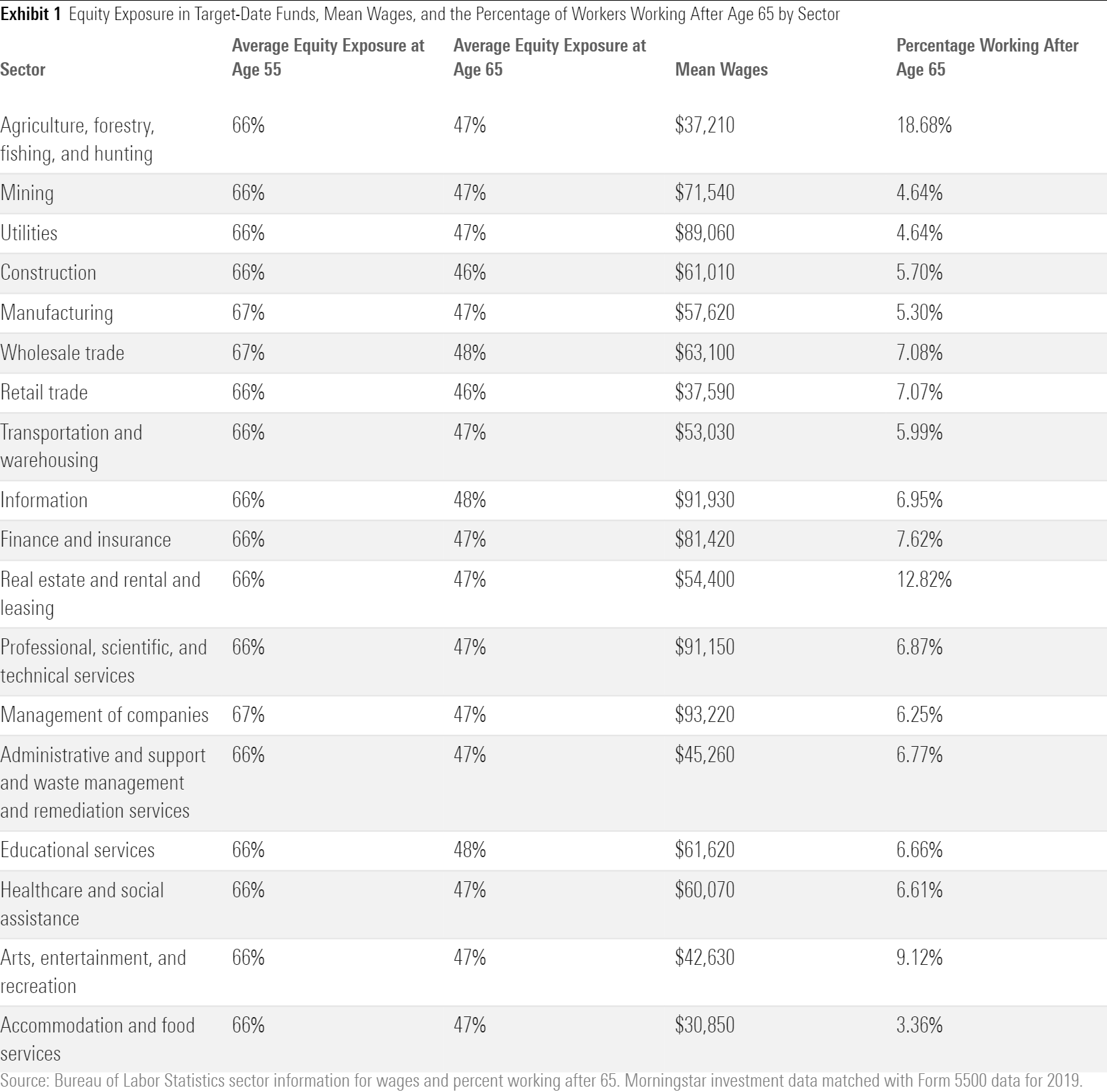

Exhibit 1 shows that across all the major sectors we could identify, plan sponsors converge around similar glide paths, despite large differences in participant characteristics.

Specifically, it shows that the average equity exposure at both ages 55 and 65 is similar across industries, despite wide differences in salary and the percentage of people retired by age 65. This finding seems to indicate that plan sponsors may not be consistently considering the specific needs of their worker population when selecting a glide path.

Does this mismatch matter? Again, while every participant’s needs are different, differences between groups do generally matter. Workers who are likely to work past 65 should be defaulted into different glide paths than those who are not, probably to nudge them to take more risk for longer. We can use a similar logic to identify an appropriate glide path for workers with higher salaries and less income replacement from Social Security.

In fact, we see one group of employers who appear to be selecting glide paths according to a now-unusual feature of retirement income. Employers that still offer a traditional pension were the most likely to adjust their glide paths to take on more equity risk compared to the norms. This makes perfect sense, as these employers know their workers will have a fixed-income-like source of income in retirement.

Workers Need to Know What’s in Store for Their Target-Date Fund and Its Glide Path

Though not surprising, our findings stress that the uniformity in off-the-shelf glide paths employers use often doesn’t reflect the differences in workers’ needs.

While no glide path is going to meet the needs of every worker at an employer, we think there is value in employers calibrating their glide paths based on what they know of their workers. Employers who offer defined-contribution plans along with defined-benefit plans appear to be accounting for their pensions, and we think such adjustments should be more common across industries.

The bottom line for people saving in a 401(k) or other defined-contribution plan is to ensure they understand their target-date funds’ glide paths, particularly as they get closer to retirement. Many people may want to align their asset allocation more closely with their own circumstances.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)