Ultimate Stock-Pickers: Top 10 Buys and Sells

Conservatism remained the name of the game in the most recent period because, to our managers, valuations still look stretched.

By Joshua Aguilar | Associate Equity Analyst

For the past eight and a half years, Ultimate Stock-Pickers' primary goal has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value.

As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers, 22 of which manage mutual funds that Morningstar's manager research group covers, and four of which manage the investment portfolios of large insurance companies. As they become available, we attempt to identify trends and outliers among their holdings, as well as any meaningful purchases and sales that took place during the period we are looking at.

In our last article, we walked through some of the buying activity we were seeing from our Ultimate Stock-Pickers during the second quarter (and the beginning part of the third quarter) of this year. The piece itself was an early read on the purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of nearly 90% of our top managers.

With all but one of our top managers reporting their holdings for second-quarter 2017, we now have a much more complete picture of what they were up to during the period. Following what had been a recurring trend over the previous five quarterly periods, our Ultimate Stock-Pickers were once again net sellers during the second quarter, albeit at a declining pace. Overall activity levels also declined to the lowest levels we've seen in more than a year and a half.

The decline in transaction activity matches the tone of the most recent quarterly commentaries we've surveyed, as our top managers continued to express concern over the stretched valuations of equities. Many of our Ultimate Stock-Pickers have highlighted the trend of more and more capital flowing into passive products, which is lifting all equities, regardless of valuation. This undiscerning form of capital allocation has made the stock-picking environment all that more difficult. While it's nothing new for active managers to point the finger at passive investing for their performance woes, our own analysis shows that the aggregate price/fair value of our entire coverage universe is 100%, suggesting that the market is fairly valued at today's prices. That said, our Ultimate Stock-Pickers found some names that piqued their interest, and we believe these are worth highlighting from a valuation perspective.

The conviction buying that took place during the second quarter (and the beginning part of the third quarter) was once again focused on high-quality names with defensible economic moats, exemplified by a high number of wide- and narrow-moat companies on our list of top 10 (and top 25) high-conviction purchases. As for the selling activity during the period, most of it seemed to revolve around paring stakes that closely approached our top managers' own internal estimates of fair value. Some positions, like wide-moat

Wide-moat

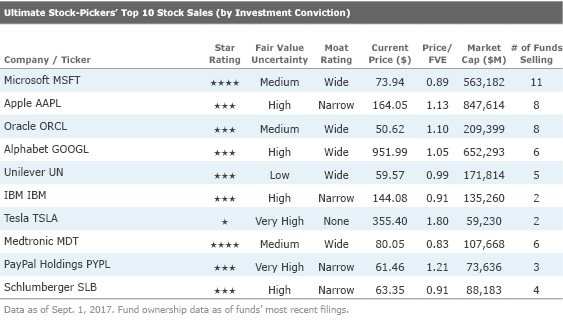

The most notable conviction sales to us during the period were no-moat

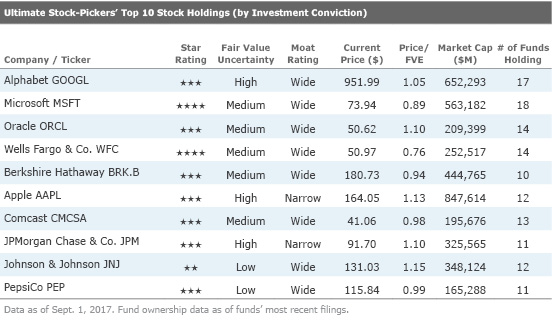

Ultimate Stock-Pickers' Top 10 Stock Holdings (by Investment Conviction)

As for sector allocation, our top managers remained underweight in communication services, energy, healthcare, and utilities relative to the weightings of the S&P 500 Index at the end of July. Our Ultimate Stock-Pickers also continue to hold meaningfully overweight positions in the consumer defensive, financial services, and technology sectors (with their exposure to basic materials, consumer cyclical, industrials, real estate being less than 100 basis points off the benchmark index). Compared with last period, our top managers saw their aggregate holdings shift more into consumer defensive and real estate names, whereas their financial services and technology exposure diminished some.

The overall makeup of the top 10 stock holdings by investment conviction did not change at all during the most recent period. In fact, the only change we saw was tied to the order of appearance, with wide-moat Oracle moving further up the list and Wells Fargo moving further down. Oracle was raised up by a meaningful purchase of the name by the managers at

Taking a closer look at the high-conviction buying that we uncovered during the most recent period, none of the names that showed up on our list of top 10 high-conviction purchases were represented on the list we highlighted in our last article, which is a rare occurrence. It should be noted that we are looking at all transaction in aggregate here, whereas in the previous article we were focused on individual instances of high-conviction and new-money purchases. What this does indicates to us, though, is that our top managers have had to turn over more rocks in search for attractive bargains.

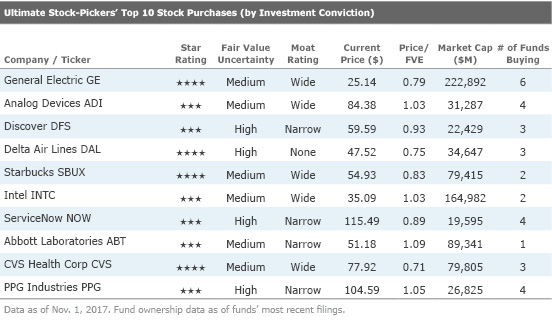

Ultimate Stock-Pickers' Top 10 Stock Purchases (by Investment Conviction)

As for where are top managers were focusing their attention, the list of top 10 conviction stock purchases this time around was far more diversified than the last time we looked at our Ultimate Stock-Pickers' top 10 buys and sells, when our Ultimate Stock-Pickers made a more concentrated bet on consumer cyclicals. Wide-moat

Wide-moat

He expects the company to maintain its specialty coffee leadership and thinks that the retail giant is poised for top-line growth and margin expansion through menu innovations, sustainable cost advantages, and evolution into a diversified retail and consumer packaged goods platform. While Hottovy acknowledges that Starbucks is already the leading specialty coffee retailer in the U.S., he believes the company has meaningful domestic growth potential. Avenues for growth include new store formats, including premium Roastery and Starbucks Reserve locations, as well as smaller-format express stores, drive-thrus and kiosks. Other growth engines that Hottovy points to include digital enhancements, expanded food and service offerings, mobile payment options and rewards programs. Although Hottovy is cognizant of transaction trends, he ultimately believes these metrics will improve through new menu innovations developed at the company's premium locations, improved loyalty member acquisition and engagement techniques, and simplified store operations and technologies.

That said, Hottovy sees Starbucks as much more than a retail story. He thinks the coffee retailer is just starting to scratch the surface of its long-term channel and geographic growth potential. Hottovy also believes Starbucks' retail core competencies should facilitate these efforts, putting the firm in a position to capture retail and wholesale market share. He adds that platforms like K-Cups and Nespresso should continue to support channel diversification over the medium term, even as Hottovy has moderated expectations for both revenue growth and operating margins during this time frame. Even so, longer term, Hottovy is optimistic about digital synergies across the firm's business lines, partnerships with various media players, new payment programs, and growth in both emerging and other international markets. While Hottovy recently lowered his fair value estimate for the name, and acknowledges the existing competitive threats, he believes Starbucks' wide moat, which has been built on strong brand equity, bargaining clout with suppliers, and a leverageable model, should keep its rivals at bay.

Wide-moat CVS Health is another name that caught our eye from our list of top 10 conviction purchases this time around. Eight of our Ultimate Stock-Pickers held the name coming into the second quarter, with four adding to their stakes, and two paring down their holdings, during the second quarter (and the beginning part of the third quarter). The stock has been weighed down as market participants have expressed concern over continued scrutiny of pharmacy benefit managers, or PBMs, and their respective pricing practices. And whispers over the potential threat of

The firm has recently faced same-store-sales pressures from its inability to participate in restricted PBM pharmacy networks. PBMs have been aggressively demanding price concessions from retail pharmacy operators for these firms to gain recognition as an approved pharmacy outlet. Lekraj adds that these restricted networks typically carry lower reimbursement and profits for participating pharmacies in exchange for being one of a limited number of participants. Lekraj attributes this trend to CVS' main rival, Walgreens, which has aggressively pursued a strategy of discounting drug products to drive increased foot traffic. Lekraj believes this tactic is a core component of Walgreens' approach, which will likely keep the retail pharmacy sector under significant pressure for the foreseeable future.

That said, Lekraj has not been surprised by these developments, and has largely factored these headwinds into his valuation. He emphasizes that the true driver of CVS' wide moat rests with its PBM business, with the firm's substantial claim volume of approximately 1.3 billion adjusted claims providing it with the opportunity to take advantage of two key industry drivers--supplier pricing leverage and centralized cost scale. CVS' claim volume affords the firm the power to negotiate top-tier drug pricing discounts with suppliers, allowing it to expand its client base and preserve its gross margin. Scale is also a source of competitive advantage as each claim processed is more profitable than the previous one. Furthermore, technology systems and centralized costs are spread across the entire level of claims, providing CVS with an advantage to larger PBMs. These factors provide the firm with the ability to produce gross and operating profits per adjusted claim that are top tier, allowing CVS to produce returns on capital well above their cost of capital, a long-term trend that Lekraj expects to continue.

Airline stocks, meanwhile, have been front and center in the news this year, particularly on the heels of their purchase by Warren Buffett's Berkshire Hathaway. The firm's decision to enter the four major U.S. airline stocks has long been attributed to comments made by

The industry has been restructured. It was fragmented. It was inefficient. It was unfocused. Now, it's efficient. It's focused on demand. We have networks that can actually deliver what people want.

Currently, the four major U.S. airlines--no-moat Delta Air Lines,

It's a fiercely competitive industry, the question is whether it's a suicidally competitive industry, which it used to be. When you get virtually every one of the major carriers and dozens and dozens of minor carriers are going bankrupt, there ought to come a point in time you find that maybe you're in the wrong industry. It has been operating for some time now at 80% or better of capacity being available seat miles. You can see what deliveries are going to be in that sort of thing. I think it's fair to say that they will operate at higher degrees of capacity over the next 5 or 10 years than historical rates, which caused all of them to go broke. Now the question is whether, even when they're doing it in the 80s, they will do suicidal things in terms of pricing, remains to be seen. They actually, at present, are earning quite high returns on invested capital. But that doesn't mean, tomorrow morning, if you're running one of those airlines and the other guy cuts his prices, you cut your prices, and there's more flexibility when fuel goes down to bring down prices than there is to raise prices when prices go up. It's no cinch that the industry will have some more pricing sensibility in the next 10 years than they've had in the last 100 years, but the conditions have improved for them. They've got more labor stability than they had before because they're basically all going to…have a shortage of pilots to some degree.

I think the odds are very high that there are more revenue passenger miles 5 years from now or 10 years from now. If the airline companies are only worth, 5 or 10 years from now, what they're worth now in terms of equity, we'll get a pretty reasonable rate of return because they're going to buy in a lot of stock at fairly low multiples.

Morningstar analyst Greggory Warren, who covers Berkshire Hathaway, has long held the view that Buffett's purchases were more of a trade than a long-term holding. On the surface, it appears this may be the case as Buffett has been paring some of his firm's exposure to the airline industry, with the notable exception of Southwest Airlines. Of the three other U.S. airlines, Delta made our list of top 10 conviction purchases, with

These dynamics allowed Higgins to tighten his forecast for U.S. airlines and led to a reduced uncertainty rating for Delta. Unlike Buffett, though, Higgins does distinguish somewhat between the Big Four carriers. He believes that Delta is the best positioned U.S. carrier thanks to its existing passenger revenue per available seat mile premium, as well as its laser-like focus on operational efficiency. Additionally, Higgins likes the firm's domestic exposure and structural advantages versus other network carriers, specifically its less unionized workforce, lower airport costs, and first-mover advantage in basic economy. He now believes that Delta's normalized operating margins will land at 16%, a slight increase from his previous midcycle assumptions.

Furthermore, despite Delta's most recent earnings miss last quarter, Higgins remains impressed with management's ability to drive operating margins in the face of revenue headwinds and cost pressures. Delta's maintenance operations, which typically account for about 10% of an airline's costs, are among the lowest in the industry on a per-seat block hour basis. He also thinks Delta's strategy of operating the oldest aircraft fleet among the Big Four carriers, with lower capital costs but higher maintenance and fuel demands, aligns well with the current environment of low oil prices. Delta's efficiency, including its aggressive pursuit of using old airplane components from its disassembled, retired fleet, allows the firm to maintain its older fleet more cost-effectively than it would otherwise. Last, like Buffett, Higgins likes Delta's attitude toward capital allocation, specifically, its commitment to returning 70% of its free cash flow to investors.

Ultimate Stock-Pickers' Top 10 Stock Sales (by Investment Conviction)

As for our list of top 10 stock holdings by conviction, wide-moat Wells Fargo was the only firm that looked attractive to us. The stock currently trades at a 24% discount to Morningstar analyst Jim Sinegal's $67 per share fair value estimate. The embattled bank was also one of the most widely purchased stocks during the period (though not by conviction), and we suspect that net conviction in the name would be positive were it not for sales by Berkshire due to Federal Reserve regulations and outright sales by two of our top managers. That said, six of our top managers added to their positions during the period.

In late May and again in early June, we added to our position in Wells Fargo, making it a top-five holding for Core Select. The company's shares traded lower following its first quarter earnings report and subsequent Investor Day presentation. In short, the earnings report was somewhat "noisy," and certain pro forma analyses presented at the Investor Day caused some confusion among investors about the possibility of weaker-than-expected revenue growth in 2017. In both cases, we saw nothing to suggest any impairment of the long-term earnings power of the company, and as such, we used the weakness in the shares as an opportunity to build our holdings.

Sinegal recently noted that the recovery for the bank is underway, even as more problems have surfaced for Wells Fargo. Fallout from its overly aggressive sales practices has led to a magnifying glass being pointed at the bank's auto loan lines of business, furthering damaging the bank's reputation. Despite its tarnished brand, Sinegal believes Well Fargo's wide moat, built primarily on cost advantages and customer switching costs, is intact. Echoing the thoughts expressed by the managers at BBH Core Select, he thinks the bank continues to fund its balance sheet at a lower cost than its largest peers.

Likewise, Sinegal doesn't see any sign that customers are leaving the bank and its dense, convenient branch network. Wells Fargo maintains the top share of deposits in many of the markets in which it operates in. Furthermore, Sinegal adds that the rate of account closures has remained steady over the past year, and deposit balances are still growing. Lastly, Wells Fargo generated 25% more revenue per dollar of deposits than the median among peers with more than $10 billion in assets in the first quarter. While Sinegal concedes that some additional revenue was likely generated from overly aggressive or fraudulent sales practices, he believes the majority of Wells Fargo's revenue generation comes from legitimate sources. He doesn't expect that management's efforts to curtail excesses will drag down the bank's earning power over the long run.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Joshua Aguilar has an ownership interest in both Berkshire Hathaway BRK.B and Apple AAPL, while Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)