Travel and Leisure Stocks are Ripe for Investment in 2022

Despite supply chain constraints, rising labor costs and new variants, we still see value in the consumer cyclical space.

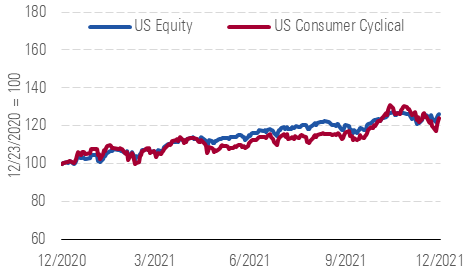

The consumer cyclical sector impressed in the fourth quarter with returns of roughly 10%, a 140-basis-point outperformance compared with the 8.6% return of the broader U.S. market (as of Dec. 23).

U.S. Consumer Cyclical Names Outshone the Broader Market in Q4

Source: Morningstar analysts

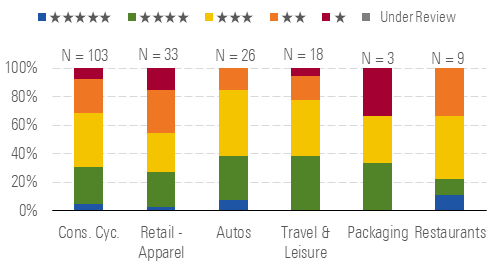

This leaves the sector as slightly overvalued, in our view, trading at a median 3% premium to our fair value estimates. Despite this, valuations in the space have become more attractive, with 30% of stocks in the sector trading in 4- or 5-star territory (a marked improvement from 16% three months ago). In this context, we think travel and leisure is ripe for investment, as we don't expect rising case counts will permanently depress consumers' desire to travel.

Investors May Want to Book a Trip With Travel and Leisure Stocks

Source: Morningstar analysts

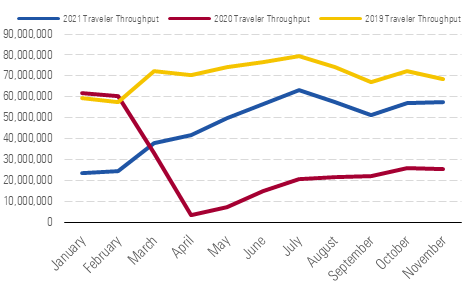

However, much consternation still centers on consumer spending. With mobility restrictions expected to ease in 2022, we see spending on goods slowing with a commensurate boost to services. For example, as consumers hunkered down at home since the pandemic took hold, increased funds were directed toward the home, particularly home furnishings and leisure apparel. Now as consumers regain a sense of normalcy, we see discretionary spending rotating to experiences, such as leisure travel and gaming. Our contention is supported by TSA checkpoint travel data, which shows the number of total airline passengers has averaged 82% of fourth-quarter 2019 levels during the fourth quarter 2021, up from 77% in the third quarter. And we don't think this demand stands to abate; we forecast the travel market to reach pre-pandemic levels by 2023.

After a Difficult 2020, Traveler Throughput Is Approaching 2019 Levels

Source: Morningstar analysts

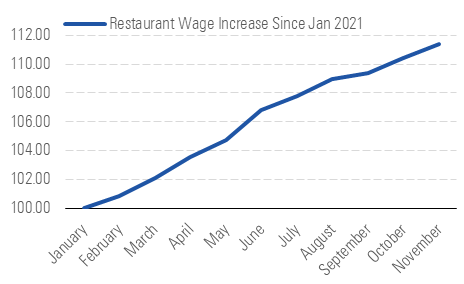

Even as consumers are venturing outside their homes, challenges persist. In this context, the tight labor market remains an obstacle for restaurants, with the labor force participation rate at a mere 61.8% in November, down from more than 63% in 2019. This imbalance has prompted a more-than 11% bump in hourly wages for restaurant employees. To counter these higher costs, restaurants have been increasing prices (7% across fast-food and 6% for full-serve restaurants, per the U.S. Bureau of Labor Statistics), but we surmise restaurants must tread carefully to avoid pricing customers out. And with wages unlikely to trend lower even as the labor market normalizes, we suspect restaurants will need to drive labor and operational efficiencies to fund continued investments in operations without a material erosion in profits.

To Entice Workers, Restaurants Are Offering Higher Wages

Source: Morningstar analysts

Top Picks

Hanesbrands

HBI

Star Rating: ★★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $26

Fair Value Uncertainty: Medium

We believe narrow-moat Hanesbrands, currently trading at a roughly 38% discount to our $26 per share fair value estimate, offers a good opportunity for investors. The firm's strong third-quarter results exceeded our operating margin and EPS expectations, and its recent investor day gave us more insight into its new strategic plan, Full Potential. We view the plan favorably, particularly its emphasis on growing "athleisure" brand Champion, and think the firm is in capable hands under former Walmart executive Steve Bratspies, who took over as Hanes' CEO in August 2020.

Nordstrom

JWN

Star Rating: ★★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $41

Fair Value Uncertainty: High

At a discount of about 50% to $41 our fair value estimate, we believe shares of narrow-moat Nordstrom are attractive. Despite disruption to its operations from the pandemic, Nordstrom's profitability has been restored in 2021, which should allow it to reinstate its dividend in 2022 (was $1.48 per share in 2019). Looking forward, we contend Nordstrom's Closer to You plan (announced in early 2021) will allow it to overcome the challenges facing department stores through its emphasis on e-commerce, growth in key cities, and a broader offering of off-price goods.

Polaris PII

Star Rating: ★★★★

Economic Moat Rating: Wide

Fair Value Estimate: $172

Fair Value Uncertainty: High

Wide-moat Polaris also offers good value, trading at around a 40% discount to our $172 fair value estimate. The company's favorable brands, innovative products, and Lean manufacturing support the firm's wide economic moat. We think Polaris will continue to capitalize on its research and development, solid quality, operational excellence, and acquisition strategy to increase demand. Polaris has historically generated topnotch returns on invested capital, including goodwill, and should be able to deliver around 39% metrics by 2030, well above our 8.4% weighted average cost of capital assumption.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)