Consumer Cyclical Stocks: Opportunities Linger as Investors Fixate on Weak Consumer Health

Our top picks in this sector are Under Armour, Hanesbrands, and VF.

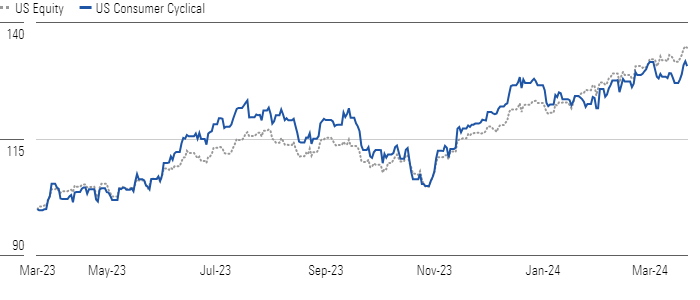

The US Consumer Cyclical Index rose 3.2% in the first quarter, underperforming the overall market’s 9.7% upswing. We surmise the space remains enticing, as the median stock trades at nearly a 10% discount to our fair value estimate, with over 40% of our coverage falling in 4- or 5-star territory.

Consumer Cyclical Stocks Lag as Broader Market Jumps In Q1

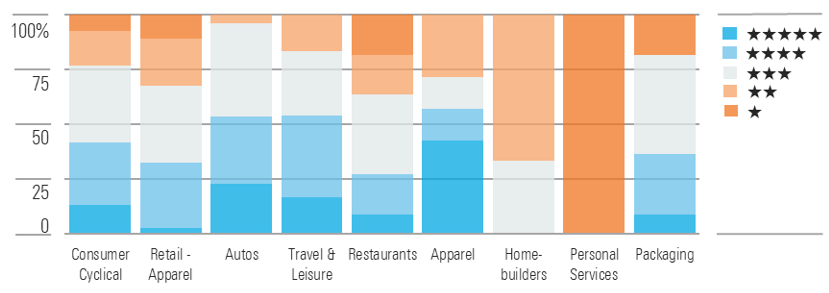

Zooming in, the apparel sector emerges as the most undervalued opportunity, trading at a 31% discount to our valuations. From our vantage point, ongoing ambiguity around consumers’ financial health and ability to spend is keeping investors on the sidelines, though we think this concern is more than baked into share prices.

Opportunity Knocks With Discounts in the Apparel Sector

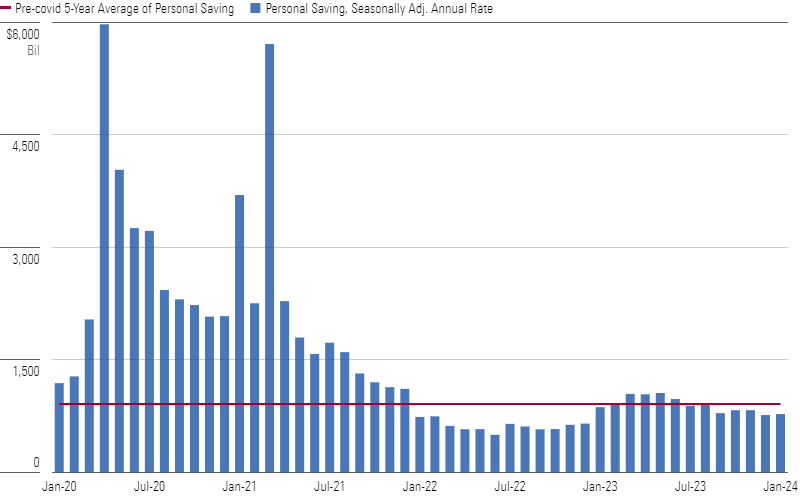

This hesitancy is driven by the depletion of pandemic-era savings due to inflation, elevated interest rates, the restart of student loan payments, and curbed aid programs. In this vein, between July and January, annual personal savings consistently fell short of the pre-pandemic five-year average of $913 billion, dipping to $779 billion in January. We surmise this reduction in savings, coupled with record household debt levels, has led consumers to reallocate their spending from certain discretionary goods and services. While the travel industry continues to see a resurgence in spending as consumers seek to compensate for previous restrictions and adapt to the freedom of remote work flexibility, demand for apparel has languished. However, even if economic conditions worsen, we believe improved inventory levels and extracted operational efficiencies in the apparel industry should soften the immediate financial impact while bolstering profitability in the long run.

Gap Between Savings and Historical Norm Hints at Financial Strain

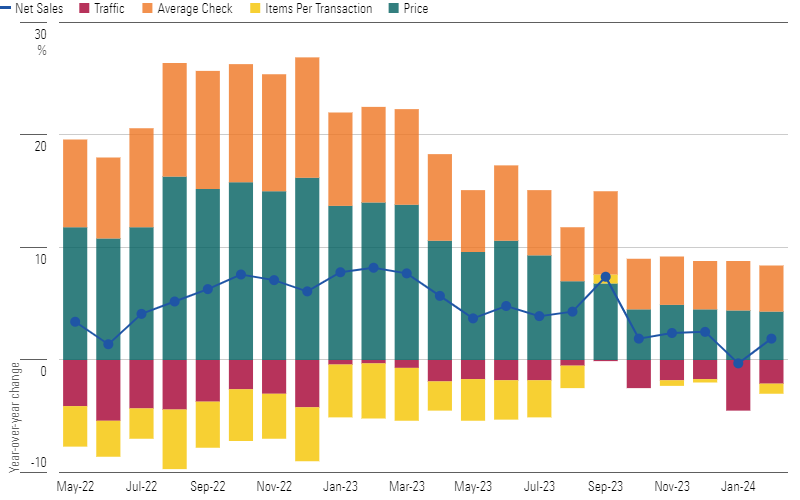

The restaurant sector has also been affected by the economic strain on consumers’ budgets. Despite efforts to temper price hikes, quick-service restaurants—favored by lower-income groups—are struggling after raising prices during the past few years to counter rampant inflation, evidenced by steadily declining traffic. This trend, alongside a reduced number of menu items purchased, has sharply curtailed net sales growth. As consumers look to ratchet back spending, restaurateurs are embracing promotions to lure them back. Against this backdrop, we posit that operators boasting strong loyalty programs and value perception will be best positioned to navigate more turbulent conditions.

Consumers Find Quick-Service Restaurants’ Price Hikes Hard to Digest

Top Consumer Cyclical Sector Picks

VF Corp

- Fair Value Estimate: $53.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

VF’s VFC shares trade at a 73% discount to our fair value estimate. We believe the market is dwelling on its challenges—including the slowdown in Vans sales, elevated inventories, management turnover, and dividend cuts—but overlooking its potential for sales growth and margin improvement in the medium term. VF has exposure to the attractive active and outdoor categories, and The North Face achieved 17% constant-currency sales growth in fiscal 2023. In October, new CEO Bracken Darrell introduced a strategy focusing on Vans’ innovation and management, a new platform in the Americas, cost cuts, and debt reduction.

Under Armour

- Fair Value Estimate: $15.50

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

Shares of Under Armour UA are on sale, trading at a 56% discount to our $15.50 valuation. Although the company has been restructuring and has struggled to generate sales growth for most of the past seven years, it operates in the attractive performance sportswear market and has wide distribution and a solid balance sheet. The firm has brought in considerable new talent and plans for significant product releases in 2025. In addition, the recent reinstatement of co-founder Kevin Plank as CEO provides a dose of stability.

Hanesbrands

- Fair Value Estimate: $17.30

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

We believe Hanesbrands HBI, trading at a steep 70% discount to our $17.30 fair value estimate, presents an attractive investment opportunity. Hanes has leading brands in innerwear in North America and Australia, but it has been struggling to generate sales growth as of late. In particular, Champion has cooled off considerably and is likely to be sold. Even so, we believe Hanes is making progress on its key initiatives, including product enhancements and reductions in inventory, costs, and debt. The firm paid down $500 million in debt in 2023 and guided to another $300 million in paydown in 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)