Consumer Cyclicals: Discounts Retain Their Allure

In this sector, we recommend VF, Hanesbrands, and Hasbro.

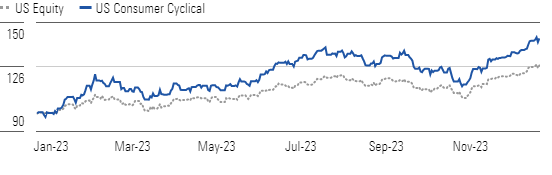

The Morningstar US Consumer Cyclical Index popped 13.4% in the fourth quarter, echoing the overall market’s upswing. Still, we remain optimistic about investment prospects within the space, as the median stock trades at a 10% discount to our intrinsic valuation, and nearly half of our coverage is in 4- or 5-star territory.

Our top picks among consumer cyclical stocks are:

Discretionary Stocks Appreciated In Sync With the Market in Q4

More precisely, we pinpoint apparel as one of the most undervalued sectors, trading at an average 11% discount. We suspect investors’ reluctance to embrace apparel shares is primarily rooted in ongoing uncertainty regarding consumers’ financial health. However, we think that this concern is more than reflected in share prices. Ultimately, we think investors are overly fixated on the industry’s short-term hurdles and overlooking the long-term profit prospects that firms can achieve through efficiency measures.

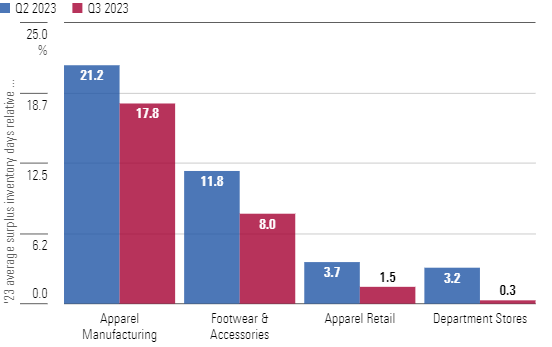

Declining Apparel Inventories Should Make 2024 More Fashionable

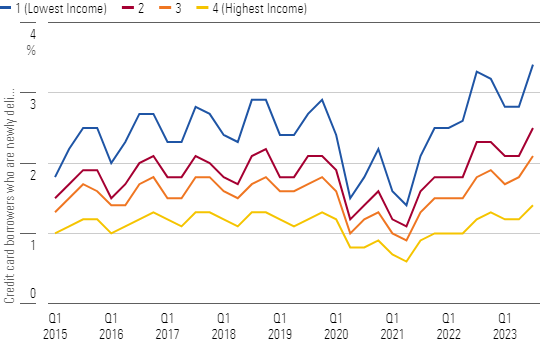

Despite the challenges of cumulative inflation and elevated interest rates, consumers have proved quite resilient. However, with excess savings accumulated during the pandemic running thin and up against the resumption of student loan repayments, cracks are showing in consumers’ financial health. For one, the percentage of new delinquencies among credit card borrowers soared to its highest point over the last eight years in the third quarter of 2023, affecting all income demographics but most pronounced in the lowest bracket. Against this backdrop, consumers may be forced to modify spending patterns, potentially making more significant cuts in discretionary expenditures. In the near term, we believe the firms best fit to navigate a more challenging spending climate will appeal to consumers searching for value and convenience by offering innovation, robust loyalty programs, and digital capabilities.

Credit Card Delinquencies Unmask a Trend of Consumers Falling Behind

In light of consumer frugalness and recent supply chain problems, apparel retailers and manufacturers have been diligently working to decrease inventory levels from the 2022 holiday selling season, initially through aggressive markdowns and order cancellations. And we’ve seen modest improvement (though still outpacing a year ago). In our view, firms must continue to temper inventory levels to avoid excessive discounting and improve operational efficiencies in 2024, thereby boosting profitability even if consumer demand remains weak.

Top Consumer Cyclicals Sector Picks

VF

- Fair Value Estimate: $57.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

VF’s shares trade at a roughly 70% discount to our fair value estimate. We believe the market is dwelling on its challenges—including the slowdown in Vans’ sales, elevated inventories, and dividend cuts—but is overlooking its potential for sales growth and margin improvement in the medium term. VF has exposure to the attractive active and outdoor categories, and the North Face achieved 17% constant-currency sales growth in fiscal 2023. In October, VF’s new CEO introduced a strategy focusing on innovation and management at Vans, a new platform in the Americas, cost cuts, and debt reduction.

Hanesbrands

- Fair Value Estimate: $18.80

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

We believe Hanesbrands, trading at a steep 80% discount to our fair value estimate, presents an attractive opportunity. We surmise investors are overly focused on near-term hurdles, including the impact of inflation, elevated interest rates, and softer consumer demand, while overlooking its prospects for free cash flow generation, its progress in managing surplus inventory, and its improving mix shift. We expect that lower input costs and Hanesbrands’ strategy to enhance Champion and North American innerwear, streamline its portfolio, and engage consumers will improve its profitability after a challenging 2023.

Hasbro

- Fair Value Estimate: $88.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Trading at a hefty 45% discount to our fair value estimate, we believe Hasbro’s shares are very undervalued. We surmise investors are over-indexing numerous challenges, which have had an impact on its recent performance, such as weak discretionary demand, entertainment-related strikes, discontinuation of underperforming lines, and inventory rightsizing. Although demand headwinds may take time to unravel, we believe the differentiated market leader will continue to invest in innovation to boost sales, while the divestiture of entertainment assets should help propel Hasbro to 21% operating margins longer term from 16% in 2022.

Top Consumer Cyclicals Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)