Consumer Defensive Stocks: Brand Investments Remain Key to Weathering Competitive Pressures

Our top picks in the sector are WK Kellogg, Kraft Heinz, and Tyson Foods.

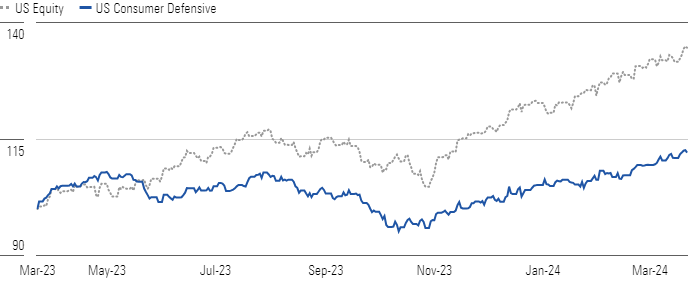

The Morningstar US Consumer Defensive Index rose 6.6% in the first quarter, lagging the overall market’s 9.7% gain. With that modest increase, the median stock in the sector appears fairly valued.

Consumer Defensive Stocks Are Lagging the Broader Market’s Outperformance

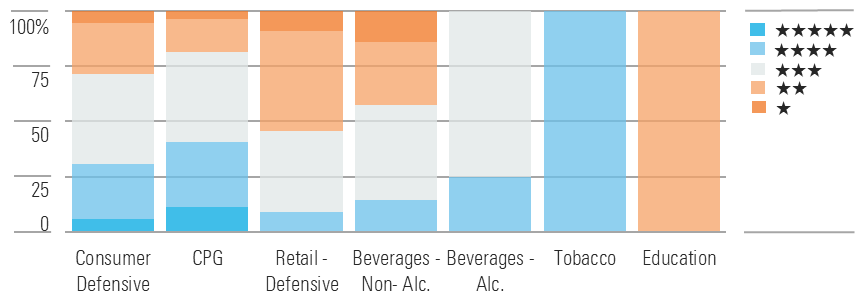

Still, we see investment opportunities in the consumer packaged goods space, with over 30% of our coverage trading in 4- or 5-star territory. We suspect the market’s concerns around stepped-up competitive pressures and macro uncertainties overshadow the product innovation and brand prowess that command pricing power in the sector.

Investors Should Stock Up on Consumer Packaged Goods Stocks

In this context, we stand firm in our belief that branded operators’ commitment to bringing consumer-valued innovation to market and touting their fare will remain crucial to maintaining brand relevance and circumventing a potential hit to volume. We believe this is particularly critical, as we anticipate a more benign pricing environment in the near term after multiple rounds of price hikes to offset inflationary pressures in recent years.

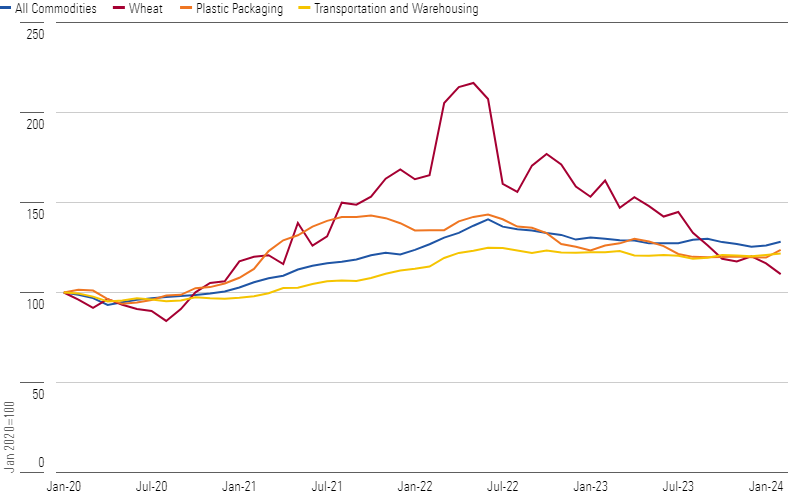

However, we don’t expect deflationary pressures on shelves, as costs (across commodities, packaging, transportation, and wages) have yet to abate meaningfully, prompting firms to pursue other initiatives (like extracting inefficiencies) to thwart any profit hit. Ultimately, we contend operators that continuously direct resources toward their brands should stay top of mind with consumers and retailers in the long term, blunting any lasting trade down to lower-priced private label options.

Cost Inflation Has Moderated but Is Still Outpacing Pre-Pandemic Levels

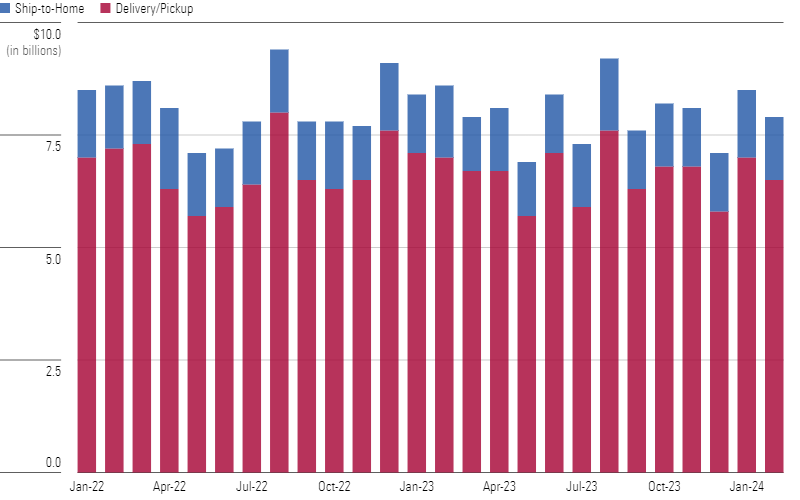

Beyond enhancements to flavor and texture, we see alterations to package sizes as particularly advantageous as consumer product firms work to extend their distribution. In this context, despite the soft macro backdrop, consumers’ penchant for the convenience of shopping through the e-commerce channel (though at a higher cost) has yet to subside. As such, we surmise it behooves consumer product manufacturers and retailers to work together to build out an appealing omnichannel shopping experience to buoy repeat purchase occasions over an extended horizon.

Consumers Aren’t Forgoing the Convenient E-Commerce Channel

Top Consumer Defensive Sector Picks

WK Kellogg

- Fair Value Estimate: $27.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

WK Kellogg KLG trades at a 33% discount to our $27 fair value estimate. While its singular exposure to the challenged cereal category and its small scale have diminished its standing with retailers and suppliers, we see a path to higher profits. The firm’s still prioritizes upgrading its outdated supply chain, which we believe will enhance operational efficiencies and structurally lift margins, with our midcycle EBITDA margin reaching 14% (from 9% in fiscal 2023). In addition, we think this should provide the fuel to invest in product innovation and marketing support to solidify its standing in the mature domestic cereal aisle.

Kraft Heinz

- Fair Value Estimate: $54.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Trading at a 35% discount to our $54 fair value estimate and with a 4% dividend yield, we think Kraft Heinz KHC is attractive. We suspect investors are skeptical that the firm will shun a material volume contraction in a challenging economic and competitive environment after recent price hikes. However, we hold a favorable view of the firm’s efforts to unearth cost savings and extract inefficiencies to support brand spending (research, development, and marketing), which we think will help support top-line growth in the long term.

Tyson Foods

- Fair Value Estimate: $83.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Trading at roughly a 30% discount to our $83 fair value estimate, Tyson’s TSN shares are on sale while offering a 3% dividend yield. Despite near-term inflationary headwinds and challenges in the beef and pork segments, we don’t see any structural changes to meat markets that warrant a permanent reduction in profitability. Rather, we remain optimistic about a return to mid-to-high-single-digit adjusted operating margins, driven by easing input cost inflation and supply-demand rebalancing. In addition, we believe Tyson’s ongoing productivity efforts should enhance long-term efficiency and support margin recovery.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)