Consumer Defensives: Moaty Operators Well-Positioned to Navigate Competitive Landscape

Within consumer defensive stocks, we highlight Tyson Foods, Estee Lauder, and Kellogg.

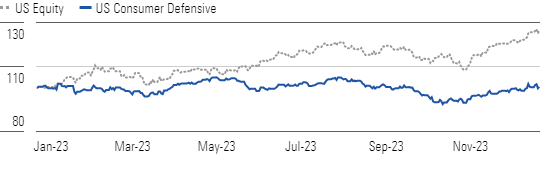

The Morningstar US Consumer Defensive Index advanced 4% in the fourth quarter, trailing the market’s 11.5% return by 750 basis points. With this tepid performance, the median consumer defensive stock appears slightly undervalued, trading at a 7% discount to our fair value estimate.

Our top picks among consumer defensive stocks are:

Consumer Defensive Sector Realized Lukewarm Gains In Q4

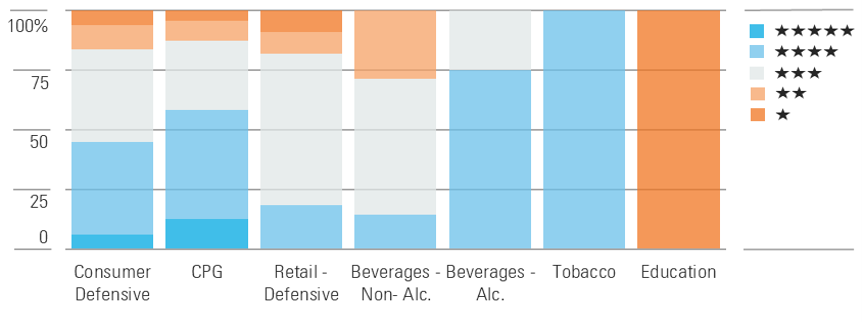

We see opportunities in consumer packaged goods, where nearly 60% of our coverage trades in 4- or 5-star territory. We believe this illustrates investors’ concerns about the unsettled economy, heightened competitive pressures, and inflation’s impact on consumer purchasing behavior while underappreciating the product innovation and brand strength that ultimately support pricing power here.

We See Attractive Opportunities In Consumer Packaged Goods

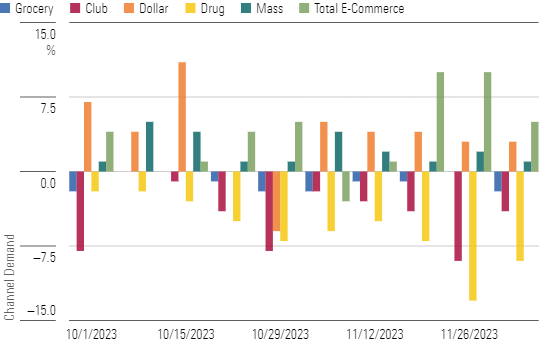

We aren’t blind to consumers’ search for value amidst strained financial resources, and the near-term impact this is having on retailers. From the first week in October to the week ending Dec. 3, both trips and basket size increased at a low-single-digit percentage on average at mass and low- to mid-single-digit at dollar channels, a stark contrast to the high-single-digit average decline within the drug channel, which tends to sit at the premium tier. While we view this shift as a temporary byproduct of the economic backdrop, we see continued opportunities for growing online penetration. And even as e-commerce showed a volatile track record of late (as consumers balance delivery fees with the channel’s convenience), we believe retailers that continue to invest in omnichannel capabilities to enhance seamless shopping experiences are better poised to win with consumers in the long term.

Consumers Are Flocking to Discount Retail Channels

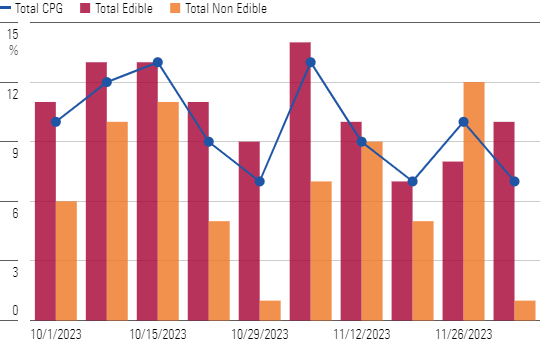

CPG manufacturers are also keen to appeal to a value-conscious consumer. While promotions weren’t used when supply and demand were off-kilter, promotional intensity has more recently stepped up. Total CPG promotional levels jumped 10% on average over the last 10 weeks versus the same period a year ago. We see this as stemming from consumers trading down to private labels; however, this could become value-destructive if used exclusively to drive near-term volumes and market share, as such initiatives fail to reinforce brand standing. Instead, we contend that firms that continuously funnel investments behind their brands (through consumer-valued innovation and marketing) while choosing to deploy promotions prudently will be able to withstand competitive pressures profitably.

Widespread Promotional Activities Pervade CPG Space

Top Consumer Defensive Sector Picks

Tyson Foods

- Fair Value Estimate: $82.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Trading at roughly a 40% discount to our fair value estimate, Tyson’s shares are on sale while offering a 4% dividend yield. Despite inflationary headwinds and challenges in the beef and pork segments, we don’t see any structural changes to meat markets that warrant a permanent change to profitability. We remain optimistic about a return to mid-to-high-single-digit adjusted operating margins, driven by easing input cost inflation and supply-demand rebalancing. Tyson’s ongoing productivity efforts should enhance long-term efficiency and support margin recovery as well.

Estee Lauder Companies

- Fair Value Estimate: $200.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe Estee Lauder’s shares are attractive, trading at around a 30% discount to our $200 fair value estimate. Although a slow travel retail recovery in China has impaired demand and margins, we remain constructive on the firm’s long-term prospects. We believe Estee’s stepped-up brand investments and solid execution will help bring its margins back to historical levels while ensuring the firm’s standing (underpinned by category-leading brands and preferred vendor status) remains in place. Further, we believe it is poised to benefit from secular premiumization trends across developed and emerging markets.

WK Kellogg

- Fair Value Estimate: $27.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Kellogg trades at a 55% discount to our fair value estimate. Although its sole exposure to the challenged cereal category and its small scale have diminished the firm’s standing with retailers and suppliers, we see a path to higher profits. The firm’s priority is upgrading its outdated supply chain, which we believe will enhance operational efficiencies and structurally lift margins, with our midcycle EBITDA margin reaching 14% (from the 9% we model in fiscal 2023), while also providing the fuel to invest in consumer-valued product innovation and marketing support to solidify its standing in the mature cereal aisle.

Top Consumer Defensive Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)