Is Broadcom Stock a Buy, Sell, or Fairly Valued After Earnings?

With rising AI-related demand and a big rally, here’s what we think of Broadcom stock.

Broadcom AVGO released its second-quarter earnings report on June 1, 2023. Here’s Morningstar’s take on what to think of Broadcom’s earnings and stock.

Broadcom Stock at a Glance

- Fair Value Estimate: $640

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

What We Thought of Broadcom Earnings

Narrow-moat Broadcom reported strong fiscal second-quarter results, slightly below our revenue expectations but significantly surpassing our earnings expectations.

Networking demand was again strong on the back of a continued tailwind of generative artificial intelligence deployment. Management noted that AI-related revenue currently represents approximately 15% of its semiconductor business. In fiscal 2022, that figure was around 10% of Broadcom’s semiconductor revenue, and management believes it can reach 25% in fiscal 2024—an estimate we view as reasonable and impressive.

There’s hesitation around AI-related growth due to the area’s potential cannibalization of the firm’s other product growth. However, we view Broadcom’s networking, storage, and broadband businesses as resilient and believe AI-related revenue is a tool to expand existing growth vectors.

Second-quarter sales were $8.7 billion, up 8% year over year. Semiconductor solutions revenue was $6.8 billion, up 9% year over year. Software sales were $1.9 billion, up 3% year over year. Demand for networking products grew 20% year over year as a result of strong growth in Broadcom’s high-speed switches and routers, which are beneficiaries of AI spending.

Server storage grew 20% year over year but was down 10% sequentially as enterprise demand moderated in the quarter. Wireless revenue fell 9% year over year, although management guided to 20% year-over-year growth in the third quarter, coinciding with the seasonal ramp of Apple’s next iPhone.

We maintain our $640 fair value estimate for Broadcom, which reflects a 50% probability that the firm’s pending acquisition of VMware will close within fiscal 2023.

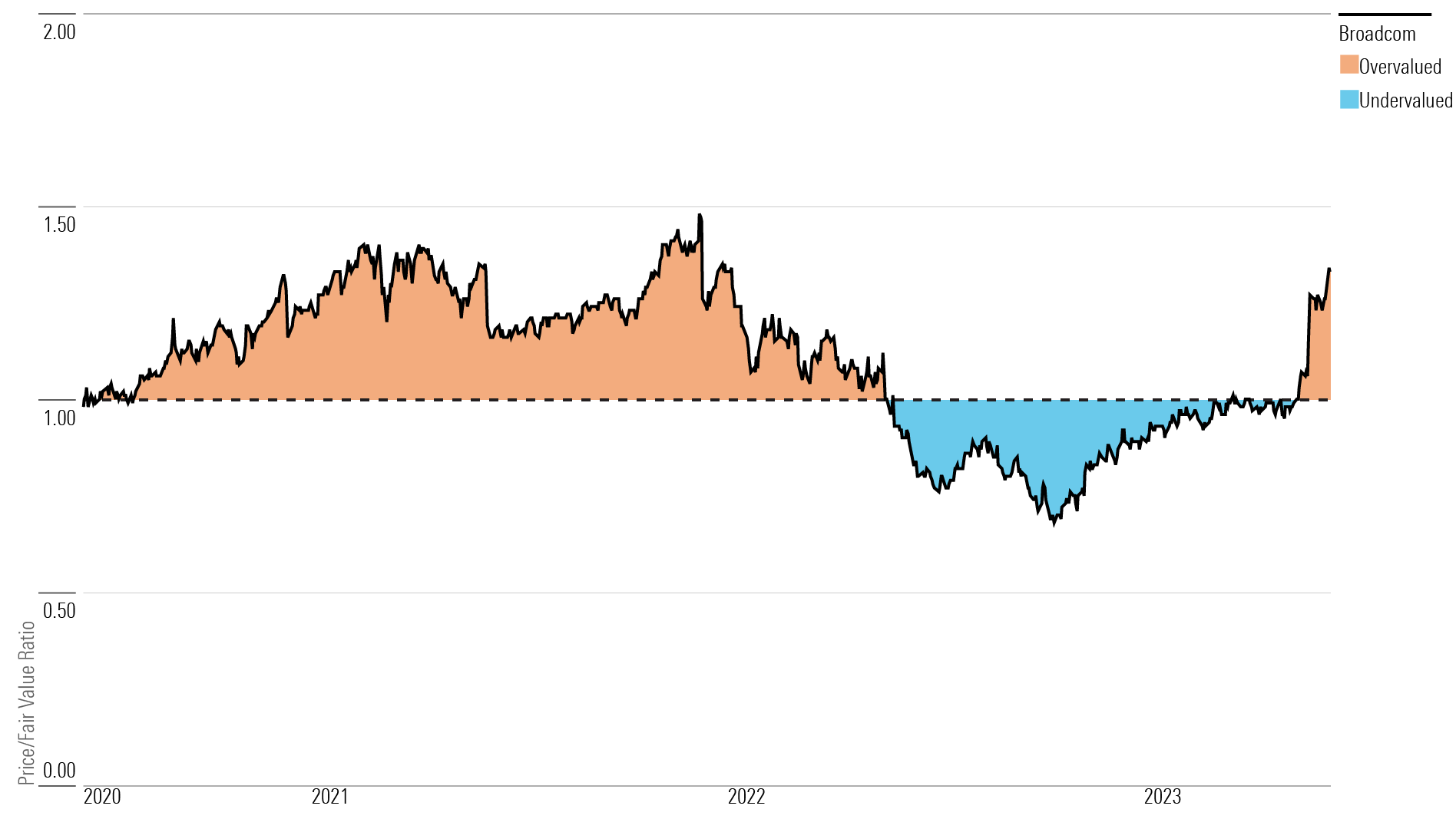

Broadcom Stock Price

Fair Value Estimate for Broadcom

At a 2-star rating, we believe Broadcom’s stock is overvalued compared with our fair value estimate.

We expect strong networking demand to persist in the coming years and average top-line growth in the mid-single digits over the next five years, in line with management’s expectations. While all of Broadcom’s core segments are poised to grow, we view the firm’s networking business most favorably.

Broadcom sells solutions for applications for data centers, telecom, and networking. This includes Ethernet switching and routing products, as well as custom chips for the likes of Cisco and cloud vendors like Google. We foresee this networking portion of the semiconductor business growing around 10% annually as the firm benefits from the shift to the cloud.

Wireless communications contributed around one-third of fiscal 2022 semiconductor sales, as Broadcom is the leader in film bulk acoustic resonator, or FBAR, filters, as well as iPhone Wi-Fi/Bluetooth connectivity chips. While we do not anticipate major unit growth in smartphones, we do foresee healthy content gains because of a greater need for advanced filters in 5G devices.

Read more about Broadcom’s fair value estimate.

Broadcom Price/Fair Value Ratio

Economic Moat Rating

We attribute Broadcom’s narrow moat to its expertise in chip design for network switching chips and FBAR filters. Among Broadcom’s many product lines, these two exhibit the greatest sources of enduring competitive advantage in our view. The firm also boasts market-leading positions in areas such as Wi-Fi chips, set-top box processors, enterprise storage chips, broadband access solutions, and fiber channel switch products. These businesses generate solid cash flow that Broadcom can subsequently use to maintain its competitive edge in core end markets by bolstering research and development as well as acquisitions.

A serial acquirer, Broadcom has seemingly perfected the process of purchasing technology companies with best-of-breed products at attractive valuations, trimming noncore product lines to streamline each business, and ultimately driving nice cost synergies.

About 70% of Broadcom’s sales come from semiconductors, while the remainder comes from software. The two largest sources of chip sales are networking and smartphone end markets.

Read more about Broadcom’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Broadcom is Medium, reflecting the fundamental risk the firm faces due to cyclicality, customer concentration, and its tendency to make large M&A deals that carry strategic, financial, and integration risks. Apple accounted for 20% of revenue in fiscal 2022 and 2021, illustrating the sizable impact any potential design loss for its radio frequency filters or other products sold into the iPhone may have on Broadcom. We think the company’s remaining segments are better diversified, which should mitigate some of the sharp swings other smartphone component suppliers are susceptible to.

Broadcom has exhibited a voracious appetite for acquisitions, as seen by its merger with Avago, its acquisition of Brocade, its failed attempt to acquire Qualcomm, and more recently its acquisitions of CA Technologies and Symantec’s enterprise security software business, as well as its pending deal to acquire VMware. This strategy could backfire if the company overpays for a subpar business or is unable to find attractive takeout candidates to drive future growth, particularly after the large wave of consolidation in the semiconductor space in recent years.

Read more about Broadcom’s risk and uncertainty.

AVGO Stock Bulls Say

- Broadcom’s proprietary FBAR filters are well-suited to handle a variety of 4G and 5G radio frequency signals.

- Broadcom’s networking chip expertise has positioned it well for selling into both on-premise data center equipment and leading cloud equipment vendors.

- The company continues to make reasonable acquisitions to expand its breadth and diversify its product portfolio, and we anticipate further accretive deals in the years ahead.

AVGO Stock Bears Say

- Broadcom still has significant customer concentration with Apple, and it would be damaging if Apple switched to another firm for FBAR filters or other components which it provides.

- Large customers like Apple wield significant pricing power and could exert pricing pressure on suppliers, including Broadcom, over time.

- Demand in some of Broadcom’s key end markets, like optical networking and enterprise storage, is inherently lumpy, and results may face volatility from time to time.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio, through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HU3X6PAILNCOVAUSKMJBJCVK6U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T45HNONTSRDFDD6ZE3D2LTNT7Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)